October 2021 is becoming the best month for trading options. As you will see in this investing and trading report we made over $8,000 this month so far and our net liquidating value jumped above $90k.

And, in the meantime, please, enjoy our weekly investing and trading report.

Here is our investing and trading report:

| Account Value: | $91,450.68 | +$2,189.14 | +2.45% |

| Options trading results | |||

| Options Premiums Received: | $3,019.00 | ||

| 01 January 2021 Options: | $4,209.00 | +16.65% | |

| 02 February 2021 Options: | $4,884.00 | +15.41% | |

| 03 March 2021 Options: | $5,258.00 | +12.79% | |

| 04 April 2021 Options: | $2,336.00 | +4.30% | |

| 05 May 2021 Options: | $6,346.00 | +9.22% | |

| 06 June 2021 Options: | $4,677.00 | +6.37% | |

| 07 July 2021 Options: | $3,865.00 | +5.14% | |

| 08 August 2021 Options: | $6,133.00 | +7.40% | |

| 09 September 2021 Options: | $2,353.00 | +2.97% | |

| 10 October 2021 Options: | $8,244.00 | +9.01% | |

| Options Premiums YTD: | $48,305.00 | +52.82% | |

| Dividend income results | |||

| Dividends Received: | $15.27 | ||

| 01 January 2021 Dividends: | $53.04 | ||

| 02 February 2021 Dividends: | $63.00 | ||

| 03 March 2021 Dividends: | $30.31 | ||

| 04 April 2021 Dividends: | $139.70 | ||

| 05 May 2021 Dividends: | $167.45 | ||

| 06 June 2021 Dividends: | $168.56 | ||

| 07 July 2021 Dividends: | $228.62 | ||

| 08 August 2021 Dividends: | $780.09 | ||

| 09 September 2021 Dividends: | $176.60 | ||

| 10 October 2021 Dividends: | $170.41 | ||

| Dividends YTD: | $2,019.26 | ||

| Portfolio metrics | |||

| Portfolio Yield: | 4.18% | ||

| Portfolio Dividend Growth: | 8.13% | ||

| Ann. Div Income & YOC in 10 yrs: | $16,886.62 | 15.76% | |

| Ann. Div Income & YOC in 20 yrs: | $128,176.48 | 119.63% | |

| Ann. Div Income & YOC in 25 yrs: | $542,659.14 | 506.47% | |

| Ann. Div Income & YOC in 30 yrs: | $3,544,761.59 | 3,308.37% | |

| Portfolio Alpha: | 45.74% | ||

| Portfolio Weighted Beta: | 0.67 | ||

| CAGR: | 632.53% | ||

| AROC: | 54.87% | ||

| TROC: | 13.76% | ||

| Our 2021 Goal | |||

| 2021 Dividend Goal: | $1,071.42 | 188.47% | Accomplished |

| 2021 Portfolio Value Goal: | $42,344.06 | 215.97% | Accomplished |

| 6-year Portfolio Value Goal: | $175,000.00 | 52.26% | |

| 10-year Portfolio Value Goal: | $1,000,000.00 | 9.15% |

Dividend Investing and Trading Report

Last week, the markets continued a strong recovery although at the end of the week the S&P 500 growth slowed down. We grew our net-liq by 2.45% last week. Since our rule of keeping min. $3,000 in BP was met, we purchased dividend growth stocks and SPXL and SSO shares to get our portfolio ready for rapid growth. We also added other dividend stocks and we rolled our strangles up (some to generate more income, others were rolled up as the market was recovering). We were also re-opening trades that expired last week.

Our options income reached another impressive $3,019.00 dollars received in premiums. That makes $8,244.00 in October so far. This is our best month in premium income.

Our dividend income was steady, we have received $15.27 in dividends last week, making October at $170.41 dividend income.

We are also growing our dividend growth portfolio and here you can see our dividend income per stock holding and how they contribute to the overall dividend income:

Options Investing and Trading Report

As I mentioned above, we generated $3,019.00 options income so far this month and we expect to generate more next week.

