I trade mostly dividend paying stocks, but watch a few companies which I consider good companies although they do not pay dividends. These I use in my portfolio as growth play stocks (for example a few months ago I did buy Alibaba (BABA) for this same reason).

In my watch list I have approx. 100 stocks I watch. Some I trade actively, some I only invest in. For example in my ROTH IRA I only invest into stocks, I do not trade. But in my TD Account I trade stocks and options, but use those exact same stocks as underlying symbol for my trades.

Among the stocks I have in my watch list I try to find those, which are currently undervalued. I use the difference between current P/E, current EPS, EPS estimates, and current price. A formula I created tells me what stock has a bigger potential for growth compared to its current pricing at the market.

The result of my screener for an undervalued stock means, that there is a significant chance that investors are not investing in those companies yet, but potentially will in the future and drive the price of the stock higher. That would be the best time to sell them the stock you purchased at the time you spot it as undervalued.

Here is a list the stocks I believe will become winners in the next year of 2015. Let’s take a look at them.

Agrium Inc. (AGU)

Agrium is in Basic materials sector but in Agricultural chemicals industry. It is not thus beaten down that much as precious metals for example. It produces, retails, and distributes the crop nutrients, crop protection products, seeds, and agronomics primarily in North America, South America, Europe, and Australia. The company operates through two segments, Retail and Wholesale. The Retail segment supplies crop protection products, such as herbicide, fungicide, insecticide, and adjuvant products; crop nutrients, including dry and liquid nitrogen, phosphate, potash, sulfur, and micronutrients; seeds; and merchandise comprising fencing, feed supplements, livestock-related animal health products, irrigation equipment, and other products.

Agrium is a dividend paying company but it is not a true dividend growth stock. It was founded in 1931 but it paid dividends only since 1993 and increased dividends in only two consecutive years.

At its current price $95.91 a share it yields 3.30% dividend yield. Its dividend growth of 160.55% is impressive, but it is hard to say whether sustainable or not. I would say, it is not and as the dividend payment plan of the company matures over time, it will decline to a more standard level.

Morningstar provides a fair value at $96 a share with a very high uncertainty and a target to sell at $148.8 a share. My own calculated fair value is at $164.83 a share.

With that said, I would consider this stock a growth play rather than a dividend growth investment. If you buy at the current price and hold until it reaches $148.80 a share, you will collect a nice 55.14% profit and in the meantime you will be collecting a nice dividend. If you play this stock, I would use a stop loss at $86.32 a share. But, be also prepared for a long holding period as it may take quite a long time to get to the target price.

In my TD account I am taking this trade as an option play selling a credit put spread expecting this stock to stay above $90 a share at expiration. In my ROTH IRA account I am currently fully invested, thus I have to skip this opportunity.

BreitBurn Energy (BBEP)

BreitBurn Energy, as its name provides, is an energy stock and it was beaten hard in the last days. Many analysts predict that price of oil will stay down until 2016 and that the oil crisis is worse than ever and similar to 80s or as in 1997 – 1999, 2001 – 2002, or 2008 – 2009. It could be. But as of now, the stock got so beaten in price that it pushed its dividend yield to levels never seen before. It now yields a staggering 21%. The company pays dividends (distribution, since it is a partnership) since 2007 and it has been increasing dividends in 4 consecutive years by average 7.64%, which is not a bad rate.

The old adage says, when there is blood on the street be buying. I believe that this is an opportunity. Investors are panicking and selling energy stocks. Buy them. I bought Legacy Reserves (LGCY) for this same particular reason. Although everybody shouts sell, sell, sell, I would buy this stock. But it will be a long run and there is a risk involved. If the oil price war continues well beyond 2016, the portfolio hedging of BBEP (as well as LGCY) would be depleted and the company may cut its dividends. Even if that happens, however, it still will be at around 10% range rate and while waiting for price recovery (to get back to 20s) you will be collecting nice dividends. When the stock returns to 20s, which may take up to two years or more, you will see a nice capital gain too.

Saudi Arabia claims that they wouldn’t cut production of oil which sent prices lower. But with their current 17% budget shortfall, they too will not be able to sustain this war for prolonged period of time as their economy is fully dependent on oil. If they start pushing oil price back up, companies involved in oil will go up again (as they did many times in the past).

