The market rallied to 3100 as I expected last week. It was probably a bit too fast though. Now, that we are at this level, what’s next?

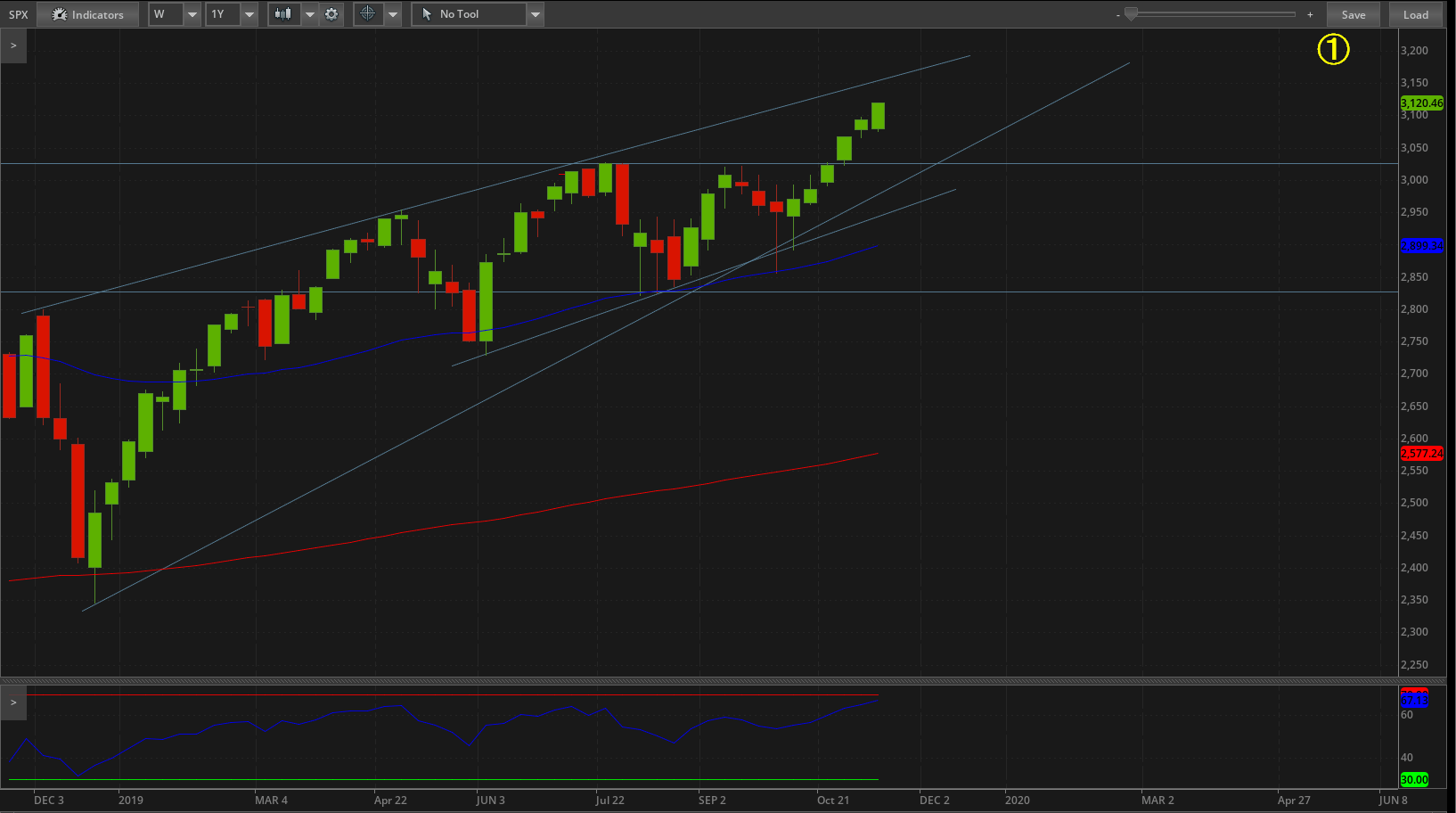

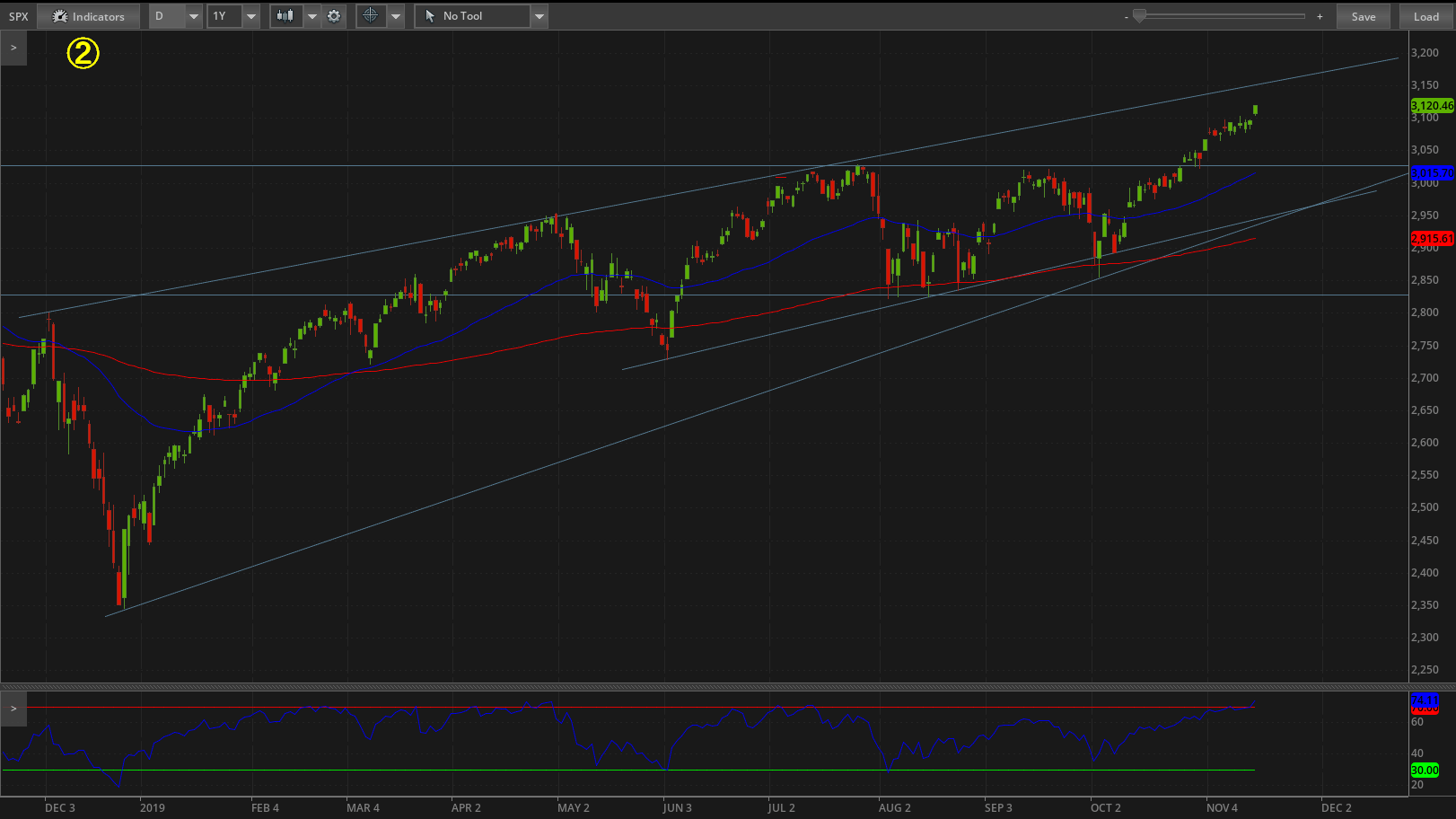

I think, we still have some room to go higher, unless Trump spoils it with his trade wars, which I think is less likely since he now has other problems than a trade war, but you never know. One tweet can change it all. But, looking at the weekly chart ① we can see that we are at the top of the rising wedge with some small room to go. Will we go higher or are we bound to reverse? The daily chart ② assumes that we still have room to the upside. But I would be cautious.

