Another week is over and I am providing my weekly investing and trading report. The last week was weak and we are on track to have the entire month underperforming. Our net liquidation value grew, but overall, the growth was small (only 7% compared to 23% and 25% in January and February – month over month growth). Let’s review how we did last week.

Here is our investing and trading report:

| Account Value: | $34,028.85 | +$3,381.36 | +11.03% |

| Options trading results | |||

| Options Premiums Received: | $340.00 | ||

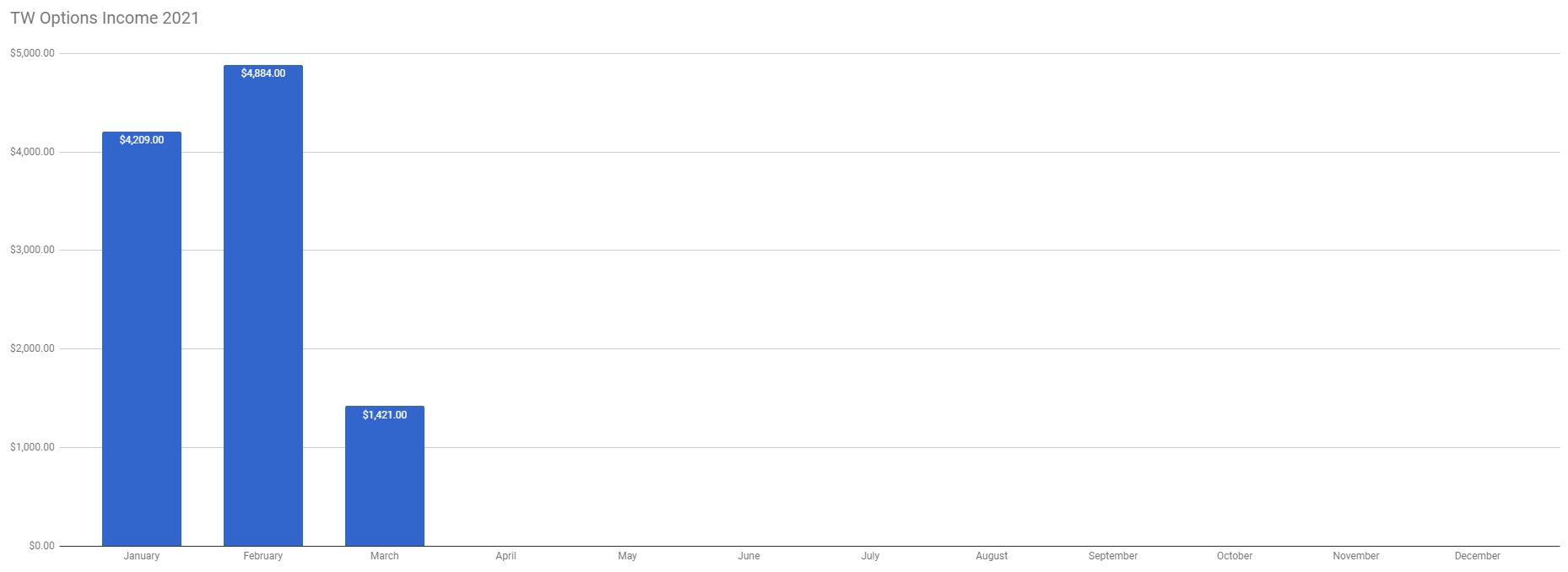

| 01 January 2021 Options: | $4,209.00 | +16.65% | |

| 02 February 2021 Options: | $4,884.00 | +15.41% | |

| 03 March 2021 Options: | $2,458.00 | +7.22% | |

| Options Premiums YTD: | $11,551.00 | +33.94% | |

| Dividend income results | |||

| Dividends Received: | $2.91 | ||

| 01 January 2021 Dividends: | $53.04 | ||

| 02 February 2021 Dividends: | $63.00 | ||

| 03 March 2021 Dividends: | $14.55 | ||

| Dividends YTD: | $130.59 | ||

| Portfolio metrics | |||

| Portfolio Yield: | 3.71% | ||

| Portfolio Dividend Growth: | 7.73% | ||

| Ann. Div Income & YOC in 10 yrs: | $3,877.00 | 12.60% | |

| Ann. Div Income & YOC in 20 yrs: | $23,504.42 | 76.40% | |

| Ann. Div Income & YOC in 25 yrs: | $82,046.63 | 266.70% | |

| Ann. Div Income & YOC in 30 yrs: | $406,504.59 | 1321.40% | |

| Portfolio Alpha: | 27.47% | ||

| Portfolio Weighted Beta: | 0.60 | ||

| CAGR: | 711.46% | ||

| AROC: | 27.43% | ||

| TROC: | 21.38% | ||

| Our 2021 Goal | |||

| 2021 Dividend Goal: | $1,071.42 | 12.19% | |

| 2021 Portfolio Value Goal: | $42,344.06 | 80.36% |

Last week, we received $340.00 in premiums trading options against our holdings. We opened one new trade against Realty Income (O) but the rest of the trades were adjustments only. For the entire March 2021, we received $2,458.00 premiums. Our non-adjusted stock holdings market value increased from $28,642.83 to $33,327.00. All our income was kept in cash.

Open trades

The table above shows all our open trades and expirations. It is just a simplified tracking and buying power reduction. Our goal is to trade a set amount of equity strangles in what I call perpetual strangle trading. It is nothing fancy. I just have a list of equities I like to trade options around them, I like to eventually own and I accumulate these stocks. Once a trade expires (or nears expiration) I re-open the trade or roll it into the next expiration (mostly trades that a stock is near the short strike and there is a risk of getting in the money).

Although, we have not opened any new trades we experienced a significant jump in buying power reduction. The BP reduction decreased from $28,780.90 to $27,393.00, a reduction of -$1,387.90 as some of our open trades expired. That represents a reduction of 4.82%. This helped to increase our net-liquidating value last week.

