Earnings growth for the S&P 500 and Nasdaq 100 in 1Q 2018 have come in at +14.8% and +16.1% year-over-year, respectively.

And rattled investors are worried about inflation and interest rates. I wonder what they will do when the music really stops?

I guess they will crap not just their pants… maybe even die.

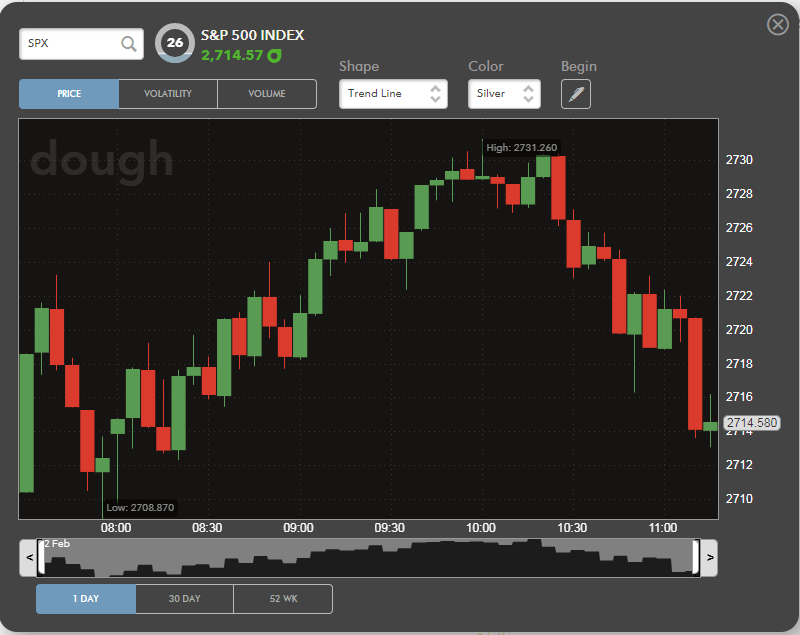

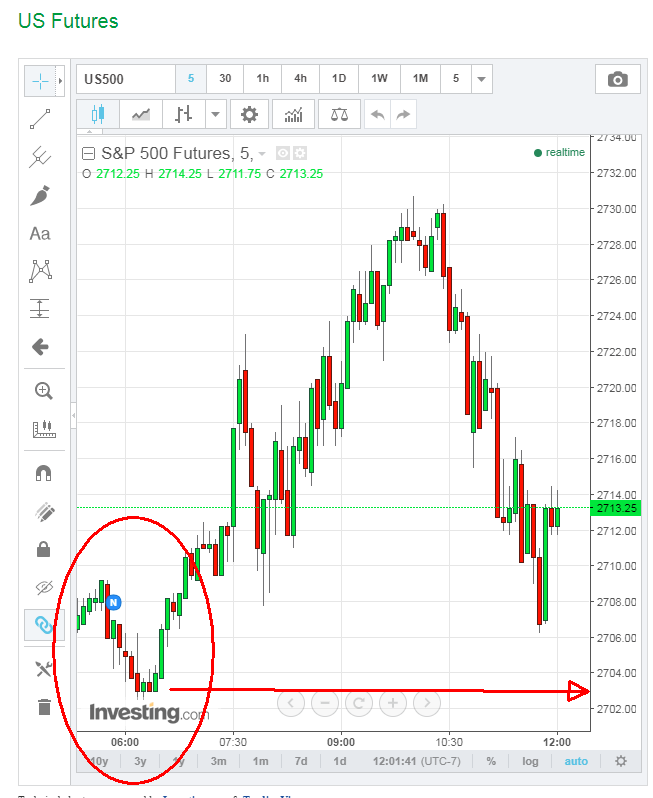

Today’s trading was really rocky. We were up 25 or 30 points, then FOMC meeting. And tanked on good economic outlook and rising interest rates. Did the world got mad already? In growing economy rising interest rates is bullish for the stocks. Yes, if you had high interest rates high inflation and faltering economy then you should be worried. Not now.

