October 2014 was a consolidation month for me and I am finally back on track making money trading options. Nevertheless this year 2014 would be a bad year for me, but that is a part of the entire game.

October 2014 was a consolidation month for me and I am finally back on track making money trading options. Nevertheless this year 2014 would be a bad year for me, but that is a part of the entire game.

If you want to trade with your money, you can make great returns. Yes, you can make 100% or 500% or even 1000% return. But such returns have a great risk involved. You must be willing to accept it and you must learn how to tame it. If you do not know what you are doing and how to manage risk do not trade otherwise you lose money.

Some time ago I decided to take that risk. It fulfils my dream and makes me happy trading options. Although it is sometimes frustrating, over all I am like a fish in the water. And I can see a huge potential of trading options and making a lot more money than I have ever dreamed of.

The only thing I need to do, besides learning how to trade options successfully, is have rules and patiently follow them.

The reason I lost money in September was that I broke my rules and was greedy. I had a hard time to take smaller profit. I could make $15,000 in a small account, but I was greedy to take only $8,000 even though I knew the trade was extremely risky. Instead of a sure $8,000 gain I ended up with a huge loss.

Time to change it.

Below are the results of my investing and trading. This time I would like to add my other accounts, although not detailed.

Dividend Growth Investing

Investing into dividend stocks is a security to me. Many times I repeated that I trade options and take gains and invest them into dividend growth stocks. I know traders who do something similar. For example John Carter, an option trader with 30 years of experience in trading options and an owner of Smpleroptions.com has a rule to take profits up to 50% and invest in properties. He buys land in Texas.

John buys land, I buy dividend stocks.

TD Account

I primarily trade options in this account, then take proceeds and buy dividend stocks. However, this time I didn’t purchase any of the dividend stocks in this account. My only recent purchase was Alibaba (BABA) which is now 34.16% up. This is not a dividend stock but my growth stock play. I do not have a plan for this stock and thinking to use stop loss to get out of the stock. Not sure if I want to hold it as a long term investment.

What would you with an investment you consider an exception to your strategy and you took it as a “play”? Would you hold it, or sell it after you reach gains and then reinvest proceeds to your primary investment vehicles (in this case dividend stocks)?

For detailed results of this account, see below.

ROTH IRA

This account is a pure dividend growth account. It’s current Net-Liq (net liquidation) value is $17,225.23 up 6.13% from previous month. I only reinvest dividends at this point. I plan to add a full allowed investment at the end of the year from a bonus if I get any.

I reinvest dividends by investing them into a non-transaction fee ETF (RWX). Since I pay no commission to buy this ETF I can invest as little as 1 share. With this approach I could save money in this fund and once I safe enough, I sell a portion of the fund to release money for my next dividend stock purchase.

For example my goal is to save $1,200 in this ETF. Once I reach this goal, I sell shares to release $1,000 and then take that money and buy a dividend growth stock, while I continue saving the new goal. And of course, while waiting I collect dividends from this fund.

As of this writing, I saved $1,112.80 and collected $16.29 (1.46%) in dividends from this fund while waiting (since February 2014). Not bad. Try to put this money into a savings account and hold them there for 10 months and compare the results.

Now I have to wait 30 days to sell the shares from RWX to release $1000. It is a part of the rule to keep all transactions commission free. After 30 days, I will be purchasing a dividend growth stocks.

In this account I received $149.34 dividends this month.

Motif Investing

My Motif account is a great way how to create a mutual fund. It works similar to 401k plans. The account allows you to invest into fractions of the stocks, so you can create a portfolio of your best stocks and start accumulating in it.

I created a few portfolios myself. I have a monthly dividend paying stocks portfolio and regular dividend growth stocks portfolio. Once you create those portfolios you can start buying them all as one piece and you will be buying fractions of the stocks. Great way to stay diversified with 30 or 60 stocks which you wouldn’t be able to purchase all in a regular account.

If you are small or starting investing, Motif is a great wealth builder. And what’s more, if you start investing now, you will get rewarded many times and you will support this blog too. You can get up to $150 when you start trading at Motif Investing! What a great deal!

My current Net-Liq value is $1,333.27, down -1.07% from the last month and I collected $6.31 (0.47%) dividends.

Scottrade

This is my compounding experiment account. I use this strategy since I do not have any. I do not add money to the account as of now. At some point I purchased (PSEC) and I use FRIP program to accumulate this account and stock. I started with 700 dollars and in 2018 I should have $4,631.82 and collecting $386.04 monthly dividends (of course if nothing bad happens with the stock.

401k account

There is nothing much to say about my 401k account. I continue saving 6%, my employer matches up to 3% and the account has a steady growing trend. Today there is $50,757.68, up 5.87% from previous month.

