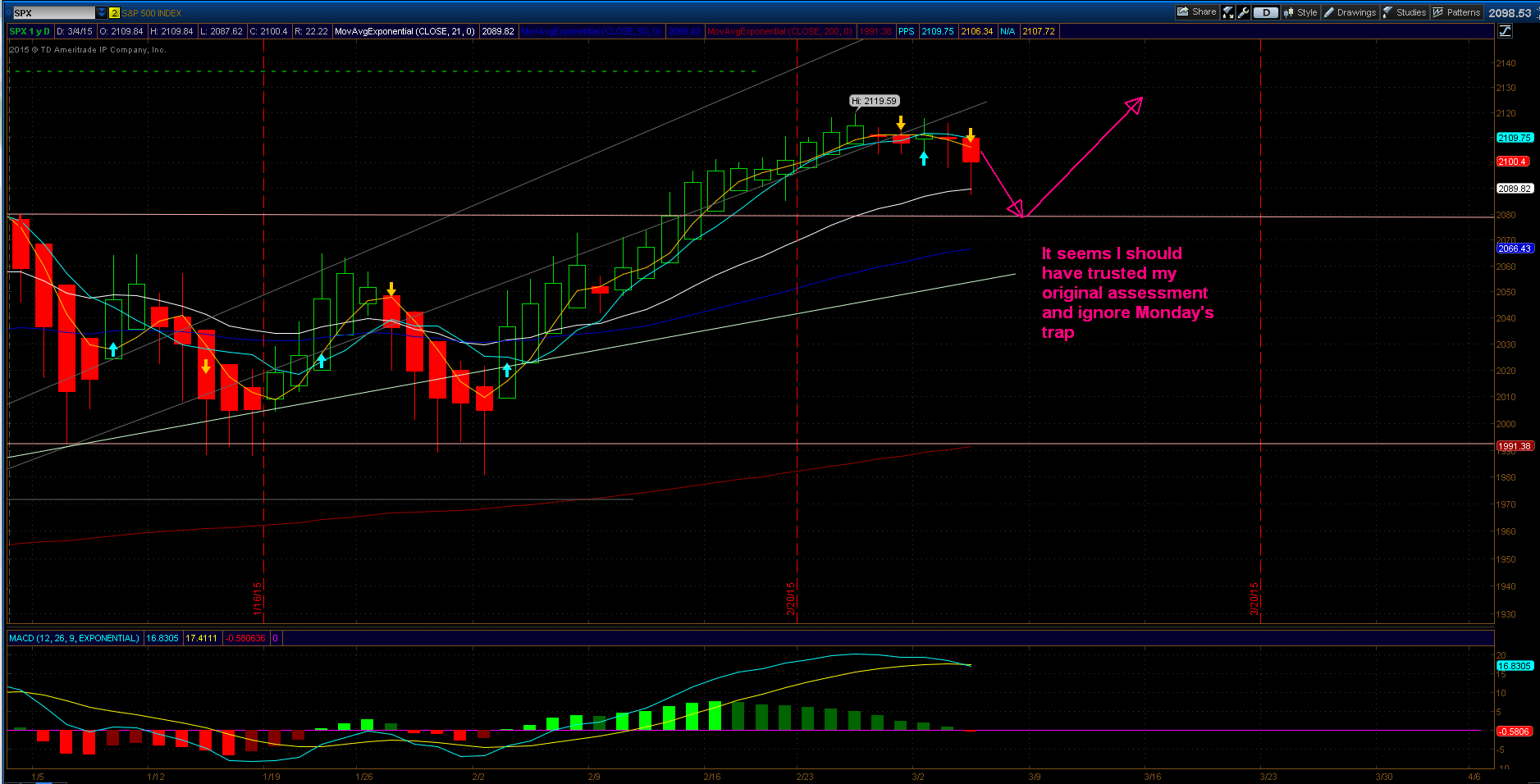

What a trading last week. I must admit, $SPX tricked me into a trap. If you go back to look at my market expectation from last Sunday I expected the market to fall down and correct the uptrend.

This is a picture I originally posted:

From the chart above you can see what my expectation for the last week was. A no brainer bearish trade. Yet I decided to open a bullish put spread against SPX last week. What changed my mind was last Monday trading which showed a very strong bullish move. So I got to believe the bearish trend will not happen.

Obviously, I was wrong. The Monday’s session was a trap.

But, are we supposed to predict where the market or stock will go or will be in a week, two weeks or in 4 days?

No. We are not. Nobody can predict where the market will be. But we can get some clues from the market.

It works in patterns and cycles. Humans act that way. We like to use and behave in cycles or patterns. We have a weather patterns, seasonal patterns. We do same mistakes over and over. We react to certain situation in predictable ways with predictable actions. We learned that throughout thousands of years of human history. If there is a danger, we panic and run for shelters, if there is a sign of prosperity we are pushed into participation.

There has been hundreds of books written about human behavior in their lives and in Wall Street. And I do not write this to make yet another study and academic paper on human psychology. This is to acknowledge, that although I try to assess where the market could go or be next day, in a week, or in a month, it is not a prediction.

