Jade lizard is a popular strategy yet not so very known among traders. I myself learned about this strategy just about a month ago although Tasty Trade performed studies on this strategy in 2013. But after I studied the strategy, I immediately fell in love with the strategy for benefits it provided.

Jade lizard is a popular strategy yet not so very known among traders. I myself learned about this strategy just about a month ago although Tasty Trade performed studies on this strategy in 2013. But after I studied the strategy, I immediately fell in love with the strategy for benefits it provided.

If you have never heard about Jade lizard strategy, here is a quick review:

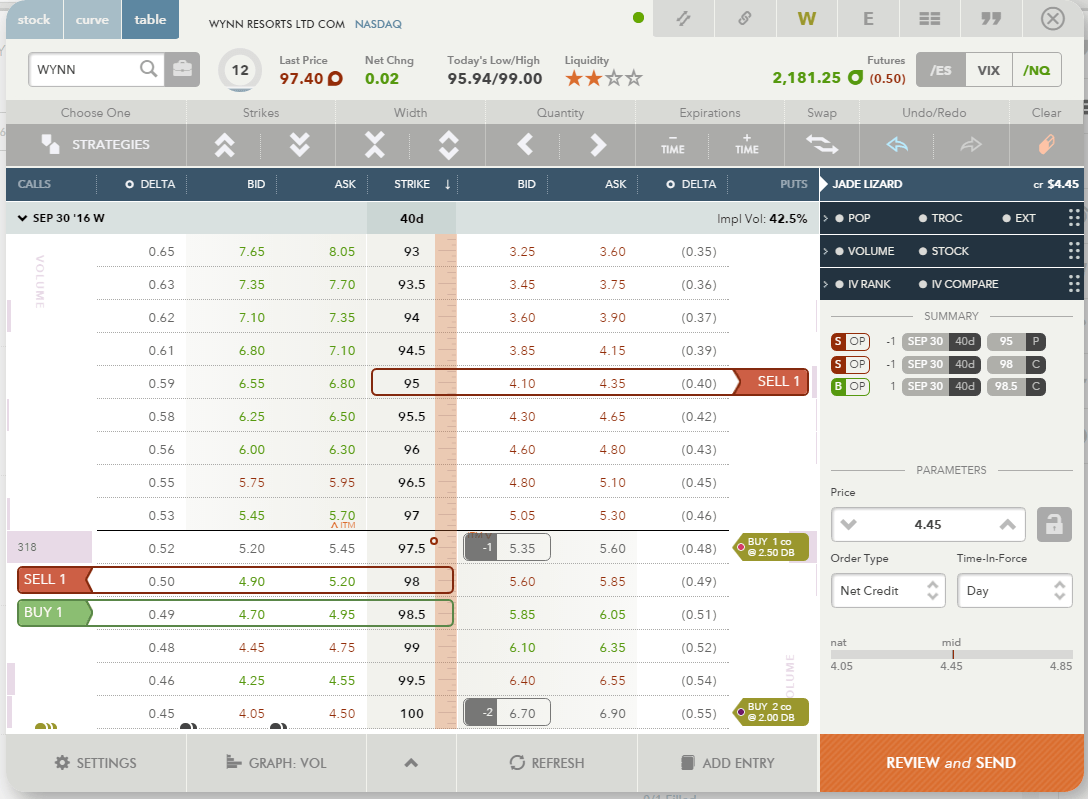

A Jade lizard consists of a short, naked OTM put and an OTM bear call spread. Let’s say, you want to trade this strategy against WYNN, then it would look like this:

In the example above I am selling 95 strike naked put and at the same time, selling 98/98.5 bear call spread.

· When do you put on this trade?

- This trade works best with high Implied volatility.

-

The stock was beaten down recently

-

It’s OK to trade this strategy during low IV if the premium is high enough to justify the trade.

· Why to trade Jade Lizards?

There are a few benefits for trading Jade lizards compared to naked put trade only:

- You collect higher premium

Collecting higher premium does twofold service to you – it lowers your breakeven price on your put side, more than a naked put, and you get more money if the trade ends as a winner.

If you take a look at the option chain above, you can see that opening a naked put only I would collect $4.10 premium while with the Jade Lizard I can collect $4.45 premium (+8.54% better result).

· How to trade Jade Lizards?

When placing Jade Lizard on you must make sure that your collected premium is larger than the entire call spread width. If for example, you trade a lizard, your call spread is $1.00 wide and you collect $0.95 premium only, then such trade is bad and will not work.

If your call spread is 1 dollar wide, it means that you can realize 1 dollar loss on your call side (or $100 total loss). You want to collect at least 1.00 dollar premium or more to cover your upside.

