One trading strategy does not work all the time and in every market. There will be time when one strategy stops working and another strategy has to be used while waiting for new opportunity to trade the first strategy again.

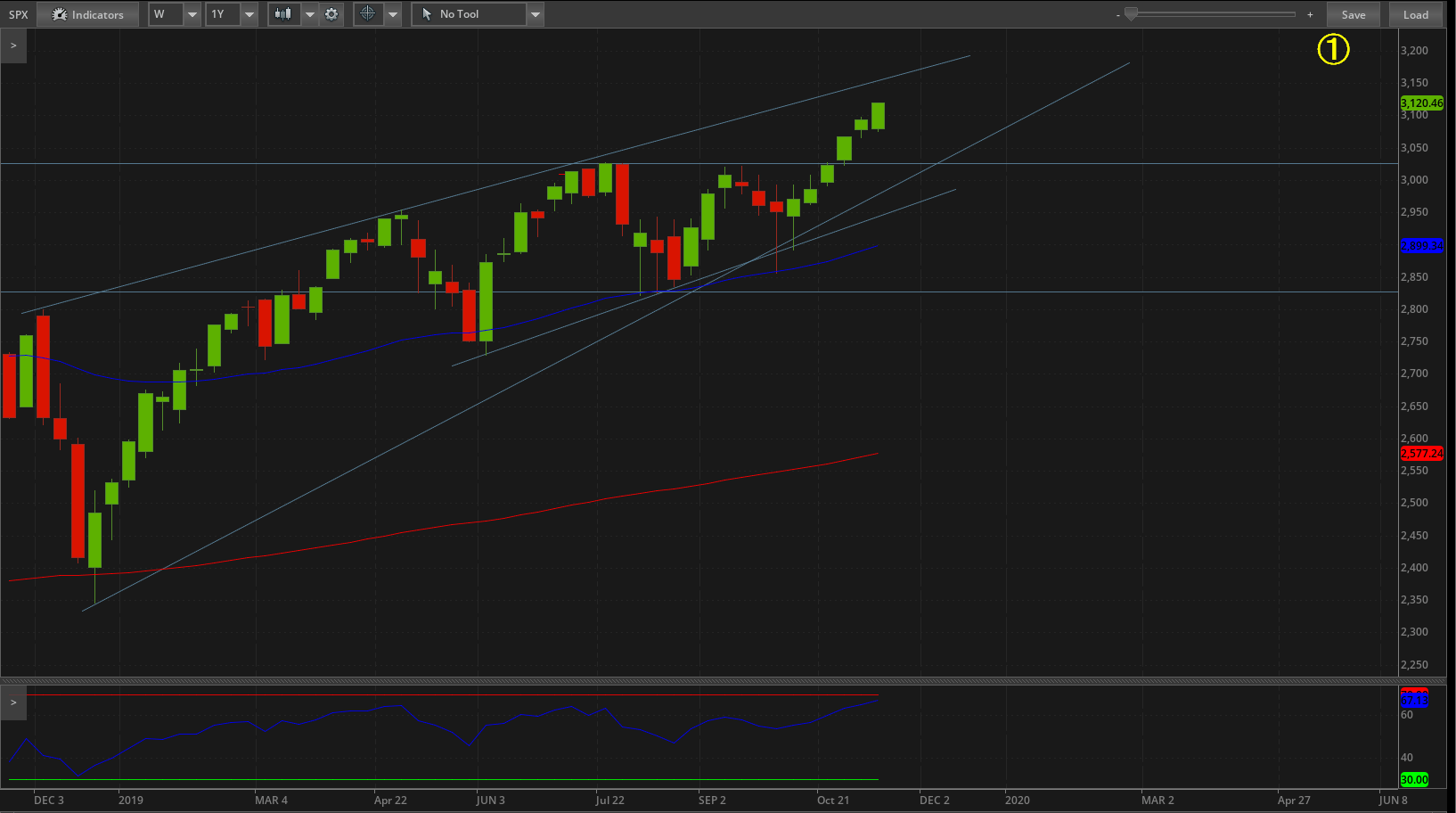

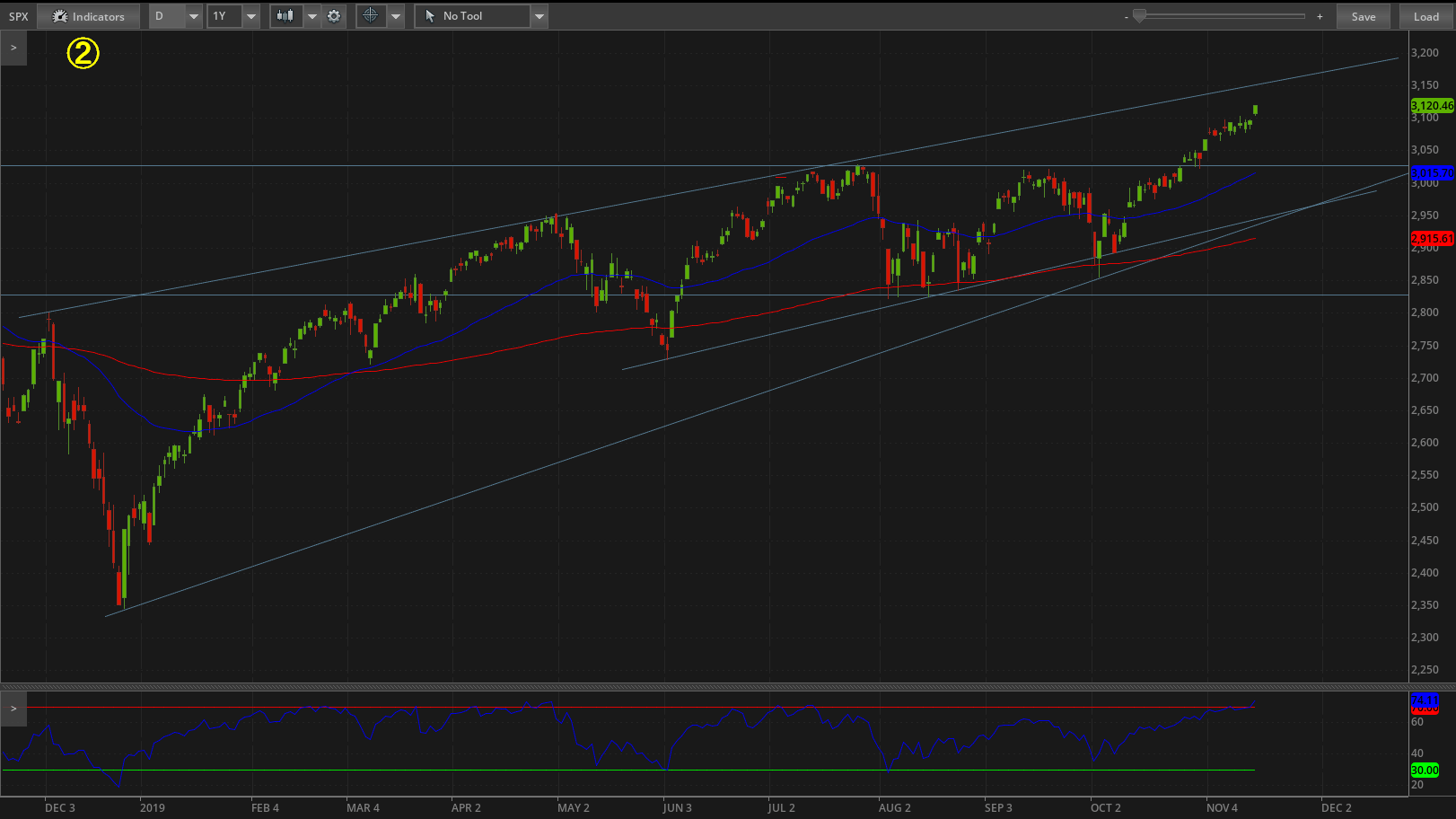

We traded SPX options lately, Iron Condors, Put Spreads, Call Spread, or Iron Flies, but in this market, I started seeing being whipsawed way too often. This is a hard market to trade. Of course, there will be traders out there who would thrive in this market. There will be traders who would make killing trading this volatility but, sadly to say, I am not one of them. I do not have means and time to sit behind the computer and adjust our trades minute by minute. I can’t respond to a market which is up 0.80% in the morning and down -1.20% in the afternoon because of a tweet.