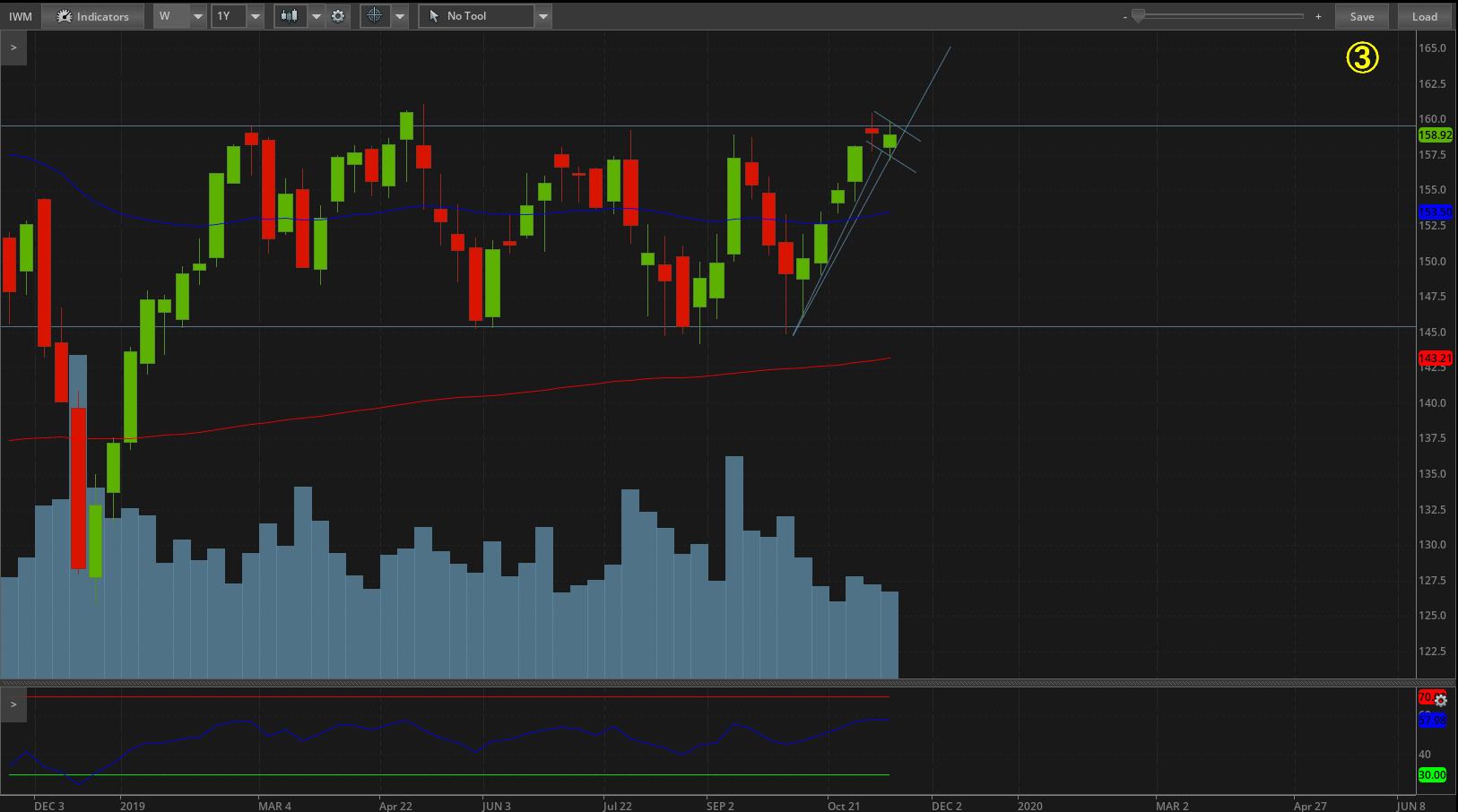

IWM also indicates on its weekly chart ③ that we are on top of the long sideways channel and that we may be reversing to the downside. However, on the daily chart ④, it is forming a nice bull flag, indicating that we may in fact clear this resistance level and breakout to the upside. We need to wait now and see. Overall, I think, we may see going to 3150 and then we will see where we go next.

Open trades:

#42 – SPY long call box – https://tinyurl.com/y6cv5r22

#43 – PBCT naked put – https://tinyurl.com/sajds2z

Stock holdings:

1 MCD

2 MSFT

1 PBCT

#40 – We took profit in our MSFT butterfly this week. The stock had a nice breakout and then entered a consolidation, or high base from which we broke up again as expected ⑤. But, it seems, the trade is now extended to the upside. It may fade next week or continue higher. If it fades, we would look like geniuses that we took profits, if it keeps blasting up, we will look like idiots for not letting it run. But, if MSFT fades, and consolidate, we may re-take the trade. So far, we made 295% profit in this trade. We then took the profits, and purchased 2 shares of MSFT to build our wealth.

#42 – We closed our 308 SPY long call trade but we still hold the debit spread of the box. We expect this trade to go away next week (unless the market sells off). As of now, we have a profitable trade and in good shape. By closing the 308 long call we achieved a 52% profit. Not as great as last time, but the market slowed down and we were running out of time. So we decided to close the trade and take profits. If the debit spread closes early next week, we will add more profits to this trade.

#43 – We were also able to release some of the bad SPX trades this week and re-allocated our funds to our equity trading plan. We opened a new naked put against PBCT stock. The stock is a dividend champion, paying nice dividend (current yield 4.31%), and increased the dividend for consecutive 26 years. The stock recently broke from a downtrend on a weekly chart ⑥ as well as daily time frame ⑦ and is now in a consolidation pattern. We think this pattern will hold and the stock will resume its uptrend. If not, and the stock dips below, we will take assignment, buy 100 shares and sit on the holding, collect dividends, and if the stock returns up and above our purchase price, we may start selling covered calls. We will not be selling covered calls if the stock is below our cost basis. The reason is, that this stock has thinly traded options and doesn’t offer much ability to roll or otherwise adjust the trade.

Leave a Reply