March 2021 is in the books! And as you would be able to see in this investing and trading report, it was our best month this year generating a nice income for our partnership members. The month of March started slow and I thought it would stay like this. But as the market started going up again and some of our options trades expired and we re-opened them, it picked up and our account ended to be the best month. The generated income from options premiums was reinvested into dividend growth stocks holdings. I hope, the next month will be even better!

Here is our investing and trading report:

| Account Value: | $41,114.22 | +$1,400.24 | +3.53% |

| Options trading results | |||

| Options Premiums Received: | $93.00 | ||

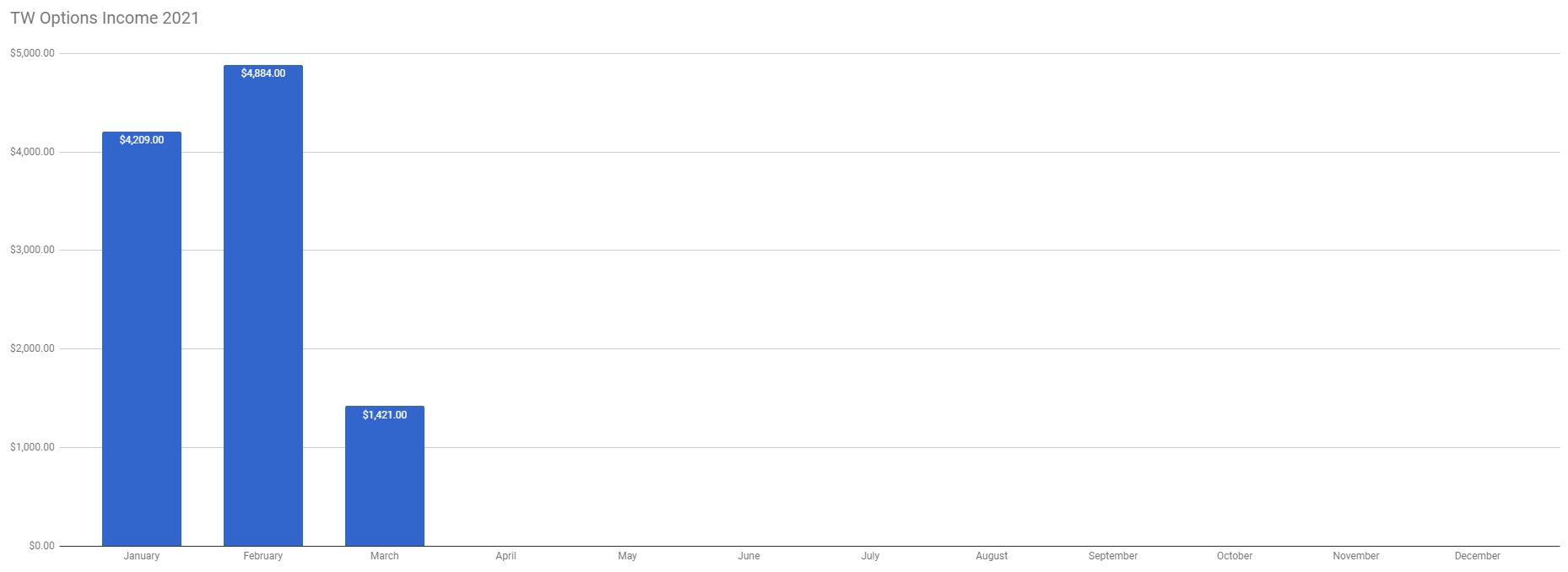

| 01 January 2021 Options: | $4,209.00 | +16.65% | |

| 02 February 2021 Options: | $4,884.00 | +15.41% | |

| 03 March 2021 Options: | $5,258.00 | +12.79% | |

| 04 April 2021 Options: | -$7.00 | -0.02% | |

| Options Premiums YTD: | $14,344.00 | +34.89% | |

| Dividend income results | |||

| Dividends Received: | $9.92 | ||

| 01 January 2021 Dividends: | $53.04 | ||

| 02 February 2021 Dividends: | $63.00 | ||

| 03 March 2021 Dividends: | $30.31 | ||

| 04 April 2021 Dividends: | $41.50 | ||

| Dividends YTD: | $187.85 | ||

| Portfolio metrics | |||

| Portfolio Yield: | 4.19% | ||

| Portfolio Dividend Growth: | 8.10% | ||

| Ann. Div Income & YOC in 10 yrs: | $6,548.14 | 15.74% | |

| Ann. Div Income & YOC in 20 yrs: | $49,403.49 | 118.76% | |

| Ann. Div Income & YOC in 25 yrs: | $207,923.34 | 499.80% | |

| Ann. Div Income & YOC in 30 yrs: | $1,345,568.52 | 3,234.47% | |

| Portfolio Alpha: | 26.02% | ||

| Portfolio Weighted Beta: | 0.87 | ||

| CAGR: | 759.37% | ||

| AROC: | 27.82% | ||

| TROC: | 22.78% | ||

| Our 2021 Goal | |||

| 2021 Dividend Goal: | $1,071.42 | 17.53% | |

| 2021 Portfolio Value Goal: | $42,344.06 | 97.10% |

The dividend growth and yield on cost growth are impressive over time. The numbers in the table above indicate how great passive income this portfolio will deliver in the next 20 years. And in the next 30 years, this portfolio will deliver over a million dollars annually in dividend income. That is a state of this portfolio as of today, given that we will do nothing from now on. But we will keep investing, accumulating, and monetizing our portfolio.

The future and the prospect of future dividend income are bright. Yet building such a portfolio is a slow and somewhat painful process. It takes time. If you look at the current dividend income, it looks pitiful and laughable. And many people will tell you that it makes no sense to invest in dividend growth stocks. The income is not worth it. We have over $40,000 invested in dividend stocks and we only received $30 in dividend income.