If buying this stock, be prepared for nice profits, but accept increased risk. The risk is in dividend cuts and further price fall. Nobody knows how low oil and the price of this stock can go. I believe this will be a winner at some point, but it will take some time, even two or more years. I would also consider this trade as a growth play, rather than a dividend growth holding.

Baidu, Inc. (BIDU)

Baidu is not a dividend paying stock whatsoever, but the recent sell off from $250 to $225 sent the stock to undervalued territory. Some investors may not agree with me, but its growth rate is more aggressive than its current valuation. Its price to growth rate is very low making this stock an attractive growth play. Baidu’s growth rate is at 37% which is more than any other stocks in my watch list. There are only a few competitors competing with this growth rate such as Netflix (NFLX), Mosaic (MOS), Alibaba (BABA), Go Pro (GPRO), and some others (some listed below). All those stocks are in a category of young companies with a huge potential for growth, while mature companies (such as AAPL) are slowing down.

Morningstar considers a selling price for this stock to be at $341 a share although their fair value is at $220 a share. I would be satisfied with $280 a share where I would sell this stock.

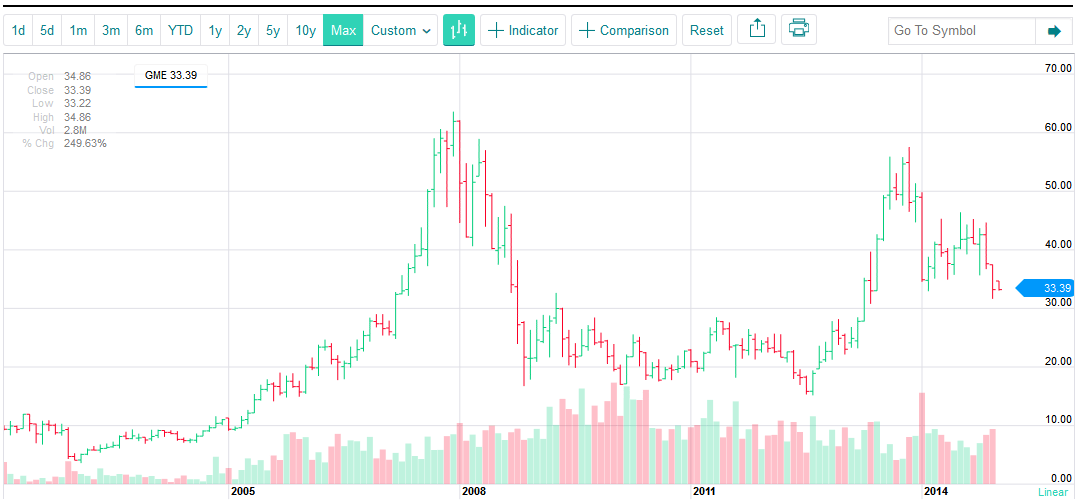

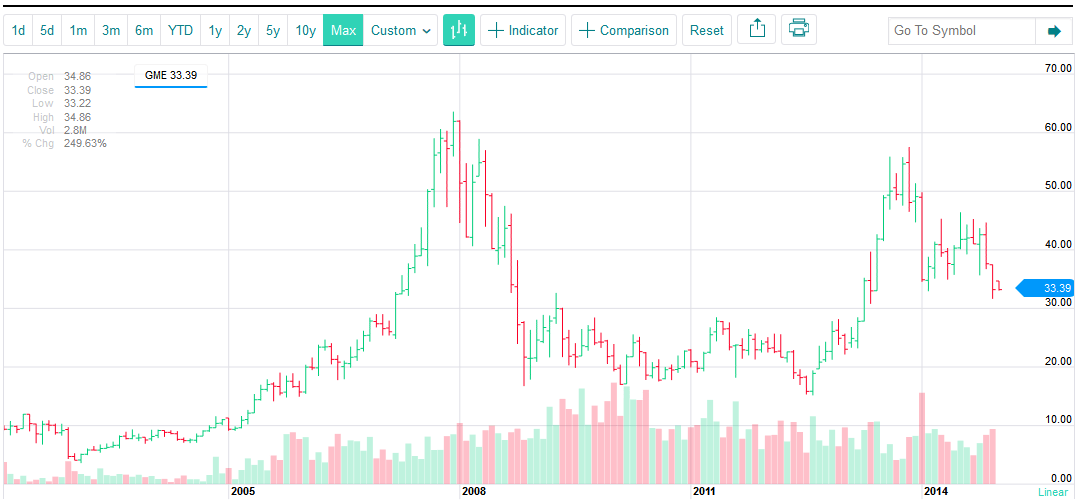

GameStop (GME)

