The market was declining last week but none of the selling was aligned with economic data. Economy is clearly strong. Labor market is strong. And the consumer’s sentiment is improving. Unfortunately, in today’s market, this is negative. Good news is bad news. Investors simply ignore that the inflation as transitory after all and it will go lower. Some perceive it as not going lower fast enough, others even believe, it is actually going up. But that is not the case, well, it depends, how far you are willing to look. If just around the corner, you may be right, this is all bad, if your horizon is more than 5 years, you should rejoice.

Weekly initial unemployment claims report has been pushing bond yields higher lately because the 4-week average of the series has been declining, suggesting that the unemployment rate remained low in October. Jobless claims likely remained low too during the October 20 week. And short-sighted investors do not like it.

The market is deeply oversold, and I expect a bounce. Futures are up right now, but will this hold throughout the day or even a week? We must wait and see, but the market is clearly driven by the bond yields now and nothing can stop it. If the yields keep rising the markets will sell. And any bounce will find sellers.

In this environment, it is hard to say what is going to happen. The rates were going up and there is no sign of a change:

Over the weekend, the yields eased (which explains the futures rising). If this continues, the markets will see a relief rally next week:

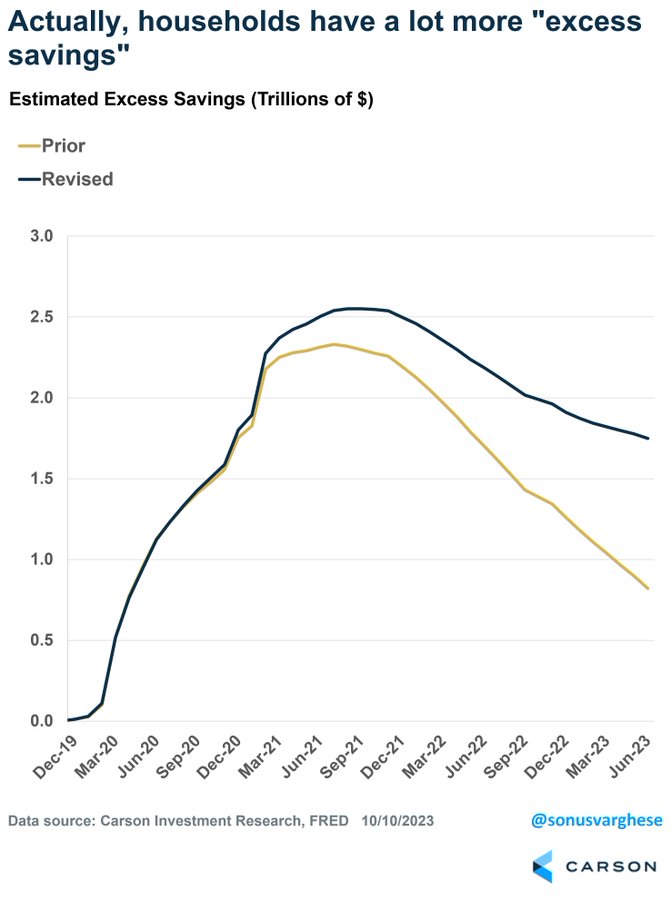

Oh, and if you still believe in hard landing, the economic data indicate that your beliefs in doom and gloom will hard land. Not the economy…

|

We all want to hear your opinion on the article above: No Comments |

Recent Comments