Last week we rolled our positions and it was extremely profitable. I keep saying that these selloffs are great for investors. All they need to do is stop panicking, assess the situation (which means learning how to evaluate the stock market as a whole), and instead of panic selling engage in buying. We rolled our options trades and made over $3k in premiums, but this selloff also allowed us to buy more stock. We also opened new trades replacing the trades that expired last week.

You can watch all our trades in this spreadsheet. You can watch the spreadsheet and look for a “NEW” indication next to the trading date. When the indicator shows up, it is typically good for up to 3 days to follow that trade.

Expected Future Dividend Income

We received $15.27 in dividends last week. It is a bit disappointing dividend income as in the past few weeks and months it started to look like our dividend income was picking up, but the last month and October sucks. I may need to review my dividend tracking as it shows that I should be getting more in dividends than what I am receiving. So, I guess, there is an error in my tracking. One item could be that I track ex-dividend date but I should probably track a payout date as I noticed that some companies can pay the dividends a few months after the ex-date.

Our projected annual dividend income in 10 years is $16,886.62 but that projection is if we do absolutely nothing and let our positions grow on their own without adding new positions or reinvesting the dividends.

We are also set to receive a $4,048.88 annual dividend income. We are 23.98% of our 10 year goal.

The chart above shows how our future dividend income is based on the future yield on cost and what dividend income we may expect in the future. The expected dividend growth depends on what stocks we are adding to our portfolio and the stocks’ 3 years average dividend growth rate. It is interesting to see what passive income we may enjoy 10, 20, 25, or 30 years from now.

Market value of our holdings

Our non-adjusted stock holdings market value increased from $115,926.73 to $118,822.58 last week.

However, we still expect the value of our holdings to grow and outperform the market long term. Many positions in our portfolio are new and “young” and they did not have enough time to show gains yet. We were building cash reserves to buy depressed stocks during selloffs and corrections as well as negative analysts reports (as long as the company is still good long term).

Our goal is to accumulate 100 shares of each stock of our interest and we are getting to that goal.

Investing and trading ROI

Our options trading delivered a 9.01% monthly ROI in October 2021, totaling a 52.82% ROI YTD. We again exceeded our 45% annual revenue selling options against dividend stocks target!

Our account grew by 344.53% beating our projections and the market.

Our options trading averaged $4,830.50 per month this year. If this trend continues, we are on track to make $57,966.00 trading options in 2021. As of today, we have made $48,305.00 trading options.

Old SPX trades repair

This week, we didn’t adjust any SPX trades. Our goal is to reach a level that we will be eligible for portfolio margin (PM). Once that happens, we plan on converting the existing SPX Iron Condors to strangles and trade these positions as strangles.

With RegT margin, the capital requirements would be approx. $66,586.06 and that is beyond our means. With PM the requirement for margin would drop to around $10k. That is doable in our account. Once we reach this level, we will start adjusting our SPX trades accordingly. Until then, we will just roll these trades around.

Accumulating Growth Stocks

Last week we have added shares of SSO and SPXL to our holdings according to our plan and rules. Our goal for the nearest future is to accumulate 25% of our net-liq in these shares and maintain the weight. If the weight goes above 25% we will start trimming the positions, and when the weight goes below 25% we will start accumulating the positions. Any leftovers will be reinvested to the dividend growth stocks, options trades, or reserves.

We also added a few shares of BITO but the ETF didn’t perform as expected so we got out of the position with a small loss. I also did some reading and learned more about the fund. It is trading futures of Bitcoin and replacing expiring futures with the new front-month futures. With this strategy, it will work in a similar manner as the USO fund, and that is a receipt for a disaster for investors as you may suffer value destruction over time because of a contango effect. This vehicle is good to capture short-term moves but not a long-term investment.

Accumulating Rules

Our rule is to buy shares of growth stocks using 20% of any BP value that is above the $3,000 October limit (in November we will be raising the limit to $4,000). For example, if our BP ends at $3,900, we can buy shares using 20% of $900 or $180 to accumulate shares of any growth stocks.

