The month is almost over and it was a bumpy one for sure. But our account survived the market weakness with flying colors as you will be able to see in this weekly investing and trading report.

At first, when the September selling started and mainly continued for two weeks and even spilled in the third week, I was not sure what to think about. Everyone out there was freaking out and selling. People were predicting the end of the world (and they still are) yet we only saw a barely 5% decline. It was difficult to keep your head clear and think. What is the reason for selling? And how does it affect the market?

You know me, I keep saying that the market follows earnings. It doesn’t care about anything else. And if any news or event out there rocks the market, you need to look at the earnings. Was it affected? Or could it be affected? If not, ignore that news and consider the selling to be just a dip you can ignore (and buy). So when the sky was falling, I was checking what the analysts and businesses were doing about their outlooks and estimates. I only found two companies issuing their earnings warnings last week. Two! Out of, what, ten thousand? Fifty thousand? A million? Two companies do not make the US economy. Everybody else held their ranks. It started to be obvious that this selling was just a dip. No matter how scary it may have appeared.

Here is our investing and trading report:

| Account Value: | $81,490.42 | -$152.39 | -0.19% |

| Options trading results | |||

| Options Premiums Received: | $2,909.00 | ||

| 01 January 2021 Options: | $4,209.00 | +16.65% | |

| 02 February 2021 Options: | $4,884.00 | +15.41% | |

| 03 March 2021 Options: | $5,258.00 | +12.79% | |

| 04 April 2021 Options: | $2,336.00 | +4.30% | |

| 05 May 2021 Options: | $6,346.00 | +9.22% | |

| 06 June 2021 Options: | $4,677.00 | +6.37% | |

| 07 July 2021 Options: | $3,865.00 | +5.14% | |

| 08 August 2021 Options: | $6,133.00 | +7.40% | |

| 09 September 2021 Options: | $1,177.00 | +1.44% | |

| Options Premiums YTD: | $38,885.00 | +44.07% | |

| Dividend income results | |||

| Dividends Received: | $49.00 | ||

| 01 January 2021 Dividends: | $53.04 | ||

| 02 February 2021 Dividends: | $63.00 | ||

| 03 March 2021 Dividends: | $30.31 | ||

| 04 April 2021 Dividends: | $139.70 | ||

| 05 May 2021 Dividends: | $167.45 | ||

| 06 June 2021 Dividends: | $168.56 | ||

| 07 July 2021 Dividends: | $228.62 | ||

| 08 August 2021 Dividends: | $780.09 | ||

| 09 September 2021 Dividends: | $130.74 | ||

| Dividends YTD: | $1,802.99 | ||

| Portfolio metrics | |||

| Portfolio Yield: | 4.59% | ||

| Portfolio Dividend Growth: | 8.13% | ||

| Ann. Div Income & YOC in 10 yrs: | $18,571.43 | 18.22% | |

| Ann. Div Income & YOC in 20 yrs: | $157,914.52 | 154.91% | |

| Ann. Div Income & YOC in 25 yrs: | $732,878.63 | 718.92% | |

| Ann. Div Income & YOC in 30 yrs: | $5,419,297.84 | 5,316.07% | |

| Portfolio Alpha: | 40.39% | ||

| Portfolio Weighted Beta: | 0.70 | ||

| CAGR: | 645.31% | ||

| AROC: | 48.77% | ||

| TROC: | 15.59% | ||

| Our 2021 Goal | |||

| 2021 Dividend Goal: | $1,071.42 | 168.28% | Accomplished |

| 2021 Portfolio Value Goal: | $42,344.06 | 192.45% | Accomplished |

I love selling days as we saw in the last three weeks. I make most of my money these days. I usually adjust my trades to release my buying power as the stocks decline and my put side of the trades got in danger and that is when I make a lot of money. And when the stocks start recovering, I roll again, this time higher, and make more money. That’s why I could make a $2,909.00 premium this week and offset last week’s negative premium that happened when I bought SPY LEAPS. Now I have a positive options premium income to report and hold SPY LEAPS that will make me tons of money long term.

