Many stock operators recently claimed that we are in a bearish market which will turn lower and retest the February lows before it turns up higher. Others were spooked of inflation claiming that it is a game changer and that the stock market is heading towards the long waited bear market. Some called for the market to close below 200 DMA in order to call the correction to be over.

And all together forgot about the state of current economy.

I do not want to sound like I know everything or a newly discovered stock market guru. Not at all. I am learning myself. And I try to be reading about the market a lot. Mostly about its history, historical sentiments, behaviors and how the markets performed in the past during similar correction.

This still can be dangerous as I saw many people claiming that this market is too similar to 1932, 1962, 1987, 2002, 2008… and who knows what else. But is it?

Again, everyone who is making comparisons with previous bear markets are comparing apples and oranges. And I wonder, is it just me who feel like an idiot telling everyone that they are comparing incomparable?

How can anyone, a bit sane, be comparing today’s market with booming economy, earnings up 16%, sales up over 6% year-over-year, historically low inflation and unprecedentedly low interest rates with an economy of 1987 which was already stagnating, we had high inflation, high interest rates, slowing earnings (some companies even showed losses)? Was the economy of 1986 – 1987 the same as today? Of course, it wasn’t!

We will ultimately get to the same state when the economy stops growing and our rates will be high, inflation high, earnings mediocre, and consumer spending stops. But we are not there yet!

If we see troubles I would expect them in 2019 but not this year.

If you look at every 10% correction in the past and look at what the market did next, you will see that it always rallied after the correction (except one exception).

In 2012 the market corrected 9.99% and never re-tested the 200 DMA, it took 3 months to create new ATH, and another almost a year before the market suffered another 10% correction.

In 2007 the market corrected 10.25% and never re-tested 200 DMA. It took about 2 months for the market to create new ATH. In November 2007 the market stumbled and turned into worst crisis since 1929. The signs of economic problems were already painted all over the place and saying that today we have the same economic problems as at the end of 2007 is ridiculous.

In 1998 the market sustained 19% correction (so not exactly what we are seeing today). It created a double bottom before it rallied up to new all time highs.

In 1997 the market corrected by 9.34%. It didn’t even reached 200 DMA, reversed and recovered sharply, creating new highs in about 3 months.

There are more examples of the same pattern further down in history. I was just lazy to look the all up and post them but you can do this search for yourself. You will most likely see the same results no matter what was the state of the US economy. The market recovered and created new all time highs before it either suffered a new correction or bear market.

Thus my expectation is that we will see another 1 to 3 months of recovery (plus/minus). Then we will see. But taking into account the booming economy I have a reason to believe that we will see more than 1 to 3 months.

· 50 DMA cleared

In my previous post I expressed my concerns that we may be in a short term bearish pattern since the market was below 50 DMA and it was not able to break up.

The market seemed to start creating a sideways pattern:

A previous day the market seemed to be in a descending triangle. As far as my limited and very poor knowledge of technical analysis goes I expected the market to break from the trianlge in the same direction as it entered into the triangle, which was up.

Today, we cleared both patterns:

And we also finished and closed above 50 DMA which clearly indicates that once spooked investors realized their spookiness and are again strong in buying into this market. The more investors who sold in panic down low will be coming back and buying back high.

We may see a small pullback to 50 DMA but we most likely continue higher as per my previous estimate based on a usual historical market behavior of 1 to 3 months recovery after 10% correction.

However, if you do your own research, market analysis, or chart studies like the ones above, you may come to different results. In fact, for every chart claiming one thing, someone else can come up with a hundred other charts saying otherwise.

In one of the Facebook groups a novice investor asked if it was feasible to set a goal and strategy to make 1% weekly revenue since he already studied all charts, back-tested all studies, and market. Really? Did he really studied all? ALL? And what makes one to believe and set a goal based on some, limited studies? I think it was not a feasible goal.

I am not saying that it is not possible to achieve such goal. It for sure is. But is it sustainable? In the long run? I don’t think so. It is not feasible to create a goal that from now on you will be making 1% per week because you have studied all indicators, charts, predictions, studies, or magical formulas.

Just by setting such a goal you put yourself mentally under large psychological pressure which will either push you to trade when you should not and making mistakes because back in your head you will feel like you have to trade.

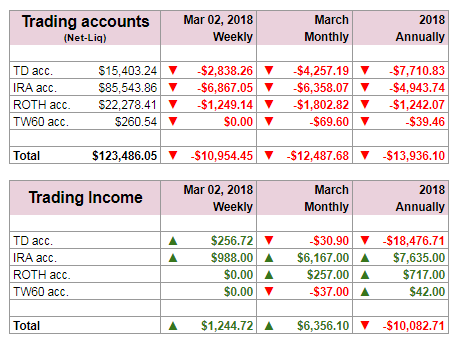

In February, this month, I just made over 5% (5.60% so far) and the month is not over yet but should I plan for it as my “feasible goal”? Not at all. Should I use this number as my goal for next month? Not at all.

I focus on protecting my money and trades so when I trade I have to make sure that I have enough cash to manage the trade should it turn against me and I need to adjust, and that I know what to do when the trade turns against me, what steps I need to take. So my trading is to stay in a comfort zone and I do not care how much money I make in the process.

Yes, I publish it for others to see and learn, but not as that was my goal.

And of course, in the past, I may have been saying different things, I am still learning and developing myself. It would be actually bad if I was staying rigidly in a wrong strategy and mistake. That’s why my trading account looked like a bum-and-bust account. I made tons of money and later lost them, then I made tons of money again, and lost them again. Not interested in such results. I want consistent result. Framing myself in an unsustainable goal is not my way and hopefully never will be. And I do not care if others take it or reject it.

If there is only 1,000,000.00 market participants you will be able to get 1,000,000 different results of analysis, expectations, and predictions. And if you can provide so many different explanations to a single event, how do you know which one is the right? Yours?

· Trading activity today

There is a market wisdom which says that if the Friday trading finishes up and strong, expect Monday market going higher. I followed S&P 500 futures and Asians markets to see what Monday morning trading would look like. And the market was set to open up.

So I opened a few bullish trades today. But the market lacked any move trading sideways. At some point it even looked like we may head lower. So I added a bearish trade. Expectations? Predictions? Analysis? All can be wrong and turn around at a dime. No even best and brilliant analysis in the entire world will not guarantee success.

And so, I had to roll my bearish trade.

Here is a summary of opening and closing trades.

(balance + $468.00)

We all want to hear your opinion on the article above:

No Comments |

As I mentioned many times before and it is a part of

As I mentioned many times before and it is a part of

Recent Comments