That was a question Yahoo! has recently asked. Sometimes it really stuns me out when liberals start slowly waking up and asking such questions, which all others with common sense already knew what was happening.

Yet there is still many with the rose colored glasses on unquestionably believing everything FED and Obama’s administration is feeding them with.

At first, I wanted to answer that question why the markets are tanking. But one of the reader in the discussion responded for me. I found his answer interesting and I decided to repost it here:

It is the economy, stupid!

Jobs: There have been no private sector jobs created, but 952,000 jobs have been added to Obama’s Federal Government. Source: White House Budget.

Unemployment: The percentage of our labor force that is employed is 62.4%., meaning that 37.6% are unemployed. Source: Department of Labor

Economic Growth: Virtually non-existent. Gross Domestic Product up 0.78% (after deducting revenue from bonds purchased by the Federal Reserve Quantitative Easing Program).

Credit Rating: The first time in Americans history our credit rating was downgraded. Standard and Poor’s dropped our rating from AAA to AA+, and Moody’s followed suit. Much was based on our debt at $14.7 trillion; now at $18,923,558,492,663.

Fraser Institute of Economic Freedom, a world-recognized organization reports that in 2010 the United States ranked #2 in the world, but 5 years of Obama’s economic Socialism has caused the U.S. to fall to #16.

The Heritage Foundation, which also calculates economic freedom reports that the United States has fallen to 12th place in the world.