Why such a rule? Up to today, I was scaling up my trades and portfolio. That resulted in rapid growth but also all our proceeds were constantly locked in the trades. If we want to live off of our dividends and options income, we cannot have them locked by new trades. We need to start accumulating “cash available to withdraw”. Therefore, I am shifting my trading to trade the same amount of contracts and invest only a certain excess of the accumulated cash.

Accumulating Dividend Growth Stocks

Last week, we added shares of OMF when the stock dropped 8% unexpectedly. We still plan on adding The Toronto-Dominion Bank (TD) or Walgreens Boots Alliance, Inc. (WBA) dividend stocks once our goal of accumulating SPXL and SSO is accomplished.

Our goal is to reach 100 shares of high-quality dividend stocks and build a weekly dividend income as per this calendar, but we have made no changes to this goal last week:

You can see the entire spreadsheet here.

Market Outlook

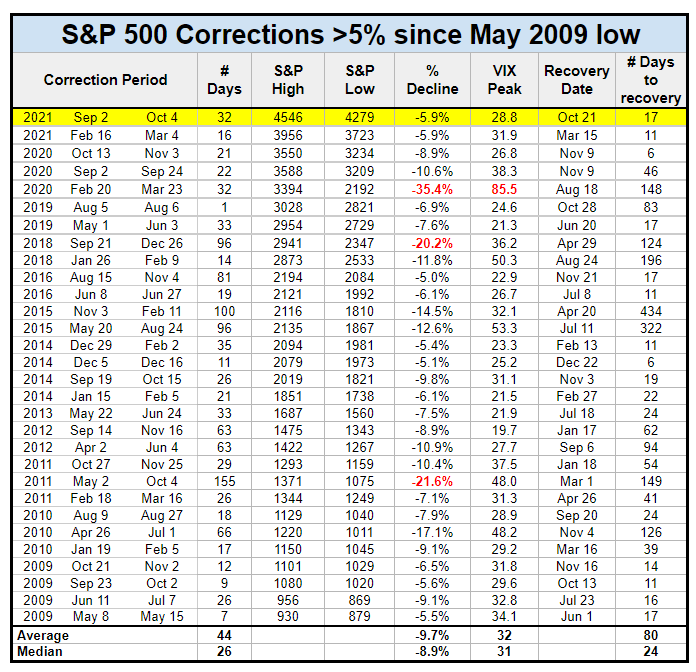

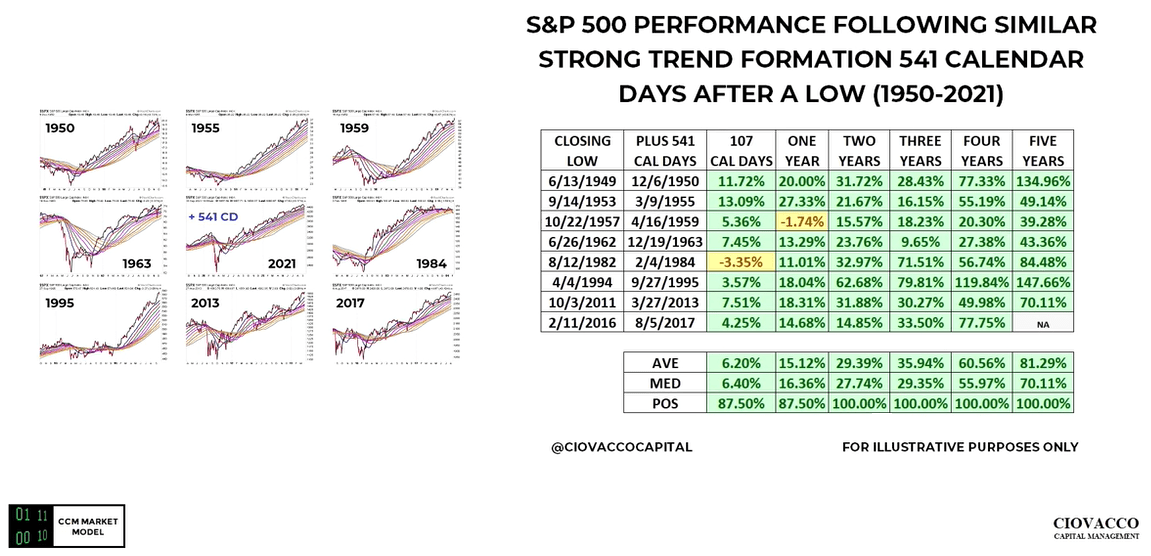

As I indicated above, the stock market continued its rally. It recovered the September pullback so we are now back on track for a new all-time high:

With that said, what could be the next move in the market? Again, we need to remember at what stage or phase this market is. The market is driven by earnings. Nothing else. Everything else is a secondary driver. The primary driver is earnings. It is astounding to see people investing in the market and not knowing what drives it. It is like driving a car but having a thick cover on the front windshield. People invest in the market completely blind and influenced by rumors false expectations and wishful thinking. They think they know but when I ask them, they turn out to be clueless.

Just yesterday I had a discussion with one investor on social media about the market and he proclaimed that it was wishful thinking to expect that the market would make new double-digit gains over the foreseeable future. He revealed that he had no idea what drives the market and he is investing based on HIS expectations and perceptions, not the market. If you are a subscriber to my newsletter, you would know why this market is, in fact, in a very healthy stage and will most likely post triple-digit gains over the foreseeable future.

My expectation for the next week is however some small pullback or consolidation of the recent gains but then we are heading to a Santa Claus rally.

We may see some bouncing around but it is my opinion that this market is heading to a new all-time high.

