Another trading week is over and we can review our accounts and see how we were doing and how our investments performed.

The last week was volatile as many investors were nervous about the Fed and its policy. On Wednesday we were expecting what Janet Yellen would come up with in regards to interest rates and that created nervousness among investors.

That nervousness had a long track into a previous week where we could see many good quality stocks falling apart. But not all of them lost ground. Majority of the losing stocks were in energy sector, REIT, BDC, and MLPs.

You may ask, why were those stocks falling hard? Why other regular dividend stocks were not following them? If you check other stocks such as Johnson & Johnson (JNJ), Abbot (ABT), Apple (AAPL), and others you will notice no selloff during last two weeks. Especially, JNJ performed excellently last two weeks creating new highs after a selloff in August.

Interest Rates Effect

As I wrote in my previous post, the reason for a selloff was interest rates and that many stocks in REIT, MLP, and BDC are influenced by them. Some more, some less. Therefore, all income producing assets in this category sold hard.

That offered a great opportunity adding some of those stocks into your portfolio.

I believe, the expectation of rising rates is already priced in. The market knows this, it is considered inevitable. However, there will be an impact on stocks if Fed raises the rates and the stocks may start drifting down or slow in growth. Also dividends may not look attractive for some investors anymore and that would be a reason for them to sell stocks and create a hard sell off, a panic.

But as long term investors who know the power of compounding and growing dividends we know, that compounding dividend will overcome the short term effect of rising rates and end up as a winning strategy.

Look at the interest rate this way, if the Fed wants to slow economy down, they increase interest rates. If the Fed wants to speed economy up, they lower the rates. It’s that simple.

And now answer yourself a question. Is the US economy speeding up so much that we need Fed jumping on brakes?

I don’t think so.

And answer yourself another question. The US has 17 trillion debt, for which it pays around 2% interest. If the Fed raises rates, the interest will go up too. It might be 3%, or 4%, or even more normal 5%. Can we afford paying such interest without increasing taxes? Or can the US economy growth offset the debt interest so much that it offsets a higher interest on our debt?

I also do not think so.

That means, in my opinion, that Fed is trapped in a situation of keeping the interest rates at zero forever.

Unfortunately, they cannot do it forever. One day, our economy speeds up and Fed will be forced to raise the rates involuntarily.

On Wednesday, we have heard about a “Considerable time” rhetoric. The investors could feel the tone of Yellen’s message and today, they are again returning back to complacency. The beaten stocks started recovering and rising again. Mostly this Friday.

Stocks Which Are Still a Good Buy

Some of the stocks I listed in my previous post recovered and I wouldn’t be buying them at this time. Instead, I would wait for the next panic and fear. Yet there are a few stocks left, which are good candidates for addition into our portfolios.

Realty Income (O)

This stock recovered on Friday a bit, but is still significantly down and in a buy zone.

O pays $2.20 annual dividend

yield: 5.10%

Its projected 10YOC is 15.15%,

payout ratio 235% (note, this is a REIT, the ratio will be at or higher than 100%)

5 yr average growth: 5.33%

paid dividend since: 1994

# of years of consecutive dividend increases: 16 years

American Capital Agency (AGNC)

AGNC also recovered a bit on Friday, but not enough to escape the buy zone. This stock can still be a good addition to your portfolio.

AGNC pays $2.75 annual dividend

yield: 11.80%

Its projected 10YOC is 11.80%,

payout ratio 129% (note, this is a REIT, the ratio will be at or higher than 100%)

5 yr average growth: -6.88%

paid dividend since: 2008

# of years of consecutive dividend increases: 0 years

McDonalds (MCD)

I didn’t list this stock in my previous post, but I believe it offers a good entry too. In the past few months McDonalds was beaten down by investors. They punished the company for bad results, or slow growth and for the risk of being forced to pay $15 per hour for hamburger flippers recently rioting on the streets.

But yesterday MCD announced dividend increase. Dividend investors already know that dividends could be used as an indicator of a company’s health. The dividend is paid from the company’s cash. If there is no cash, then there is no dividend. If a company is losing, the dividend is cut.

If MCD is as bad as we could hear in media lately and it is going to sluggish or even die, why they increased the dividend yesterday? Did they do it to speed up their suffering?

Maybe they did it because there is no suffering at all and it is all a hype.

