October 2021 has started last week and it started on a good note. Our account has recovered fully and went on a growth mode again. Our net-liquidating value, as you will see in this investing and trading report jumped up significantly, our buying power also went up allowing us to open a few new trades, and we continued accumulating speculative stocks that we believe will ensure rapid portfolio growth over the long run.

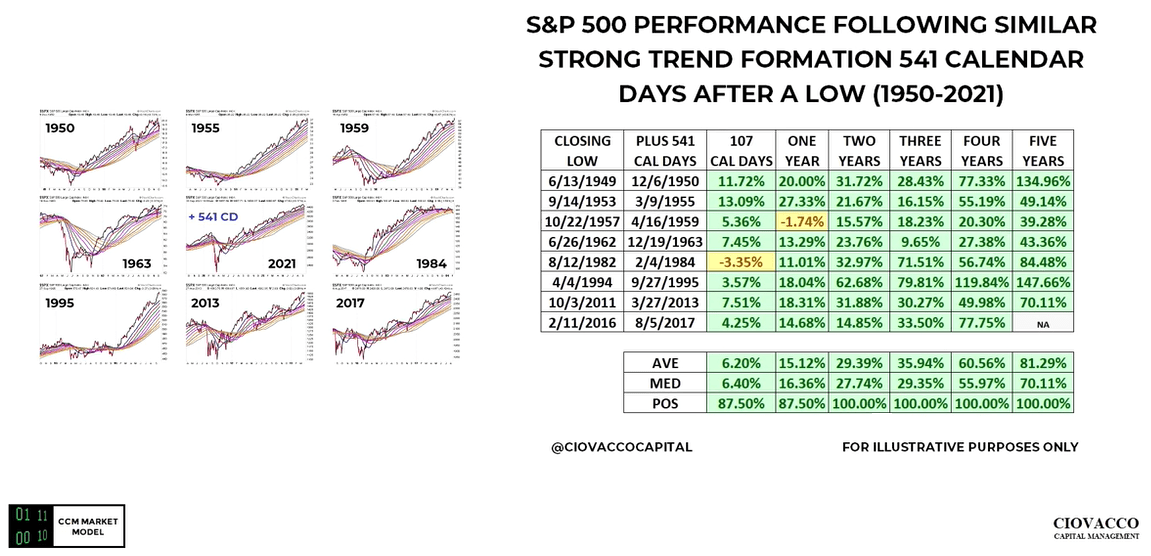

There is still a lot of fear out there, people worrying about things that are either not important or exaggerating issues that are not a problem yet. As you will see, and if you are a subscriber to our newsletter, you will learn more details, that the US economy is still humming well and set on the growth track. It is stunning to see people being blinded by a fact that the economy is running in waves and you have small waves and big waves. We should be worried about the big waves and not the small ones and I strongly believe, that the September pullback is a small wave of a typical economic cycle. Even if we see it as an economic pullback, it will rebound and continue higher.

Study the market’s history, the last secular bull market took 20 years (1980 – 2000), we are in a secular market that has taken 12 years only. And it is pretty normal that you will see cyclical bears, pullbacks, and corrections in between. Don’t freak out where you do not need to.

And, in the meantime, please, enjoy our weekly investing and trading report.

Here is our investing and trading report:

| Account Value: | $85,025.27 | $5,804.79 | 7.33% |

| Options trading results | |||

| Options Premiums Received: | $1,396.00 | ||

| 01 January 2021 Options: | $4,209.00 | +16.65% | |

| 02 February 2021 Options: | $4,884.00 | +15.41% | |

| 03 March 2021 Options: | $5,258.00 | +12.79% | |

| 04 April 2021 Options: | $2,336.00 | +4.30% | |

| 05 May 2021 Options: | $6,346.00 | +9.22% | |

| 06 June 2021 Options: | $4,677.00 | +6.37% | |

| 07 July 2021 Options: | $3,865.00 | +5.14% | |

| 08 August 2021 Options: | $6,133.00 | +7.40% | |

| 09 September 2021 Options: | $2,353.00 | +2.97% | |

| 10 October 2021 Options: | $1,396.00 | +1.64% | |

| Options Premiums YTD: | $41,457.00 | +48.76% | |

| Dividend income results | |||

| Dividends Received: | $65.14 | ||

| 01 January 2021 Dividends: | $53.04 | ||

| 02 February 2021 Dividends: | $63.00 | ||

| 03 March 2021 Dividends: | $30.31 | ||

| 04 April 2021 Dividends: | $139.70 | ||

| 05 May 2021 Dividends: | $167.45 | ||

| 06 June 2021 Dividends: | $168.56 | ||

| 07 July 2021 Dividends: | $228.62 | ||

| 08 August 2021 Dividends: | $780.09 | ||

| 09 September 2021 Dividends: | $176.60 | ||

| 10 October 2021 Dividends: | $65.14 | ||

| Dividends YTD: | $1,913.99 | ||

| Portfolio metrics | |||

| Portfolio Yield: | 4.18% | ||

| Portfolio Dividend Growth: | 8.13% | ||

| Ann. Div Income & YOC in 10 yrs: | $16,336.97 | 15.77% | |

| Ann. Div Income & YOC in 20 yrs: | $124,089.30 | 119.82% | |

| Ann. Div Income & YOC in 25 yrs: | $525,647.30 | 507.55% | |

| Ann. Div Income & YOC in 30 yrs: | $3,436,221.65 | 3,317.94% | |

| Portfolio Alpha: | 41.48% | ||

| Portfolio Weighted Beta: | 0.69 | ||

| CAGR: | 635.14% | ||

| AROC: | 37.10% | ||

| TROC: | 16.78% | ||

| Our 2021 Goal | |||

| 2021 Dividend Goal: | $1,071.42 | 178.64% | Accomplished |

| 2021 Portfolio Value Goal: | $42,344.06 | 200.80% | Accomplished |

| 6-year Portfolio Value Goal: | $175,000.00 | 48.59% | |

| 10-year Portfolio Value Goal: | $1,000,000.00 | 8.50% |

Dividend Investing and Trading Report

Last week, as the markets have shown some recovery, we grew our net-liq value by 7.33%. If the trend in S&P500 continues I expect rapid growth (mostly due to SSO and SPXL holdings) of our net liq in the coming weeks. If the current trend doesn’t hold (see our market outlook below or subscribe to our newsletter for a full market outlook analysis), our net-liq may drop again. But it will be a temporary drop. A good opportunity to buy more shares.

Our dividend income was steady, we have received $65.14 in dividends last week, making October at $65.14 dividend income.

Here are our holdings today:

Options Investing and Trading Report

Our options income started great in October. We generated $1,396.00 options income so far this month and we expect to generate more. I hope, the market would stay pressured for a while so I can keep buying cheaper stocks and making more money on options.

Last week our buying power (BP) went above the $2,000 limit we set for October and that allowed us to open new trades. We sold strangles against AAPL, WBA, KBE, and BAC stocks.

Other than that, we rolled our strangles against AAPL, KBE, MU, OXY, XOM, and we rolled our KBE covered call higher (for a credit).

You can watch all our trades in this spreadsheet. You can watch the spreadsheet and look for a “NEW” indication next to the trading date. When the indicator shows up, it is typically good for up to 3 days to follow that trade.