And even if I was able to adjust my trades it all turned out to be wrong again and I got whipsawed. I tried to adjust and do something about my trades just to find out, it didn’t work. So, in situation like this, the best thing one can do is to stop trading, step back, and evaluate the situation. And that is exactly what I did. I rolled all my bad trades away to gain time and see what I can do next and stopped trading.

That’s why you may have seen no activity, no posts, no trades in our Facebook page.

And, while evaluating our trading I found out that I was trading way too aggressive and too much. Trade often, trade small. Well, I think I was trading way too often and not small. And this contributed to my “piss off” mood. I was at attention all the time, constant stress, watching the monitor all too often… That was exactly the time to step back and calm my soul again.

And when the whipsaw mode went to the point when I shouted “I can’t trade this market anymore!” I realized, this was a time to change.

So, what will we be doing?

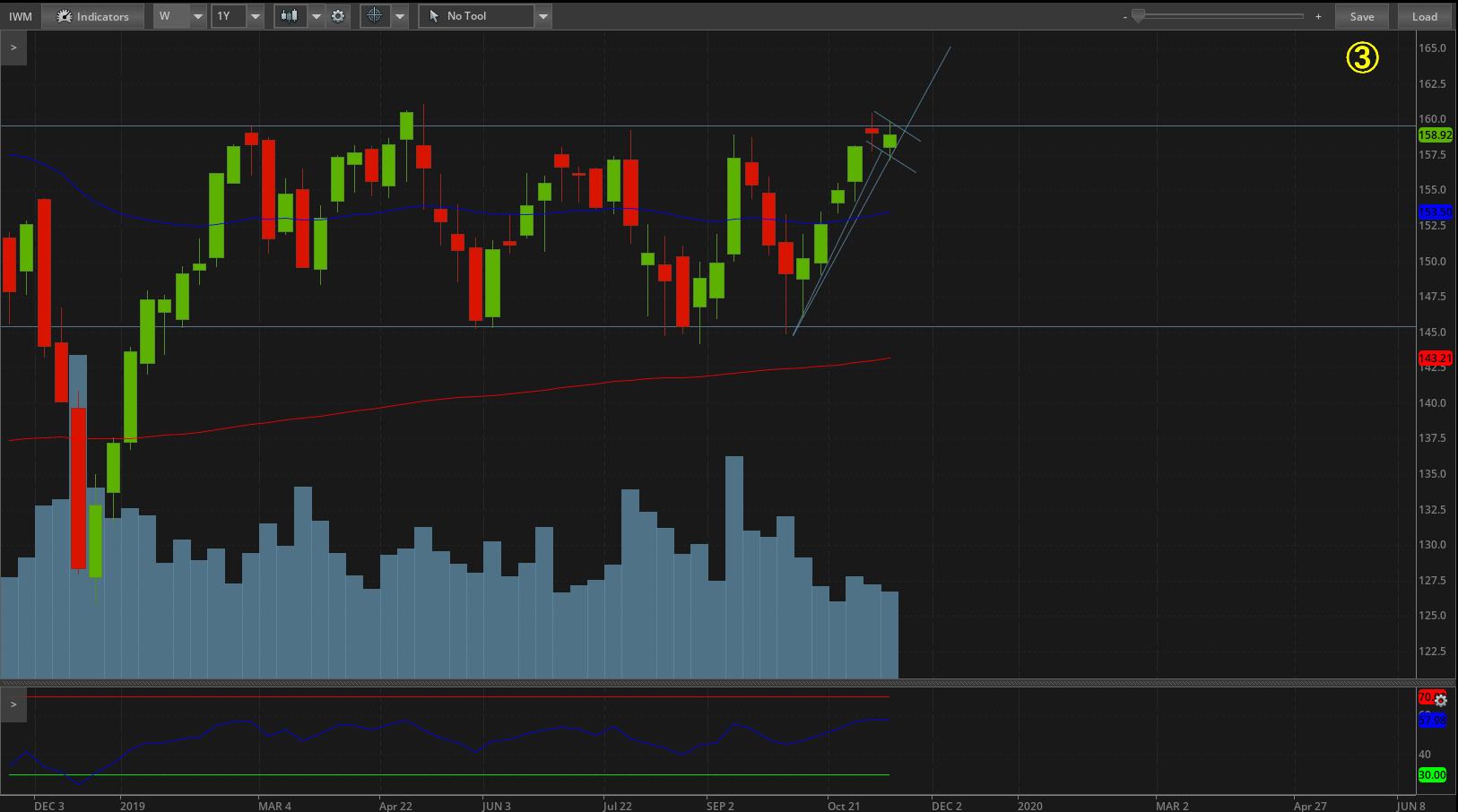

1) As of now, we will not be trading SPX trades as often as you may have seen. We will be primarily rolling our bad trades to get out of them. This may take months or years, but it is important. Time to time, we may open a small trade, usually right after a large selloff, consolidation, or breakout. But it will be more of a wait and trade than a regular weekly trading.

2) We are adding equity options trading, meaning we will be trading options using dividend stocks as underlying. We will be selling naked puts and covered calls.

3) We will be selling naked puts against dividend stocks with 25 – 30 delta and 30 to 45 DTE. If the puts get in the money, we will attempt to roll the puts into the next expiration cycle only if the roll will be a credit trade. If it cannot be a credit trade, we will take assignment and buy 100 shares. In this case, it is important to have enough cash in a trading account to be able to buy 100 shares without getting into a margin call.

4) Once we get assigned, we will start selling covered calls. The strategy however is to build a dividend stocks portfolio with intention of NOT selling our stocks. We want to keep all stocks we acquire. If the calls get in the money, we will hedge the position to protect our position. One strategy may be to sell new puts to get back into the lost position. For example, a stock is trading at $30 a share. We sell a $32 strike covered call. The stock moves to $34 a share. We may let the calls call our position away but we sell new $34 strike puts to get back in. We will also adopt rolling the calls gradually up and away (as long as it is a credit trade), or simply closing the position.

