The year 2020 is over. It was a very difficult year for many. It was a difficult year for me on a personal level too. I almost lost a job but found a second job and secured income to support my family. But on the investing and trading level, 2020 was an exceptional year.

At the end of 2019, I realized that my trading was wrong. I traded SPX Iron Condors (as you may know reading this blog). I loved this trading and I tried to learn as much as I could. But it didn’t work for me. So, I stopped trading it. And it was a good decision.

For the 2020 year, I set a goal to recoup the losses and trade what I know that worked for me in the past. I also wanted a strategy that was easy to manage, protected my cash, and made money. And selling options around the dividend stock positions is that strategy.

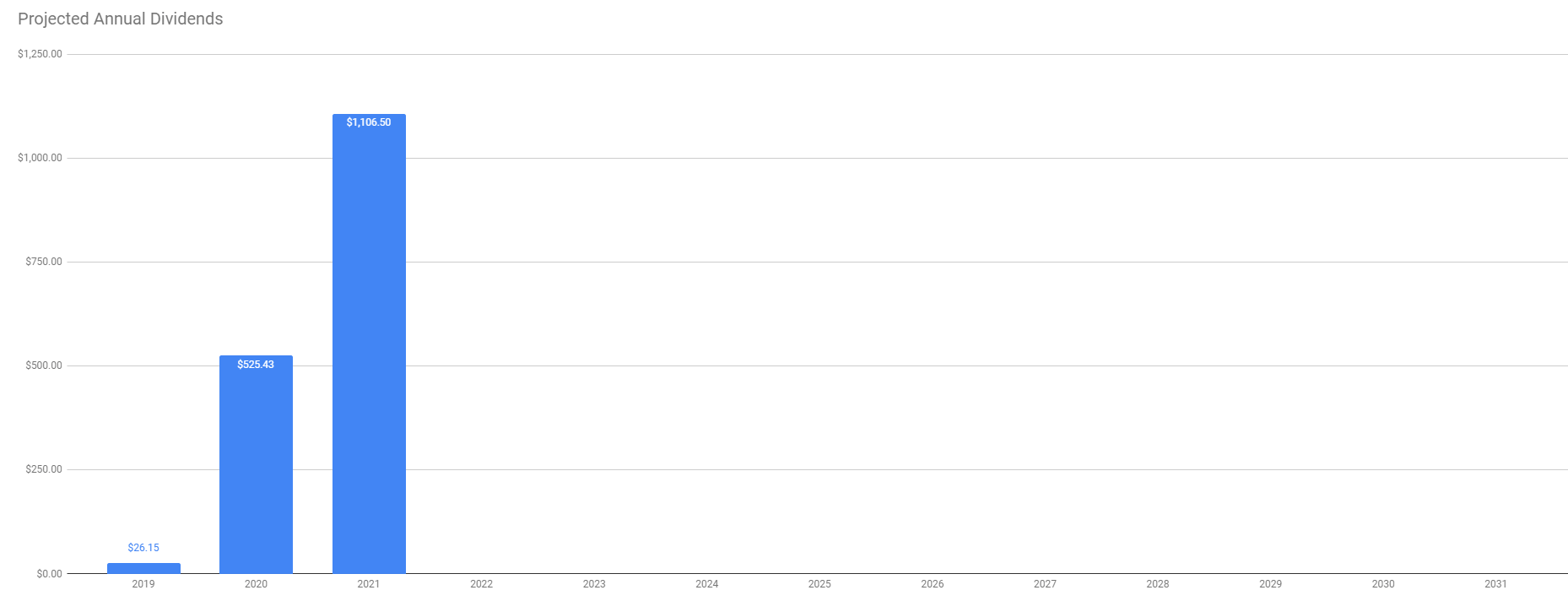

Fro 2020, I set up a goal to accumulate dividend aristocrats. Own the shares, collect dividends, and sell options against these positions. I started selling cash-secured puts and immediately reinvested the premium I have received. And when dividends arrived, I have reinvested them too. I started with cheaper stocks like PBCT, PPL, or GAIN, T, MO, and others. I took a bit of risk that not all puts were cash secured. But I knew that a single put option is easy to manage. Easier than an SPX spread. I was surprised how quickly my account started growing up again. Even during the coronavirus problems where I had to roll many of my trades and my net-liq tanked hard, I knew, I would be in good shape when the mess is over. And when the market started recovering, the net-liq shot up like a rocket.

And as the market was growing and accumulating cash I started saving money for more trades. Soon I was able to start trading more expensive trades such as buying LEAPS against indexes and selling covered calls against those positions (poor man’s covered call) and start trading strangles against stocks such as AAPL. I set a goal that helped me in focusing on accumulating either cash positions or stocks and grow the account.