Unfortunately for the naysayers, this is an incredibly simplified and incorrect view. The invested amount is an amount as of today, invested in these stocks just last week and it had not yet time to transform into the dividend income. It will come later as the next quarterly dividends kick in. But people fail to see it.

Last week we continued accumulating our stocks to achieve our dividend weekly dividend income. We accumulated shares in Realty Income (O), ABBV, AAPL, and AES according to our plan. I also decided to start increasing holdings in AT&T (T) stock. I also got rid of a few stocks that no longer meet our original criteria for investing in them. We sold out Helmerich & Payne (HP) and Oxydental Petroleum (OXY). The companies stopped growing their dividends and cut them significantly. We just held them in our portfolio for a better exit time. As oil rallied, these stocks increased in price and we could sell them break even. We kept all the dividends we ever received, though. Our non-adjusted stock holdings market value increased from $41,602.80 to $44,923.51.

Last week, we received $93.00 in premiums trading options against our holdings. It was low as we traded for only two days in the last week of March. We just adjusted a few trades only. Also, on the first day of April (Thursday only, as on Friday, April 2nd, the markets were closed for Good Friday) we generated a small loss. In fact, it was not a loss but closing some positions (we closed a call spread against BABA and TSLA), so our credit premium was in March but closing debit already got in April (as I keep this track based on CASH accounting standard). For the entire March 2021, we received $5,258.00 premiums, and all our income was reinvested.

Open trades

The table above shows all our open trades and expirations. It is just a simplified tracking and buying power reduction. Our goal is to trade a set amount of equity strangles in what I call perpetual strangle trading. It is nothing fancy. I just have a list of equities I like to trade options around them, I like to eventually own and I accumulate these stocks. Once a trade expires (or nears expiration) I re-open the trade or roll it into the next expiration (mostly trades that a stock is near the short strike and there is a risk of getting in the money).

We only adjusted a few new trades last week. The BP reduction increased from $36,124.40 to $37,123.70, a reduction of +$999.30 or +2.77%. This increase was just a volatility fluctuation.

