Today, Tesla (TSLA) dropped 12% in a sharp and swift selloff that was a continuation from Monday selling. On Monday, TSLA tried to recover, but more bad news came today, and the carnage was brutal. But it was not something I was not expecting.

Last weekend I wrote to my newsletter subscribers:

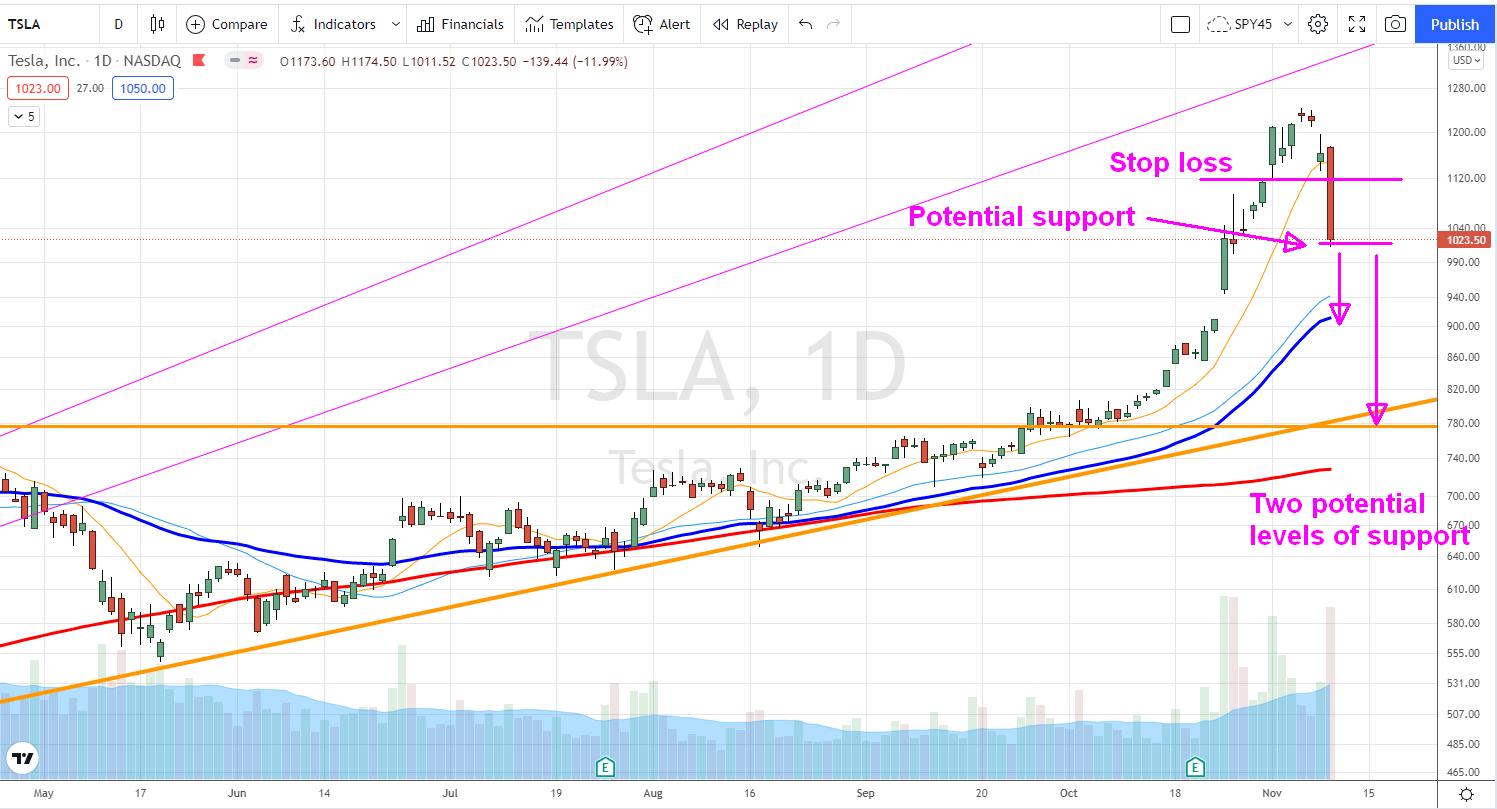

Many bears are being beaten heavily and even a legendary short Michael Burry was forced to reduce his short position in Tesla. Are we done with the squeeze? We do not know yet. What worries me though is the trend chart itself. The trend up is a parabolic move, and these usually crash as quickly as they go up. But is this the case with Tesla? So I am expecting a pullback and decided to place a tight stop on the trade at $1,120 level and if I get sold out, I plan on returning back when selling is done.

On Monday, Tesla got pushed lower by 6% on Elon Musk’s tweet, today, the stock went down 12% on bad news from lesser sales in China than expected:

We bought the stock at $620 a share and we placed our stop loss at $1,120 a share and when the stop got hit today, we closed this position with a very nice profit. Now we need to wait for selling to end before we re-enter into TSLA again.

It appears, that the stock is searching for support at $1,020 but it is early to say. The support at this level is weak and the most likely scenario is that we will go down and retest either the $900 or $775 level:

Leave a Reply