Account Net-Liq: $5,534.40

SPX value: 3,215.63

Shiller PE: 29.97

People keep screaming: “The market is overvalued!” Maybe. Investors use all sorts of metrics and formulas to calculate the valuation of the market. They use PE, Shiller PE, Buffett Indicator (typically a Wilshire 5000 Total market cap / GDP ratio) and according to all these metrics, the market is overvalued.

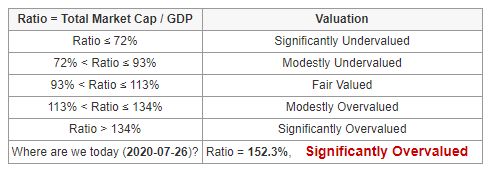

For example, whenever the “Buffett indicator” goes above 113% the market is considered overvalued, and with the current reading at 153% it is considered significantly overvalued:

With today’s ratio at 152.3% the market is significantly overvalued.

But, there are a few problems with all these metrics. First of all, they have no predictive value, so saying “the market is overvalued so I will wait for better valuation”, can cost you a lot of precious time and money. The market can stay overvalued for years or get even worse before it corrects itself.

Second, these metrics became obsolete the very first moment the FED started messing things up and got itself involved with fixing the economy and the stock market. The day, FED started pouring trillions of dollars into the economy and the market, the indexes got completely detached from reality.

When you look at the recent correction when the markets shed 40% of its value, it became just an insignificant blip on the market valuations. Compare the correction in 2000 – 2003 and 2008 – 2009 with 2020 on the chart below. You won’t even notice it!!

In fact, there is no blip!

That’s how ballooned the market is. Trillions of dollars in QE, FED’s bond-buying (and now even junk bonds purchasing), all that contributed to the market being where it is today.

So, what should you do?

In my opinion, definitely not waiting! People are selling their stocks, waiting aside, and speaking about the overvalued market. Many are just simply waiting for a better valuation. But, here is a problem.

When was the last time, this market was overvalued this high? It was in 2000, it was 20 years ago. It took almost 9 years for the market to get strongly undervalued. Back then, the market lost 70% of its value and you can clearly distinguish that value drop on the valuation chart. In March 2020 the market dropped 40% and it was a small blip that quickly recovered. And even that, people refused to buy in the market because the valuation was too high. With all that said, waiting may cost you 10 years or even 20 years of time waiting. And time, my friends, time, is what we do not have. Once we lose that time, we can never go back and fix our errors.

What you gonna do? Waiting can be extremely costly, investing now may be expensive.

The only way out of this situation I see feasible is to keep investing. Keep buying high-quality dividend growth stocks, or if you do not feel comfortable with individual stocks, keep accumulating ETFs. Buy index and sector funds, such as SPY, XLE, XLY, XLU, etc. There is a great website Deep value ETF accumulator which posts a set of ETFs and their valuations. You can keep buying those which are considered undervalued, or even in “crash” mode and keep investing and rotate to those undervalued ETFs. They post the charts every week, just follow those charts and keep buying.

Or, if you like individual stocks, as I do, pick the dividend aristocrats and start investing in them. Here is a set of stocks I like to accumulate:

But, hey, we just said, that the stock market is overvalued, in fact, extremely overvalued! And now, we should be buying these stocks?

Yes, we should be buying these stocks, but also monetize them. Keep buying these stocks until you reach 100 shares (in case you do not have enough money to buy 100 shares outright) and once you reach 100 shares, start selling covered calls. Lower your cost basis. Keep doing it every month. Keep a record of your initial cost basis and premiums you receive from the covered calls. If you buy a stock at $34 a share and you sell a covered call for 0.34 premium, your cost basis would go down to 33.66 a share. Repeat this every month. Collect dividends and premiums and keep track of your cost basis. One day, your cost basis will reach zero. And once your stock reaches zero, you own the stock for free. And in this case, who cares about market valuations? Nobody! I don’t! And if you happen to get assigned and your stock is called away, then start selling cash-secured puts and collect premiums. And keep track of those premiums because once you get assigned and you buy back 100 shares of your stock, the premiums you collected in the meantime can be counted against your cost basis again.

That is the only way, I see, as a feasible method of going around the high market valuations. The FED will stay and it will be involved in propping the markets and economy more and more. The old metrics will no longer work, new will develop. And you have to adapt to the new reality too. And yes, keep buying not only today when the market is high, but also when the market crashes (many missed that boat and now pray for another crash which may not come in the next 10+ years).

|

We all want to hear your opinion on the article above: 1 Comment |

Recent Comments