Dividend Investing and Trading Report

Our net-liquidating value got a hit last week when the market tanked. We dropped to $75k from $82k. That was an 8.5% dip, more than the market. The market dipped 5.4% only. But I didn’t flinch, held my positions, and more importantly continued buying more shares. That will pay a lot in the future!

As I mentioned above, we have received a great deal of options premiums when adjusting the positions. We were also reopening the expired positions last week. We still have a few positions to reopen but I have to wait for the buying power to rise to be able to start opening those new trades. My rules – see below about these rules.

Our dividend income got smaller than expected. Looks like, we have received all the dividend income in August and very little in September. Either, I have my tracking of dividend income wrong, or this was just an anomaly this season. I will leave it for now. The truth is, we only made $49 in dividends totaling $130 for September. Our expectation was to receive $411 in September.

Here are our stock holdings that contribute to our dividend income:

Options Investing and Trading Report

Last week we rolled AAPL, BA, OMF, PMT, OXY, AXP, MU, XOM, BABA, and AES strangles. All trades delivered great premiums while kept our buying power positive at all times. No margin call whatsoever.

We also opened new strangles against trades that expired last week, such as AES, MU, KBE, DKNG, OXY, and OMF.

You can watch all our trades in this spreadsheet. You can watch the spreadsheet and look for a “NEW” indication next to the trading date. When the indicator shows up, it is typically good for up to 3 days to follow that trade.

Expected Future Dividend Income

Our dividend income was slower last week. We received $49 only for dividends but I am still happy with it. We are in an accumulation phase so I do not care much about the total amount of dividends I am receiving. I am building the portfolio and I know it will bring fruits later.

Our projected annual dividend income in 10 years is $18,571.43 but that is if we do absolutely nothing and let our positions grow on their own.

We are also set to receive a $4,404.54 annual dividend income. We are 24.20% of our 10 year goal!

The chart above shows how our future dividend income is based on the future yield on cost and what dividend income we may expect in the future. The expected dividend growth depends on what stocks we are adding to our portfolio and the stocks’ 3 years average dividend growth rate. It is interesting to see what passive income we may enjoy 10, 20, 25, or 30 years from now.

Market value of our holdings

Last week we aggressively bought shares that would ensure the future growth of our portfolio. We want growth that would outperform SPY and deliver great income. So we added SSO and SPXL leveraged ETFs into our portfolio and started accumulating these funds. It is a risky proposition but profitable in the long run. I made a goal to accumulate 25% of our portfolio in these funds and accumulate whenever they drop below 25% and sell anything above 25% and reinvest the proceeds elsewhere.

I am also accumulating SPY LEAPS but LEAPS are expensive so we have to wait to save cash first. Unfortunately, the LEAPS do not contribute to our stock holdings performance so it looks like they do not exist.

And of course, we keep accumulating dividend growth stocks, high yield dividend stocks, and growth stocks to boost the portfolio growth.

I used to accumulate cash in the ICSH fund but realized that it is a waste of money to keep a large holding in this fund making only a little above the savings account. Therefore, I split our holdings between ICSH and SPY. We still will be saving cash in the ICSH fund but also in the SPY ETF.

Our non-adjusted stock holdings market value increased from $106,589.22 to $109,309.61.

We still expect the value of our holdings to grow and outperform the market long term. Many positions in our portfolio are new and “young” and they did not have enough time to show gains yet. We were building cash reserves to buy depressed stocks during selloffs and corrections as well as negative analysts reports (as long as the company is still good long term).

Our goal is to accumulate 100 shares of each stock of our interest and we are getting to that goal.

Investing and trading ROI

Our options trading delivered a 1.44% monthly ROI in September 2021, totaling a 47.72% ROI YTD. We again exceeded our 45% annual revenue selling options against dividend stocks target!

Our account grew by 296.12% beating our projections and the market.

Our options trading averaged $4,320.56 per month this year. If this trend continues, we are on track to make $51,846.67 trading options in 2021. As of today, we have made $38,885.00 trading options. This was an increase from previous weeks and months.

