November 2017 is over and it is time once again to review my accounts and performance.

As of today, I manage four accounts (my own) and one client account. Here is a list of accounts I manage and review in my monthly reviews her on this blog:

TD Ameritrade – trading account, taxable

IRA – retirement account, pre-tax deferred, former 401k account

ROTH IRA – trading account, after-tax deferred

Lending Club – P2P lending, taxable

November 2017 was extremely good month and I made good income trading options. Let’s take a look at each account individually:

· ROTH IRA account:

I am polishing this account to bring it up to follow my 2018 options strategy I published yesterday. That means that I am bringing my options trading in line with the strategy, stop trading options against stocks not in my watch list and I also will be removing non-compliant stocks from the portfolio.

I started doing this by removing PSEC, and LGCY. Other stocks I plan on keeping for now, but only a few will be used for further accumulating (only those which are in my watch list).

My options trading in the ROTH was limited to available cash and I only made $125 dollars in premiums and $87.09 in dividends. It is in line with my previous performance and in the coming months I expect this to improve and grow my income which will be used to purchase new shares or accumulate and re-invest in options trading as per my strategy.

| November 2017 net-liq: | $23,020.51 ▲ | (up by $161.64 0.71%) |

| November 2017 dividends: | $87.09 ▼ | (down from previous $88.60) |

| November 2017 options: | $125.00 ▲ | (up from previous -$4.04) |

| XIRR: | 9.01% ▼ |

Monthly dividend Income:

My dividend holdings:

· TD account:

Trading account was very successful in November 2017 and we generated nice income from options. We continue cleaning the account from bad trades and use the income proceeds to do so (for example in December we may use November income to close some bad positions and offset the loss). We will also bring this account up to our strategy rules but it will take longer to do it. We are taking only a few trades, mostly rolling or adjusting the trades as needed. No active trading as of now.

| November 2017 net liq: | $25,067.45 ▼ | (down by $115.43; -0.46%) |

| November 2017 options: | $2,094.64 ▲ | (up from previous $523.34; 8.36%) |

| XIRR: | -22.81%% ▲ |

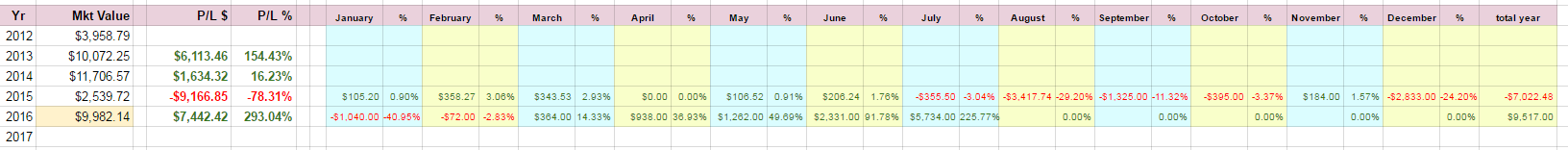

Month-to-moth trading results

(The red dots on the chart indicate income estimate, blue bars actual earnings.)

We are presenting you our month-to-month business performance review:

· Lending Club

Lending Club is still showing one note delinquent which still keeps me annoyed. But I decided to give it a try so I will continue the course and see if it really makes any sense to invest in P2P. But I am refusing to put more money against this vehicle. I deposited $500 dollars and that’s all I am willing to play with as of now unless proven that it makes sense. If even after losses from delinquent borrowers the account resumes its growth then I might consider adding more money to it.

As of today, I consider it a lost case. Still.

| November 2017 net liq: | $499.41 ▲ | (up by $2.17 0.44%) |

| November 2017 interest: | $8.89 ▲ | (up from previous $5.17) |

| XIRR: | -7.94% ▲ |

· IRA Account

I started trading this account in October 2017 and I am already trading it according to my rules mentioned in my yesterday’s post. So trading is smooth and profitable.

I want to reach the growth rate of my former 401k account and grow faster than that. I hope, I will be able to do it. As of now, after two months of trading, my former 401k CAGR was 24.84% after 9 years in the plan, and the rolled IRA’s CAGR is 16.72% after two months in the account. I consider it a not bad result so far. Let’s see how next month will do.

| November 2017 net liq: | $88,574.19 ▲ | (up by $979.33 1.12%) |

| November 2017 options: | $2,567.00 ▲ | (up from previous $313.00) |

| CAGR: | 16.72% ▲ |

· Conclusion

My outlook for December 2017 is still bullish (in fact, I think the whole year 2018 will be a strong bullish rally, unless the economic expansion changes).

Lately, I had a discussion at Stocktwits… Sometimes very “interesting” and fiery with all the crystal ball owners.

They drive me crazy.

And I think, I am becoming and old fart, grumpy one (the picture in my profile is about 10 years old, that’s when I was young and handsome). Sometimes I like to tease them for their art (which I call a coloring book for kindergarten kids – that makes them furious as they spent hours and hours creating their charts and I downgrade it to a coloring book). But lately it makes me allergic to all sort of predictions. They are in fact worthless.

It took me two years to grasp the psychology of trading (and I still think I am not there as it is an evolving process), and by the way, watch the recent Bitcoin mania closely as you are witnessing craziness and idiocy live right in front of you, you no longer need books to read about a crash in 1932, 1987, 2003, 2008… it is all happening again, so watch it closely and learn from it.

So, what matters in the market?

It doesn’t matter what the market does or wants to do and what the so called gurus think the market will do tomorrow or in the next five years.

What matters is that you know what you will do when Mr. Market throws at you any of his/her obstacles. Always have a plan what to do and minimize a loss or avoid it whatsoever.

Trade what you see and not what you think may happen (some go even further and say what “will” happen). It doesn’t matter how long we are in a bullish trend, it doesn’t matter what the PE of the market is, or what the current valuation is (because what is expensive today, can become even more expensive tomorrow – again, just look at Bitcoin), or if a trend lasts 2 years or 20 years – it all means absolutely nothing.

What means/matters a lot is that you know what to do when the music stops… And this is the hardest part of trading! You see it happening and you stop believing what you see, you get frozen and paralyzed and you lose it.

Many spend hours drafting their charts predicting reversals and when the reversal happen they still miss it. Don’t be one of them.

As long as we see this improvement there is no need to be selling your stocks on valuation. Instead, buy every dip you can.

What do you expect from the stock market in December? What is your strategy for the rest of the month/year?

I agree with your strategy that you have written in the previous post and I have come to almost the same conclusion through the school of hard knocks.

There is one thing that I shall be implementing that you have not mentioned, stop loss.

If I see that the trade is not working for me, then I am out of it.

I am still rolling about 12 trades that are still in negative equity and frankly I don’t think I am going to win them.

I am going to try to do the stops for 2 X the premium received and see how that goes.