I got this idea to write about my reasons for trading options when reviewing monthly results of other investors, such as Dividend Hut, Dividend Mantra, Roadmap2retire, and many others.

I regularly review my peer’s investing progress as that motivates me for further strive reaching my goal. Humans are competitive creatures, so seeing other investors really pushes me forward. Their success kicks me forward.

I saw many investors starting their investing journey (like Captain Dividend) about a year ago, receiving just a few bucks in dividends and today their accounts outgrew mine in terms of received dividends.

So, why I started trading options instead of continued competing with my peers? (Take my words of “competing” in as good manner as possible as there is no animosity in it. I take it in a motivational way.)

Many of the investors I mentioned are a lot younger than me and they can afford a slower pace of building their wealth-well. Time is on their side. On the other hand I started late and my accounts are relatively small. Probably at the same or similar level as those of my peers, but I lack the time on my side.

Many of the investors I mentioned are a lot younger than me and they can afford a slower pace of building their wealth-well. Time is on their side. On the other hand I started late and my accounts are relatively small. Probably at the same or similar level as those of my peers, but I lack the time on my side.

Another reason for looking for alternatives was my family. We have older kids requiring a lot of cash to support them at school, daily activities, after-school activities, sports event, then mortgage (and we live in a very expensive area, so our small condo cost us as a mansion elsewhere in the US), and other bills prevent us from saving 30, 40 or even more percent of our income. How I envy Jason from Dividend Mantra that he realized his dreams and goals early so he could adopt his 50% salary saving goal.

When you start your saving goal early and set the rules early, it is easy, or easier to have them adopted and create your life around it.

When you do it the other way, create your life first and then want to adopt some “drastic” saving rules, it is very difficult and some life events even prevent you from doing it at all.

Because I am a competitive, ambitious person, I wasn’t satisfied with a slow building process dividend investing requires. Above mentioned reasons basically prevented me from saving large amounts of money to my accounts. In many occasions I could only save $50 or $100 a month, not more. With that money I would be saving $100,000 account for 83 years (of course, I excluded compounding and capital appreciation).

Because I am a competitive, ambitious person, I wasn’t satisfied with a slow building process dividend investing requires. Above mentioned reasons basically prevented me from saving large amounts of money to my accounts. In many occasions I could only save $50 or $100 a month, not more. With that money I would be saving $100,000 account for 83 years (of course, I excluded compounding and capital appreciation).

When you are approaching your 50s, it is not acceptable way for building my money machine.

My competitiveness and ambitions were the engine of me learning other strategies besides dividend growth one. But don’t take me wrong. I am still a great fan of dividend investing, just read further, why I am trading options and even learning futures.

As I said, building a dividend growth portfolio which would provide you with ever lasting income no matter what you do (and income for your children, and their children, and their heirs all the way down the road of your family history) is a very slow process. If you want to succeed, you need to start as early as possible and let your greatest friend – time – work for you.

If you do not have that time, you need to find other ways to boost your portfolio. But having other ways of boosting your portfolio doesn’t mean gambling your retirement money! Not at all! Stay away from any gambling whatsoever!