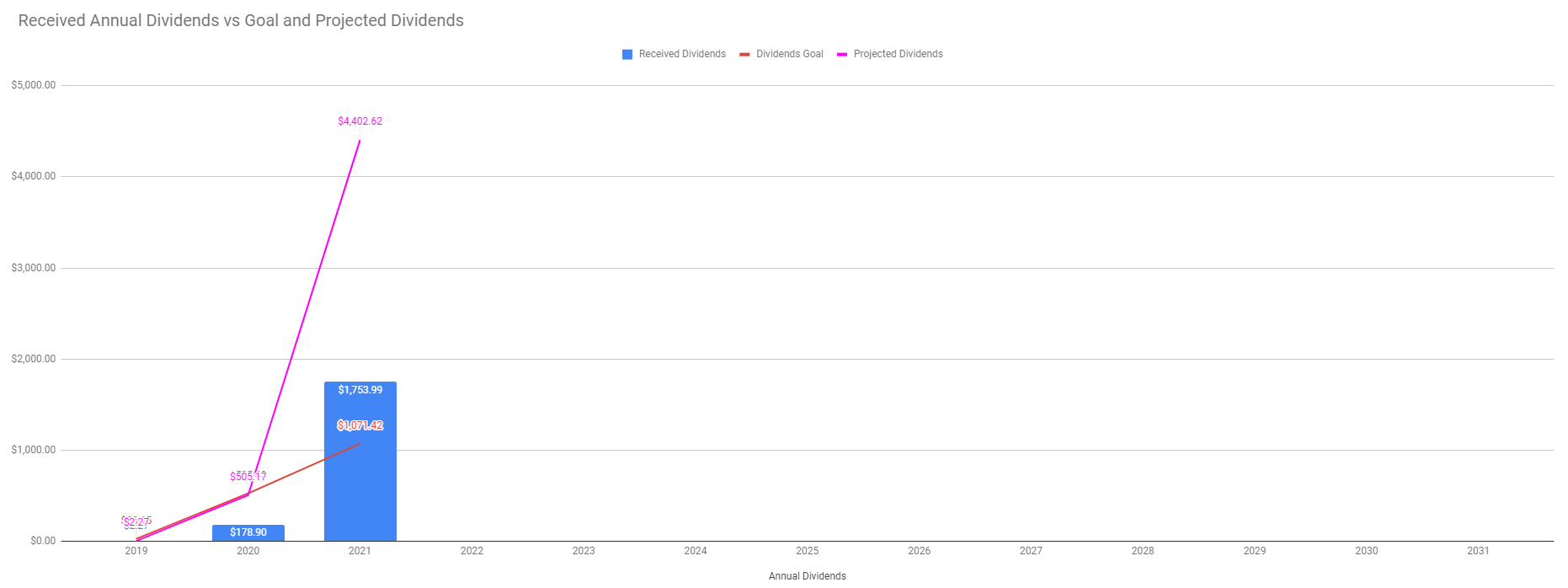

Expected Future Dividend Income

We received $65.14 in dividends last week. It is still slow that I would like to see but we are still in an accumulation phase so I do not care much about the total amount of dividends I am receiving today. I am building a portfolio with the expectation of getting large dividends in the future. And in the meantime, I learned how to trade option to generate consistent income today.

Our projected annual dividend income in 10 years is $16,336.97 but that is if we do absolutely nothing and let our positions grow on their own.

We are also set to receive a $3,940.36 annual dividend income. We are 24.12% of our 10 year goal.

The chart above shows how our future dividend income is based on the future yield on cost and what dividend income we may expect in the future. The expected dividend growth depends on what stocks we are adding to our portfolio and the stocks’ 3 years average dividend growth rate. It is interesting to see what passive income we may enjoy 10, 20, 25, or 30 years from now.

Market value of our holdings

Our non-adjusted stock holdings market value increased from $108,138.05 to $111,297.56 last week.

However, we still expect the value of our holdings to grow and outperform the market long term. Many positions in our portfolio are new and “young” and they did not have enough time to show gains yet. We were building cash reserves to buy depressed stocks during selloffs and corrections as well as negative analysts reports (as long as the company is still good long term).

Our goal is to accumulate 100 shares of each stock of our interest and we are getting to that goal.

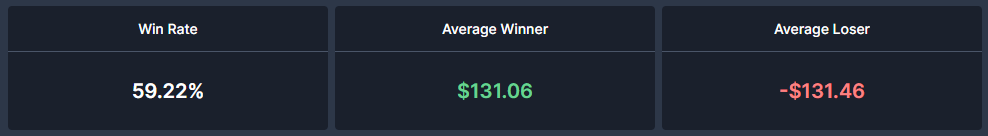

Investing and trading ROI

Our options trading delivered a 1.64% monthly ROI in October 2021, totaling a 48.76% ROI YTD. We again exceeded our 45% annual revenue selling options against dividend stocks target!

Our account grew by 313.30% beating our projections and the market.

Our options trading averaged $4,145.70 per month this year. If this trend continues, we are on track to make $49,748.40 trading options in 2021. As of today, we have made $41,457.00 trading options.

Old SPX trades repair

This week, we didn’t adjust any SPX trades. Our goal is to reach a level that we will be eligible for portfolio margin (PM). Once that happens, we plan on converting the existing SPX Iron Condors to strangles and trade these positions as strangles.

With RegT margin, the capital requirements would be approx. $66,586.06 and that is beyond our means. With PM the requirement for margin would drop to around $10k. That is doable in our account. Once we reach this level, we will start adjusting our SPX trades accordingly. Until then, we will just roll these trades around.

Accumulating Growth Stocks

Last week we have added 5 shares of SSO and 9 shares of SPXL to our holdings according to our plan and rules. Our goal for the nearest future is to accumulate 25% of our net-liq in these shares and maintain the weight. If the weight goes above 25% we will start trimming the positions, and when the weight goes below 25% we will start accumulating the positions. Any leftovers will be reinvested to the dividend growth stocks, options trades, or reserves.

