S&P 500 2,723.06 -17.31(-0.63%) Dow 30 25,270.83 -109.91(-0.43%) Nasdaq 7,356.99 -77.06(-1.04%)

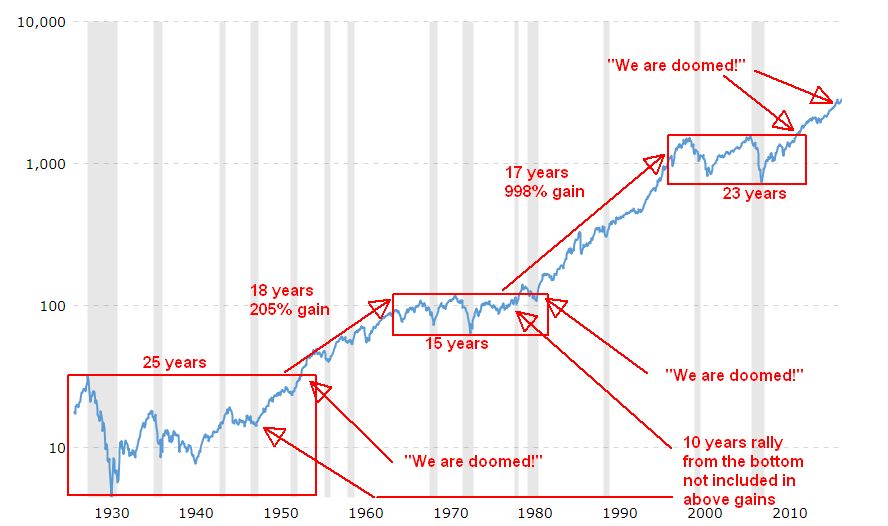

October was a terrific as well as horrible month! Tons of volatility, negativity, pessimism and losses. At some point, it became depressive. The markets kept falling and falling with no retreat, no relief rallies. Any attempt to have a rally was immediately sold off and it faded.

Is this the beginning of an end?

Many have asked this question and many predicted more selling more bear market to come.

But we do not know what is going to happen. if you see all the predictors predicting this market to rally to the moon, others predicting gloom and doom, do not trust either of them. They do not know. They are just guessing.

No one knows where the markets will go. There is a lot of uncertainty and we may really crash into a bear market or resume a rally.