Old SPX trades repair

This week, we didn’t adjust any SPX trades. Our goal is to reach a level that we will be eligible for portfolio margin (PM). Once that happens, we plan on converting the existing SPX Iron Condors to strangles and trade these positions as strangles.

With RegT margin, the capital requirements would be approx. $66,586.06 and that is beyond our means. With PM the requirement for margin would drop to around $10k. That is doable in our account. Once we reach this level, we will start adjusting our SPX trades accordingly. Until then, we will just roll these trades around.

Accumulating Growth Stocks

We started accumulating SPXL and SSO leveraged ETFs. We were stopped out last week but we bought back in when the stocks dropped further. So we are in these positions on a cheaper cost basis. We will continue purchasing these funds and we hope and plan to raise holdings in these stocks to 25% of our entire portfolio.

Once we reach that level, we will be trimming our position in SSO and SPXL if they exceed the 25% mark (price appreciation) or buy more when they drop below the 25% mark. As of today, we hold 5.48% of our net-liq in these shares.

We also added shares of AAPL to our current holdings.

Accumulating Rules

I still have issues with the rules when managing our portfolio. It is simple and easy to set the rules and say “stick to it”. But it is difficult to do so. I created a spreadsheet to track my portfolio, my trading, and my stock accumulation process. Yet I have a hard time sticking to the rules. What am I doing wrong?

I was thinking about it and realized I may have been making mistakes. I set up goals, but I set up too many of them. Then it is hard to follow them and hard to focus on them. And my mind and habits are not trained for it. I am not trained to keep a single rule!

So, I need to break those rules to even smaller tasks and focus on only one task.

The task for this season then is to trade only strangles against trades I have already open. Reopen them only when they expire (rolling to protect them is OK) and maintain my buying power at or above $2,000 at all times. At the end of any trading session, my BP must be above that level.

Accumulating Dividend Growth Stocks

Last week, we didn’t add any new dividend growth stocks.

In the upcoming weeks, we will continue to accumulate the higher yield income stocks to boost our income and reinvest the proceeds but following our accumulation rules as described in the above section.

Our goal is to reach 100 shares of high-quality dividend stocks and build a weekly dividend income as per this calendar, but we have made no changes to this goal last week:

You can see the entire spreadsheet here.

Market Outlook

The stock market sold off again on Monday last week but on Tuesday the market printed an inverted hammer. That is typically a reversal hammer if followed through. Given that the market underlying fundamentals haven’t changed, I realized that the selling was over.

And sure enough. In the next three trading sessions, we had a strong rally. On Friday the rally was a bit muted but I think it will continue in the next few weeks and end of the year despite people still refusing to believe it and waiting for a correction that may never come.

So what is our expectation for the future? This secular bull market has not ended and it will not end for a long time. The stock market follows earnings and earnings estimates for the rest of the year are another 28% growth for 3Q and 21% for 4Q. The recent selloff hasn’t changed that outlook.

Recently, Ryan Detrick posted on Twitter about the December lows indicator:

As we noted at the end of Q1 when the S&P 500 doesn’t violate the December lows in Q1, the rest of the yr is usually extremely strong (higher 94.3% of the time). In fact, for the full yr, the SPX is up an average of 18.4% when the Dec low isn’t violated in Q1. The S&P 500 is up 18.5% YTD.

