February 2017 trading went well. I opened a few very profitable trades which allowed me to close some “skeletons in the closet” mainly WYNN trades.

That meant taking a loss but I am happy about it because that helped me to reduce exposure in that stock and still be profitable.

Again, I expected $1,605 dollars income in February.

I am happy to see that we were able to make $2,213.10 dollars of option income.

· Options Trading Strategy

Over time since I learned trading options I went from trading spreads, single naked puts, later added naked calls and landed on trading strangles. Many people are afraid trading strangles. They do not know how to protect themselves when having naked calls trades. I was afraid too until I found out that it is not as dangerous as others say.

I am not saying that there is no risk, but if you know how to handle the risk, you will be able to navigate through strangles with no fear.

Over time I developed my own rules and strategy. You can review it in this section.

I trade primarily weekly strangles against dividend stocks. A strangle is a strategy where a trader sells OTM naked puts and OTM naked calls with the same expiration day. It is a neutral strategy, so you want the underlying stock to ideally stay between the two strikes.

It is though a manageable trade even when the stock is not staying in between the strikes. You can successfully trade strangles when the stock goes down in a decent decline or up in a decent upward move.

What hurts strangles a lot is a sudden strong (violent) move either direction. Managing strangles when the prices drops suddenly becomes a hard work. It is doable, but it can be frustrating.

Here are my rules for trading strangles:

- I trade aggressive strikes (one or two strikes near the money).

- I also trade strikes based on expected move for the given expiration day.

- I trade weeklys only (longer terms only when rolling and roll is not possible for the next week).

- A stock to trade must be a dividend stock (I want to get paid if I get assigned and have to hold the stock).

- A stock to trade must have weekly options (I do not want to give Mr. Market too much time to go against me).

- A margin requirement for a weekly strangle trade must be less than $1,000 dollars (I want the most bang for as little money as possible).

- A premium for a new weekly strangle trade must be 0.40 or $40 or more.

If you want to learn more about how I trade strangles, read my previous post about it.

With the rules set above I trade every week. Every Thursday, Friday, or Monday I open near the money strangle and as the stock moves one direction, I close the untouched side for 0.05 debit and roll the touched side down (if puts) or up (if calls).

Therefore, I am closing winners for profit and roll losers to avoid a loss.

By rolling, I try to improve the losing trade and make it a winner again.

Over the years I worked on my strategy to make it mechanical as much as possible to eliminate any emotions or second guessing.

I know what I want to trade, how I want to trade it, and when to trade it. And I do it every week. And I do always the same thing every week, same trade methodology, and same execution process.

This allows me to ignore any noise in the market and not tremble in fear “what if I open a trade and it goes against me”.

Are you Ready to Trade?

If you like results of our trading open yourself an account with OptionsHouse.com and start trading with a low commission rates + free virtual trading tool!

Your new trading account will come with a paper money account and will be immediately funded with $5,000 of virtual money for you to test the options trading and if you join our trading group on Facebook you can get a guidance, ideas, and trading education. Before you commit your real hard-earned money you can use the virtual account to test our strategies, learn, and ask all questions you need to learn options trading.

Once you learn and get ready, start trading live account and earn monthly income similar to ours. And we will be happy to assist you with that.

Seize the opportunity. Open a new OptionsHouse Account Today! Open and fund an OptionsHouse account to receive up to $1,000 worth of commissions on online trades for 60 days.

· Options Trading Results

As stated above our trading in January was really great and we made $2,213.10 dollars.

Below you can see all data and progress in our trading account:

Month-to-moth trading results

(The red dots on the chart indicate income estimate, blue bars actual earnings.)

| In February 2017 we made: |

48 trades |

| Total trades in 2017: |

94 trades |

| February 2017 options trading income: |

$2,213.10 (64.59%) |

| 2017 portfolio Net-Liq (net)*: |

$4,020.72 (-12.22%) |

| 2017 portfolio Net-Liq (gross)*: |

$24,520.72 (-2.90%) |

| 2017 portfolio Cash Value (net)*: |

$23,432.72 (-5.21%) |

| 2017 portfolio Cash Value (gross)*: |

$43,932.72 (-2.85%) |

| 2017 portfolio Equity (net)*: |

$31,984.72 (-4.81%) |

| 2017 portfolio Equity (gross)*: |

$52,484.72 (-2.99%) |

| 2017 Liability/Debt: |

$20,500.00 (0.00%) |

| 2017 overall trading account result: |

+23.40% |

* The numbers marked as “net” and “gross” are results with loan (liability) included (gross) or excluded (net).