GameStop is my favorite stock. I was able to make good profits with this stock in the past. A recent sell off of this stock, mostly based on fear and panic that they won’t be able to survive online shopping of the games and a new competition such as Walmart (WMT) entering into used games business, sent this stock again into undervalued territory.

Game stop is a dividend company, although it is not a true dividend growth stock. It yields 4% at its current price and it increased dividend once since 2012 when it started paying dividends.

GME still may continue falling, however, there is a strong support at $30 a share. If the stock holds this level, we may see it marching back up towards my calculated fair value at $47.2 a share. Buying and holding this stock would be a growth play rather than dividend investment, but during waiting time for the stock to grow, you would collect a nice dividend. I also may use this stock for my options plays opening a credit bull put spread with around 30 strike.

Mosaic Company (MOS)

Mosaic is in the same category as Potash Corp. of Saskatchewan, Inc. (POT) producing and marketing concentrated phosphate and potash crop nutrients for the agriculture industry worldwide. Mosaic is a dividend company currently yielding 2.20%, but it only increased dividends for 2 consecutive years since 2008 when it started paying dividends. Also the dividend growth rate is quite low (only around 2%). That would make this stock a growth play too.

This stock’s growth may be a bit tricky when looking at the long term chart. Morningstar considers this stock’s fair value to be at $56 a share which would deliver 20% capital gain if it gets to that level. That would be my selling point although Morningstar recommends a selling price to be $86 a share. While waiting for this stock to grow, you would be collecting an acceptable dividend. There is a nice potential potash contract waiting in India and China and if that happens (expected early in 2015) that can lead to increased potash prices and Mosaic would benefit from it greatly.

