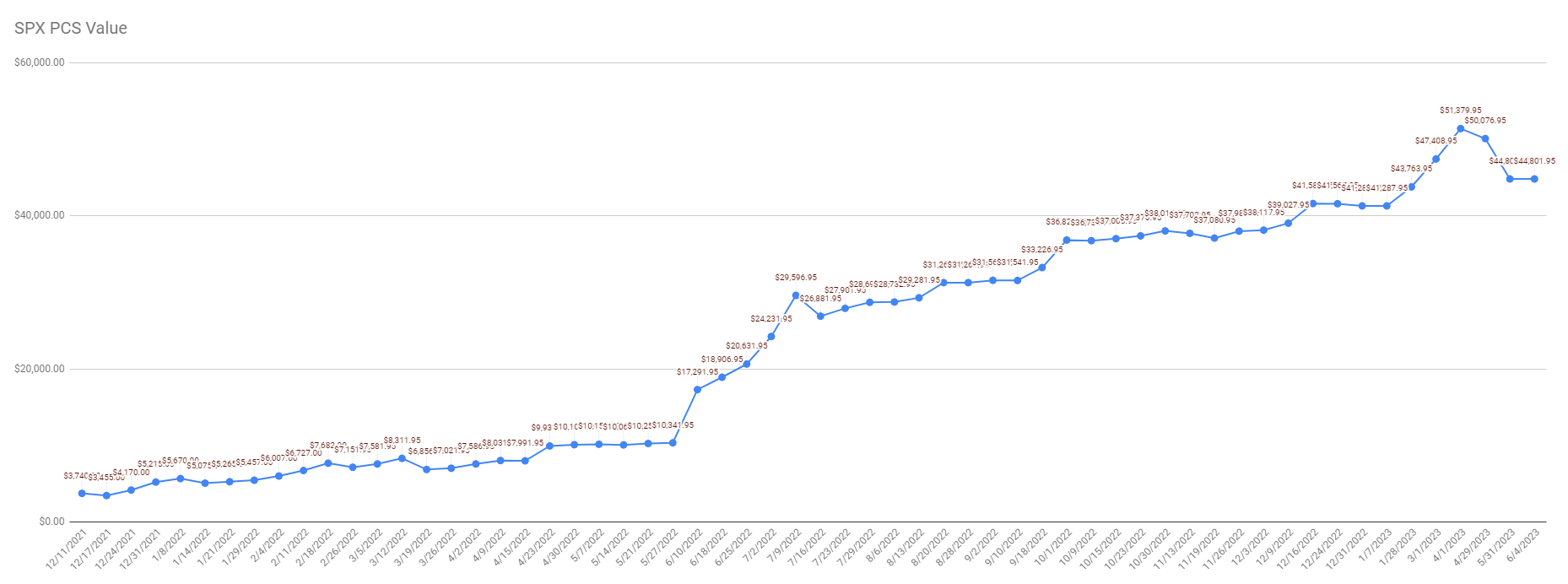

It looks like I forgot to report April SPX trading, so in this May report, I will report both months. Both months were losing months. In April we lost -$1,303.00 (-2.54%) and in May we lost -$5,275.00 (-10.53%) while SPX gained 1.46% and 2.71% respectively. The loses were mostly due to letting bad trades go rather than trying to repair them. Overall, our account is still up by $41,201.95 (1144.50%) while the SPX is still losing by -9.10%. Given that, we decided not to roll the trades.

Our SPX account is up +1,144.50% since the beginning of this program, and we have $26,065 in unrealized gains.

Initial SPX trade set ups

I dedicated a $3,600 initial amount that will be used to trade SPX PCS strategy per week. Today, the account is up at $44,801.95. However, due to the recent bear market, many trades are still open, and the funds are tied to those open trades. The trades need to expire or be closed for a profit to release the funds.

Our SPX strategy is designed as directional options trading. We are selling credit put spreads to collect premiums, and hopefully, these spreads expire worthlessly, or we repurchase them for a small debit.

We use a set of indicators, trend prediction (primarily based on moving averages, volume profiles, and trend forecasting), and market sentiment that generates bullish signals. The trading is based on a “trend-following strategy.” We open the trade if we have a bullish signal and a bullish trend. If we do not have a signal, we stay away. We also trade credit call spreads when we have bearish signals. In a choppy market, we stay away from or trade very short expirations (usually 1 or 2 days or up to 7 days), but the trading is muted as we need a trending market.

Unfortunately, today, the market is headline sensitive and can gap in either direction to fail and reverse. It is not easy to trade and not get whipsawed. That’s why we are managing our older trades and not opening new ones until we see a clear market direction.

Here you can see all our 2023 trades:

![]()

Click on the picture above to see the entire list.

Last month trading

Overall, the strategy resulted in a +1,144.50% gain last month.

| Initial account value (since inception: 12/07/2021): | $3,600.00 |

| Last month beginning value: | $51,379.95 |

| Last month ending value: | $44,801.95 (-13.07%; total: +1,144.50%) |

| The highest capital requirements to trade this strategy: | $19,995 |

| Current capital at risk: | -$13,065 |

| Unrealized Gain: | $26,065 (-199.50%) |

| Realized Gain: | $3,346 (-25.61%) |

| Total Gain: | $29,411 (-225.11%) |

| Win Ratio: | 51% |

| Average Winner: | $722 |

| Average Loser: | $728 |

As you can see, our account currently shows a realized gain of $3,346, and we have an additional $26,065 unrealized gains.

SPX PCS account vs SPX index net liq

If you want to receive trade alerts whenever we open a new SPX put credit spread or a hedge trade, you can subscribe to our service:

Note that if you wish to subscribe to multiple levels, you can only subscribe to one level and send us an email that you want to be added to other levels.

Also, if you like this report, hit the like button so I know there is enough audience wanting to see this type of report. If you have any questions or want to see anything else about my SPX trading, do not hesitate to contact me or comment in the comments section. Thank you!

Leave a Reply