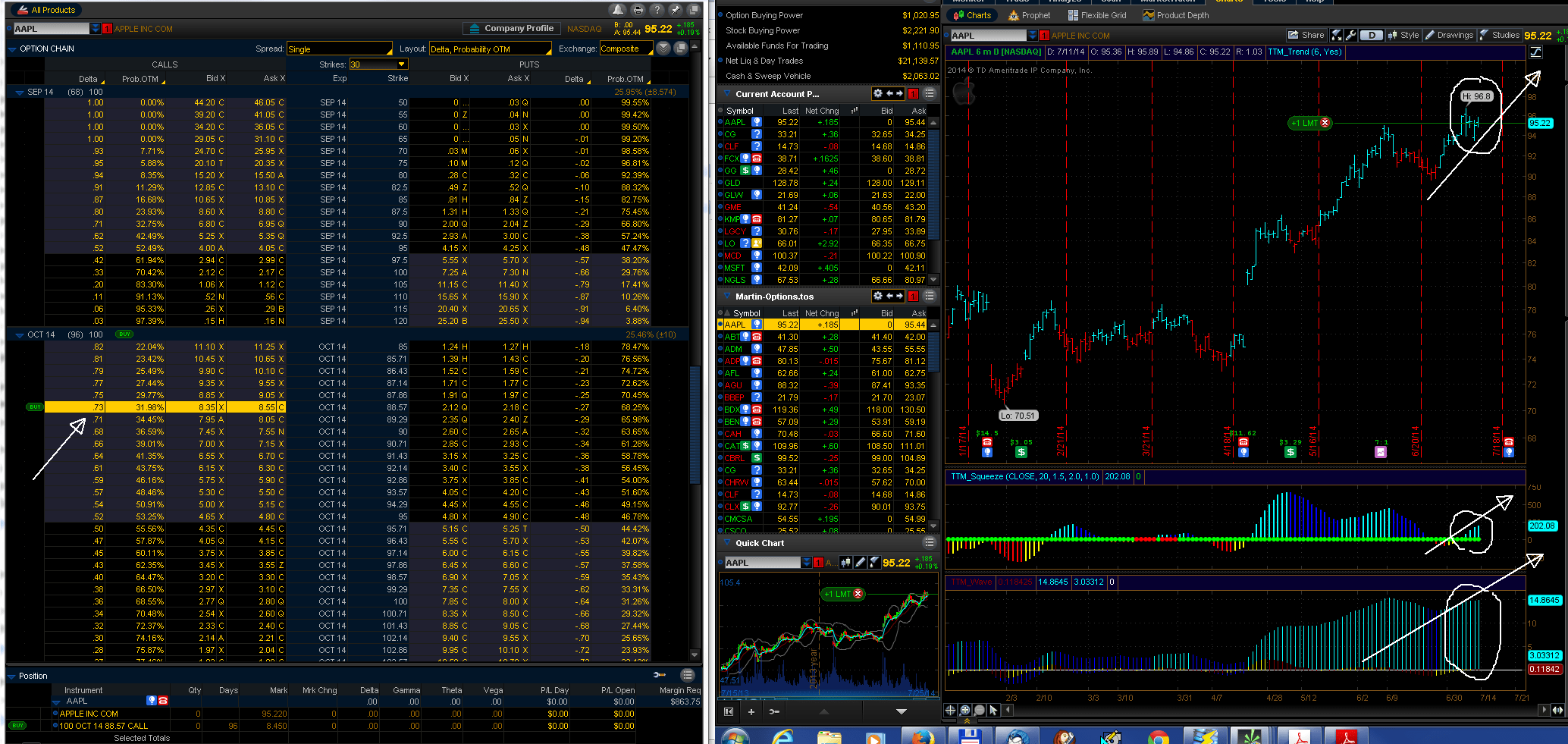

You may have heard from advisers and other investment gurus, that options are dangerous and that you should stay away from it. I say, it is not true. Options are not dangerous any more than investing into stocks themselves.

Yes, options are actually safer and provide you with great protection when investing into stocks. So where is the risk in options? It is in investor’s ignorance.

If an investor has no or little knowledge of how to trade options and doesn’t understand the risk and how to mitigate it, then options are a great danger to his money and his account. I experienced this on my own. But I learned my lesson already (or at least I hope I did).

So why I trade options?

As I mentioned above, it is a lack of time on my side. I needed a boost to my portfolio. I needed a boost to my money I can invest in dividend stocks. When contributing only $50 or $100 a month it wasn’t enough to build an account fast, so I needed a strategy which could bring in more cash which I could add to those contributions of mine to buy more dividend growth stocks.

Options perfectly fit into that desire. And they even outperformed my expectations. In average, I receive $150 monthly in dividends and on top of that I receive $800 monthly from options premiums. Now, my money to invest every month grew to circa $1000 a month. And mostly, I use other people’s money to build my account.

But I do not use that money immediately as I make them. That wouldn’t be wise. That would be that exact case of trading options with a huge risk. You cannot trade options with little cash. You need to stay small and trade only a portion of your cash and use the rest as reserves, security, or protection. If the trade goes against you, you must have enough cash for repairs of such trade. If you overextend your account, then you expose it to a great risk.

For that reason I use the cash I make from options for further trading and I made myself a rule, that at the end of the year I stop my options trading (either fully or partially), close as many trades as possible, count the profits or losses and if profits, take a percentage of those profits and buy dividend stocks.

For the current year I will take 10% of my profits and use it to buy dividend stocks. Next year, the percentage will be larger, maybe 20%. I do not have it decided yet. Then I use the rest reinvesting in options for the rest of the next year to double my account again, make more money and at the end of the year buy new dividend stocks. Rinse and repeat!

If I will be as successful in options trading as in the last three years, I will be able to stop contributing to my account completely, use my salary to enjoy it with my family, and still grow my account.

My dream of creating an ever lasting, ever growing and sustainable income will be fulfilled.

But do I want to stop here?

No! Not a chance! I mentioned above that I am a competitive and ambitious person. I want to learn more and I want more. While still trading options and investing in dividend growth stocks, I started learning other strategies – futures.

I read that futures are even better than stocks or options. They can make you even more money even faster than options!

I read that futures are even better than stocks or options. They can make you even more money even faster than options!

I do not know for sure. I have never traded them and now I do some reading on basics of futures trading. I will also trade them in my paper money account to see the mechanics of futures, how they work, how my indicators will respond to futures, what risks I will be facing, how to mitigate the risk, and how to make money in futures. If the futures make me even more money faster, I will be happy and my dream will come true.

And I will post about it. Life is about everlasting learning. I just put a challenge in front of me. Let’s see how it will work out.

I would like to encourage you – learn as much as you can about investing in stocks, trading options and maybe more (like futures). Even if you decide to stay away from them, learn it. Use paper money, fake account, to train and practice. You will see how easy it will be and maybe adopt that strategy in your account. And if you have a question about options or dividend stocks, you can always shoot me an email or post the question here on this blog.

Have a successful trading and investing next week!

We all want to hear your opinion on the article above:

6 Comments |

Many of the investors I mentioned are a lot younger than me and they can afford a slower pace of building their wealth-well. Time is on their side. On the other hand I started late and my accounts are relatively small. Probably at the same or similar level as those of my peers, but I lack the time on my side.

Many of the investors I mentioned are a lot younger than me and they can afford a slower pace of building their wealth-well. Time is on their side. On the other hand I started late and my accounts are relatively small. Probably at the same or similar level as those of my peers, but I lack the time on my side. Because I am a competitive, ambitious person, I wasn’t satisfied with a slow building process dividend investing requires. Above mentioned reasons basically prevented me from saving large amounts of money to my accounts. In many occasions I could only save $50 or $100 a month, not more. With that money I would be saving $100,000 account for 83 years (of course, I excluded compounding and capital appreciation).

Because I am a competitive, ambitious person, I wasn’t satisfied with a slow building process dividend investing requires. Above mentioned reasons basically prevented me from saving large amounts of money to my accounts. In many occasions I could only save $50 or $100 a month, not more. With that money I would be saving $100,000 account for 83 years (of course, I excluded compounding and capital appreciation).

I read that futures are even better than stocks or options. They can make you even more money even faster than options!

I read that futures are even better than stocks or options. They can make you even more money even faster than options!

Recent Comments