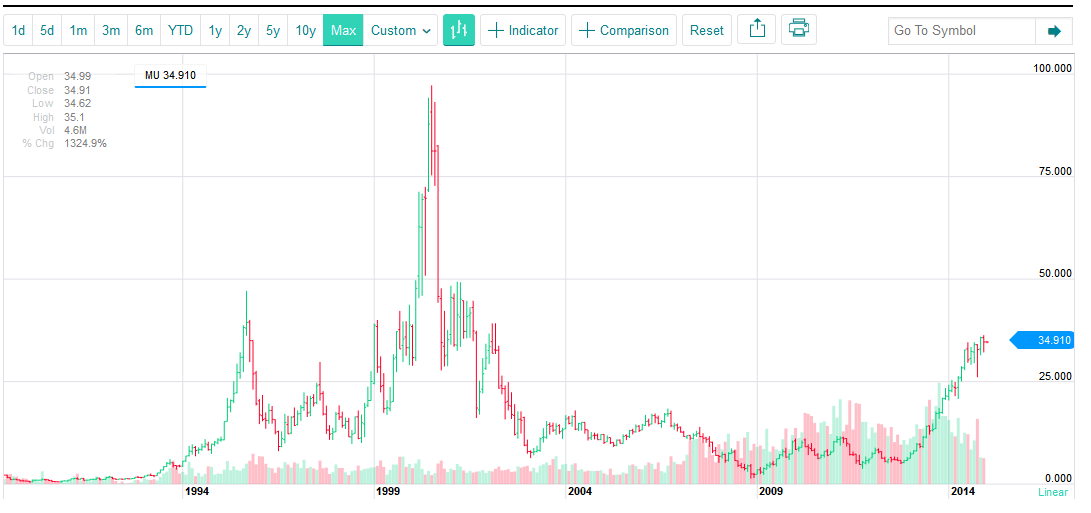

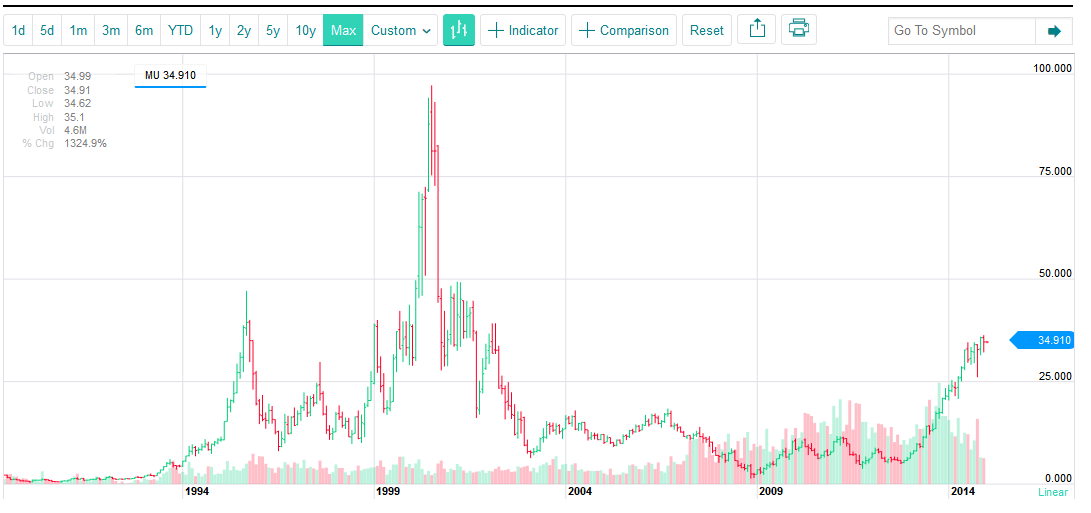

Micron Technology (MU)

Micron Technology, Inc., provides semiconductor solutions worldwide. The company manufactures and markets dynamic random access memory (DRAM), NAND flash, and NOR flash memory products; and packaging solutions and semiconductor systems. It doesn’t pay dividends and therefore this would be a growth play. The stock recently ran up in 2014 due to expectation of more massive use of NAND – solid state drives (or SSDs) which could soon replace traditional hard drives. Although it will surely happen unless something better shows up on the scene, the price of SSDs is still prohibitive.

The target price for this stock is at $43.75 a share. At current price $34.91 a share this trade could provide a nice 25% profit.

But there is a danger that the stock will exhaust its run up (as the volume is declining with the new highs), so I would play this trade with a stop loss at around $31.40 a share.

Old Republic (ORI)

Old Republic (ORI) is a dividend growth stock with 7 years of consecutive dividend increases. It is engaged in underwriting insurance products primarily in the United States and Canada. The company’s General Insurance Group segment offers automobile extended warranty, aviation, commercial automobile, commercial multi-peril, general liability, home warranty, inland marine, travel accident, and workers’ compensation insurance products; and financial indemnity products for specialty coverages, including errors and omissions/directors and officers, fidelity, guaranteed asset protection, and surety.

It currently yields a nice 5% dividend yield, but its dividend growth is only 1.43%. Recent sell off in August and October this year sent the stock to $14.59 a share. Yet this price is still below resistance at $15 a share and well below $17 a share of two year max price. I would also consider this stock as a growth play, but it will be okay to add this stock to a dividend growth portfolio too since the stock shows nice disproportion between the EPS growth and stock valuation. Therefore there is still a good potential to catch some capital gains while collecting high dividend in the meantime.

My expected sell target would be at $21.98 a share unless you decide to keep this stock longer or forever to collect dividends.

Qihoo 360 Technology (QIHU)

Qihoo 360 Technology provides Internet and mobile security products and services in the People’s Republic of China. Its core Internet security products include 360 Safe Guard, a solution for Internet security and system optimization; 360 Anti-Virus, an anti-virus application that uses multiple scan engines to protect users’ computers against various kinds of malware, as well as 360 Mobile Safe, a security program for the Google Android, Apple iOS, and Windows smartphone operating systems.