MCD pays $3.40 annual dividend

yield: 3.60%

Its projected 10YOC is 6.64%,

payout ratio 59%

5 yr average growth: 10.17%

paid dividend since: 1976

# of years of consecutive dividend increases: 37 years

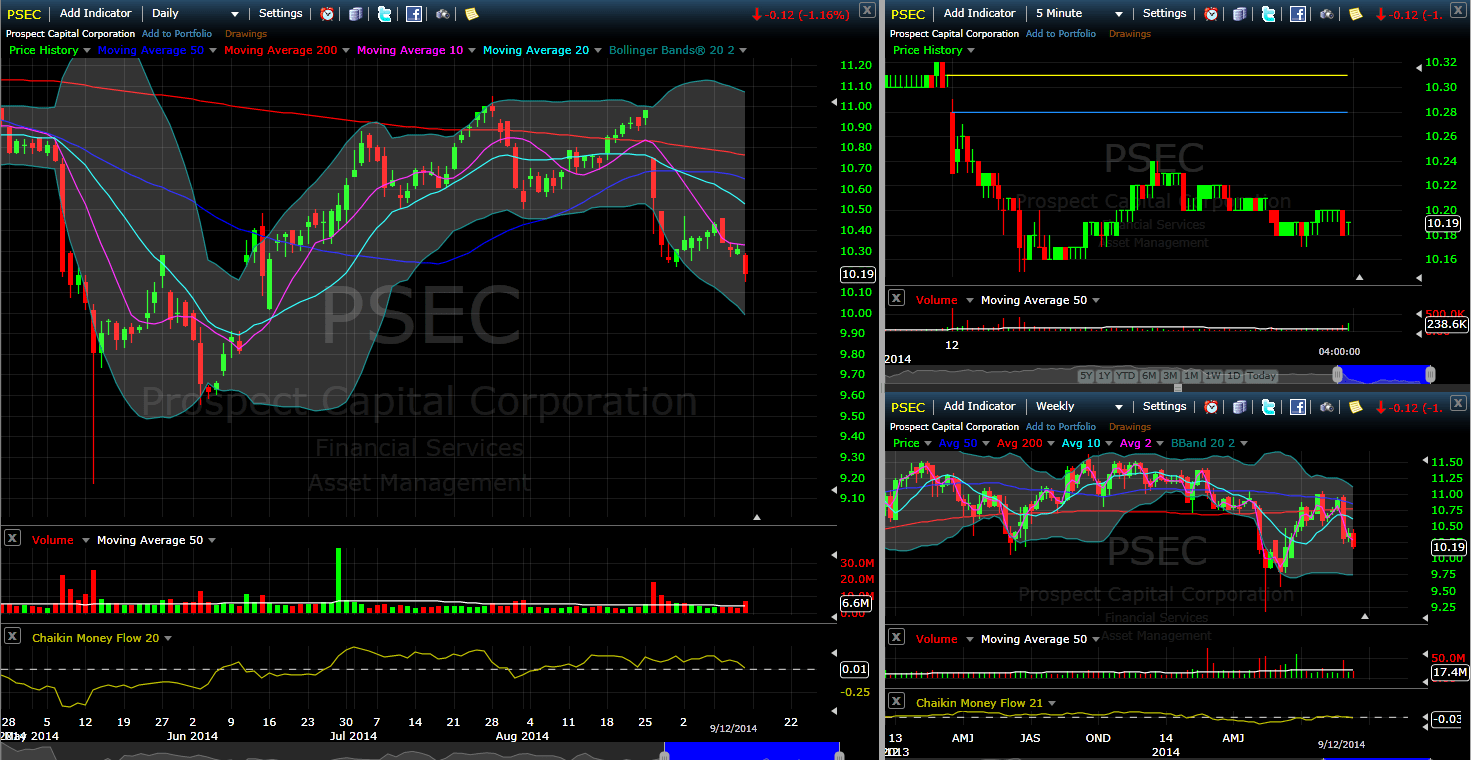

Prospect Capital Corporation (PSEC)

PSEC is still hovering around $10 a share which is a good price entry. You will enjoy stable, almost 13% annual dividend while waiting for appreciation to $11.50 a share or more.

PSEC pays $1.33 annual dividend

yield: 12.90%

Its projected 10YOC is 19.47%,

payout ratio 171% (note, this is a BDC, the ratio will be at or higher than 100%)

5 yr average growth: -3.43%

paid dividend since: 2004

# of years of consecutive dividend increases: 2 years

Vanguard Natural Resources (VNR)

This MLP didn’t recover and it continued down. At the end of the trading day, it paired some losses, but ended the day in red. It still offers a good entry. It pays monthly dividends. Today, the company announced increased distribution at a new annual rate of $2.52 per unit. It is a slight increase from $2.51.