Investing and trading ROI

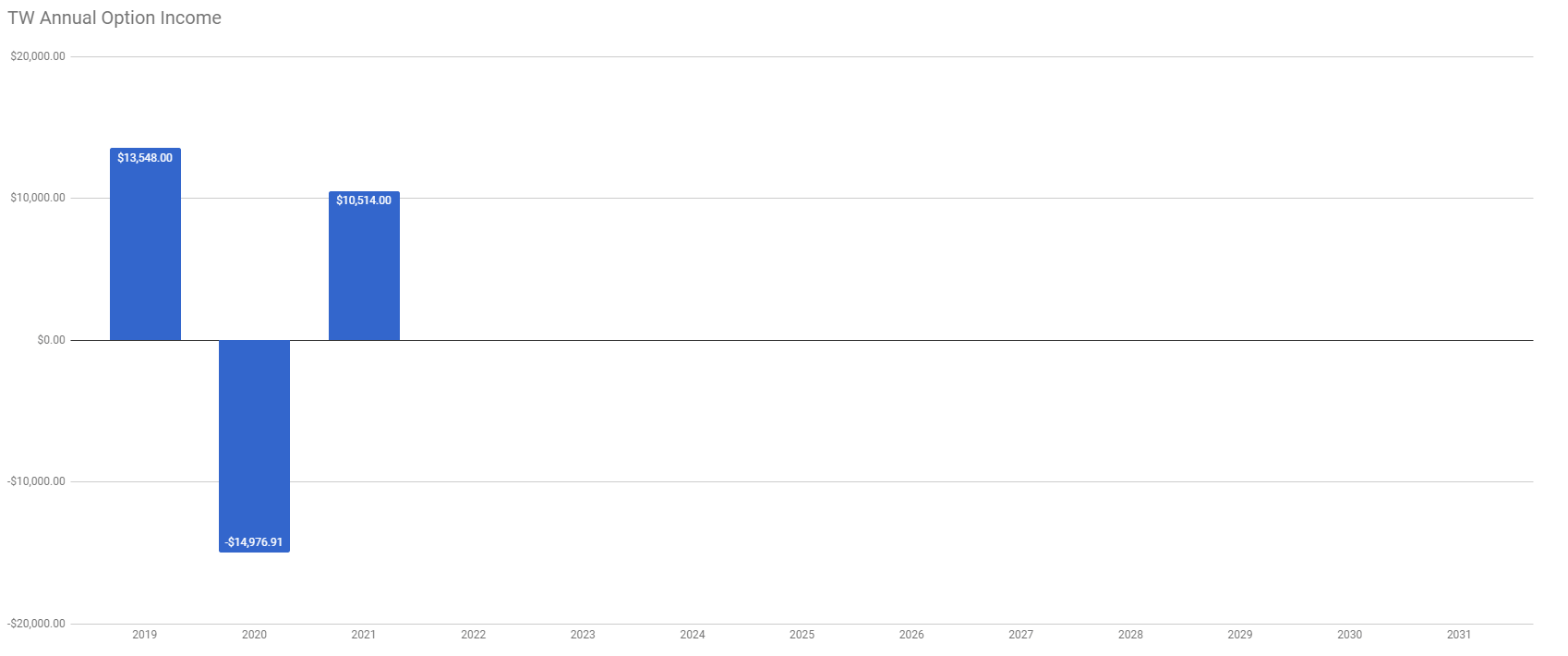

Our options trading delivered a 7.22% monthly ROI, totaling a 33.94% ROI.

Our account increased to 65.41% YTD growth. We are happy with this result.

Our options trading averaged $3,850.33 per month this year. If this trend continues, we are on track to make $46,204.00 trading options in 2021.

We are still on track to complete goals in our portfolio. We made slight adjustments and we are providing our comments to our goals and tasks we set up in the week 6 report:

Old SPX trades repair

This week we have not done any adjustments to our old SPX trades. We are still sitting on those trades and waiting for the untouched side close so we can roll the trades again. The goal will be to roll the trades until we will be able to close them for at least break even and release the buying power. We will keep doing this only if the resulting trade will be a credit trade or a very small debit. If adjusting these trades would require adding more new money, we would rather close these trades and move on.

Accumulating Growth Stocks

This week I gave in and bought Tesla (TSLA). Yes, you may be surprised but I bought a share and I might be adding more shares of this company. I was never a fan of Tesla and considered it a bad company that is just in a bubble and hyped to levels not justifying its valuation. It doesn’t make money, it has no revenue and it makes expensive cars on a very small scale compared to other automakers. Without government subsidies, far fewer people would buy a Tesla car.

But there was something that changed my mind and I didn’t see or refused to see.

