Today, Trump announced his new steel and aluminum tariffs policy. And all I heard people saying was that he imposed tariffs on countries from which the US doesn’t trade steel nor aluminum, all others will be exempt or can apply for exemption. Or he imposed tariffs on everyone and them exempted everyone.

But markets liked it.

After almost of whole day of doing nothing, the markets popped about 12 point. That was it. A big humbug for nothing. Now that the news of tariffs-no-tariffs are out, we have to wait for something new to spook the markets. Don’t worry. Trump and his cronies will come up with something.

Until then, we need to trade cautiously and wait. I am raising cash and closing as many trades as possible to overcome any drops of the market should they occur.

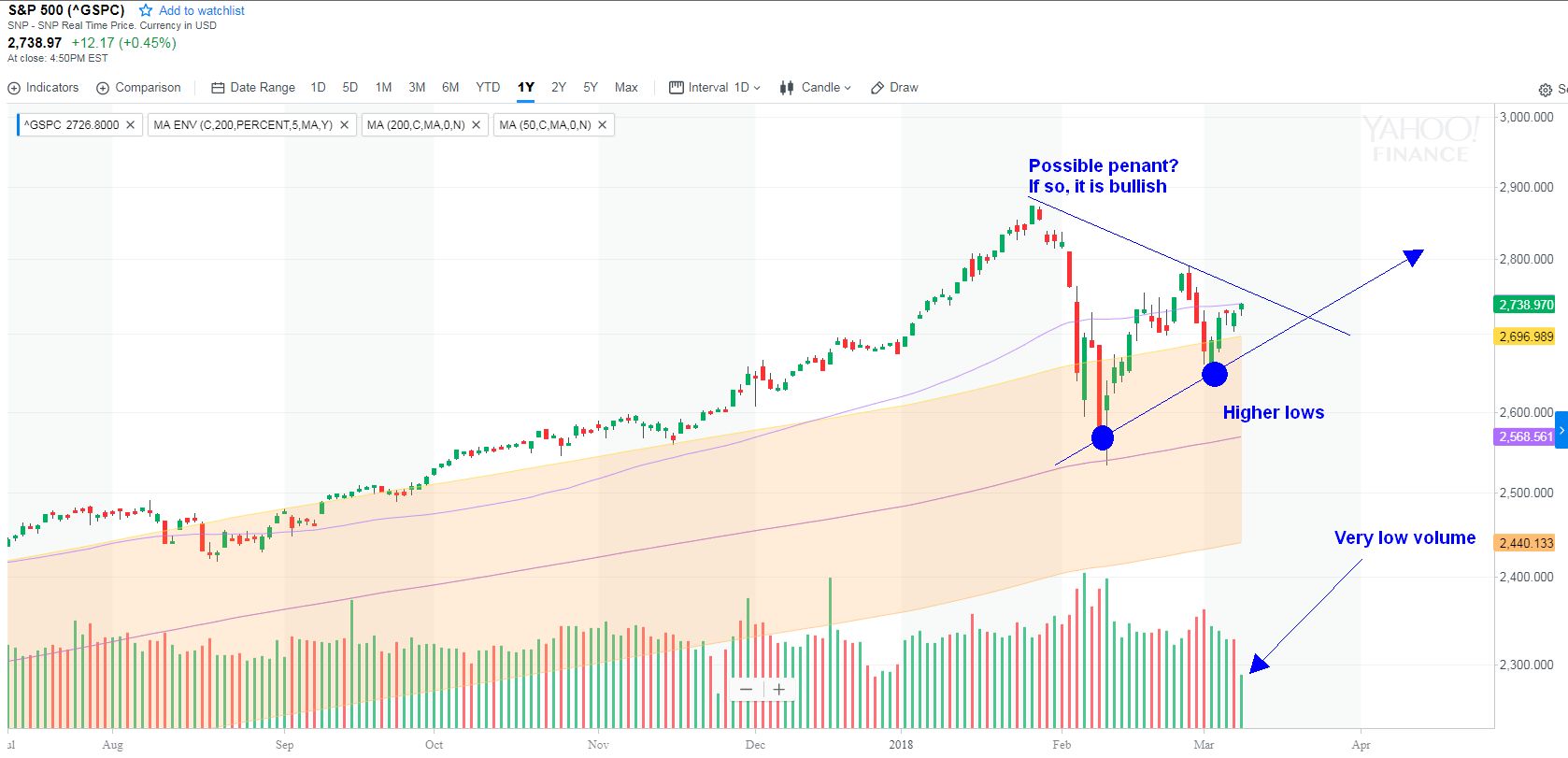

So far, it seems we created a new higher low and we might be going higher.