Investing and trading ROI

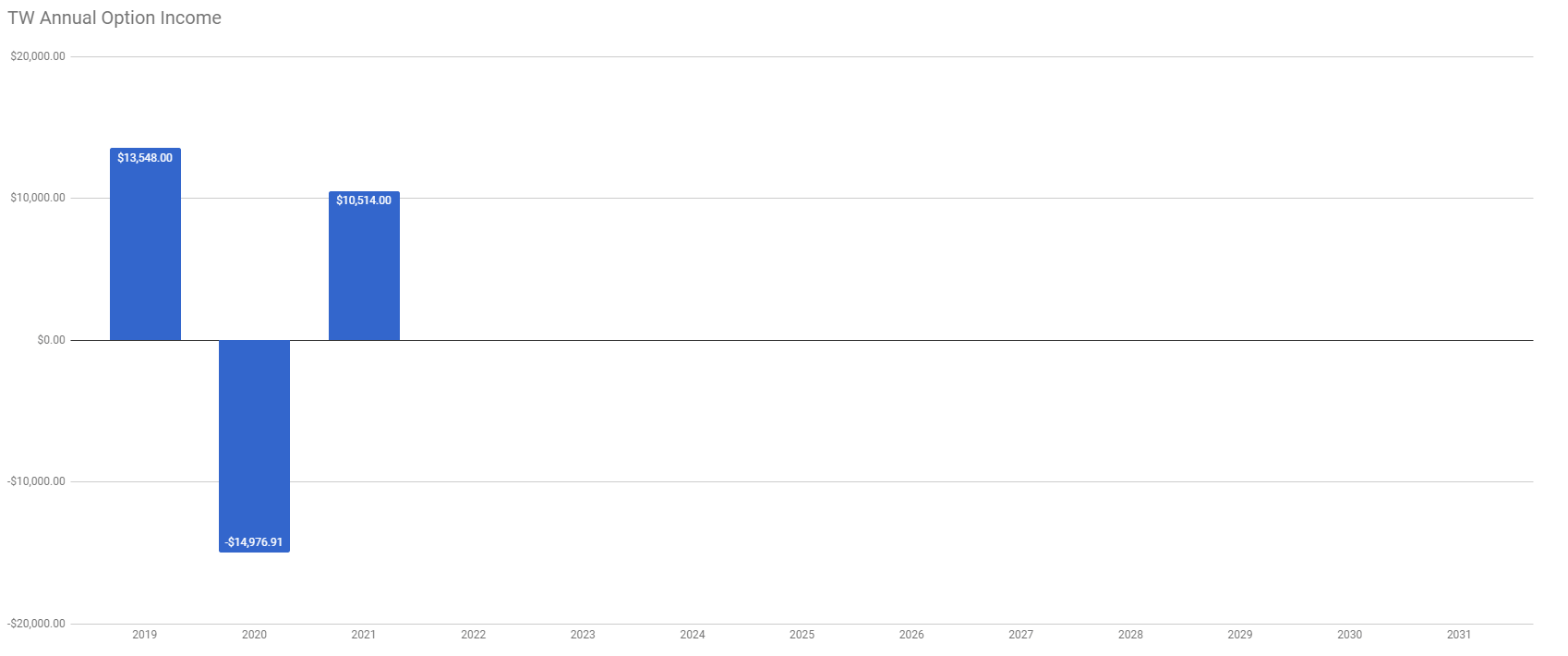

Our options trading delivered a 12.79% monthly ROI, totaling a 34.89% ROI.

Our account increased to 99.85% YTD growth. We are about to double our money in the next month if this trend continues.

Our options trading averaged $3,586.00 per month this year. If this trend continues, we are on track to make $43,032.00 trading options in 2021.

We are still on track to complete goals in our portfolio. We made slight adjustments and we are providing our comments to our goals and tasks we set up in the week 6 report:

Old SPX trades repair

This week we have not done any adjustments to our old SPX trades. We are still sitting on those trades and waiting for the untouched side to close so we can roll the trades again. The goal will be to roll the trades until we will be able to close them for at least break even and release the buying power. We will keep doing this only if the resulting trade will be a credit trade or a very small debit. If adjusting these trades would require adding more new money, we would rather close these trades and move on.

Accumulating Growth Stocks

Last week I kept accumulating TSLA stock right before it started moving up again. Now we are sitting on a nice gain just a few days after our investment. We however limit our growth stocks holdings to 10% of our portfolio. Currently, we are at 15% and that means that next week or in the upcoming weeks, I will not be adding more shares (unless Tesla tanks so much that it would be a steal to invest).

I also kept accumulating Apple (AAPL) as the stock was displaying weakness. However, it looks like that the weakness in the tech stocks ended last week and these companies are in favor again and rallying. If so, it will be difficult to buy cheap (although, AAPL is not cheap even at this “cheap” level). AAPL is a dividend stock and part of my dividend growth investing strategy and I will keep accumulating this stock.

Accumulating Dividend Growth Stocks

Buying high-quality dividend stocks is our core strategy. And we will continue to do so and at a faster pace. I continued accumulating Realty Income (O) this week and as of today, we hold 55 shares.

