Account Net-Liq: $7,676.23

SPX value: 3,372.85

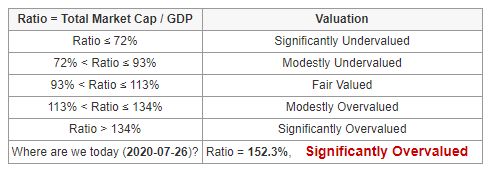

Shiller PE: 31.20

I wondered all the time whether it is better to own monthly or quarterly dividend-paying stocks. The narrative goes, that with monthly paying stocks, your dividend compounding will go faster and you get better results over time.

- Well, the truth is, it doesn’t matter.

- You will not get any better results with monthly payers than quarterly payers. The difference is so insignificant that it doesn’t justify the pitfalls of investing in monthly payers.

- Investing in monthly payers is just psychological. All it does is that you feel better about your dividend portfolio.

- Unfortunately, most monthly payers are in REITs, BDCs (Business Development Companies), or MLPs category, and except a few, risky and garbage not worth your money.

- There are better ways to create monthly dividend by staging quarterly payers together. If you select high-quality dividend aristocrats, it will take just 12 stocks to create monthly dividend payments.

- Use options to boost your income rather than trying to compound dividends alone.

I too felt like if I am buying monthly dividend-paying stocks, I will be better off. My portfolio would grow faster because I will be getting my dividends more often and thus buying more shares more often and snowballing my dividend income. But I never put the math behind my thinking. And the feeling about the income boost was so good.

But there was something back in my head which was telling me that something was not right, so I sat down to do the math. I hoped to prove myself that by buying monthly payers, my portfolio would grow faster, bigger, and fatter. And I will be rich in 5 years instead of 40 years.

The first thing, which came across my mind was: well, with monthly dividend payers, I get a smaller dividend every month than in three months, I will get the same amount of dividends as in three months. And I will be able to buy the same amount of shares no matter when I get the dividend. At the end of the three month period, I will have the same dividend and same amount of shares no matter if I received the dividend and reinvested it every month or at the end of a quarter.

There is a difference in compounding though. I am not saying that it is all the same. But the difference is so insignificant that it makes no sense to chase monthly payers and put your money in a larger risk.

I decided to use Gladstone Investment Corporation (GAIN) as an example. GAIN is a widely used darling among dividend investors. I hold a few shares of this stock too, but I am a bit hesitant investing my money into this stock thanks to my past bitter experience with this type of company.

The company was around since 2005 and diligently paid its dividend since then every month. Unlike others, the company never split its stock which is a good thing. It seems, it also never issued an SPO (Secondary Public Offering) which is also a good thing. Splits (reverse splits), SPOs, and dividend cuts are always a sign of value destruction, and if you see your company engaging in this practice, run away. Gladstone seems never engaged in this practice.

The price action of the stock is not very appealing. Right after its inception, the stock got hit hard in 2008-2009 and it dropped from $15 a share to $2.5 a share. From 2011 until 2016 the stock was trading sideways in a multiyear consolidation pattern. It broke up, reached its peak of $15 a share from the pre-2008 crisis, but soon was again hit with the 2018-2019 trade war volatility and in 2020 with the COVID fear. As an investor, you would have to sustain this volatility and rely on dividends only. Unfortunately, the dividends were not any better either. Here is a dividend history since inception:

As you can see, the dividend history is littered with cuts, misses, spikes, lack of growth. If you are a retiree, would you invest hundreds of thousands of dollars in such stock to suffer from price volatility and unstable dividends to live off of them? And if you invested in this stock in 2014 and bought 1000 shares, your initial investment of $8,040 would grow to $9,765 today. A meek 21.46% return over 6 years.

I wanted to see if I compounding the dividend would provide a better result and compared monthly compounding with quarterly. The difference was staggering (well, the lack of any difference).

If I bought 100 shares of GAIN and compounded dividends monthly vs. quarterly for the next 10 years, I would achieve the following results:

It is evident that the difference between the two is so small that it doesn’t justify putting your money into riskier monthly payers. If you feel that the monthly payer will give you better results, then it is just a feeling.

Many monthly dividend-paying stocks are among REITs, BDCs, or MLPs. And, unfortunately, these stocks are very low quality. There are a few exceptions though. Well, I can only think of one stock exception – Realty Income (O). Everything else out there is garbage, in my opinion.

I used to invest in these stocks but, mostly, I lost money, and dividends received were never able to recover the capital loss, not mentioning providing a sustainable income. And you want income to live off of it not recovering losses.

I used to invest in AGNC. Constant dividend cuts and capital depreciation caused my investment to be destroyed. The stock went from $40 a share to $14 a share today. Received dividends never covered the loss.

I used to invest in VNR. The stock went eventually bankrupt and I lost the entire investment. Dividends were not able to cover the loss.

I used to invest in PSEC. The stock fell from $18 a share to $5 a share while the company was constantly cutting dividends. Dividends never covered the loss.

I used to invest in ARR. Another example of value destruction. Constant dividend cuts and reverse split destroyed my value. Dividends were never able to cover the loss.

There are many other examples of companies in REITs, BDCs, and MLPs category which would effectively destroy your value. There is no justification to buy these companies when they pay monthly dividends because you may think that they would grow your portfolio faster. They most likely won’t.

