January 2016 is over and it is time to report my trading and investing results. We are in a bear market and it may offer a great investing and trading opportunity although it may look scary at first.

Many will make the bear market look and speak of it as if it was the end of the world and end of stocks, stock market, and capitalism. No, it is not and it will not be. Even though it may feel gut wrenching you stay the course no matter what is happening around you.

You need to review and always have on mind your goal and strategy. As an investor I continue investing into dividend growth stocks, reinvesting dividends and building the wealth. I will do so even if the stock market tumbles, people panic, pundits saying the sky is falling, or all tumble is released. Why?

Because I invest into dividend growth stocks for the next 20 years. And a time horizon like this no crisis is big enough and no crisis lasts long enough to hurt me or my portfolio. In 2020 no one will remember a bear market in 2008 or 2016 no more than just a historical fact that it happened. Same as in 1929.

As a trader I still continue learning trading option spreads successfully to create a consistent income equal to dividends. I am not yet there and I am still losing money. But I take it as a tuition.

You may be interested in:

A New Year And A New Beginning By All About Interest with All About Interest

She said yes! My Wedding Proposal in New Orleans! By Alexander with Cash Flow Diaries

My New Year’s Resolution: Become A Better Investor By Mr. Groovy with Freedom Is Groovy

Extra Income Challenge Update By Tre with House of Tre

Trade Log By Mark with Success With Options

From Fishbone to FIRE: How We Plan to Achieve Our Goals By Garrett with Two Cup House!

January Dividend Update By Captain Dividends with Captain Dividend

· January 2016 trading results

My January trading didn’t start well. Once again I found myself overinvested and opened a few trades which turned against me and I had to close them for a loss. I made new rules at the beginning of the year. One rule was to no longer roll the trades but rather take a small loss than later take a large one.

Last year, I had trades where I could close a trade for $100 or $200 dollars loss. Yet rolling it I created a loss of $3,000 dollars. So no rolling of spreads anymore.

And again I didn’t keep my trades small and risked more than I could afford to lose. Greed is a good servant, but it is a bad master.

You may be interested in:

2015 Wrap-up and 2016 Goals By Income Surfer with Income Surfer

7 Tips to Help You (Actually) Achieve Your Entrepreneurial Goals This Year By BRETT SNODGRASS with BiggerPockets

HOW NOT TO SAVE By Penny with SHE PICKS UP PENNIES

Review of 2015 and Goals for 2016 By HAYLEY with Disease Called Debt

Trading Expectancy: A Formula for Consistent Profits By Tim with EMiniMind

6 Aspects of a Frugal Lifestyle – What It Means & How To Live It By Fehmeen K with Frugal Consumerism

I consider myself a novice in trading options and I have a lot to learn. Still I want to post my trades for others to see. I hope, one day it will help others to learn trading options as I believe it is a great tool to make money. I created a Facebook closed group. You can join and follow my trades in real time. I post the trades at the time of opening them.

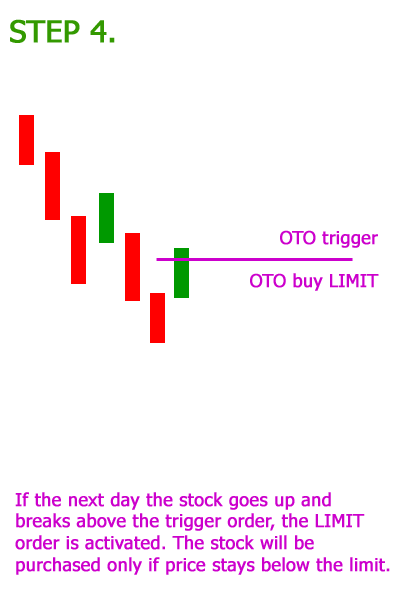

I am trading SPX put or call spreads or Iron Condor. I trade 5 dollar spreads as of now with maximum risk of $500. Due to losses I had to reduce my trading even more to preserve my capital. I will also try to sell rallies. When the market rallies up and then the rally stops and the market reverses, I will sell call spreads.

The same will be if the market falls and the selloff ends and the market reverses, I will be selling put spreads.

If the market moves in a range, I will be selling Iron Condors.

This is actually market timing. You probably have heard that timing of the market is impossible and futile. Well, sort of. I do not expect myself to be right and always catch the bottom or top. All I want to improve the probability of success. When selling call spreads, I want to sell when the market is as high as possible so it will be unlikely for it to go higher, but rather reverses and go down.