Some fellow investors also asked why was the market so calm today and it spiked only at the end of the day? As you can see the chart above has the answer. Investors were out staying aside and waiting for Trump. No one wanted an exposure to this uncertainty. That’s my take.

And I decided to do the same and closed some positions, which were almost worthless anyway to reduce my exposure should the tariffs news be bad and market would tank.

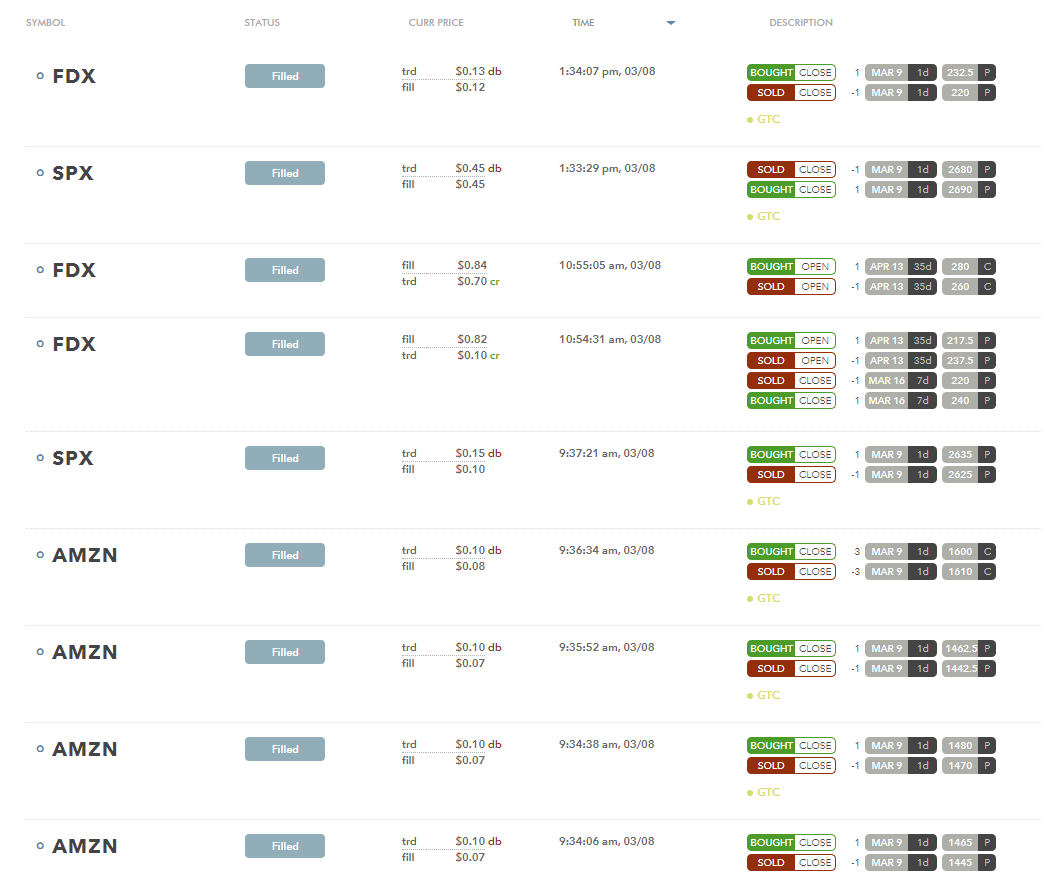

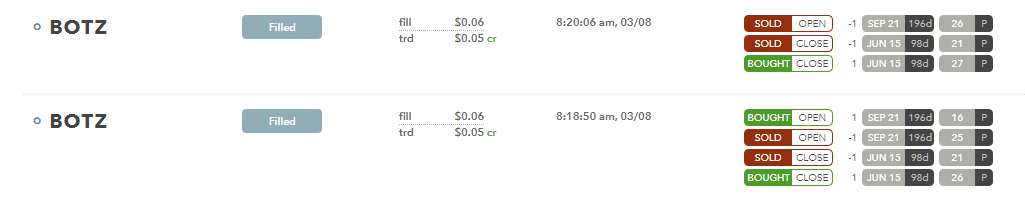

· Trading activity today

A summary of opening and closing trades.