If you want to learn more about the stock market, events that moved the market last week and will likely impact it in the near future, I recommend you to subscribe to our weekly newsletter. Knowing where the market is heading and knowing when you should expect its reversal can benefit your trading and investing. Subscribe and you get one month free.

Investing and trading report in charts

Account Net-Liq

Account Stocks holding

Last week, S&P 500 grew 57.11% since we opened our portfolio while our portfolio grew 29.77%. On YTD basis, the S&P 500 grew 27.27% and our portfolio 22.79%.

The numbers above indicate that our portfolio grows faster than the market and we are pairing this year’s market performance. I expect this trend to continue in the next years.

The numbers above apply to our stock holdings in our account, not the overall account net-liq growth. Our overall account beats the market growing by 344.53%!

Stock holdings Growth YTD

I expect our stock holdings to start outperforming the market as they mature. However, these are just our stock holdings. The entire portfolio beats the market by far thanks to monetizing those positions.

Our 10-year goal is to grow this account to $1,000,000.00 value in ten years. We are in year two and we accomplished 9.15% of that goal.

Our 6-year goal is to reach $175,000 account value to be eligible for portfolio margin (PM) and today we accomplished 52.26% of that goal.

Our 2021 year goal is to grow this account to a $42,344.00. We already accomplished this goal.

Investing and Trading Report – Options Monthly Income

Investing and Trading Report – Options Annual Income

Our dividend goal and future dividends

We have accomplished our dividend income goal. We planned to make $1,071 of dividend income this year and we finished receiving $2,019.26. However, we accumulated enough shares to start making $4,048.88 a year.

Our account cumulative return

The chart below indicates our cumulative adjusted return. It shows how the last week’s selloff shook down our returns but we are recovering along with the market.

As of today, our account cumulative return is 51.87% (note, data in this section are since March 13, 2021, only as that is the date we started tracking these metrics. Thus the results are skewed a bit and will show full picture next year.).

Conclusion of our investing and trading report

This week our options trading was within our expectations and I believe, the rest of the month will be even better.

We will continue accumulating the dividend growth stocks in our portfolio to reach 100 shares and continue building our cash reserves so we have enough cash to sustain any market corrections and be able to buy depressed stocks.

We will report our next week’s results next Saturday. Until then, good luck and good trading!

|

We all want to hear your opinion on the article above: No Comments |

Recent Comments