Qihoo is undervalued compared to its growth rate and makes it a good growth play as it doesn’t pay dividends. It, however, fell thru its long term support at $75 a share completing a head and shoulders pattern. Now it is marching towards $25 support. And it may get there.

I recently played this stock on the downside and made money. There is unfortunately nothing to be seen what can stop this stock from further fall. Although this stock is now undervalued when comparing its price valuation vs. EPS growth rate, it still doesn’t mean the stock will rise again. If you decide to play this stock, I would do so with a tight stop loss and get out of this stock at $75 a share (target) or move the stop loss higher with the stock.

Amid the price fall QIHU has been under heavy accumulation since October 2014 and that may continue well in 2015 as China will stabilize their economy and the rest of the world will move its attention somewhere else. Their government has been encouraging the Chinese people to enter the equities market. Like the US during the boom, China wants to prove to the world that their system works. They know that in order to do so they have to be economically sound and financially seen as superior.

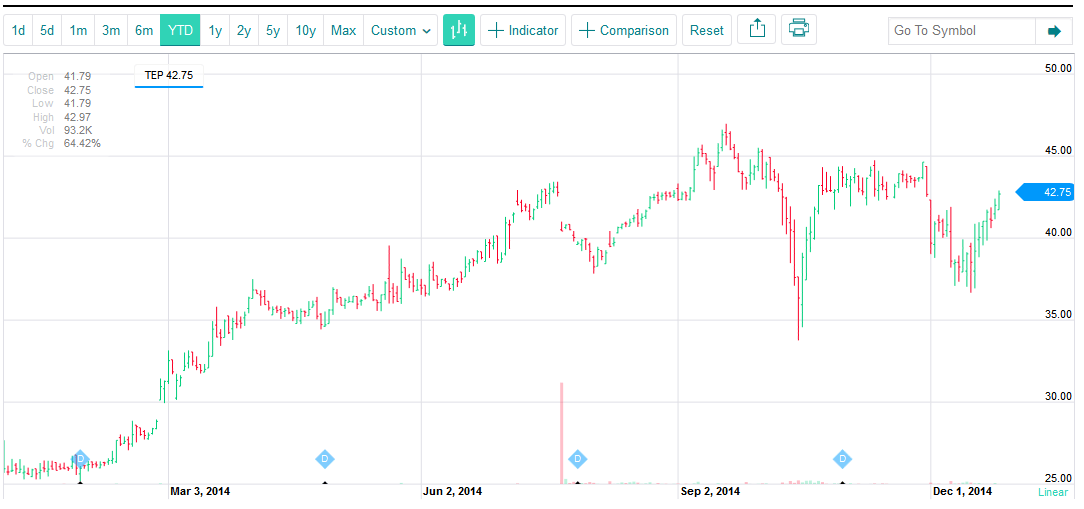

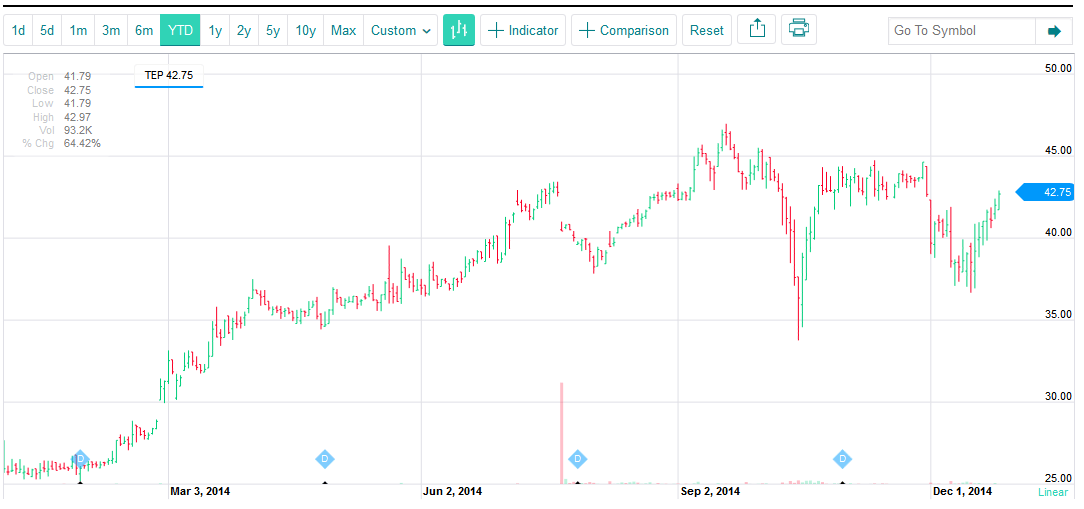

Tallgrass Energy (TEP)