We are presenting you our month-to-month business performance review:

Or February 2017 trading was successful and we made enough money to pay off the debt and grow our account.

· Options Trading March 2017 outlook

I am still optimistic as far as the entire market performance.

Recently, I have read a report originally provided by Gallup survey and published at Stansberry Research Report citing that currently HALF of Americans don’t own any stocks, at all and that global investors sit on $70 TRILLION dollars cash (source: Blackrock President, Rob Kapito, Reuters)

That is a lot of potential prop for the market.

Many investors and traders I follow became worried lately about the market. They say that the stock market has been rising for 8 years and they think it can’t run much higher.

They think it’s up over the last few months because of the “Trump Bump.” But this is not how bull markets end. Bull markets do not end when so much money is on the sidelines.

Bull markets end when everyone is invested… and there’s no one left to buy. And that’s precisely why they end… because with no one left to buy, prices have nowhere to go but down. (Stansberry Research Report)

When investors, currently sitting on a cash, start panic buying that would be the time to start being conservative and moving into cash. We are not yet there.

Nevertheless, our goal for March will be reducing exposure and increasing cash. I must admit that we are still over-invested and that means I am breaking the rules of trading small!

This can be seen on our open trades (Inventory) as we increased our inventory by $6,965.80 from January $34,444.90 to February $41,410.70. This had impact to our net-liq and overall performance since the trades (Amazon failed earnings play) are still on and they will end in six months. Until then they will impact our net-liq value.

However, we have a few trades which are about to end and they will help boosting our performance. Then we will stick strictly to our strategy as described above.

This is important for us as our account currently has a potential of trading for a living; if we could successfully reduce the exposure to our technically dead trades and could move the money to our current strategy.

Out of $44,000 dollar account (cash) we can trade only $15,000. The rest of the money is tied to bad trades we had to roll further away into long term expiration (bad trades in 2016 mostly against WYNN, LULU, and MNK which happened due to a mistake in our allowed trading calculations and I over-traded the account).

Our outlook for March income is however very conservative. I think, I will not be able to reach the goal income for March which is $1,717.35 dollars. I think we will be negative or around zero income in March. The reason is further unloading bad trades (WYNN) early in March and I do not plan on offsetting this loss. But we will see at the end of the month. There may be a good opportunity trade which I may take and offset all the loss.

Last thing I would like to add to this report is that I will posting our trades in this blog too. As of now, I was posting them in our Facebook group and to email subscribers only.

At the end I will then list a summary of those trades here in the report for your review. This will however happen in the March report.

What do you think about options trading?

We all want to hear your opinion on the article above:

No Comments |

No Comments

market commentary

Trumpfear

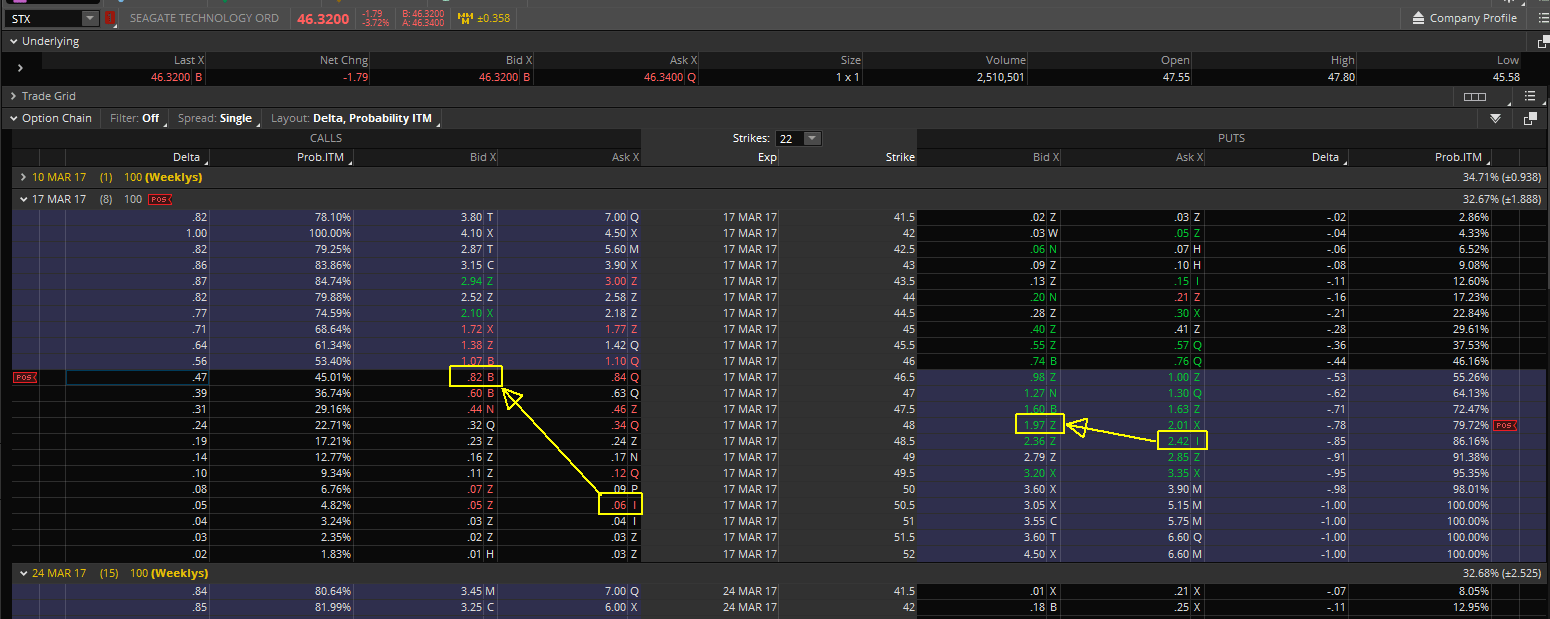

Lately, I was quite busy and actually not in a good mood, so I wasn’t publishing my trade adjustments against US Steel (X) and Seagate Technology (STX).

I was able to roll those trades quite successfully last week although both stocks were losing after a big selloff in Wall Street.

And tomorrow, it seems we will see yet another selling as fear returned back to the market. It was quite obvious to me that Trump is not going to win nor deliver any of his promises. He thinks it is a piece of cake to govern the country of 300 million people.

However, I was riding the optimism others were happily sharing.

Looks like, after Trump’s loss of repealing Obamacare the same people now are in fear that he might have the same issues to deliver his other promises.

Duh!

Unless Trump becomes a supreme and only rule of the United States, a sole dictator (who he for sure is and thanks God for the Constitution!) he has to negotiate. And although he makes things look like he is a winner, he actually is not.

He calls himself a great negotiator who masters an art of a deal, but a recent video I saw today following him since 1975 unto 1990 show that he actually was quite bad in making deals.

Watch for yourself and make your own judgment.

[fvplayer src=”https://hellosuckers.net/wp-content/uploads/movies/Donald Trump.mp4″ splash=”https://hellosuckers.net/wp-content/uploads/2017/12/” width=”450″]

So, the optimism seems to be gone for some time and we may see some selling coming.

It may be a good thing. I depends where you are and what your plans are. Mine are well defined. I trade options and invest into dividend stocks. With options I can trade both sides. But I trade strangles and large and violent moves are not very strangles friendly.

Yet last week I could roll my trades however, my put sides are still in the money and in danger. What danger? A danger of assignment. The deeper they get the greater danger of early assignment. If this continues, I will have to start enlarging my expiration time from weekly to two or three weeks. I will see next week. If selling takes over, it will be a sure thing.

As a dividend investor I actually welcome this selling. I will be reinvesting my dividends and buying more shares for less. What a gift!

I still look at my dividend investing from the next 25 years investing horizon perspective. And this selling, or even Trump rally is quite insignificant.

For some time I have been recording events in the S&P 500 chart. Just for curiosity. I do not do it to predict the market, I do not do it to look for reasons and excuses. I do it just as a time stamp. I want to look back and see how futile we investors and traders as a crowd sometimes are:

This “event recording” became my new pet. When I see all the talking heads predicting the disaster and it doesn’t happen I am laughing. And also when they are too optimistic, predicting new highs, market going to the moon and it crashes, I am also laughing.

Tomorrow we may see Trumpfear in the market.

I will be rolling my existing trades lower and manage them through the turmoils in my trading account. In my ROTH I will continue holding my dividend stocks and trade options (Iron Condors, cash secured puts, covered calls).

I wish you all success in coming week. Stay calm and do not panic. There is no reason for it. There never will be and never has.

Share this:

No Comments