5) Here comes the wealth building part. These days, many brokers cut the commissions to zero. That is a great opportunity to build your portfolio at no cost! You can literally buy only 1 share of a company stock and it will cost you nothing. What an opportunity! This will also allow us to invest all proceeds – premiums and dividends – into dividend stocks. If, for example, we sell a naked put, and collect $34 credit, we can buy 1 share of a stock trading at $34 or less. And even 1 share will allow us to start receiving dividends and participate in a price appreciation! And the more credits we receive and more dividends we receive, the more shares we can buy at no cost!

6) One important thing to mention, trading this strategy requires enough savings in one’s account. We will be trading in a margin account to lower the capital requirements. In a margin account, a stock trading for $30 a share will require approx. $1,300 buying power. In a cash account, a trader will need $3,000 buying power. If you do not like trading on margin, you must save the entire amount before you start selling puts (in this case cash secured puts). The worst thing which can happen to you is to be forced to close a newly acquired 100 shares (when assigned) at a loss because you got a margin call due to lack of buying power.

7) As mentioned above, we will be investing all dividends and all credits from options into dividend stocks from our watch list – cheaper stocks at first, more expensive stocks later (as the cash flow increases). Our watch list is shown below:

And, what about SPX?

We will still trade SPX. This is not an abandonment of a strategy. We are just adjusting our trading to mute what stopped working for us and add a strategy which, in my opinion, would better suit this market, our time available to be dedicated to trading, and peace of mind. As our trades will be repaired more and more, this market calms down a bit and shows direction again, or I will get more confident trading SPX more often, I will start adding more and more trades. As of today, my state of mind is fear. Fear of being wrong, fear of losing money. Fear of being whipsawed again. Fear of not knowing what to do. I think, it is bad, very bad for any trader. I want trading to be not just a business but also fun. And these days, it was not fun; it was frustration. Let’s make trading fun again.

We all want to hear your opinion on the article above:

3 Comments |

Recent Comments