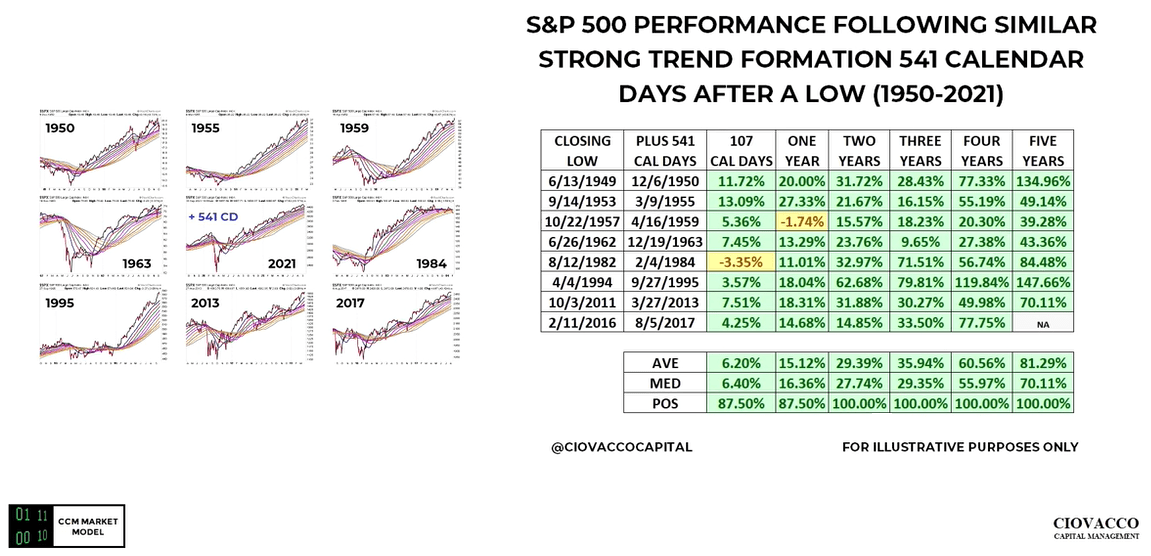

Other technical analysts I follow agree with this outlook and predict this market to continue higher. Here is what Chirs Ciovacco posted in his weekly Youtube videos (great work by the way):

From this table above you may want to be open for further run upwards. The same expectation was provided by Tom Lee recently in his interview with CNBC.

Bank of America also issued its prediction for next year’s earnings. They predict 30% growth. That has not been revised recently. Thus you may expect a bullish outcome in the near future.

My expectation for the next week is that S&P 500 will reach $4,500 again.

If you want to learn more about the stock market, events that moved the market last week and will likely impact it in the near future, I recommend you to subscribe to our weekly newsletter. Knowing where the market is heading and knowing when you should expect its reversal can benefit your trading and investing. Subscribe and you get one month free.

Investing and trading report in charts

Account Net-Liq

Account Stocks holding

Our stock holdings still do not beat the market but I am positive that the growth will pick up and exceeds the market. We just need time and continue reinvesting the proceeds. S&P 500 grew 54.02% since we opened our portfolio while our portfolio grew 22.89% only. On YTD basis, the S&P 500 grew 24.18% and our portfolio 15.91%.

But the numbers above apply to our stock holdings in our account, not the overall account net-liq growth. Our overall account beats the market growing by 296.12%!

Stock holdings Growth YTD

I expect our stock holdings to start outperforming the market as they mature. However, these are just our stock holdings. The entire portfolio beats the market by far thanks to monetizing those positions.

Our goal is to grow this account to $1,000,000.00 value in ten years. We are in year two and we are accomplishing this goal by 8.15%.

Our goal is to grow this account to a $42,344.00 value in 2021. We already accomplished this goal.

Investing and Trading Report – Options Monthly Income

Last week, we bought SPY LEAPS, and the chart showed a negative September. Thanks to the selloff in the market last week, we rolled many trades and generated large income that fully offset last week’s negative report. We are in a positive income again.

Investing and Trading Report – Options Annual Income

Our dividend goal and future dividends

We have accomplished our dividend income goal. We planned to make $1,071 of dividend income this year and we finished receiving $1,802.99. However, we accumulated enough shares to start making $4,404.54 a year.

Our account cumulative return

The chart below indicates our cumulative adjusted return. It shows how the last week’s selloff shook down our returns but we are recovering along with the market.

As of today, our account cumulative return is 42.01% (note, data in this section are since March 13, 2021, only as that is the date we started tracking these metrics. Thus the results are skewed a bit and will show full picture next year.).

Conclusion of our investing and trading report

This week our options trading was within our expectations and I believe, the rest of the month will be even better.

We will continue accumulating the dividend growth stocks in our portfolio to reach 100 shares and continue building our cash reserves so we have enough cash to sustain any market corrections and be able to buy depressed stocks.

We will report our next week’s results next Saturday. Until then, good luck and good trading!

Leave a Reply