When Tesla came out many years ago, my first thought was that it wouldn’t be able to survive. Elon was just a schmuck who would not be able to compete with big automakers. I was wrong. Not only he did make it, but he also forced the entire car industry to follow him. They didn’t steamroll him. He steamrolled them. Without his leadership, there would be no electric vehicles, and no big car maker would ever consider even thinking about them.

But I must admit I refused to look beyond car making division of Tesla. And Tesla is not just about cars. Tesla is a tech company. Tesla took leadership in electric vehicles and now taking leadership in AI and their autonomous driving. Again, I thought, that this would be something big automakers would do and develop on their own. But they didn’t. Elon Musk, again, took the lead and forced the industry to start looking at yet another feature they never dreamed of (only in 1950’s comics books).

Next, Elon Musk started developing batteries for his cars and the entire industry is waking up and starts thinking about how to copy him without infringement. And Tesla has the lead once again.

Tesla started looking at solar panels. And developed panels that are 40% more efficient than those we see today and Tesla is testing solar roofs when no one was seriously thinking about it (I was once thinking why no one is developing it and why you have to have a roof and on top of it install the PVs, why not have the roof as a PV? And just today, I watched a video that Tesla is in fact developing the roof PVs). Speaking of PVs, my other thought was why Tesla cars do not have a PV panel integrated into the roof of the car and be able to charge using solar energy when driving or just parking in front of a shopping mall. I guess the issue is with the equipment you need to transform the energy, standardize frequency, and store it into the batteries. I guess the equipment is still too large to have the car towing a transformer station behind it. But who knows, maybe Elon is already working on it.

