May 2021 started in a similar manner as the previous months – slowly. We only made about $551 trading options in the first week of May. Honestly, it was a surprise to me as I expected less due to the stock market slowdown and selling pressure. So, this income is a nice surprise. In today’s trading report, I will once again, show what stocks we were trading options, what stocks we were accumulating and why, our goals, and the market outlook for the next week and beyond.

Let’s go and review this week’s investing and trading.

Here is our investing and trading report:

| Account Value: |

$55,037.21 |

+$727.03 |

+1.34% |

| Options trading results |

| Options Premiums Received: |

$551.00 |

|

|

| 01 January 2021 Options: |

$4,209.00 |

+16.65% |

|

| 02 February 2021 Options: |

$4,884.00 |

+15.41% |

|

| 03 March 2021 Options: |

$5,258.00 |

+12.79% |

|

| 04 April 2021 Options: |

$2,336.00 |

+4.30% |

|

| 05 May 2021 Options: |

$551.00 |

+1.00% |

|

| Options Premiums YTD: |

$17,238.00 |

+31.32% |

|

| Dividend income results |

| Dividends Received: |

$74.64 |

|

|

| 01 January 2021 Dividends: |

$53.04 |

|

|

| 02 February 2021 Dividends: |

$63.00 |

|

|

| 03 March 2021 Dividends: |

$30.31 |

|

|

| 04 April 2021 Dividends: |

$179.10 |

|

|

| 05 May 2021 Dividends: |

$74.64 |

|

|

| Dividends YTD: |

$400.09 |

|

|

| Portfolio metrics |

| Portfolio Yield: |

4.39% |

|

|

| Portfolio Dividend Growth: |

7.47% |

|

|

| Ann. Div Income & YOC in 10 yrs: |

$8,677.62 |

15.70% |

|

| Ann. Div Income & YOC in 20 yrs: |

$59,028.67 |

106.78% |

|

| Ann. Div Income & YOC in 25 yrs: |

$224,164.94 |

405.49% |

|

| Ann. Div Income & YOC in 30 yrs: |

$1,231,947.22 |

2,228.47% |

|

| Portfolio Alpha: |

21.59% |

|

|

| Portfolio Weighted Beta: |

0.97 |

|

|

| CAGR: |

795.16% |

|

|

| AROC: |

31.11% |

|

|

| TROC: |

19.12% |

|

|

| Our 2021 Goal |

| 2021 Dividend Goal: |

$1,071.42 |

37.34% |

|

| 2021 Portfolio Value Goal: |

$42,344.06 |

129.98% |

Accomplished |

Dividend Income Report

Our dividend income picked up. We are seeing larger dividends coming to our account. We have received $74.64 in dividends in the first week of May and I expect more dividends coming in the following weeks as we keep building our weekly dividend income.

The chart below indicates our current annual dividend payout from our dividend stock holdings. I am adding it to show how each stock contributes to our income. It is important for a dividend growth investor to be aware of this payout from each stock. The chart indicates that some stocks contribute (or will be contributing to our income with large sums while others contribute very little. That can be a problem. If a company that contributes with large dividends suddenly cuts the dividend, it will have a very significant impact on our income (for example, if OMF cuts the dividend, or suspends it, the impact on our portfolio dividend income will be significant.

During the accumulation phase, I am OK with this imbalance but plan to address it in the next phase of cultivating our portfolio.

Last week, our dividend income reached 37.34% of our dividend income goal.

Options Income Report

Last week we continued trading options against the stocks we either already own or plan to buy in the near future. We opened new short strangles against OMF, OXY, and rolled short strangles against ABBV, AFL, and APPL as these trades got one side of the trade into danger and we had to adjust.

We also rolled (adjusted) our TSLA spreads as tech stocks continued their selloff last week and the put side got also into trouble.

The new trades and adjustments delivered $551.00 options premiums last week.

Expected Future Dividend Income

As the table above indicates, our aggressive dividend growth stocks accumulation is starting to show significant progress in our future dividends income. Our portfolio dividend yield and dividend growth will be bringing us almost $60,000 in 25 years and $1,231,947.22 in 30 years. Of course, we want to be able to generate liveable income sooner than in 25 years. And the portfolio is starting to show this to be happening.