I try to use statistical data and chart reading to create my expectation of where the market will be heading. On Friday last week, take a look at what a statistical expectation was and what the market did:

As you can see the market blasted thru all supports and levels. Investors freaked out about too good job reports that they would move FED into increasing interest rates earlier than expected. Did this fear have legs and be justified?

I am not convinced. First, look at the structure of the jobs. In February employment rose by 295,000 jobs. Per the Bureau of Labor Statistics, “Job gains occurred in food services and drinking places, professional and business services, construction, health care, and in transportation and warehousing“:

- Food services and drinking places added 59,000 jobs (20%) – low wage, mostly seasonal jobs

- Construction added 29,000 jobs (10%)

- Healthcare added 24,000 jobs (8%) This was decline from average 29,000 job additions in previous months

- Transportation and warehousing added 19,000 jobs (6%)

- Retail trade added 32,000 jobs (11%)

- Manufacturing added 8,000 jobs (3%)

- Business services added 51,000 jobs (17%)

So, who was the biggest contributor? Food services business services and retail trade. Food services and retail trade are mostly seasonal low paying jobs in fast food and hospitality.

I live in an area with economy based on hospitality. We have seen companies hiring. Grocery stores, fast food, hotels, all those were hiring. But they were hiring knowing that when the season ends in April or May, when the resort closes, these people will be laid off again. They even openly admit this.

What else the Bureau of Labor Statistics says?

Employment in other major industries, including wholesale trade, information, financial activities, and government, showed little change over the month.

What else do we know about the newly added jobs? The average workweek hours haven’t changed for the fifth month in a row and stays at 34 hours a week. Doesn’t this sounds like a part time job to you? It does to me. Also wages didn’t grow in February. They added 3 cents to salaries and the overall hourly rate was almost the same – $24.78 per hour.

Can we be excited about this data? In January a great growth of 257,000 new jobs was revised to 239,000 – revised down by 7%.

If investors were fearful that these numbers can make FED increase rates sooner than later, then I am not impressed at all and I think they are crazy. And what media say while investors are freaking out?

Reuters:

“U.S. factory orders fall again in January”

“U.S. jobless claims rise; fourth-quarter productivity revised down – The number of Americans filing new claims for unemployment benefits unexpectedly rose last week and nonfarm productivity contracted more sharply than previously thought in the fourth quarter.”

What Washington Post says although they praise the employment data?

But the recovery is still a fragile one, particularly because wages have been flat for years and consumer spending could pull back if energy prices again climb.

I hope I made a point, saying that the jobs weren’t that impressive as they may look at the surface and that the economy is still not in a such good shape to justify too early interest rates hike. But I may be wrong. FED may impose rates hike, make it harder for Americans (and Treasury) to pay their debt, people and business borrow more expensive money, mortgages going up higher and refinancing becomes more expensive.

I do not try to predict when and whether this event of rising rates happen. It is not my job whatsoever. And I am not even qualified for that.

In trading stocks or options, the key is not predicting the market or events. The key is to have a plan and solid money management to be able to properly react to those events. If the trade goes with you, great, make your money. If the trade turns against you, know your steps how to avoid a disaster. When trading options, you need to know how they work, where the risk is and how to manage them and eliminate that risk. Not premonitions, predictions, or witchcraft.

So what did I do with my trade? It obviously got in-the-money. Nothing enlightening and to be happy about.

But I decided to move the trade away in time and moved it. I kept the strikes.

Originally we had:

long SPX 2080 puts and

short SPX 2085

This trade was expiring last Friday. I just moved it three weeks away. I collected a credit for this roll. I increased a potential gain if this trade finishes worthless. I still have the same in-the-money trade as before. Only the expiration is now at the end of March.

From my employment data hysteria review above I believe the selling was too violent and it created a buy opportunity although people are now scared again and expect more selling. I am bullish on this trend more than before. I expect this market to reverse and move higher.

If I am correct and the market starts rising again or even goes sideways, I can roll the trade again and lower the strikes this time to increase chances that it expires worthless.

If I am wrong (remember, I do not try to predict the market, only assess all possible options) I will reverse the trade into either a bear call spread or debit bear put spread.

The market stopped at 50 day moving average and a previous sideways channel resistance, now support. If this level holds, we will see the market going higher, potentially to new highs. If it doesn’t, we will see more selling.

Since Friday was extremely extreme trading, I expect a bounce next week. I expect the market to bounce up to previous resistance at 2092 or even back up to 2119 level from which the market may reverse down again. The 2092 level is more likely resistance from which we may bounce down again.

Above is a picture of what the market may do next week. Monday and Tuesday may set the tone for the week. If we see a bounce on Monday it may spark more selling as traders will sell the move up. Even Tuesday may see more upward pressure and yet I expect it to fail and the market may continue lower. Remember, once selling is undergo, it feeds more selling. Nevertheless, any bounce up would help our trade to roll it again or convert into a bearish trade easier.

Let’s see next week rolling.

We all want to hear your opinion on the article above:

No Comments |

Irving Kahn, a legendary investor, and student and later coworker of Benjamin Graham, once said about speculators and investors in Wall Street:

Irving Kahn, a legendary investor, and student and later coworker of Benjamin Graham, once said about speculators and investors in Wall Street:

Recent Comments