VNR pays $2.52 annual dividend

yield: 8.70%

Its projected 10YOC is 8.70%,

payout ratio N/A

5 yr average growth: 4.77%

paid dividend since: 2008

# of years of consecutive dividend increases: 0 years

Goldcorp Inc (GG)

Goldcorp continued in a harsh selloff today. It is offering an even better entry point than a week ago. But to entry into this stock I would use a contingency order. It means, that I wouldn’t buy outright, but track the stock down and buy at reversal. For example, I calculated my next entry point to be at $24.33 a share. A contingency order means, that you place a conditional order, which activates your buy order if conditions are met, (if you do not know how to place such order, contact your broker and ask them how you can achieve it).

Then, the order would look like this:

If GG is at or above 24.33 activate a buy limit order at or below 24.33 a share. If on Monday the stock continues lower, the activation price at 24.33 will not be hit and nothing happens. You just lower your price lower for the next day. If however the stock continues higher and hits the 24.33 the limit order will become active, but you would buy the stock only if the price stays or drops below 24.33 a share. That will protect you from the price jumping way over the limit. I will write about this type of order in my next post.

GG pays $0.60 annual dividend

yield: 2.40%

Its projected 10YOC is 4.01%,

payout ratio 31%

5 yr average growth: 30.18%

paid dividend since: 2001

# of years of consecutive dividend increases: 4 years

HCP (HCP), Ventas (VTR), Omega Healthcare invest (OHI)

These are the stocks I didn’t list in my previous review. They were brought to my attention by Keith from DivHut blog.

All three candidates are in REIT sector, but they invest solely in a healthcare industry. I knew about OHI for example, and I even have it in my watch list as a good candidate for addition, but that’s where my knowledge about these kind of REITs ends.

I reviewed the price action of all three stocks and they all copied the other REIT price patterns. From that perspective they look like a good addition to portfolio along with other REITs I mentioned above. If you want to be exposed to healthcare REITs (and as our nation will be aging the healthcare industry will prosper more and more, so the REITs involved in that industry), it makes a perfect sense investing in them.

But are they good dividend stocks?

Let’s take a look.

HCP pays $2.18 annual dividend

yield: 5.50%

Its projected 10YOC is 8.45%,

payout ratio 99%

5 yr average growth: 3.32%

paid dividend since: 1990

# of years of consecutive dividend increases: 19 years

The dividend growth is quite low, so I would use this stock as a money making machine to generate cash which can be later used to purchase more shares of another dividend growth stock. It is a good dividend payer with excellent history of consecutive dividend increases.

My calculated fair value is at $36.5 a share (based on DCF). Morningstar estimates its fair value at $51 a share. With that said, I am OK purchasing this stock around 36 – 39 level (as close to 36 as possible). To buy in I would again use a contingency order.

VTR pays $2.90 annual dividend

yield: 4.80%

Its projected 10YOC is 12.76%,

payout ratio 176%

5 yr average growth: 7.21%

paid dividend since: 1999

# of years of consecutive dividend increases: 4 years

This stock has a nice dividend growth as well as current yield. The history of consecutive increases is short, so investing into this stock would require caution. It is, in my opinion, a good candidate to buy. The stock price still has a tendency to fall lower, so to buy in I would use a contingency order, too.

Morningstar estimates its fair value at $76 a share (as of 09/15/2014). The median price for this stock (5 year time frame) is at $63 a share. To me, the actual price at $61.12 looks acceptable.

OHI pays $2.04 annual dividend

yield: 5.90%

Its projected 10YOC is 14.76%,

payout ratio 256%

5 yr average growth: 10.58%

paid dividend since: 1992

# of years of consecutive dividend increases: 10 years

As I mentioned above, I had this stock in my watch list but wasn’t aware of its performance. From the numbers above, it is a very good candidate for addition, too. It has a nice history, good dividend growth and superior yield. Morningstar doesn’t follow this stock and my DCF didn’t return anything due to lack of data needed to calculate a fair value. The median price is at $30 a share, so it may be worth to wait if the stock drops lower.

It may not happen, so to get in, I would split my cash dedicated for this stock in three parts and leg into positions in a sequence using contingency order. That way you could buy a third of your future position now and see if the stock continues falling. If so, you buy a second third using a contingency order and average down. You do it as long as you get into your target position.

That’s my review of stocks which were beaten down last two weeks and which could offer a good opportunity to buy REITs, BDC, or MLP stocks cheaper. When investing into these stocks be sure you understand risk involved with these stocks. A risk I can see is the interest rates hike as that may send these stocks even lower than they are today. If you are eager to invest and have your money working for you, invest now only a portion of the entire amount you plan to invest.

You can also use put options to buy these stocks, although not all of the stocks mentioned above are optionable.

What do you think about these stocks and which of them would you invest in?

We all want to hear your opinion on the article above:

1 Comment |

Recent Comments