The only black sheep (or rather a white sheep) among these stocks is Realty Income (O). It is a company which prides itself to provide value to their shareholders and keep a monthly income coming every month after month. The company even increases its dividend every year (sometimes multiple annual increases). They are proud of it. They know many retirees depend on them, and they strive to not disappoint them. You won’t find many shareholders friendly companies out there such as Realty Income. They even advertise themselves as The Monthly Dividend Company that:

“…started with a simple idea – to use the rent collected from commercial properties held under long-term leases to support monthly dividends to shareholders.”

That, in my opinion, is the only company in the monthly dividend REITs category worth your investment.

To create monthly income, the only feasible way is to use quarterly dividend payers and stage them so you receive the dividend every month. It takes some effort but you can select stocks in that way that you receive dividends every month. It only takes 12 stocks to create monthly dividend payouts. And, what’s best with this strategy? You can fish among good quality dividend aristocrats. You can choose reliable companies that will grow dividends every year and sustain any recessions without cutting the dividends. Your value will not be destroyed and your income will grow. You will be able to use dividends for your living expenses and not value recovery.

How can you boost your dividend income then if monthly dividend payers can’t provide it? The only way I know of is to use options. It takes some effort to learn options but if you use a simple strategy of selling covered calls and cash-secured puts to boost your re-investable income, you will not do badly. Your portfolio will grow faster. And what’s best is that you can create a monthly income selling covered calls against your existing quarterly dividend-paying stock.

I traded options in the past a lot. I traded strategies such as Iron Condors, straddles, and strangles. But I traded them for pure speculation. There was no strategy behind the trading. The problem was, I traded just because I had to trade. I had to be in the trade all time and I falsely believed that this would make me rich and my portfolio will grow fast. No, it didn’t. I lost money and I am where I was 6 years ago. I recommend you not going this path. It is a dead-end. It is also a daring admission to finally admit to myself that I was wrong. Or maybe not wrong, just not skilled enough, not educated enough, not a great trading guru as so many on Facebook, who are making millions in a year and never lost a penny (well, maybe only a few pennies).

Since I am not this miraculous financial, CPA, millions making guru from Facebook, I had to adjust my strategy to something more conservative but stable. My goal always was to create income from my investments which can be re-invested to grow my portfolio into a level where the income starts covering my expenses and I can quit my daily job and live off of my dividends and trading. And I had to adjust my mind and my strategy to achieve this goal. And it is working! Finally!

What I decided to do is to accumulate a few good quality dividend stocks and reach 100 shares of each. Then apply a strategy called a “Wheel of fortune“, or a Wheel strategy.

In short, I accumulate shares of my high-quality dividend aristocrats and once I have 100 shares, I start selling covered calls. I try to avoid assignment and have my shares called away should the stock go higher and breach my call strike. In this case, I roll the call higher and usually away in time. I keep receiving dividends and options premiums. If everything goes well, I keep generating income every month, and once every three months I receive two payments (dividends and options premium). Sometimes, I have to roll my options two or three months away to roll higher for credit. And I am OK with that.

If the stock gets called away I start selling cash-secured puts to generate monthly income and eventually buy my stock back and gain 100 shares again. Then I start selling covered calls again.

If I have enough cash in my account to start selling puts before reaching 100 shares of a stock, I start selling puts. Sometimes, I sell the puts without a desire to get assigned and be forced to buy 100 shares of the stock. But in this scenario, I make sure, I do not overdo put selling so if I get assigned I do not suffer huge losses.

I also use this strategy of options selling to replace dividend cuts. In 2020 many great companies decided to cut or suspend dividends. Disney (DIS) suspended its H1 (first half of the year) dividend, Helmerich & Payne (HP) cut the dividend (HP was a dividend aristocrat with 47-year dividend increases), Wells Fargo (WFC) cut the dividend by 80%, Meredith (MDP) cut the dividend after 27 years of dividend increases, Dominion Energy (D) cut the dividend, BP, BA, cut the dividend, and these are only among the good quality stocks that cut their dividends. Many not so good quality companies cut the dividends too. And, unfortunately, we may see more cuts or suspensions coming.

Selling options looks like the only way to replace the lost income. It also lowers your cost basis so you hold the stock cheaper and cheaper every year. At some point in the future, you will hold the stock for free (the dividends and options premium income will return you all your investment) and in that case, it won’t matter to you what the stock is doing out there.

I also use LEAPS instead of a stock. Usually, I use LEAPS against indexes such as SPY or IWM. To buy 100 shares of SPY at a current price of $336.84 a share, an investor will have to come up with $16,836.32 in a margin account or $33,672.08 in a cash account (such as IRA). Purchasing LEAPS call option would cost $3,941 only. A fraction of what you would need if buying 100 shares.

Recently, I have purchased IWM LEAPS and started selling covered calls against the position (a strategy called Poor man’s covered call). It only cost me $2,255.00 to buy the LEAPS call option. After the purchase, I started selling the covered calls and received $265 in credits. That lowered my cost basis to $1,990:

And, I can reinvest the options income to other stocks and keep accumulating and growing my portfolio. It is not a quick-rich scheme. It is not trading the millionaires from Facebook preach. But it provides a steady income and portfolio growth. And since I started using this strategy, I sleep better. I do not have to be glued to the monitor every Friday to see if my options expire or I will lose money. And, what’s most important? I see my accounts growing again.

If you are interested to see what stocks and what options we trade, then join us at MeWe. We no longer participate at Facebook (very little though) but we are active at MeWe.

We all want to hear your opinion on the article above:

No Comments |

Recent Comments