Accumulating Rules

Our rule is to buy shares of growth stocks using 20% of any BP value that is above the $2,000 limit. For example, if our BP ends at $2,900, we can buy shares using 20% of $900 or $180 to accumulate shares of any growth stocks.

Why such a rule? Up to today, I was scaling up my trades and portfolio. That resulted in rapid growth but also all our proceeds were constantly locked in the trades. If we want to live off of our dividends and options income, we cannot have them locked by new trades. We need to start accumulating “cash available to withdraw”. Therefore, I am shifting my trading to trade the same amount of contracts and invest only a certain excess of the accumulated cash.

Accumulating Dividend Growth Stocks

Last week, we didn’t add any new dividend growth stocks.

Our goal is to reach 100 shares of high-quality dividend stocks and build a weekly dividend income as per this calendar, but we have made no changes to this goal last week:

You can see the entire spreadsheet here.

Market Outlook

The stock market rallied most of the last week and reached the upper trend line of a downward sloping channel. We need the market to break above that level and move higher. If it doesn’t, expect more selling. We are seeing the market creating lower highs and lower lows. From the TA perspective, it is a bearish trend. We need that trend to be broken.

Although anything can happen in the stock market at any time, I do not see this trend break but either continue going lower or wobbling sideways with the slight downward push. My expectation for the upcoming week is still down to the $4,230 level unless some good economic news (such as better job report, consumer index, PPI, or retail sales) comes that would push the market up. The market can also run on the ceiling debt optimism (rumors) and then pull back on the news on October 18th.

Definitely, we are at crossroads and have to wait. But, these lower prices are a great opportunity.

If you want to learn more about the stock market, events that moved the market last week and will likely impact it in the near future, I recommend you to subscribe to our weekly newsletter. Knowing where the market is heading and knowing when you should expect its reversal can benefit your trading and investing. Subscribe and you get one month free.

Investing and trading report in charts

Account Net-Liq

Account Stocks holding

Our stock holdings still do not beat the market, although when I was preparing this report and updating our Watch list page, I noticed an interesting discrepancy (if I can call it that way) between the market’s return and our account stock holdings return.

I compared our stock holdings at the end of August (week 35 report) and saw that the market returned 56.79% since 04/01/2019 (it is the inception date of our portfolio) and our stock holdings returned 20.94% at that time.

Today, the market is returning 51.81% but our portfolio stock holdings returned 24.66%. Putting it together, the market return went down, while our stock holdings return went up.

Last week, S&P 500 grew 51.81% since we opened our portfolio while our portfolio grew 24.66%. On YTD basis, the S&P 500 grew 21.96% and our portfolio 17.67%.

But the numbers above apply to our stock holdings in our account, not the overall account net-liq growth. Our overall account beats the market growing by 313.30%!

Stock holdings Growth YTD

I expect our stock holdings to start outperforming the market as they mature. However, these are just our stock holdings. The entire portfolio beats the market by far thanks to monetizing those positions.

Our 10-year goal is to grow this account to $1,000,000.00 value in ten years. We are in year two and we accomplished 8.50% of that goal.

Our 6-year goal is to reach $175,000 account value to be eligible for portfolio margin (PM) and today we accomplished 48.59% of that goal.

Our 2021 year goal is to grow this account to a $42,344.00. We already accomplished this goal.

Investing and Trading Report – Options Monthly Income

Investing and Trading Report – Options Annual Income

Our dividend goal and future dividends

We have accomplished our dividend income goal. We planned to make $1,071 of dividend income this year and we finished receiving $1,913.99. However, we accumulated enough shares to start making $3,940.36 a year.

Our account cumulative return

The chart below indicates our cumulative adjusted return. It shows how the last week’s selloff shook down our returns but we are recovering along with the market.

As of today, our account cumulative return is 41.20% (note, data in this section are since March 13, 2021, only as that is the date we started tracking these metrics. Thus the results are skewed a bit and will show full picture next year.).

Conclusion of our investing and trading report

This week our options trading was within our expectations and I believe, the rest of the month will be even better.

We will continue accumulating the dividend growth stocks in our portfolio to reach 100 shares and continue building our cash reserves so we have enough cash to sustain any market corrections and be able to buy depressed stocks.

We will report our next week’s results next Saturday. Until then, good luck and good trading!

|

We all want to hear your opinion on the article above: No Comments |

Recent Comments