Yesterday, I posted why selling is over on Reddit. Moderators deleted that post later during the day and I do not know why. I can only assume that it was because the post sparked so much controversy, mockery, and hatred from other users.

“Yesterday, we got an inverted hammer. That is typically a reversal candle. Today’s strong follow-up can become a recovery. If we survive FED today and tomorrow we have a follow-through, this 5% pullback is done for now.”

That simple post caused a lot of controversy and mockery. The users were telling me that the selling hasn’t started yet and it is all coming, some were comparing my note about the inverted hammer to astrology (“inverted hammer aligned with Mercury and Venus will not stop selling), markets are due for a selloff, people rely on technical analysis too much, and many other responses that indicated to me that those who were reacting didn’t understand the market and forces that move it.

I was thinking about it and decided to address some of those responses and indicate why I think this selling is really over. Of course, there still may be some sort of black swan news or any other event that may reverse the course of the market and it still can go down but I think it is very unlikely.

Here are my thoughts on each argument and why this selling is over:

The selling is not over yet, it has not started yet

I have seen this argument from many investors and traders who are anticipating more selling to come. The market has been selling off for 20 days now. Yet it was not able to crash. There is simply no catalyst or fundamental reason for the market to tank. If there was an underlying fundamental problem, the market would already tank hard. Yet, for the last 20 days, it was wobbling around a 5% decline.

In March last year, the market lost 30% in 20 days. This year, we barely got 5%. This indicates that bulls and long-term investors didn’t see any problem and decided to hold their positions and didn’t join the selling spree.

The market is overvalued and long, long, long due for a large correction

Yes, the market is overvalued but it is not an issue. The valuation is caused by FED’s easy money, not by the exuberance of the market participants. The market can stay overvalued for years (in fact, it will as long as FED keeps interest rates down). But generally, the market follows earnings, not a P/E value, and as long as earnings are growing and estimates are in positive territory, the market will not care about valuation. It will care about it once FED raises the rates or earnings will start going down. As of today, earnings estimates are pointing to 30% growth next year. I only found two companies issuing warnings about their future earnings. That still doesn’t mean the market will crash.

P/E of S&P 500 is at historical levels

P/E… the favorite mantra of the bears. But the P/E is only one part of an equation. The second part is earnings. If you are a subscriber to my weekly newsletter, I write about my market outlook every week and show the relationship between the P/E and earnings to come up with the market valuation.

But moreover, looking at the current P/E, you are referring to ancient history. That P/E has been derived from historical data, from the past, from something that no longer exists. The market doesn’t care about history. It cares about the future. Today’s P/E is irrelevant.

The same goes with the Schiller P/E. It is a moving average of the multiple P/Es. And looking at it and saying: “market is overvalued and will crash” is like looking at 50-day MA and say the market will go up because the price is above the 50-day MA. Although it may go up, the moving average doesn’t have a predictive function as well as P/E doesn’t possess such predictive power.

FED

Another indication of this selling end is FED and the recent FOMC meeting notes released yesterday. Our friendly neighbor Jerome-man indicated 6 to 7 interest hikes by 2024. And the market didn’t flinch! Remember when Powell said that they would raise the rates in 2018 and the market tanked? Trump was furious at that time and was even thinking of replacing Powell for it. Today, the market ended the session with a 1.3% rally.

Wait for FED tapering and interest rates hike!

As I said above, FED announced the rates hikes. Six or seven of them! But will they actually do it?

This indicates one thing and that is that the FED expects our economy to prosper. It sees it as in good shape and growing through 2024. That alone will prop the markets for the near future, or at least until the FED actually raises the rates. So far, they have been talking about tapering and raising the rates since 2009. They were setting all sorts of limits after which they will do it. For example, Janett Yellen was talking for years about raising the rates once inflation hits the 2% mark. Today, inflation is at a 5%+ mark. So here came the “transitory” explanation to excuse no tapering and no rates raise (although I think this inflation is really transitory; I agree with Lacy Hunt on this).

So will FED do it and raise the rates? I personally doubt it. I think FED is scared itself of any market selloffs and they will do whatever it takes to make the markets flow above the water and step in every time the market’s boat gets shaky.

What’s next?

I do not rely on technical analysis only. I, in fact, suck in technical analysis. But when I saw the market printing the inverted hammer candle and knowing these fundamental relationships of the P/E, earnings, the reluctance of further selling from investors, I realized that this selling was finally over.

It doesn’t mean that there will be no more selling in the future. No, we may see another selloff next week, or next month (but most likely next year). I do not have a crystal ball to predict the next selloff (I wish I had one) but I can say with certainty that this particular selling is done. Expect a path to recovery.

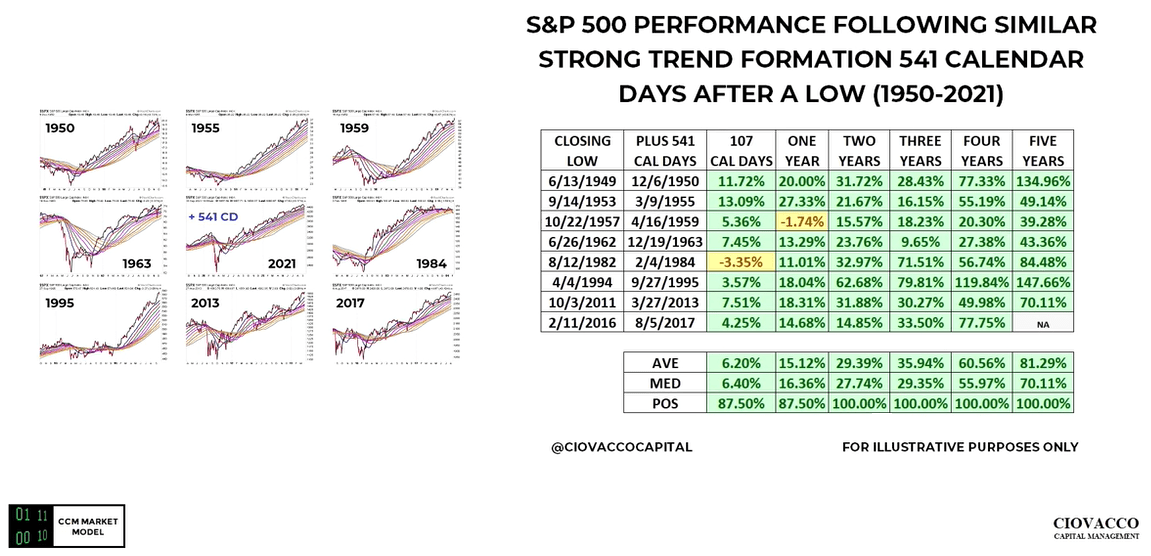

I like to follow Chris Ciovacco and his weekly market analysis. He does a great job identifying past occurrences of what is happening today (or similarities). In his last video he identified similar market trends since 1950 up to today and he looked at what happened next and compared it with what is happening today.

Although this is not a prediction, it can set one’s expectations of a possible future outcome.

Can this outcome change and be different from those similar past occurrences? Of course, it can. There is no guarantee to it. As an old adage says, past performance is not a guarantee of the future outcome. But this adage is a CYA note from the brokers and investment advisors to protect themselves while the market and its behavior are about human psychology. And humans repeat themselves very often.

Make sense to me!