One of the most important rules for an amateur day trader to follow is never invest in a stock in which you are emotionally involved. This is the fastest way to bankruptcy. It is like betting on your favorite sports team simply because you bleed those colors. The competition does not care what color your soul bleeds. It is all about how the talent on one team matches up with the talent on another team. Betting any other way is foolish.

Tech fanboyism may work for deciding your next smartphone. That is because for the most part, they are all good enough. It is hard to find one worth being a fan over that is truly disappointing.

But it is the worst way to determine stock value. Amateur investors put money on things they like, or on companies that are aligned with them morally or politically, or religiously. None of these things have anything to do with whether the investment will make you money.

If you are having a hard time understanding why your favorite company’s stock is not doing as well as you think it should, here are three indicators that might clear things up:

· It’s Not Just About the Numbers

One of the big mistakes non-professionals make is that they only look at the numbers divorced from even more important factors. Mastering analytics is about more than just the profit/loss column in the quarterly report. The professionals go to school for a long time before they are qualified to publish an opinion. Shortcutting the process doesn’t make you smarter than the analysts.

Besides the amount of money they made year over year, a company’s stock can also be affected by:

• The weather in the region of a major supplier

• Political uncertainty

• Scandalous behavior of a C level executive

There are more things than poor sales that can negatively affect a stock. You have to analyze more than the numbers on the balance sheet.

· Decreased Brand Value

Samsung may well be the most powerful brand with regard to Android phones, possibly even more so than Google. But Samsung has a problem. Their latest flagship product: the Galaxy Note 7 has a tendency to overheat and explode for causes unknown.

They have suffered an unprecedented product recall in the US. One of the new phones offered as a fix post-recall caught fire on a Southwest Airline plane, compounding the problem even more.

Despite these setbacks, Samsung earnings have not suffered. But it is a critical mistake to confuse short-term earnings with long-term stock price. The reputation of Samsung has suffered a blow that the trial vs. Apple never delivered.

It is going to take a lot of business intelligence using big-data analytics to sort out the aftermath. And it may be several months before the real fallout becomes apparent. Brand value assessment is a vital part of the analytics toolbox. A loss of brand value over time will negatively affect the stock.

· Expectations and Forecasts

Analysts make predictions about earnings. In gambling terms, these predictions are like the line. The stock market treats earnings as a game of over/under. When the earnings are better than expected, the stock price usually gets a temporary boost. When it underperforms, it has a temporary setback.

These analyst predictions tend to only have a temporary affect either way. The other prediction comes from the company itself. On the same earnings season Apple announced their billionth iPhone sold, they also forecasted decreased financials for the following quarter.

The downgrade may not have anything to do with lower sales expectations. Apple recently lost a major fight against a patent troll regarding FaceTime. They will have to pay up. Even Apple is not immune from the impact of patent trolls.

The stock market is not really the black box consumers think it is. It works by a predictable set of rules. To follow it more successfully, you have to do the analytics beyond the balance sheet. Factor in the gains and losses in brand value. And pay attention to how well the company meets expectations.

Christina Moore is a part time blogger and full time learner! Originally from the east coast, she now resides in San Diego. She enjoys writing about business, finance and whatever else peaks her interest.

|

We all want to hear your opinion on the article above: 1 Comment |

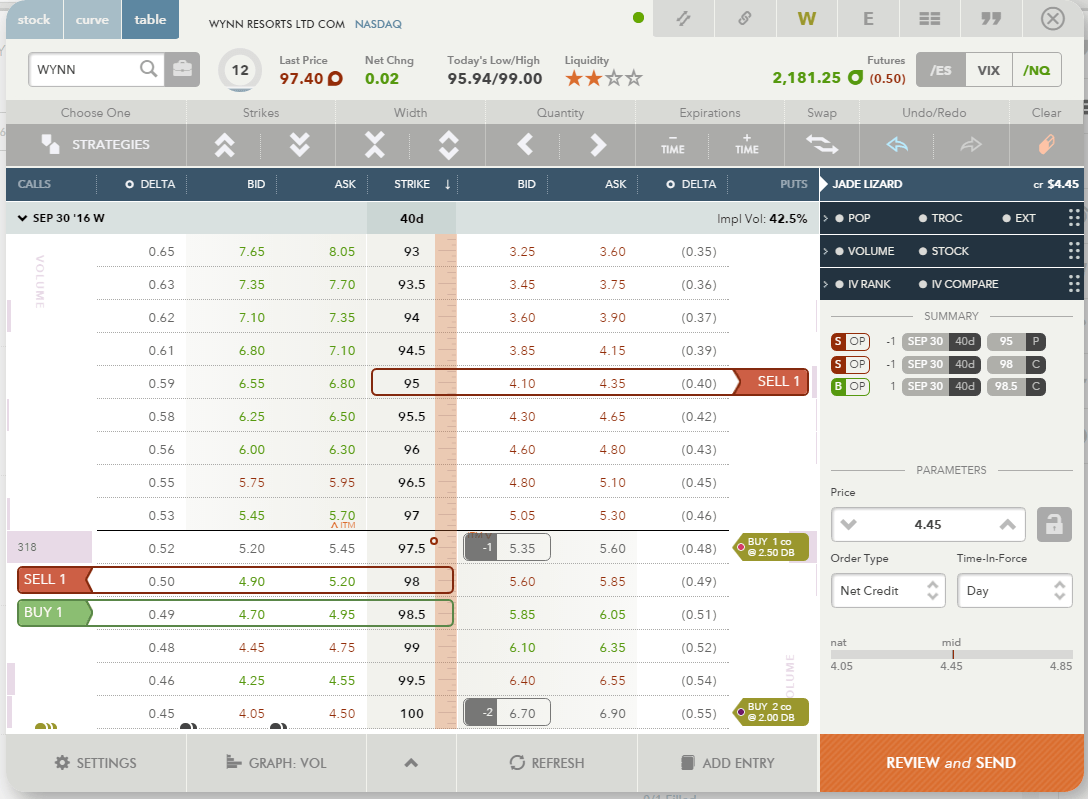

Jade lizard is a popular strategy yet not so very known among traders. I myself learned about this strategy just about a month ago although Tasty Trade performed studies on this strategy in 2013. But after I studied the strategy, I immediately fell in love with the strategy for benefits it provided.

Jade lizard is a popular strategy yet not so very known among traders. I myself learned about this strategy just about a month ago although Tasty Trade performed studies on this strategy in 2013. But after I studied the strategy, I immediately fell in love with the strategy for benefits it provided.

Recent Comments