In the example above I can collect 4.45 premium. My call side is only 0.50 wide. The call side is literally risk free. Even if the bear call spread gets in the money, I still will end up profitable.

· How to manage Jade Lizards?

When I open a Jade Lizard trade I usually place a closing order right after the trade fill for 50% credit. So ideally, we want the trade to end as soon as possible for 50% of collected premium. It would look like this compared to a naked put only:

WYNN naked put trade opening for 4.10 credit, closing for 2.05 debit, 2.05 credit left

WYNN Jade lizard trade opening for 4.45 credit, closing for 2.225 debit, 2.225 credit left (+8.54% better result)

Let’s take a look at different situations which may occur:

Stock trades in between short put and short call

50% credit management: You do not have to do anything as both your puts and calls will be losing value and you will be able to close the trade for 50% credit (+8.54% better result).

At expiration: You do not have to do anything. All your options legs will expire worthless and you will collect full credit profit (+8.54% better result).

Assignment risk: There is no early assignment risk in this situation.

Stock trades in between short call and long call

50% credit management: You do not have to do anything. Your puts will be losing value and although your call spread short leg will be in the money, you will be able to close the trade for 50% credit (+8.54% better result).

At expiration: You let your puts expire worthless. Close your bear call spread. You will realize loss on your calls which will equal to the amount of how much the spread is in the money. If the stock ends at $98.30 for example, it is 0.30 in the money and you will see $30 dollars loss. Your overall trade will be $4.15 profit (4.45 – 0.30 = 4.15) or 1.21% better than naked puts only. You want to close the spread manually to avoid assignment fees which are usually high.

Assignment risk: There is no early assignment risk in this situation. No one would ever early assign an at the money option. A risk of assignment at expiration is avoided by closing the spread.

Stock trades above your call spread

50% credit management: You do not have to do anything. Your puts will be losing value and although your call spread will be in the money, you will be able to close the trade for 50% credit (+8.54% better result).

At expiration: You let your puts expire worthless. Close your bear call spread. You will realize loss on your calls which will equal to the amount of the spread width. In our example, it is 0.50 or $50 dollars loss (98.5 – 98 = 0.50). Your overall trade will be $3.95 profit (4.45 – 0.50 = 3.95) or -3.66% worse than naked puts only. You want to close the spread manually to avoid assignment fees which are usually high.

Assignment risk: There is no early assignment risk in this situation if the stock is trading fairly close to your spread. If however early assignment happens, then exercise your long call to cover your short stock. Your overall loss will still equal to the width of the spread. A risk of assignment at expiration is avoided by closing the spread.

Stock trades below your puts

50% credit management: You still may be able to get out of this trade for a profit by closing it early before gamma kicks in. Generally, however, you won’t be able to do much and the trade will stay open until expiration.

At expiration: You let your call spread expire worthless. Roll your in the money put into the next month and at the same time sell a new call spread against it creating a new jade lizard. Based on where the stock is if at the money but still in the money then roll into the same strike, if deep in the money then roll to a lower strike.

Assignment risk: There is no early assignment risk in this situation if the stock is trading fairly close to your naked put. Again no one would ever exercise at the money put. If the stock sinks too deep and an early assignment happens, then keep the stock and start selling covered calls. A risk of assignment at expiration is avoided by rolling the put away in time.

· Conclusion

If you follow my blog and read regularly you may know that I do not predict the market or stock move. I believe it is a futile work to try predicting the market. Instead of predicting what your stock will do next, make a plan what you will do next.

Above, I tried to show you what everything can happen with a trade once you put it on and my plan what I would do with it. It is all you need to know. You need to know answers to all those situations before you place a trade.

Once you place a trade and know all the steps you would do, you will be trading with ease and in a comfort zone. You will no longer be worried what would happen with the stock. You will no longer be worried if you open a trade and you will be wrong and the stock tanks.

It is because no matter what happens you have a trading plan for that situation and you know what to do to make that trade still a winning trade.

And then it all comes to your money management instead. You do all these trades and trade adjustments without over-trading your account. If you keep enough cash reserve in your account then you do not have to worry about your margin, early assignment, or anything what jumps on you.

If you over-trade, however, you will not be allowed to do anything with your trade, you will see a margin call, and you will be forced closing your positions at a loss. And you do not want that.

Jade Lizards… they sound very applying to me.

Sadly, it requires me to use a non Belgian broker to tarde them easily… I am just not yet ready for that. Maybe, one day…

I understand that out of the US it may not be as easy as here in the US. I have the experience too.

However, those lizards are quite easy to create and manage as in fact you only manage the naked part of the structure (either a put or naked call in reversed lizard). You can try one trade and see how that goes. I can also help with setup and management if needed.

Thanks for stopping by and commenting.