It would be surprising if there wouldn’t be any other energy stock which wouldn’t show up as undervalued on my radar. Originally, I thought almost all energy stocks would be undervalued, but it doesn’t seem to be true – yet.

Tallgrass Energy (TEP) is one of the stocks which shows symptoms of discrepancy between price valuation and its growth rate. As is typical for partnership, this stock pays nice dividend and yields 4.30% at its current price at $42.75 a share. Surprisingly this stock wasn’t beaten down too much during the energy stocks sell off and so far it recovered quickly:

If purchasing this stock I would purchase it at this level as a growth play and sell $50 a share collecting dividend while waiting. Since the stock recovered nicely from recent sell offs while oil prices are still down, we may expect that the stock would grow fast with the oil recovery. Then we may capture nice capital gain and dividends.

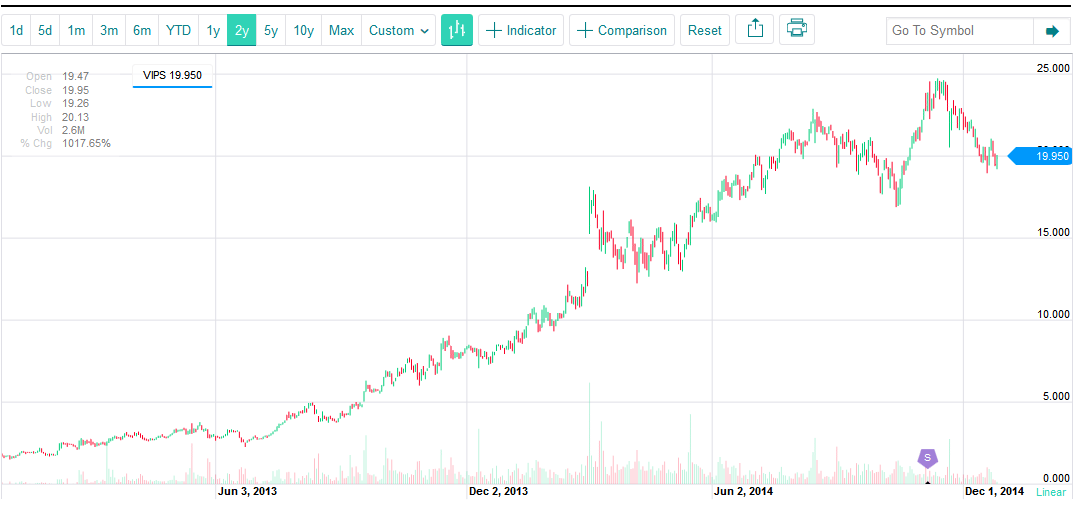

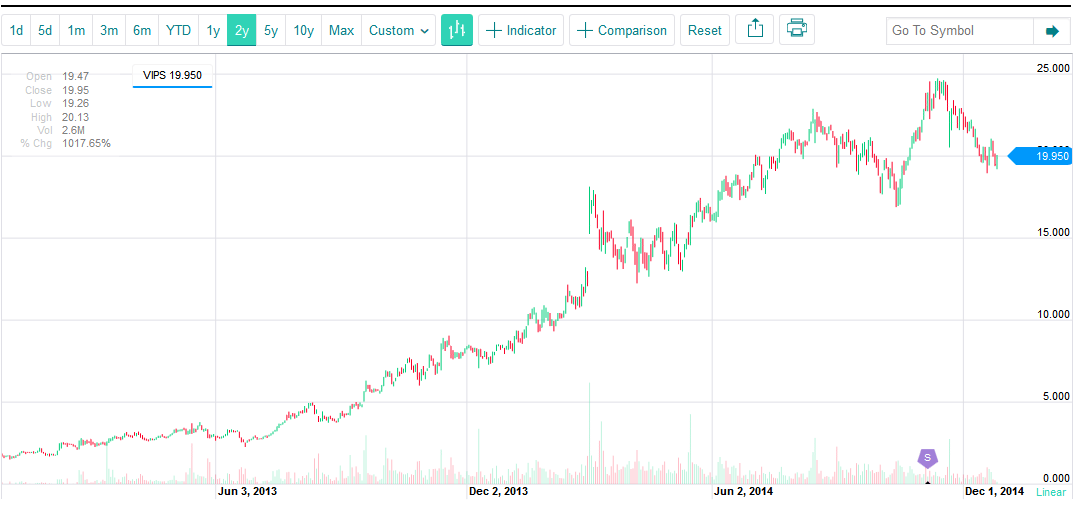

Vipshop Holdings (VIPS)

I have this stock in my watch list for my options trading. VIPS doesn’t pay dividends, so it is a pure growth play.

Vipshop Holdings Limited, through its subsidiaries, operates as an online discount retailer for various brands in the People’s Republic of China. It offers a range of branded products, including apparel for women, men, and children; fashion goods; cosmetics; home goods and other lifestyle products; footwear; sportswear and sporting goods; luxury goods; and gifts and miscellaneous products. The company provides its branded products through its vipshop.com and vip.com websites, as well as its cellular phone application.

The stock may see a growth back to around $25 a share (after split) where I would sell realizing a nice 25% profit. However, the stock may continue its fall down to $17 a share support and if it breaks it, it can fall all the way down to $15 a share. Therefore I would trade this with a tight stop loss or wait how this stock moves in a couple of few days in January 2015. The entry point into a position in this stock isn’t clear. For this reason I would use a contingency order placing a buy order above previous day high so I would buy this stock only on its way up.

YY Inc. (YY)