We also accumulated ABBV and AES stocks and we hold 13 and 70 shares respectively.

We also plan on adding Eaton Vance Municipal Income Trust (EVN), PIMCO Municipal Income Fund III (PMX), and Eaton Vance Municipal Bond Fund (EIM) stocks. The reason for that is that although not dividend growth stocks, they pay a relatively good dividend, they pay consistently, and that are tax free.

Our goal is to not only reach 100 shares of high-quality dividend stocks but also create a weekly dividend income from these stocks All it takes to create a weekly dividend income is to buy 12 stocks to spread the income for every week. I created this dividend calendar and track the stocks I want to buy to get this goal done fast.

As you can see in the table above, we are reaching our weekly dividend income goal as almost all weeks are filled with dividend income. All that is missing is February and March first week “slot” (and subsequent months) but others are already filled. April should deliver an income every week. After we add all weeks, we will start increasing shares so the income is larger and larger every week. Also, note that I have included holdings of 100 shares in this table only. So, for example, we own 17 shares of AAPL and therefore it is not yet included in this table although we will receive income next month.

Market Outlook

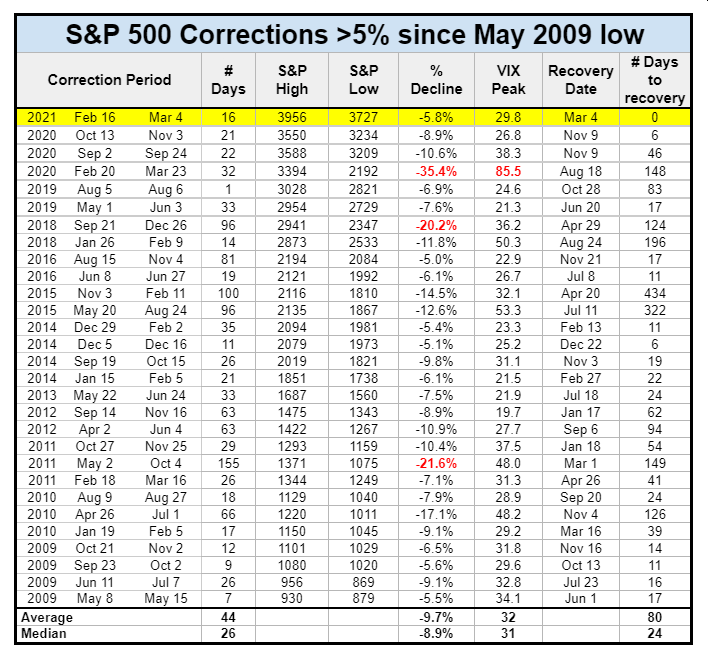

Last week, I mentioned that the market was creating two significant patterns pointing to a potential rally up if these patterns play out. At first, the market had some struggle to break up and fulfill the patterns but then it spiked up on a strong note. Now we have the pattern completed and I expect it to continue.

Our expected price target is now at $4,200 for SPX. It is a measured move from the bottom of a cup (see the lower arrow) projected to the top of the breakout (see the second higher located arrow). I can’t predict whether this happens and if it happens, how long will it take to get there. It may be a strong narrow rally or a choppy painful move. We have to wait to see.

Trading options

We continue trading options around the stocks we own or plan to own (stock we do not yet own but we started trading options against them, see a book “Generate Thousands in Cash on your Stocks Before Buying or Selling Them“). I call it monetizing our positions. It has a threefold benefit. It lowers our cost basis (at some point we will own all our shares for free), covers our call sides of each trade, and generates an additional income on top of the dividends. And that income is significant as you can see from our report at the top of this post.

We added a few new trades to our portfolio and we are close to having our trading “full”, or be fully invested. Once that happens, we will start trading multiple contracts. As of now, we mostly trade one contract of strangles. I am still thinking about building a ladder using LEAPS against SPY and AAPL as of now but not yet decided.

Investing and trading report in charts

Our aggressive accumulation of dividend stocks, using proceeds from aggressive options trading (by “aggressive” I do not mean reckless, but using all available funds and be fully invested at all times), is delivering fruits. Our net liquidation value increased significantly this year. I expect this trend to continue. I am also preparing our account for portfolio margin and once we achieve the required net-liq value, I will add this feature to our account. I hope to be able to trade a bit more aggressively. And yes, I am aware of potential risks.

