June trading exceeded my expectations in generating income. It didn’t seem like I would make as much money as I did. Also Brexit shook with my account in a scary way, but it remained just that – a scary hysteria. The markets recovered all losses in two days.

I learned a good lesson though. In the past I tried to predict and analyze the movement of the market as well as stocks I am about to be trading. It showed to be a useless effort. Every trade, every day is unique and every outcome will be different. No one knows future and no one can predict it. Even if all patterns known to the entire world point to a certain outcome, it doesn’t guarantee that the trade will do exactly what the pattern says it should do.

Predicting future in trading is basically setting you up for a big disappointment.

That’s why I am learning not to predict anything but rather be prepared for everything. If I am ready for any outcome and any outcome makes me happy, then I am able to trade without fear and carelessly (not recklessly). If a stock goes against my trade, I am perfectly OK with that because that presents a new possibility for a profit.

In May 2016 I made $1,262.00 in collected option premiums which was a great result exceeding my monthly goal making $1,000 per month. This month I made even more and finished with $2,331.00 in options premiums!

Hopefully, I will be able to repeat this success next month too!

June dividend income was higher than in May, but still lower than all higher months. The dividend income was $81.68 vs. $57.75 last month.

Options Income = $2,331.00 (account value = $5,589.18 +120.07%)

Dividend Income = $81.68 (account value = $20,143.39 +33.05%)

If you wish to see details about each account, continue reading below.

You may be interested in:

Travel Hacking from Anchorage Alaska to London & Paris By MAGGIEBANKS with NORTHERN EXPENDITURE

Are You Trapped on the Yellow Brick Road? By Mortimer with Mortimer’s Moneymachines

How to buy a car and not get screwed. 5 tips from a former car salesmen By Ty with Get Rich Quick’ish

Who is The One Percent? (Prepare to be Surprised) By THE MONEY WIZARD with THE MONEY WIZARD

3 Ways to Make Money in the Markets By Ben Carlson with A Wealth of Common Sense

· June 2016 trading results

June trading was successful. I accomplished my monthly goal $1,000 in the first week of June. However, I didn’t expect that I would be able to make more mainly due to Brexit mess. At first the markets rallied hard as everybody expected that Britain would stay in the EU and some trades could be closed for 50% credit earlier than I expected. Then Britain voted to leave EU and stocks crashed.

It was only a two days crash and today the market has recovered all losses. This allowed me to load some new trades. Now we need to wait whether we will be able to repeat the June success or not. If not, I will be OK with that outcome too. The only way I won’t be able to repeat June’s income would be if the trades turn against me and I will be forced to roll them. And that is OK too.

If you want to see and follow those trades, new trades we open you can join our Facebook group where traders like me post a trade at the time of opening it, tracking it, rolling it if needed, and closing it. Then you can see what we trade and eventually mirror it.

Here is my trading result for the month:

| June 2016 options trading income: | $2,331.00 (91.78%) |

| 2016 portfolio Net-Liq: | $5,589.18 (92.03%) |

| 2016 portfolio Cash Value: | $8,544.68 (78.01%) |

| 2016 overall trading account result: | 120.07% |

Here are the results of my options trading:

Here is my monthly income from options trading:

Here are the results of my options strategy:

The table above shows a good strike of winning trades. I hope will be able to continue my trading this way.

My average trade holding time is currently 17 days, average P/L 2.31% and 75.95% annualized return.

Here are results of the individual trades:

ESV

ABBV

LULU

TRGP

PSX

STX

OKE

If you like these trades and want to be informed when I place them and trade them in real time, you can join our closed Facebook Group. The group is a closed group and there are other traders posting their trade ideas too. We learn from each other, eventually ask questions, get answers, but most importantly you can see what we trade and how. You can follow those trades.