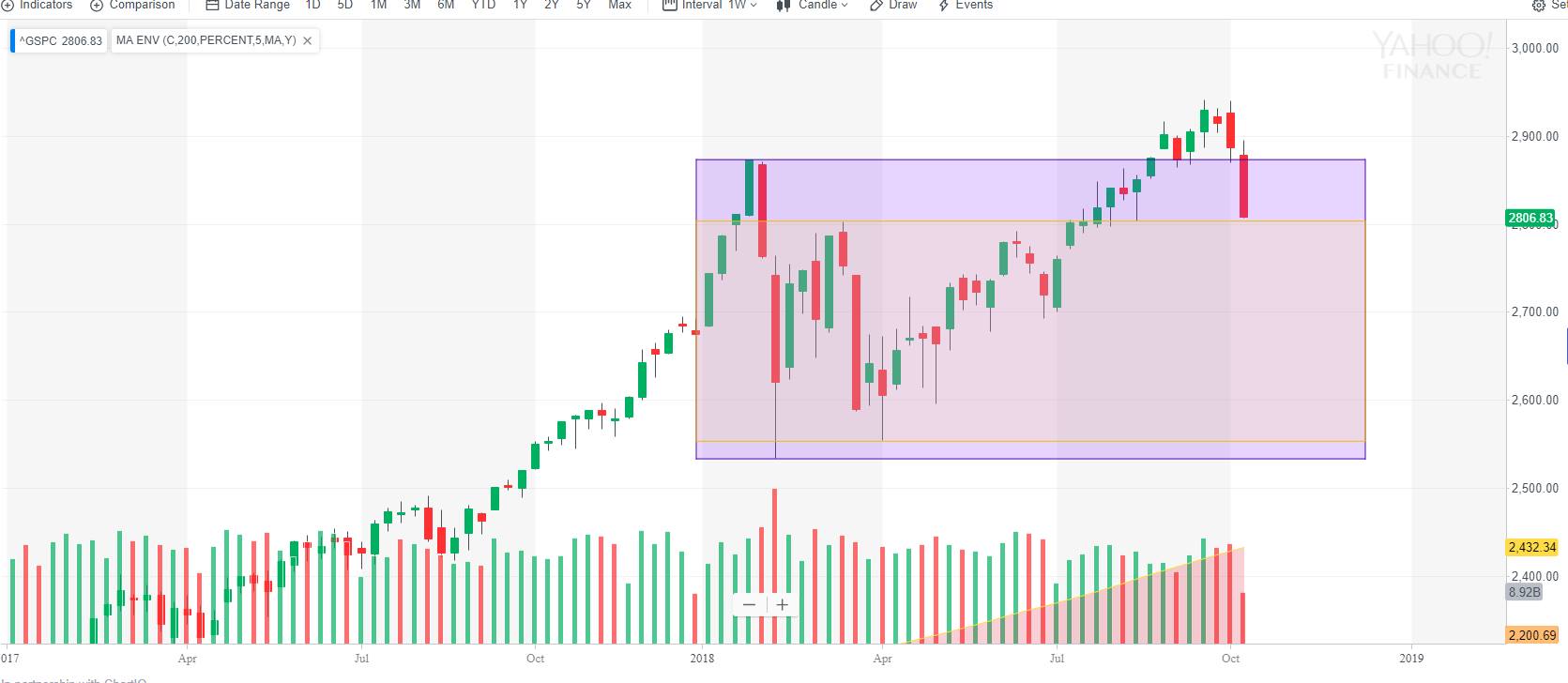

Last week the markets rebounded from the October selloff but we created a gap up. Most gaps, if not all, get closed at some point:

There are runaway gaps but these are fairly rare. Thus next week we may expect the market to actually go lower to close the gap.

We also have election on Tuesday and the results may also affect the market behavior next week.

Historically, the markets rallied after the midterm election. We may see the same happening this year too. But we will know for sure once the market reveals its direction.

In October, we were mostly adjusting our trades to make sure majority of them would be positioned well for their upcoming expiration. We had many Iron Condors on SPX with puts deep in the money. Thus we rolled those Condors lower to be not too deep in the money. We are still bullish, so we didn’t want to roll those Condors too low to avoid calls being in trouble once and IF the market really rebounds and start rallying.

We also had many spreads and Iron Condors using stocks as underlying but in this volatile market with a lot of whipsaw price action we needed to avoid getting our stock positions in the money and have them early assigned. We had SPY early assigned last week and lost money. We didn’t want that to happen to all of our stock options trades.

Thus we rolled most of our stock options into SPX options. The reason behind is that with SPX there is no risk of early assignment and in this zig-zag price action I can let either side of any Condor to get in the money without a fear of early assignment. And with any breached side I can wait until literally five minutes before end of a trading session to see if the breached side recovers or I need to roll it into another expiration. You won’t be able to do this with stock options.

Rolling our trades delivered nice premiums income, unfortunately, it didn’t end those trades and thus they stay open and consume net-liq of our accounts. And due to October selloff and many puts still in the money, our net-liq got smashed hard in October. But we see this as not the end of the world. I am optimistic and I will keep rolling those puts as long as they end up out of the money and expire worthless.

This is reflected in our end of the month trading results. As you can see, our net-liq ended down a lot while our income jumped up by more than $15,000 dollars in October:

We made $1,207.00 income last week and the Net-liq of all accounts increased by $4,368.16. But overall, October ended with a nice $15,510.06 dollars premiums while Net-liq finished down by $31,040.98 dollars.

We post our trades on our Facebook page and we also post (or try to post when I have time to do so) our end of day trading results.

Here are the entire 2018 year trading results:

· Dividend stock investing

Dividend investing is doing great on both accounts – ROTH and IRA. I keep using 50% of all options income and buy dividend stocks. IRA account keeps growing fast with new stocks being purchased every month. ROTH is more or less stagnant.

Here is a review of our accounts stock holdings:

Traditional IRA

ROTH IRA

TD account

In August we purchased the following shares:

IRA purchases:

We haven’t purchase any shares in ROTH or TD this month.

We keep spending 50% of our options trading proceeds to buy good dividend growth stocks using our screener to get a better entry into the stocks. Although capital appreciation is not our goal but a secondary target, timing the entry creates good results as our positions are mostly up. However, do not be too excited, any large selloff can temporarily send those stocks down again. It is a dividend income what matters to our portfolios, not the portfolio value and capital appreciation. It seems to be evident that using options to grow the portfolio is the right way to do.

· Dividend Income

IRA dividend income

ROTH IRA dividend income

We all want to hear your opinion on the article above:

No Comments |

Recent Comments