I am still uneasy about this stock and hesitant to be buying it. But I missed Amazon before when I could buy it for $360 a share. I missed Apple when I could buy it for $60 a share. And since Tesla still has a good price appreciation in the future, I think, I shouldn’t be missing this boat either, although I have missed a significant portion of that boat already.

Accumulating Dividend Growth Stocks

Buying high-quality dividend stocks is our core strategy in our fund. And we will continue to do so and at a faster pace. Last week, we started accumulating Aflac (AFL) stock to reach 100 shares. As of today, we own 80 shares.

We also added 100 shares of Liberty All-Star Growth Fund, Inc. (ASG) to our portfolio. This stock is not necessarily a dividend growth stock. It is a speculative, high yield dividend stock and we may remove the stock from our portfolio if it no longer follows our criteria.

We want to accumulate 100 shares of each stock in our watchlist or list of stocks we want to own. This lot of shares is not, however, the end number. Once we are fully invested (own all stocks we want to own), then we will start adding on top of those 100 shares.

Our goal is to not only reach 100 shares of high-quality dividend stocks but also create a weekly dividend income from these stocks All it takes to create a weekly dividend income is to buy 12 stocks to spread the income for every week. I created this dividend calendar and track the stocks I want to buy to get this goal done fast.

We are also interested in adding some high-yield, yet still safe, dividend earners to further boost our dividend income. I found a few good stocks and closed-end funds, candidates I believe are worth accumulating. Every month I will be posting these stocks, accumulation progress, or stock removal from the portfolio. These stocks or funds may be riskier than the aristocrats and I plan on monitoring them carefully. When the stocks no longer meet my criteria and/or underperform, I will remove them from our portfolio. My first list for March accumulation can be found here.