Debt: up $8,262,260,795, Up 77.76%, Source: US Treasury

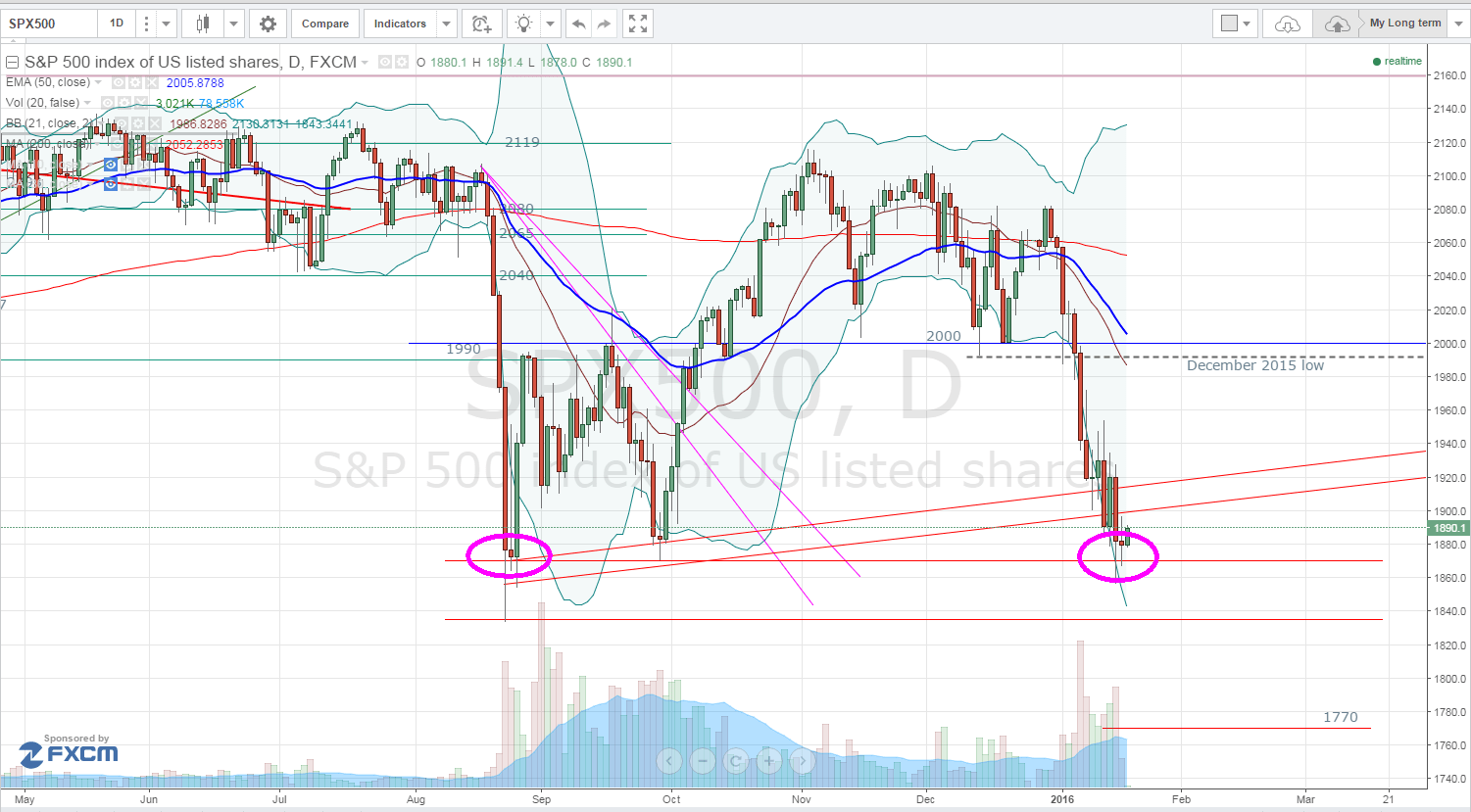

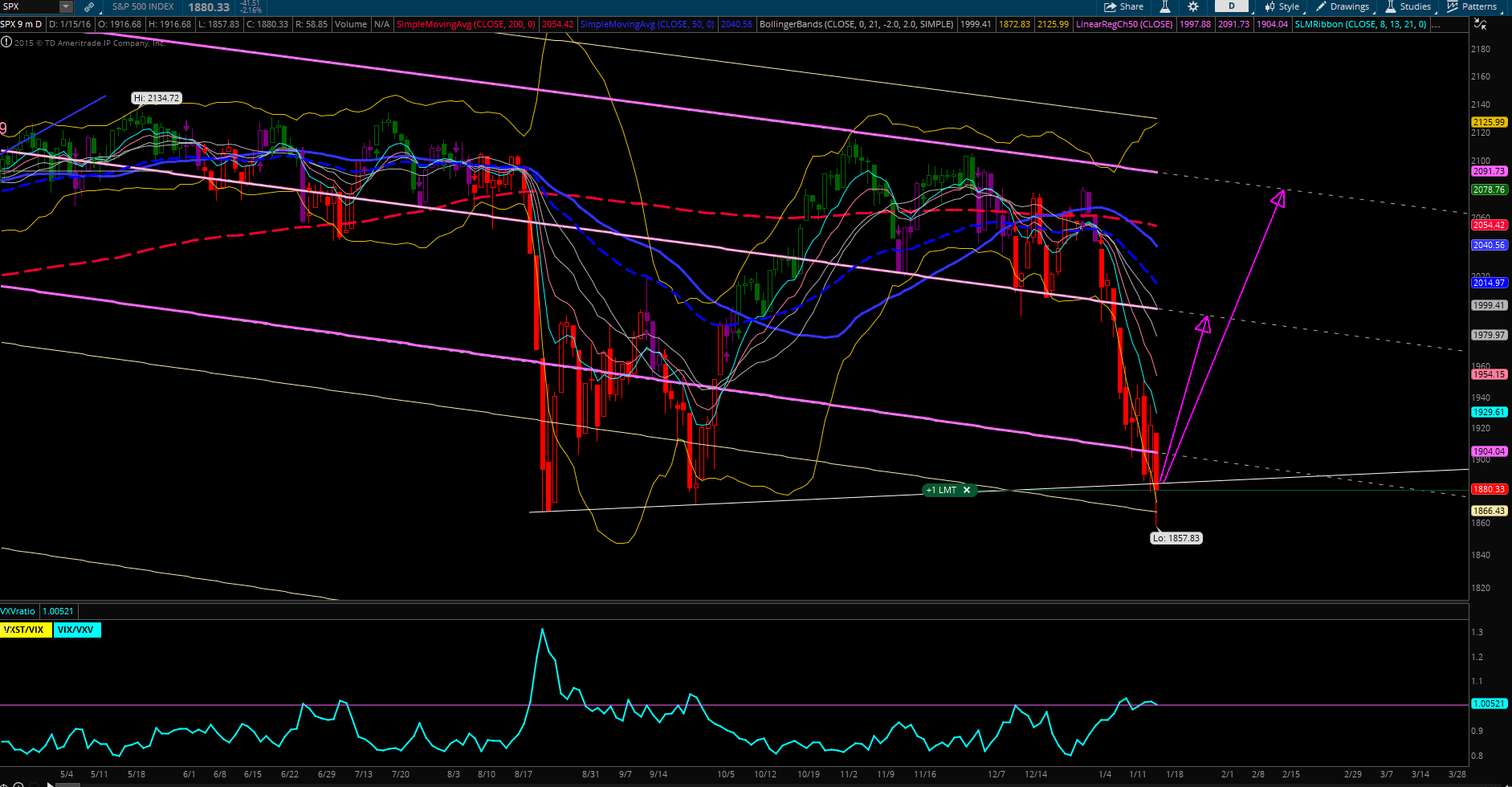

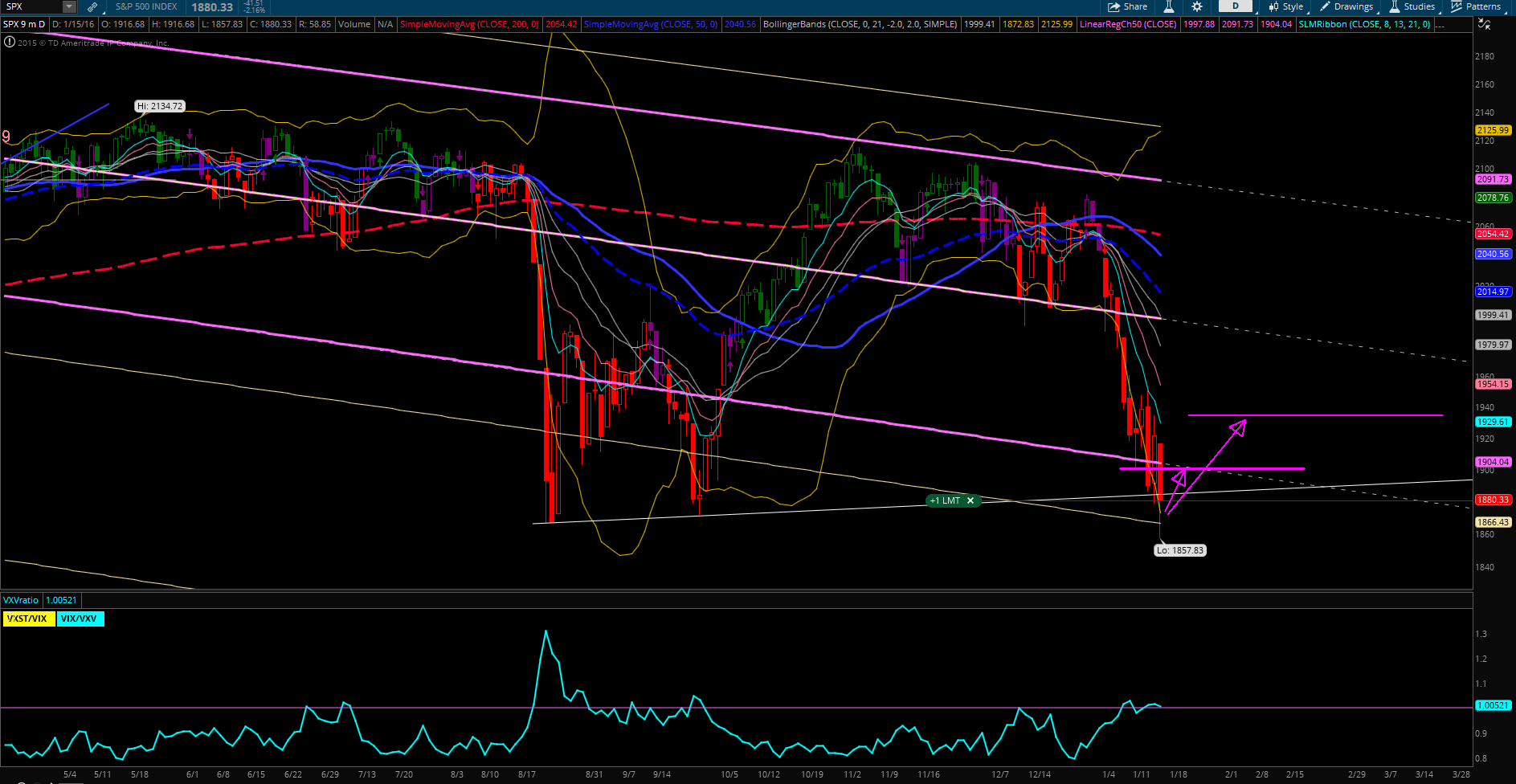

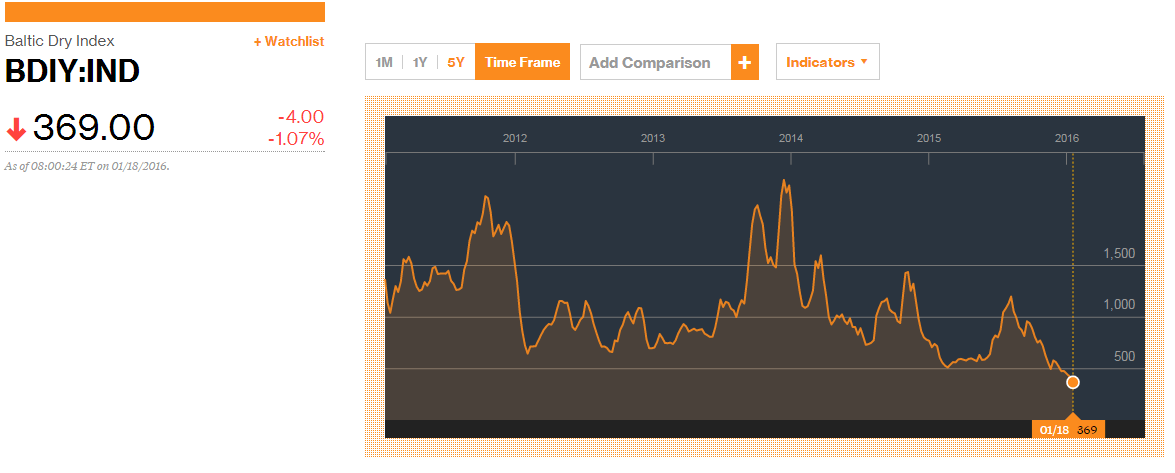

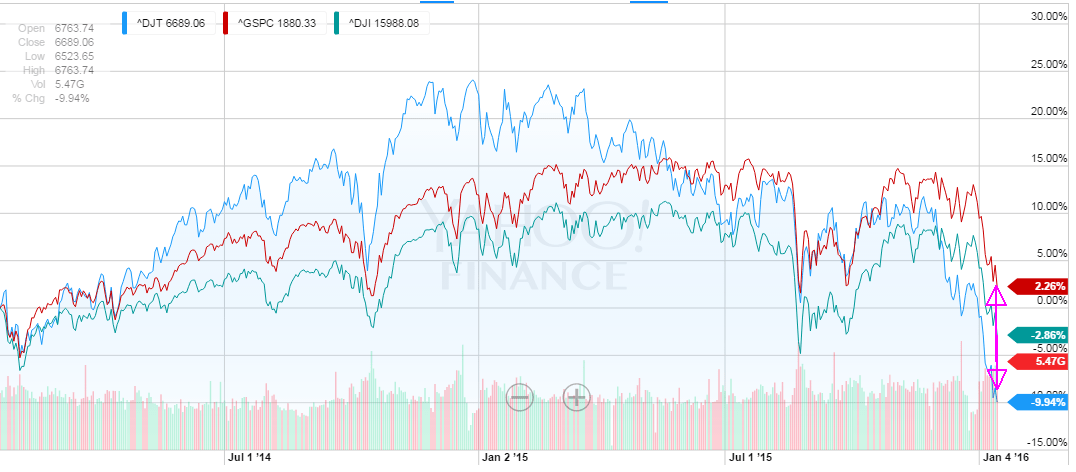

DOW Jones: Lost 96.61% of its 2015 gains since December 24, 2015.

Household Income:

Income per Capita (in 2013 dollars):

All Races -1.18%

White -0.37%

White (non-Hispanic) 0.66%

Black -1.57%

Asian -3.90%

Hispanic -1.66%

Median Household Income:

All Races -4.56%

White -1.72%

White (non-Hispanic) -3.01%

Black -6.41%

Asian -5.07%

Hispanic -0.13%

Source: U.S. Census Bureau

Poverty: 8,644,875 citizens added to our poverty rolls, Source: US Census Bureau

18,313,000 citizens added to our food stamp rolls, Source: US Dept. of Ag.

