Last few weeks and months, many people thought and predicted that there will be a stock market crash. Many predicted another crash in 2020. That didn’t happen. Now they are predicting a crash in 2021. Here is why I think there will be no market crash in 2021 either.

Pundits join the stock market crash narrative

More and more pundits are joining the narrative about the stock market crash. Recently, Suze Orman joined the group of panic spreaders with her prediction of this year’s stock market crash and that she is preparing for it. In the recent Yahoo article, Orman advised on how to prepare yourself for the upcoming crash. Let’s ignore the fact that Orman has little to no exposure to the stock market and almost all her wealth is in bonds (in 2007 interview with NY Times magazine, she admitted that her $30 million net worth is in municipal bonds and only one million dollars is in stocks, because “she doesn’t believe in stocks“), her advice has or should have, no value to anyone listening to her.

Then you go to Youtube and you have another large group of people predicting crashes and fiercely explaining why they sold off their portfolios and you should too.

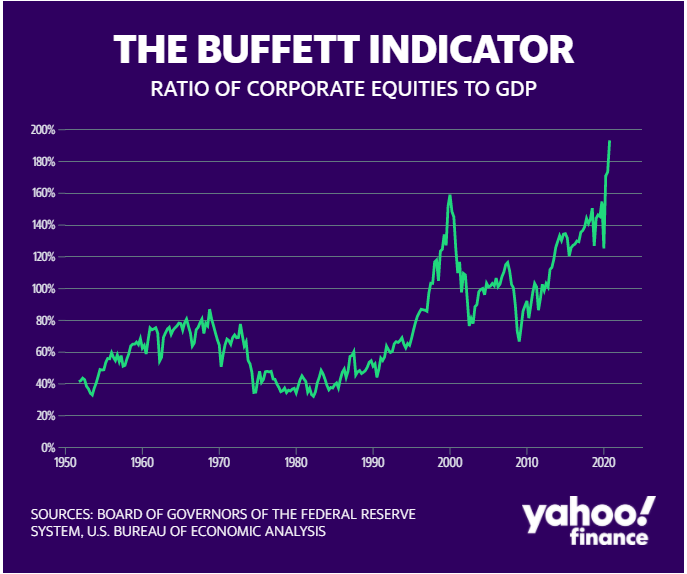

One main reason for the upcoming crash these people push through is the so-called “Buffett indicator”.

Buffett Indicator is a sham

When you know what the so-called Buffett indicator is, you probably wonder, as well as I do, whether Warren Buffett really believes in this indicator himself. Although, Buffett said about the indicator that it is “probably the best single measure of where valuations stand at any given moment”, I believe, it is either grossly misused or I am looking at it from the wrong perspective.

So, what is the indicator about? It is an aggregate market ratio (or how cheap or expensive the market is) to the economic output (or to the nation’s GDP).

And according to all those “experts”, …the Buffett Indicator, which is a measurement of the ratio of the stock market’s total value against U.S. economic output, continues to climb to previously unseen levels.

2 + 2 = fish

Using the Buffett indicator resembles the famous quote by Jamie Shipley in Big Short that “It’s like two plus two equals fish.” Why? Because, in my opinion, and correct me if I am wrong, the indicator, the way it is described, is comparing two totally different outputs that are not comparable.

Let me explain.

If the indicator is comparing the current market valuation with the current nation’s GDP, then it is utterly wrong. The stock market is a forward-looking pricing machine. The stock market is pricing in the future economic output, not current output. It prices in the future expectations about the economy. The market is predicting the future and then correcting itself if the future prediction was not as expected. We all know that Ms. Market looks ahead to 6 months or one-year future and provides us with prices of what she thinks is going to happen in that future.

February 2020 – March 2020 stock market crash and economic output

When the Covid-19 hit the fear of the catastrophic impact on the US and global economies would be severe and the stock market crashed almost 40%. Everyone was predicting the end of the world. The decline and fear of the virus started on February 20, 2020.

Was the market expressing the current economic output? No, it was not. The data were not yet reported. No one could know what the GPD would look like in February! The Bureau of Economic Analysis releases GDP data quarterly and February 20, 2020 data were not known until March 25, 2020, so what caused the stock market to crash? Certainly not the current economic output the pundits are telling us using the Buffett Indicator.

The US economy, cities, towns, and businesses got closed on March 27, 2020. I know that, because on that day, I was moving from Colorado Springs to Denver and Denver’s mayor issued a curfew that day and closed the businesses. And when that happened, the market was already down 40%. In fact, it already recovered some of the losses!

And when the GDP data got released on March 25, 2020, showing that the US economy got down by 5.36%, the market rallied. The next issuance of the GDP data showed that the GDP lost 15.58% the market rallied even more.

People considered it crazy, saying that the economy lost 16% GDP and the market rallies… crazy!… manipulation!!… FED fault!!! But no, the market was just correcting itself. It crashed by 40% but the economy crashed by 16% only, so it was obvious that the market would rally to the mean value. And it continued rallying as it was obvious that there will be no more damage and that the US economy will be undergoing a sharp recovery.

Why there will be no stock market crash, at least not now

By now, I hope you see my point. The market is looking far ahead, so comparing it to today’s economic outlook (GDP) is wrong and misleading. If you want to compare today’s stock market pricing, then compare it to the GDP 6 months in the future, not today, well, of course, if you have any means to know what the US GDP will look like 6 months from now.

People were again outraged by the market’s behavior. People were losing jobs, businesses closed and bankrupt, and the crazy market was rallying and thus detached from reality.

But again, not true. The market was looking far beyond reality. It was looking to the future and saw, that there will be vaccines, businesses reopening, the government approving stimulus packages to support the businesses and Americans, and the economy would be growing again.

Today, our current government approved the 1.9T stimulus package. The Biden administration is about to proceed with a large infrastructure program. If approved as presented in its current writeup, it would be the largest program comparable to Roosevelt’s New Deal.

Biden plans to spend $621 billion on infrastructure, $650 billion on housing improvement, and affordable housing, $400 billion on caregiving programs and caregivers, and $480 billion on research, development, and manufacturing.

You may say that it is another money pumping into the economy that would inflate the bubble even more. But no, this time, if really spent as planned, it would create jobs across the board. Road workers will be needed, construction workers, nurses, scientists, engineers, teachers, all professions will be involved to participate. And it will spark the largest economic boom ever seen. And the market is in fact pricing it in and positioning itself for more bullish growth. Of course, there will be corrections and bumps (dips) on the road, but that is normal and to be expected.

Leave a Reply