Comparing this trading report with our previous reports you will be able to see that although our Yield on Cost (YOC) is decreasing, our future dividend income is actually increasing. With this trend, we should be able to achieve a passive dividend income sooner.

Market value of our holdings

Our non-adjusted stock holdings market value increased from $59,324.59 to $60,327.92. Many of our positions show nice profits and on an adjusted basis, our only losing position is SNOW. All other stocks are in green.

Our goal is to accumulate 100 shares of each stock of our interest and we are getting to that goal. However, as mentioned above, this has a negative impact on our dividend payout. Therefore, once we reach this goal (which we set because of the ability to trade covered calls), we will start accumulating these shares to equalize our dividend income rather than have an equal amount of shares.

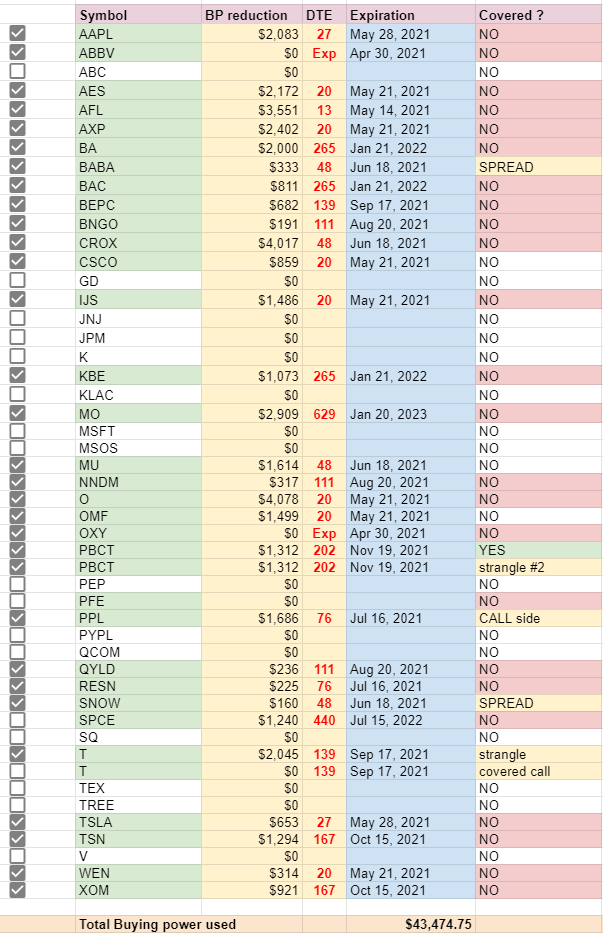

Open trades

The table above shows our open trades (in a simplified version) and the margin or buying power required for those trades. I keep track of this to see what trades I have open and when these trades are set to expire. It helps me to see all trades in one place and I can review them all at one glance rather than browsing through all positions in a brokerage account trying to figure out which trade needs my attention. I also use this to keep an eye on my buying power to make sure that I do not get myself into trouble overtrading. So far, this doesn’t work as I was not able to figure out how Tasty Work manages buying power and maintenance requirements. It appears to me, that they do it manually for every client and their requirements are zig-zagging from one extreme to another.

With new trades and trade adjustments, our BP reduction increased by 10% from $43,474.75 to $48,167.40 (+$4,692.65), yet our BP usage dropped from 167.00% to 125.60% (a 25% drop). How come?

Investing and trading ROI

Our options trading delivered a 1.00% monthly ROI in May 2021, totaling a 31.32% ROI YTD.

Our account grew by 167.53% this year.

Our options trading averaged $3,447.60 per month this year. If this trend continues, we are on track to make $41,371.20 trading options in 2021.

Old SPX trades repair

This week we have not done any adjustments to our old SPX trades. We are still sitting on those trades and waiting for the untouched side to close so we can roll the trades again. The goal will be to roll the trades until we will be able to close them for at least break even and release the buying power. We will keep doing this only if the resulting trade will be a credit trade or a very small debit. If adjusting these trades would require adding more new money, we would rather close these trades and move on.