Yet it seems, investors, are forgetting it. If we have strengthening economy and the outlook for 2018 is about 15% growth (earnings) the interest rates and inflation is not an issue! What all this freaks expected? That FED would say, “well economy is great and expanding, so we will do nothing”? And let this economy overheat and hit the wall?

Yes, this bull market will end one day, this economy will cool down and we will enter a recession. But we are not there.

However, we saw a nice recovery from the lows so far and it seems, it is time to cool down a bit. We may see some pullback.

Today’s price action showed that this market has a lot of weakness. Although higher interest rates are historically bullish (in expanding economy) the so-called investors are rattled about it. There is a chance that we will see a pullback in this market. Still there is no reason for re-testing the lows.

All those predicting that the markets will crash again and retest February lows are wrong.

History shows that when markets rallied making 4% gains within 2 months, then made at least 1 new all time high within those two months, and then corrected, and wiped out all those gains in just 7 days then the markets usually recovered withing the next 1 to 3 months.

This process happened during December – January when markets rallied and provided 4% gains. They also created not 1 but several new all time highs in those two months and then wiped it all out in 7 days in early February correcting more than 10%. Historically, this was a bullish set up for the markets. In several past occurrences sine 1939 the market never continued lower (except during major reversals to bear markets, which we are not in a bear market at all). It always recovered. It was a bumpy road but it took in average 1 – 3 months for the market to recover the 10% correction and actually created new highs.

Only in 1 instance out of 16 (since 1950) the market re-tested the previous lows.

The strength of the market, economic growth and overall state of the US economy indicates that we will follow the same path and recover the losses from early February.

And again, if you follow me, you know that I do not predict the market, not even try to do so. I actually dismiss predictions and consider them futile wasting of time. However, I do try to identify patterns, repetitions, trends, and supports-resistances and then trade in accordance with them. However, I approach it knowing that it is my bias, my perception of the market, and that I may be completely wrong. So, putting on a trade with expectation of the recovery as per historical precedents, I still take it that such trade may turn to be a complete loser. Thus have a plan how to adjust a complete loser to a winner (or at least break even or small loss).

Let’s see how this plays out.

My outlook is still bullish and I still think that this market is heading up. Nevertheless, if my view is wrong, I am prepared to adjust my trades and ride it down.

· Trading of the day

Today, I opened a few trades which until after about 2:30 pm ET those trades were in a great shape to expire worthless. Then investors rattled themselves, crapped their pants over interest rates and 30 point gain in S&P 500 evaporated to a 14 point loss.

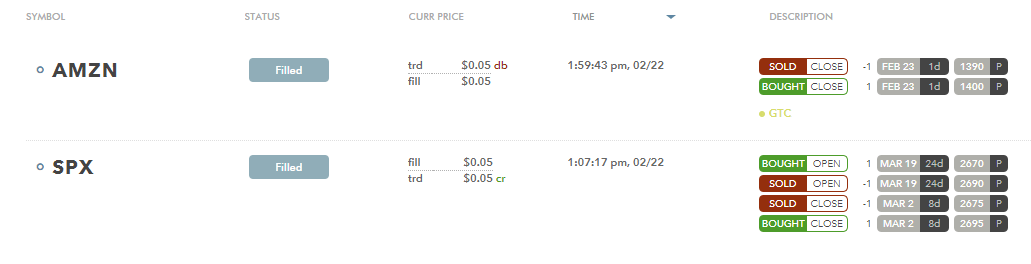

Most of my trades closed except one which I rolled to a 9 DTE expiration and down. Futures do not look good, however, it still may change. If not I will be rolling or converting into calls should this develop into more selling.

This still is a dip buying opportunity!

A summary of opening and closing trades.

(balance + $201.75)

Good luck!

We all want to hear your opinion on the article above:

No Comments |

Besides work, I try to do what Warren Buffett did and still does – read. So I read books about history, investing, trading, and trading psychology. And the trading psychology books are really revealing. It shows you how ignorant I was when I approached the markets in the first time.

Besides work, I try to do what Warren Buffett did and still does – read. So I read books about history, investing, trading, and trading psychology. And the trading psychology books are really revealing. It shows you how ignorant I was when I approached the markets in the first time.

Recent Comments