We received a new CPI report today showing that inflation continues moderating and gliding lower although because of the media hysteria, it may have not looked like it. Yes, the pace slowed down significantly compared to the second half of 2022 but still, we are easing down a bit. The headline and core CPI rose 6.4% y/y and 56% respectively, down from 6.5% and 5.7% in December. The market reacted to the numbers with a rally followed by a selloff and zig-zag moves. In the end, it ended almost flat.

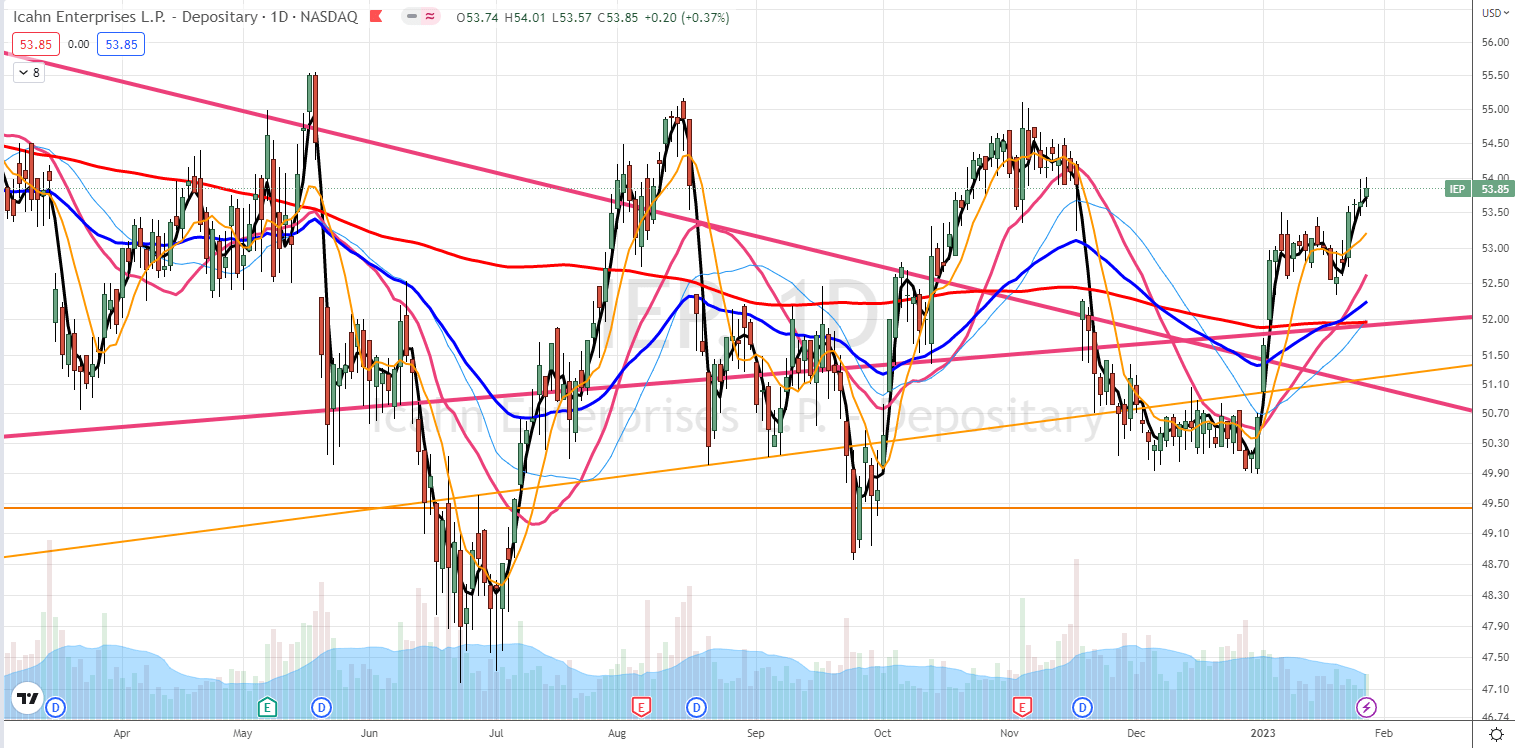

If you look at the chart above carefully, you will see that the market is forming a flag pattern. That is a quite strong bullish continuation pattern, usually followed by many investors if they recognize it:

Thus we can safely assume, that the trend will continue at some point in the future. How exactly long we stay in this pattern and when we break up is unknown. But we may expect it to happen. Unless the FED comes out with bad news and turns this all down to the abyss.

The Ichimoku chart shows a strong bullish pattern too:

If we switch to the weekly Ichimoku we will see that the market is trying to improve too. There is still a lot of work to be done but the most important and enlightening price action is that the price is trying to get above the cloud. This would definitely confirm this new bull market.

The market followed the forecasted pattern almost to the tee, today. We rallied, then pulled back, and rallied again to recover. The only difference was that at the end of the trading session, the market sold off again. Tomorrow, I expect the market possibly sell again but rally by the end of the day.

If you want to learn more about our SPX weekly analysis, subscribe to our weekly newsletter.

|

We all want to hear your opinion on the article above: No Comments |

Recent Comments