This is my last stock in my watch list which is shown as undervalued. Why Why company operates an online social platform in the People’s Republic of China. The company engages users in real-time online group activities through voice, video, and text on personal computers and mobile devices; and enables users to create and organize groups of various sizes to discover and participate in a range of activities, including online games, music activities, education, live game broadcasting, and conference calls.

It doesn’t pay dividends and therefore I would consider this stock again as a growth play only. The stock recently bounced from $60 support. If it doesn’t hold, the next stop is at $50 a share. But the stock seems to be holding and marching back up. If we add its valuation vs. growth rate into an equation, we may see this stock marching up to $70 or even to $80 a share.

These were the stocks which seem to be undervalued when taking into account their current price, EPS, P/E, and EPS estimates. Of course, as anything in the stock market, this doesn’t guarantee that those stocks will grow and make you money. I however see high chances of doing so. If trading those stocks which are not dividend growth stocks I would trade them with a stop loss, but those which pay and grow their dividend I would consider not using a stop loss at all and potentially keep them.

I take these stocks a good opportunity for 2015 investment.

Which of the stocks you would buy for the 2015 year?

Disclosure: I hold bull put spread against AGU (long). I do not have any positions in other stocks mentioned above. I may open new stock positions in my ROTH IRA or options positions in TD account against the stocks mentioned above. If I will be opening a new position I will post it on this blog.

We all want to hear your opinion on the article above:

1 Comment |

Recently, I enjoyed two articles at Seeking Alpha about Realty Income Corporation (O). One post was written by Casey Hoerth “Realty Income Corp: Why Now’s A good Time To Sell” and the second one by Achilles Research “Realty Income: Why Now Is Not A Good Time To Sell This REIT Nugget“.

Recently, I enjoyed two articles at Seeking Alpha about Realty Income Corporation (O). One post was written by Casey Hoerth “Realty Income Corp: Why Now’s A good Time To Sell” and the second one by Achilles Research “Realty Income: Why Now Is Not A Good Time To Sell This REIT Nugget“.

. Motif allows you to select 30 stocks of your own, create a portfolio (a motif) and invest an equal amount of cash every month, for example, and that amount will be equally (or as per your target allocation) distributed among those stocks.

to start investing with when you open an account.

Recent Comments