(balance + $82.00)

· Dividend stocks to buy

Out of our watch list of 36 dividend stocks the following ones are a good buy at today’s prices (03/08/2018):

AGNC

AWK

CVX

HD

KMB

MCD

OXY

PG

XOM

Disclaimer: The list above is based on calculated fair value and 52wk high offset valuation. The values are subjective to our calculations and opinion and may differ from your own. If you decide to trade or buy these stocks, do so on your own risk and do your own homework. The list is not our recommendation to you.

· Market outlook

1) From the long term outlook the market is still bullish.

2) Trump’s tariffs are now behind us and they will no longer pose threat to this market short term.

3) We are still below 50 DMA which serves as a resistance and that may pose some short term difficulties.

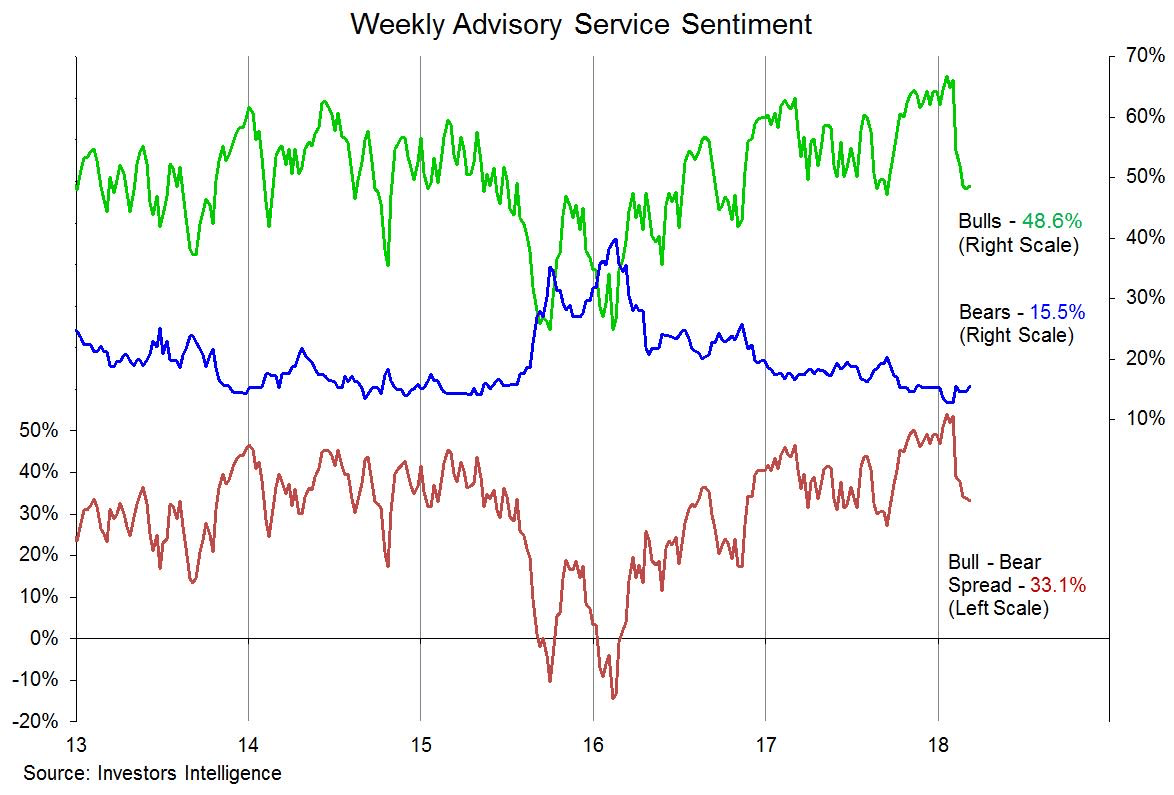

4) Investors’ sentiment is still very bullish (source AAII).

5) Based on historical market behavior I believe, this bull market has about 2 years in life ahead in front of us.

6) According to JPMorgan the Global Manufacturing Growth and PMI has been falling (economic slowdown) and they expect it to fall throughout 2018. That corresponds with my expectation of 2 years remaining in this bull before we see a serious bear market or deep correction. But, you know me. I do not have a crystal ball and this may be just a bias. Don’t bet a penny on this. This is not a prediction.

What do you think? Are we nearing the end of this bull market?

|

We all want to hear your opinion on the article above: No Comments |

As I mentioned many times before and it is a part of

As I mentioned many times before and it is a part of

Recent Comments