Originally, I set a goal with only 22 tasks but later during the year, I started expanding the goal.

During the year, I added a few more tasks. It was not that I would be accomplishing them all. I didn’t expect it. It would be a stretch and financially, it was not feasible. Although my account was going up fast, it didn’t go up that fast. The reason for adding more tasks was to capture the ideas I had during the year. For example, I was thinking about ways how to increase income and decided that one way to do it would be to trade strangles against more expensive stocks such as Apple. So I added those tasks to my goal list. Now, I do not forget about it and will work towards that goal. Of course, if during the year something has changed and I found out that the idea was not reasonable, I deleted the task.

As of December 2020, I ended up with this:

So, although I accomplished this goal by 36.86% only, I am actually happy with the results because those tasks I wanted the most were fulfilled.

· 2021 Goal

I plan to continue with this kind of planning and set the goal for 2021. I rolled over the goals from 2020 and added a few more goals I wanted to focus on. Over time, I may add a few more goals the same way I did during the 2020 year. Here is my initial goal:

I will also continue accumulating the following stocks during 2021:

AAPL

ABBV

ABC

AFL

BABA

CB

GAIN

GD

KMI

MO

PBCT

PPL

SNA

SNOW

T

TSN

I will be accumulating these stocks on all four accounts. Some accounts have the stocks accumulated and I sell covered calls. I will focus on stocks that provide better premiums first, for example, I would be prioritizing accumulating MO, or AFL over GAIN stock due to options.

And again, I will be primarily an investor and a trader later on.

This year, I will use the same strategy:

We are investors, not traders. We buy assets – dividend-paying companies. We buy dividend growth companies. Our plan is to hold those companies forever. We treat those businesses we are buying as our businesses. It is like real estate. People do not buy homes just to sell them the next day, or next month. People buy to hold their home for the next 30 years or more. We buy dividend growth companies for the same reason.

We buy dividend growth companies to generate income receiving dividends. We want our businesses to reward us for holding their shares and paying us for it. We reinvest the dividends to accumulate more shares. Our goal in accumulating shares of a selected company is to reach 100 shares of that business. All dividends and account deposits are used to accumulate shares.

Once we accumulate 100 shares of a company, we start selling covered calls. When selling covered calls, we sell to avoid our shares being called away. We deploy all hedging strategies to avoid the exercise of the calls. If, however, our shares are called away, we immediately start selling naked or cash-secured puts. We sell puts as a means of investment to buy shares, not to speculate or sell put just to bring premiums. We sell puts against companies we want to buy. Once the shares are assigned to us, we implement the Wheel of Fortune strategy by immediately start selling covered calls again.

All premiums generated from selling covered calls or puts are used to buy more shares of the companies we want to hold.

We only sell our companies when they no longer meet our requirements – reduce or suspend the dividend.

From time to time, we use other options strategies to generate income: poor man’s covered calls, butterflies, covered strangles, or collars.

· Poor man’s covered call

We use this strategy against expensive stocks where we do not have enough capital to trade a standard covered call right away or in the near future and when saving money would take many months or years; usually indexes such as SPY, RUT, IWM, etc. We also use it against ETFs or individual stocks while accumulating shares of that stock.

· Butterflies

We use this strategy as a directional trade. When we identify a strong trend in any direction, we may apply this strategy to limit our risk but reap a decent profit. For example, buying a call against SPY to participate in a strong trend would cost us $800 while the same butterfly would cost us $200. This limits our risk in case we are wrong.

· Covered strangle

This strategy is selling an OTM put and a call against a stock which we want to add shares to our holdings and we already own shares. For example, we own 100 shares of a stock XYZ, and we are OK to buy another 100 shares. We sell covered strangle and our calls are covered by the existing position we already own and our put is covered by cash we have in our account in case we get assigned.

· Collars

We may use this strategy (selling covered calls and use the premium to buy protective puts) if we see a need to protect our holdings and buy insurance. The covered calls will generate income for us to buy the puts.

· Cost basis offset

Selling covered calls and puts, as well as other strategies, will be used to offset our cost basis. This is more of a psychological or mental offset. However, it helps to see it as having less risk in our stock and see it that we have purchased our shares for “free” (we used premiums collected when selling the calls and puts, although on many occasions we started collecting these premiums after we purchased the stock).

· What about other options strategies?

From time to time we may use a different options strategy, for example, naked call, if we see it fit and we are prepared for any consequences from such trades. But, these trades will be very rare. One strategy we will employ will be credit spreads where capital requirements are too high. An example could be trading Iron Condors against SNOW stock.

I also updated my Trades & Income page where you can see all open trades and stocks accumulation during 2021 trading year.

I wish you a Happy New Year and a lot of success!

We all want to hear your opinion on the article above:

1 Comment |

Recent Comments