Market Outlook

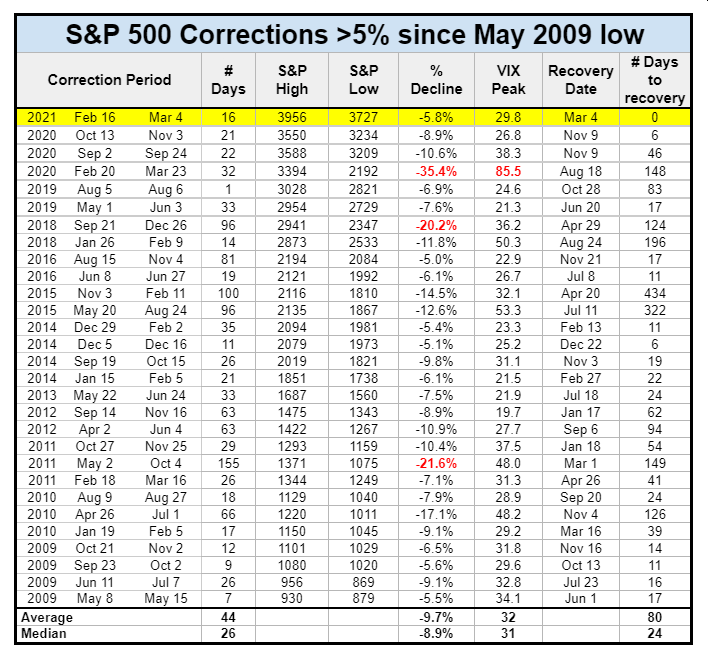

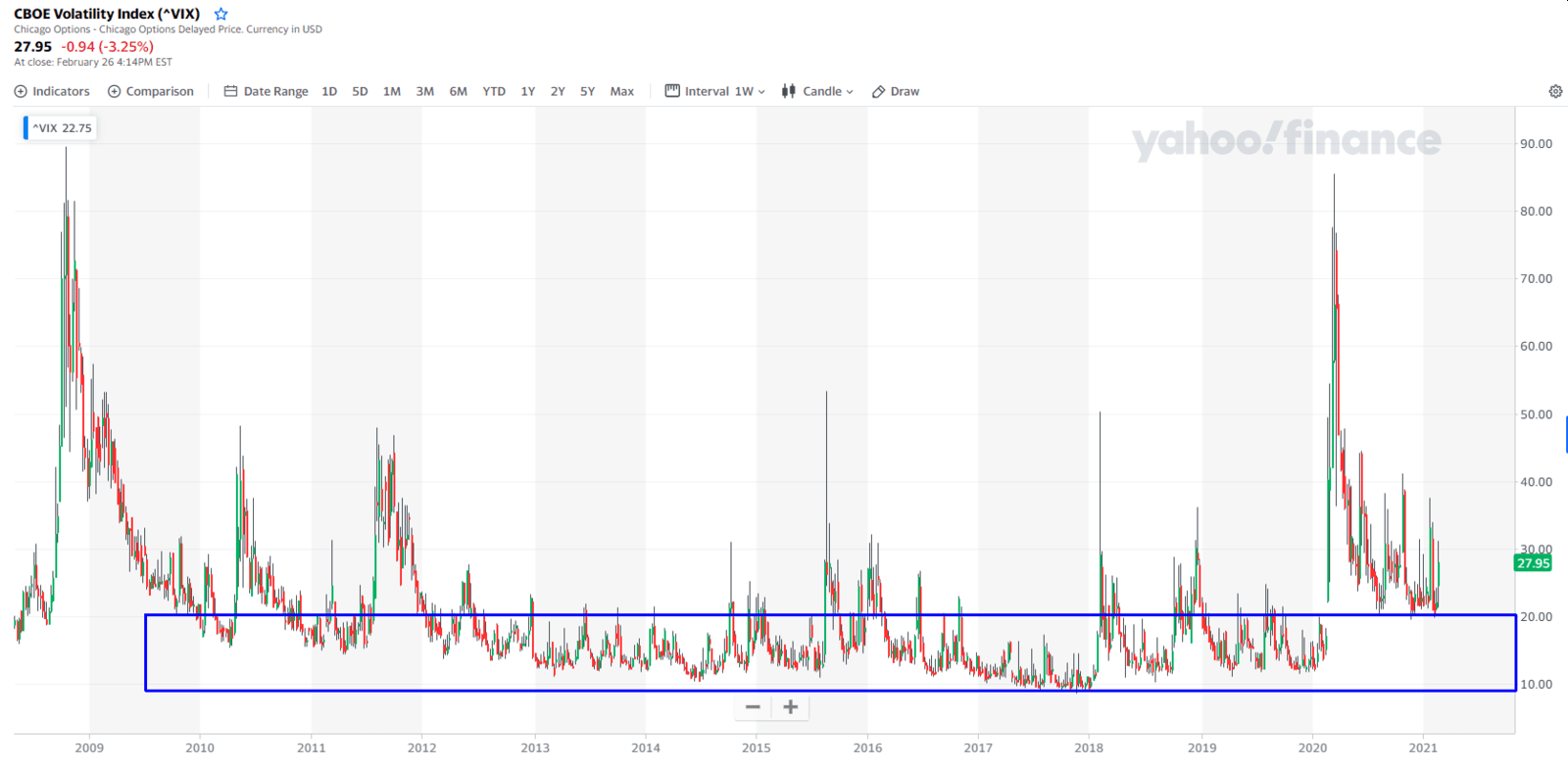

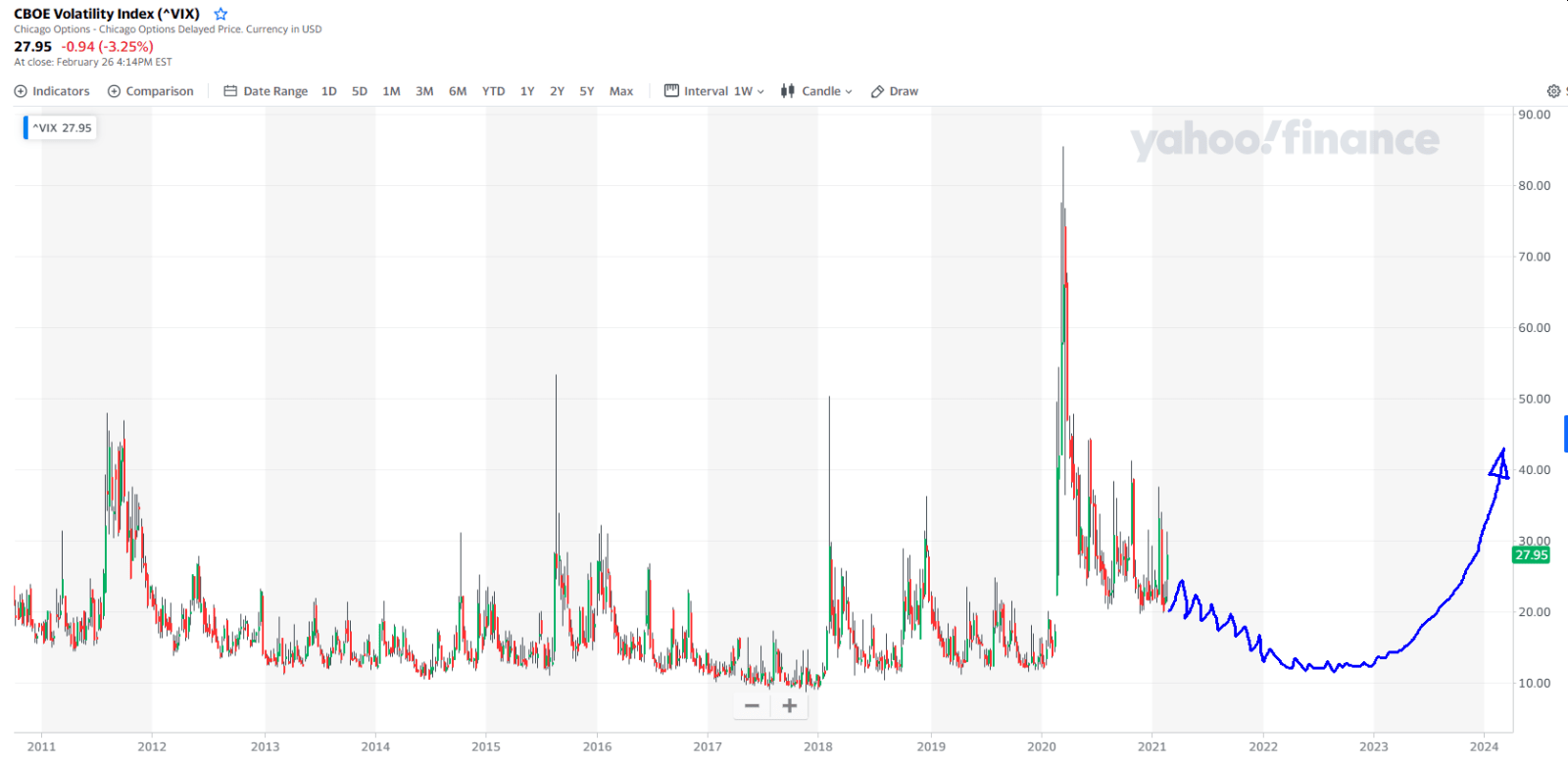

Although the stock market recovered its 5% correction and reached a new ATH (all-time high) it couldn’t hold the new highs and sustain the rally. On Thursday and Friday, the market dropped again as the new euphoria from the FED meeting faded away.