Options Trading

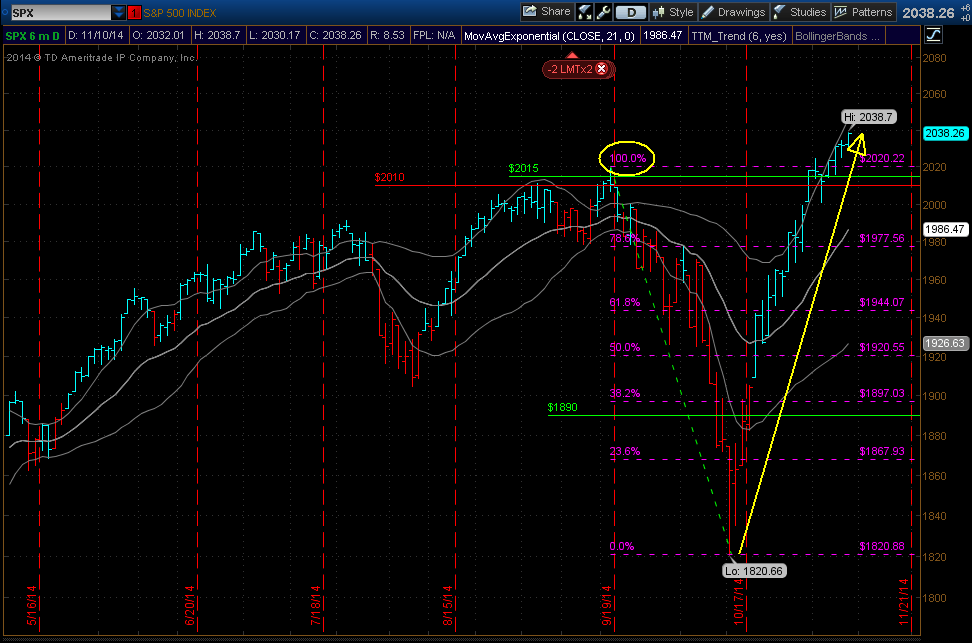

I only trade options in my TD account. As I mentioned above, this month was a consolidation month and I hope November 2014 will show profits again. During October 2014 I got rid of some risky trades (and realized loss) and also changed my strategy a bit shifting into weekly options trading.

I give away my options trade via a newsletter, so if you want you can follow them or copy them in your own account. You can follow my trades at My Trades & Income page. But if you want to receive a trade alert in your email box at the time I enter it with my broker myself, you need to subscribe to my free newsletter.

My newsletter will be free for the next three years (until beginning of 2018) then I will start collecting a fee.

October 2014 TD account results

| January 2014 premiums: | $156.10 (1.55%) |

| February 2014 premiums: | $139.26 (1.38%) |

| March 2014 premiums: | $746.62 (7.41%) |

| April 2014 premiums: | $421.63 (4.19%) |

| May 2014 premiums: | $803.32 (7.98%) |

| June 2014 premiums: | $230.21 (2.29%) |

| July 2014 premiums: | $4,602.44 (45.69%) |

| August 2014 premiums: | -$172.58 (-1.71%) |

| September 2014 premiums: | -$14,399.60 (-142.96%) |

| October 2014 premiums: | -$100.49 (-1.00%) |

| January 2014 dividends: | $25.87 (0.26%) |

| February 2014 dividends: | $167.02 (1.66%) |

| March 2014 dividends: | $68.77 (0.68%) |

| April 2014 dividends: | $25.91 (0.26%) |

| May 2014 dividends: | $168.51 (1.67%) |

| June 2014 dividends: | $68.81 (0.68%) |

| July 2014 dividends: | $25.96 (0.26%) |

| August 2014 dividends: | $150.49 (1.49%) |

| September 2014 dividends: | $68.86 (0.68%) |

| October 2014 dividends: | $26.00 (0.26%) |

| Total 2014 income: | -$4,996.67 (-49.60%) |

| 2014 unrealized premiums: | 2,065.49 (20.51%) |

| Account Equity: | $18,703.84 (7.93%) |

| Account Net-Liq: | $14,143.82 (-9.08%) |

| December 2013 balance: | $10,072.25 |

You can see my dividend and options income on My Trades & Income page.

What about you? How was your October 2014 and the entire year so far? I hope better than mine! Post a link to your website or write down your results to encourage other investors!

Have a great November 2014!!

|

We all want to hear your opinion on the article above: 4 Comments |

If you follow my blog, you know that I use two strategies –

If you follow my blog, you know that I use two strategies –

Recent Comments