7,668,224 citizens filed personal bankruptcy, Source: US Bankruptcy Court

Health Care: Obamacare is Socialized Medicine. It is not about health care. It is about controlling the people and forcing them to become dependent of the Federal Government. It was sold to the citizens on lies, as most have experienced increases in premium and deductible costs. There is, indeed, a “death panel.” We have seen how it has worked with the Veteran’s Administration in Phoenix, AZ in 2014, where 40 wounded veterans died because they were denied basic health care needs.

National Security: There is none. Our borders are wide open, and Homeland Security has bussed in millions. Obama has released 106,000 criminal illegal aliens from our prisons, and the number of ISIS attacks continue to increase. We also have 1.7 million citizens of the radical Middle East countries here on student visa’s whose backgrounds have never been checked, and no means of determining where they are, if they have over staid their visas or if they have connection to ISIS. We need to secure our borders immediately.

Law Enforcement: Non-existent. Obama, and his neo-Marxist Democrats make victims of the villains and villains of the victims. Obama, Holder, Sharpton, and Lynch have incited our race riots in violation of Federal Law.

Judicial System: As corrupt as the rest of the Federal Government. According to the Federal Election Commission campaign finance reports, the Judges and Attorney’s PAC has contributed $2.2 Billion dollars to Democrat politicians, a full 84% of their contributions. Democrats are willing to pass millions of laws to control the citizens, and each law makes another attorney a millionaire. The Supreme Court has been stacked with Democrats, including John Roberts, who twists the law like a thing of wax. Additionally, on two occasions in 2015 he ruled on cases that resulted in money going to his family members. In one case the amount was $250,000. His administrative staff called it “human error.” Actually it is a conflict of interest, a violation of the law, and sufficient to impeach him in accordance with Article 3, Section 1 of the Constitution. We the people must demand term limits for Judges as well as members of Congress.

Guns: Obama’s teary eyed pitch for firearm control falls short of an Academy Award. It is not about controlling guns, it is about controlling law abiding citizens, making them defenseless and unable to defend themselves against murderous illegal aliens, ISIS cell members, and, possibly, from our Federal Government.

The 2009 annual report from the Center for Disease Control shows 13,200 homicides involving firearms. It further shows 2,453,000 deaths due to alcohol and alcohol related disease, and 37,423 deaths due to alcohol related auto accidents.

Marxist despots throughout history have, upon achieving power, disarmed their citizens, and then slaughtered all that refused to accept Marxist doctrine. Lenin, Stalin, Mao, Pol Pot, and Tito combined slaughtered 88,086,000 of their citizens for that very reason.

Bill Ayers, a close, personal friend of Obama’s who introduced him into politics in Chicago, was a co-founder of the Stalinist Weather Underground, an anarchist, and a convicted cop killer. In the Preface of their revolutionary Manifesto, “Prairie Fire,” they laud Sirhan for killing Bobby Kennedy.

Ayers informed Undercover FBI Agent Larry Grathwohl the Underground was prepared to slaughter 25,000,000 Americans if they refused to bow to Communism.

Thomas Jefferson said, “No free man shall ever be debarred the use of arms. The strongest reason for the people to retain the right to keep and bear arms is, as a last resort, to protect themselves against tyranny in government.”

Global Warming: Our own NASA scientists, on December 13, 2015 stated that the France boondoggle on taxpayer dollars was the grandest fraud ever perpetrated on the citizens of the world.

Consensus is not science. But there is no consensus. Only 36% of supposed scientists believe global warming is man-made, while 64% believe it is not. That includes John Coleman of Chicago, who founded the National Weather Service.

The corrupt politicians, despots, and pseudo-scientists at the U.N. created climate science out of whole cloth. And corrupt world leaders continue to bilk the citizens of their countries. Obama and his Democrats have spent $138.2 BILLION middle class taxpayer dollars funding their friends and supporters like at Solyndra. In return millions of our tax dollars are returned to Obama and Congressional Democrats in the form of campaign contribution.

Green companies launder taxpayer dollars and turn them into cash for Democrat politicians.

It is a violation of federal racketeering law, but Democrats have never found a law they believe applies to them.

We need a Congressional investigation and demand the pseudo-scientists turn over all of their scientific data.

What do you think? Do we have a rosy economy and the current two weeks of selling is just transitory?

We all want to hear your opinion on the article above:

No Comments |

Recent Comments