Accumulating Growth Stocks

Last week, we took advantage of tech selloff and added 1 share of SNOW and 1 share of TSLA to our positions. I know, it’s just one share. But these are expensive stocks and I can afford to accumulate these stocks slowly. We still want to accumulate 100 shares of this stock and start selling covered calls. As of now, we trade Iron Condors against this stock, but once we accumulate shares, we will switch to a CC.

Accumulating Dividend Growth Stocks

Our primary goal of our investing and trading strategy is to accumulate high-quality dividend growth stocks. Last week, we added 10 shares of OMF and increased our positions in this company:

OMF (80 shares).

Our goal is to reach 100 shares of high-quality dividend stocks and build a weekly dividend income as per this calendar:

We are reaching our weekly dividend income goal as almost all weeks are filled with dividend income.

Market Outlook

The stock market continued trading sideways for the most part of the week. We shortly broke above the narrow tight range but then started drifting lower. The big companies reported earnings (AAPL, Tesla, Amazon, etc.) yet these companies sold off heavily. That made many people wondering how was that possible when the companies delivered better than expected results.

You need to understand that the market is forward-looking and when companies report earnings, most of the time, the stock market reacts to the future outlook than the current report. The current report is the past. It is history. And no one cares about history. Everyone cares about the future. So, if a company was expected to report 70% growth and it grew 70% as reported in the most current earnings, then there will be a selloff. Investors will take their profits. The goal was met, there is no need to stay in the position longer unless the company provides an even better outlook that makes the stock participants maintaining their position.

But then, on top of all that, Janet Yellen got on TV and forgot that she was no longer a FED chair and proclaimed that “we may need to raise interest rates to prevent our economy to overheat.” Jerome came quickly to deny it and Yellen backed off. But the damage was done and the stock market dropped (Nasdaq over 2%).

When the storm was evaded, the market recovered quickly and rallied on Thursday and Friday last week. We broke up from the consolidation pattern and based on that, I expect this market to continue rallying higher for the next few months. Based on similar market behavior since 1982, we may expect a further rally until the end of the year (possibly August) where we may experience a significant correction.

My new target is $4,430. It may take some time to get to that level, and we may see bounces and pullbacks on the road (a 5% pullback would be normal).

Investing and trading in charts

Account Net-Liq

Account Stocks holding

The table above shows our current holdings and gains. The “Options Adjusted” columns indicate how options help to boost (or ruin) our stock holdings appreciation, or in other words, lowering the cost basis. Without options, our holdings would be up 9.13%. With options, our holdings are up 16.77% (from inception on 4/1/2019). The SPX is up 46.32% since inception.

Our options adjusted stock holdings underperform the overall market (up only 16.77% vs SPX 46.32%). On a YTD basis, the market gained 16.47% while our options-adjusted stock holdings grew 9.79%.

Account Growth YTD

The stock holdings growth slowed down because we added many new stock positions and these positions didn’t have time to grow yet, so I expect the growth trend to improve over time and beat the market.

Trading Report – Options Monthly Income

Trading Report – Options Annual Income

Our dividend goal and future dividends

Our portfolio still doesn’t represent the true dividend income potential but we are seeing the results of our accumulation effort already. We are on track to accomplish our dividend income goal, currently, we are at 37.34% of the goal to reach $1,071 of dividend income this year.

However, the chart below indicates that our dividend income will possibly exceed this goal as we accumulated enough shares to receive $2,858.04 in dividends.

Our account cumulative return

This is another metric I started tracking (since March 13, 2021) recently.

As of today, our account cumulative return is 26.07% (since March 13, 2021).

Conclusion of our investing and trading report

This week our options trading exceeded our expectations. I hope, the rest of the month will be even better.

We will continue accumulating the dividend growth stocks in our portfolio to reach 100 shares. We will also replenish our cash reserves to bring them back to 25% of our current net-liq value.

We will report our next week’s results next Saturday. Until then, good luck and good trading!

We all want to hear your opinion on the article above:

No Comments |

Recent Comments