Same goes with puts. I want to be selling puts when the market is as low as possible so it will be unlikely for it to go lower and if it does go lower, it will not endanger my positions.

Trading options against SPX, is a hard work, frustration, and tears. One trader once said: “Trading options is the hardest way to make easy money.”

He was right.

Statistics say, 90% of new options traders get broke the first year. I hope I will be one of those who survive, learn this art, and become consistent winners.

Here is my trading result for the month:

| January 2016 options trading income: |

-$1,040.00 (-40.95%) |

| 2016 portfolio Net-Liq: |

$1,596.26 (-37.15%) |

| 2016 portfolio Cash Value: |

$1,791.26 (-32.14%) |

| 2016 overall trading account result: |

-8.63% |

Here are the results of my options trading:

(Click to enlarge)

Here are the results of my new options strategy:

(Click to enlarge)

Here is the entire account value from the beginning of tracking it up to today:

You may be interested in:

Walter Schloss investing strategy By Geblin with The dividendcollector

Money Glee Monday #3 – Investing 101 By Jef Miles with Money Glee

When Free Games Get Expensive By Emily Jividen with The John & Jane Doe Guide to Money & Investing

2015: The Year in Review By R Ann with Racing Towards Retirement

Position Sizing and Expectancy By Chris with Chrisperruna

Monthly Update: December 2015 By Dividend Dream with A Dividend Dream!

· January 2016 dividend investing results

My dividend investing continues slow pacing towards the goal. I created my tracking spreadsheet which finally reflects and tracks what I wanted to see in my portfolio. I can track the dividend yield and the growth of the entire portfolio.

(Click to enlarge)

Dividend stocks added or removed from portfolio:

| January 2016 dividend stock buys: |

none |

| January 2016 dividend stock sells: |

none |

Here is my Motif Investing account you can review:

I continue reinvesting my dividends using DRIP program. I love how my holdings grow when reinvesting the dividends and when the stock prices are going lower. As I believe we are heading into a recession I will be able buying more shares for a lot cheaper.

Dividend stocks DRIP:

| January 2016 DRIP: |

American Capital Agency Corp. (AGNC)

Realty Income Corporation (O)

PPL Corporation (PPL)

Prospect Capital Corporation (PSEC)

Reynolds American Inc. (RAI)

Vanguard Natural Resources, LLC (VNR)

|

Here are my ROTH IRA trading/investing results:

| January 2016 dividend income: |

$81.80 |

| January 2016 options income: |

$0.00 |

| 2016 portfolio value: |

$15,321.76 (1.20%) |

| 2016 overall dividend account result: |

1.20% |

My dividend income dropped in January due to dividend cuts of KMI and LGCY distribution suspension. Unfortunate but I am ready to deal with it. I wrote about my KMI decision as well as LGCY to keep those stocks. Selling them now would create a loss I am not willing to take.

Here my dividend income:

Here is the entire account value from the beginning of tracking it up to today:

You may be interested in:

teaching kids about finance By ambertreeleaves with AMBER TREE LEAVES

Farm Life Dreaming By Mr. Benny with Stuff That Pig Blog

New Year’s Resolutions: Pay Off Credit Card Debt By Femme Frugality with Femme Frugality

9 Ways To Become A More Consistent Trader By Femme Frugality with Investing With Options

Be Prepared for These Startling Price Increases in 2016 By Gary Weiner with Super Saving Tips

Dividend Income Update January 2016 By Keith Park with DivHut

Below is my dividend income review for the entire year:

My ROTH IRA dividend income breakdown per month and per company.

· All accounts

Besides trading and dividend accounts I also have 401k account, emergency savings account, etc., which I do not report in detail. You can review those accounts in my “All Accounts Value” table at the bottom of My Trades & Income page.

My accounts dropped from previous month and are losing -1.88% (down from previous month) for the year. This is however caused by the overall markets selloff and if a recession comes I expect those accounts going even lower. A temporary drawdown. No big deal.

Remember, if you like trading options and want to have trade ideas for free, join my Facebook closed group and follow my SPX trades in real time, comment, ask questions, and interact with other members.

What do you think?

How about your investing or trading results?

We all want to hear your opinion on the article above:

8 Comments |

Well, never don’t try this at home! As goes the famous disclaimer. If you do try you will end up broke and maybe even in prison for fraud.

Well, never don’t try this at home! As goes the famous disclaimer. If you do try you will end up broke and maybe even in prison for fraud.

Recent Comments