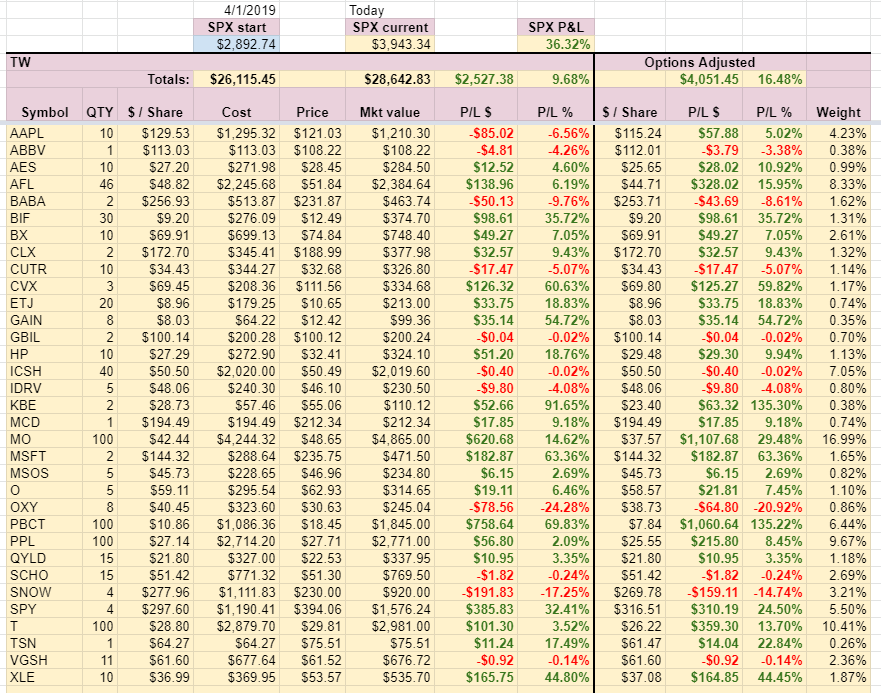

The table above shows our current holdings and gains on those holdings. Adjusted columns indicate how options help to boost (or ruin) our stock holdings appreciation, or in other words, lowering the cost basis. Without options, our holdings would be up 7.99%. With options, our holdings are up 14.05% (from inception on 4/1/2019). The SPX is up 38.96% since inception. Since the inception of the fund, our stock holdings underperform the overall market (up only 14.05% on a cumulative basis). This week, our adjusted stock holdings underperformed the market. The market gained 9.12% YTD, our portfolio options-adjusted stock holdings grew by 7.07% YTD (note this includes stock holdings adjusted by options trading, not the entire portfolio).

The stock holdings growth dropped because we added many new positions and these positions didn’t have time to grow yet, so I expect the growth trend to improve over time and beat the market.

Our dividend goal and future dividends

I have added another view into our holdings and their expected performance. Below is a chart of all future expected dividends on our holdings. The chart above indicates our dividend goal rather than expected dividends, the new chart below indicates our holdings and their dividend payouts vs. received payouts. In other words, these are the dividends we should receive if we held these positions at the current level since January 1st. But because we have not held those positions since January, we will not be able to receive those dividends. We added new positions just recently so all dividends that are included in the “projected” value were not paid to us. But, if we stop investing now, the “projected” dividend value (currently $1,866.22) is the annual dividend rate we should be receiving as passive income every year without touching anything in our portfolio.

Our account cumulative return

This is another metric I started tracking (since March 13, 2021) recently. I subscribed to Wingman tracking software (I am on a trial now and not yet fully decided whether to keep it or not). And that helps to track the open positions and account balances without the hassle of doing it manually. I will see if I am happy with the result of the subscription or not.

As of today, our account cumulative return is 13.33% (since March 13, 2021).

Conclusion of our investing and trading report

This week our options trading was great and we created a lot of income making March our best month so far.

We will continue accumulating the dividend growth stocks in our portfolio to reach 100 shares. We will also replenish our cash reserves to bring them back to 25% of our current net-liq value.

We will report our next week’s results next Saturday. Until then, good luck and good trading!

|

We all want to hear your opinion on the article above: No Comments |

Recent Comments