Here is the entire account value from the beginning of tracking it up to today:

You may be interested in:

Tearing Out the Kitchen By Yetisaurus with YETInvesting

Tearing Out the Kitchen By Cash Flow Celt with Cash Flow Celt

Preparing for Retirement in Your Early 20s By Money Beagle with Money Beagle

Getting Out Of Debt By Brian with Debt Discipline

Recent Stock Purchase II June 2016 By Keith with DivHut

· June 2016 dividend investing results

There is not much to say about my dividend investing. It is a slow and boring work. All dividends were reinvested and the account is slowly growing. Unlike options trading there is no effort needed. Just pick a good, high quality, dividend growth stock and you are done.

However, my plan in a ROTH account is also to trade options, but primarily investing into dividend growth stocks. Last month I decided to create three sub-accounts (created just in my spreadsheet) with a certain purpose:

1) In 2016 I want to save $1,000 for great opportunity. Time to time a stock with a great opportunity shows up. A sudden fall in price or selloff can happen. Then, I do not have cash to buy such stock. This fund would serve this purpose to have cash to buy.

2) My next “virtual account” is dedicated to options trading. In 2016 I planned to save $2,000 dollars and use them for options trading. This month I was able to save $2,000 and have it fully invested in options to generate cash. All income from options is now being relocated to my “Great opportunity virtual account”.

3) Once my “Great opportunity virtual account” will be funded I will be relocating all income into my next virtual account – stock purchasing account. Once I save at least $1,000 in this account, I will buy shares of a stock in my buy list.

Well, little game of mine.

But, it helps me to stay on track.

Here is a picture of my spreadsheet showing my “virtual accounts”:

Here is my ROTH account review:

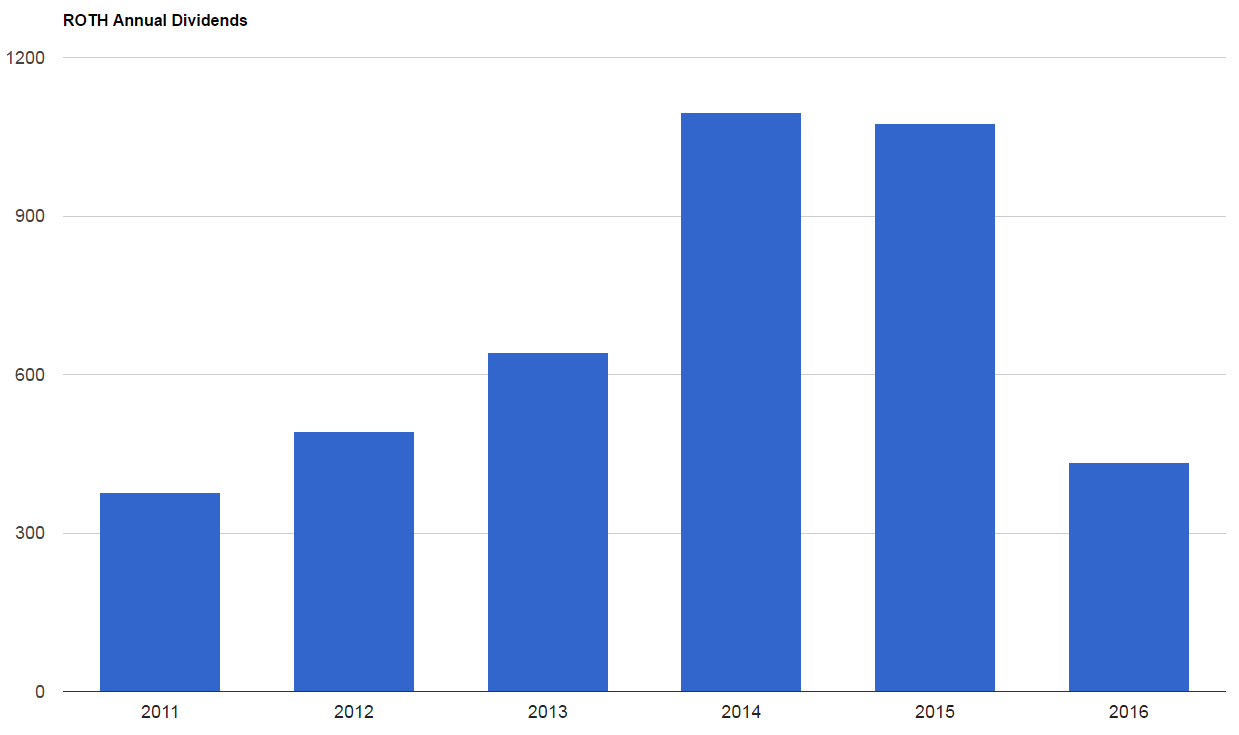

My annual dividend income this month is up from $918.74 to $925.26.

Dividend stocks added or removed from portfolio:

| June 2016 dividend stock buys: | none |

| June 2016 dividend stock sells: | none |

To purchase stocks I use trailing stock order strategy OTO trade order (one triggers other) and I described this strategy in my post about purchasing stocks in falling markets.

I also invest into dividend paying stocks using Motif investing which allows me to buy all 30 stocks I want in one purchase using fractional investing, similar to a mutual fund.

You can actually build your own mutual fund with Motif investing.

Here is my Motif Investing account you can review:

I continue reinvesting my dividends using DRIP program. I love how my holdings grow when reinvesting the dividends and when the stock prices are going lower. As I believe we are heading into a recession I will be able buying more shares for a lot cheaper.

Dividend stocks DRIP:

| June 2016 DRIP: |

American Capital Agency Corp. (AGNC) |

Here are my ROTH IRA trading/investing results:

| June 2016 dividend income: | $81.68 |

| June 2016 options income: | $0.00 |

| 2016 portfolio value: | $20,143.39 (3.84%) |

| 2016 overall dividend account result: | 33.05% |

The account grew by 3.84% from last month, overall I am up 33.05%. The dividend income was down from last month. All dividends were reinvested back to the companies which generated them.

Here is my dividend income:

Annual dividends since the beginning:

Here is the entire account value from the beginning of tracking it up to today:

You may be interested in:

11 Ways to Save on Summer Barbecues By Gary Weiner with Super Saving Tips

Essential Summer Expenses We Can’t Do Without By Emily Jividen with The John & Jane Doe Guide to Money & Investing

How $25 Made My iPhone Like New Again By Brad Kingsley with Maximize Your Money

On a tight budget? Save on your next vacation with these money-saving tips By centsiblyrich with Centsibly Rich

Top 4 Lessons Learned Working as an Equity Research Analyst By R2R with Roadmap2Retire

Below is my dividend income review for the entire year:

My ROTH IRA dividend income breakdown per month and per company.

· All accounts

Besides trading and dividend accounts I also have 401k account, emergency savings account, etc., which I do not report in detail. You can review those accounts in my “All Accounts Value” table at the bottom of My Trades & Income page.

My accounts increased from previous month and are making 26.03% (up 7.40% from previous month) for the year.

Remember, if you like trading options and want to have trade ideas for free, join my Facebook closed group and follow my put selling trade ideas in real time, comment, ask questions, and interact with other members. Other members of the group can also post their trades so you can learn from them too.

What do you think?

How about your investing or trading results?

Do you have any question? Need help to start trading or investing? Shoot me an email or let me know below in comments how I can help you.

Pretty awesome results all around from growing dividend income to an amazing month for collecting option premiums. You sure wre buys with many trades being placed and so many naked positions too. I don’t think I’d ever trade naked. I think I’d feel more comfortable with cash to secure my puts. Thanks for sharing.

Congrats on a fantastic options month. Making more than $2k on options contracts in a single month, now that’s impressive.

Hi, yes, it was a really successful month for me although at some point it didn’t look like that it turned out well. Now trying to repeat it next month. Thanks for commenting!