However, if you know the market history and look at the past behavior, such choppiness is normal. It doesn’t predict that we are going to crash from here, nor it doesn’t predict that we are about to skyrocket again. From the historical perspective and past performance, this market can drop to $3,700 and it still will be a normal performance in the given historical perspective. Similar behavior occurred in 1982 and 2010. In both instances, the market posted a significant correction of 14% before renewed rally moved the market back to nice gains (if you had a stomach to stay invested).

I still expect an additional 15% to 75% gains in the next one to five-year time horizon even if we dip lower from here (which I do not expect but it may happen). If we dip to $3,700 it will be a great buying opportunity.

Trading options

We continue trading options around the stocks we own or plan to own. I call it monetizing our positions. It has a threefold benefit. It lowers our cost basis (at some point we will own all our shares for free), covers our call sides of each trade, and generates an additional income on top of the dividends. And that income is significant as you can see from our report at the top of this post.

Investing and trading report in charts

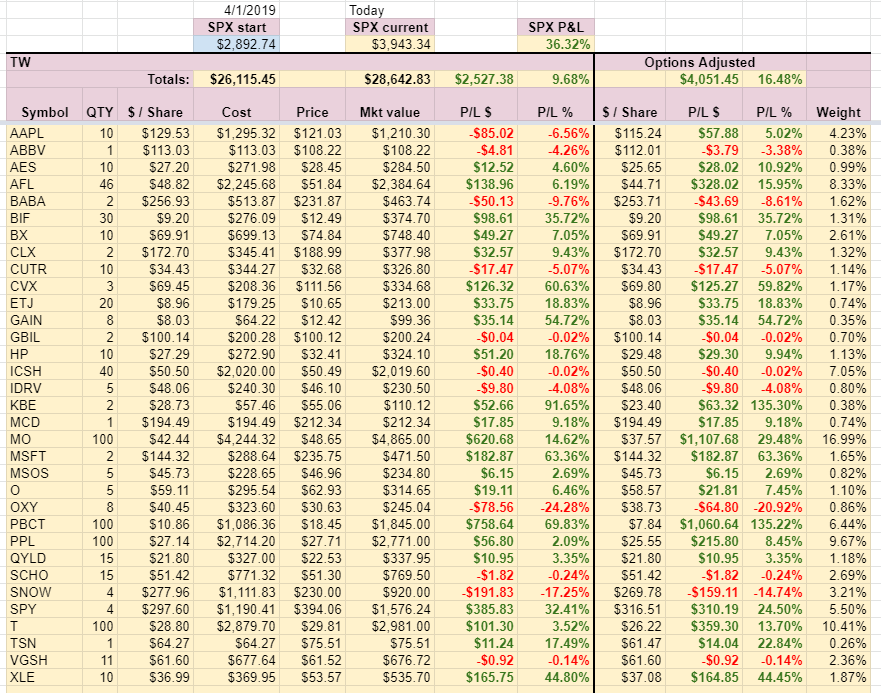

The table above shows our current holdings and gains on those holdings. Adjusted columns indicate how options help to boost (or ruin) our stock holdings appreciation, or in other words, lowering the cost basis. Without options, our holdings would be up 8.33%. With options, our holdings are up 14.85% (from inception on 4/1/2019). The SPX is up 35.27% since inception. Our stock holdings underperform the overall market since the inception of the fund (up only 14.85% on a cumulative basis). However, this week, our adjusted stock holdings significantly beat the market. The market gained 5.43% YTD, our portfolio options-adjusted stock holdings grew by 7.87% YTD (note this includes stock holdings adjusted by options trading, not the entire portfolio).

Conclusion of our investing and trading report

This week our options trading was weak and as we laid it out in our previous report we were primarily adjusting our trades and opened only very few new trades. Next week, we may reopen trades that expired last Friday.

We will continue accumulating the dividend growth stocks in our portfolio to reach 100 shares. We will also replenish our cash reserves to bring them back to 25% of our current net-liq value.

We will report our next week’s results next Saturday. Until then, good luck and good trading!

|

We all want to hear your opinion on the article above: No Comments |

Recent Comments