May 2017 is over and it is time to report how we did with our options trading.

My plan for April 2017 was to make $1,966.19 dollars of income.

This month we weren’t able to reach the goal as we received only $1,475.59 dollars of option income.

Overall, May 2017 showed us a stagnation in our trading account. We struggled to grow the account despite opening new trades as will be seen below. Our equity grew, our cash value grew, but our net-liq went down this month. Also our income lacked behind the plan.

· Options Trading Strategy

Over time since I learned trading options I went from trading spreads, single naked puts, later added naked calls and landed on trading strangles. Many people are afraid trading strangles. They do not know how to protect themselves when having naked calls trades. I was afraid too until I found out that it is not as dangerous as others say.

I am not saying that there is no risk, but if you know how to handle the risk, you will be able to navigate through strangles with no fear.

Over time I developed my own rules and strategy. You can review it in this section.

I trade primarily weekly strangles against dividend stocks. A strangle is a strategy where a trader sells OTM naked puts and OTM naked calls with the same expiration day. It is a neutral strategy, so you want the underlying stock to ideally stay between the two strikes.

It is though a manageable trade even when the stock is not staying in between the strikes. You can successfully trade strangles when the stock goes down in a decent decline or up in a decent upward move.

What hurts strangles a lot is a sudden strong (violent) move either direction. Managing strangles when the prices drops suddenly becomes a hard work. It is doable, but it can be frustrating.

Here are my rules for trading strangles:

- I trade aggressive strikes (one or two strikes near the money).

- I also trade strikes based on expected move for the given expiration day.

- I trade weeklys only (longer terms only when rolling and roll is not possible for the next week).

- A stock to trade must be a dividend stock (I want to get paid if I get assigned and have to hold the stock).

- A stock to trade must have weekly options (I do not want to give Mr. Market too much time to go against me).

- A margin requirement for a weekly strangle trade must be less than $1,000 dollars (I want the most bang for as little money as possible).

- A premium for a new weekly strangle trade must be 0.40 or $40 or more.

If you want to learn more about how I trade strangles, read my previous post about it.

With the rules set above I trade every week. Every Thursday, Friday, or Monday I open near the money strangle and as the stock moves one direction, I close the untouched side for 0.05 debit and roll the touched side down (if puts) or up (if calls).

Therefore, I am closing winners for profit and roll losers to avoid a loss.

By rolling, I try to improve the losing trade and make it a winner again.

Over the years I worked on my strategy to make it mechanical as much as possible to eliminate any emotions or second guessing.

I know what I want to trade, how I want to trade it, and when to trade it. And I do it every week. And I do always the same thing every week, same trade methodology, and same execution process.

This allows me to ignore any noise in the market and not tremble in fear “what if I open a trade and it goes against me”.

Are you Ready to Trade?

If you like results of our trading open yourself an account with OptionsHouse.com and start trading with a low commission rates + free virtual trading tool!

Your new trading account will come with a paper money account and will be immediately funded with $5,000 of virtual money for you to test the options trading and if you join our trading group on Facebook you can get a guidance, ideas, and trading education. Before you commit your real hard-earned money you can use the virtual account to test our strategies, learn, and ask all questions you need to learn options trading.

Once you learn and get ready, start trading live account and earn monthly income similar to ours. And we will be happy to assist you with that.

Seize the opportunity. Open a new OptionsHouse Account Today! Open and fund an OptionsHouse account to receive up to $1,000 worth of commissions on online trades for 60 days.

· Options Trading Results

Our trading in May 2017 disappointed as we struggled to grow the account and made only $1,475.59 dollars which was only 6.12% monthly revenue on invested capital (ROC).

Last year we could achieve 10% ROC or more. Our account average is at 9.45% ROC (better than in April) but still lacking to maintain the original growth.

However, we increased our investments by adding more new trades (we invested approx. 8.17% more of available cash this month) and our equity grew by 3.53%, this had no impact on our net-liq as the net liquidation value actually dropped by 2.63%.

We have a few trades ending soon and if Mr. Market stays calm in the next two months we should be able to close a few significant trades for a profit, such as our Amazon earnings play trade. This should have a positive impact on our net liquidation value and we should start seeing some growth again.

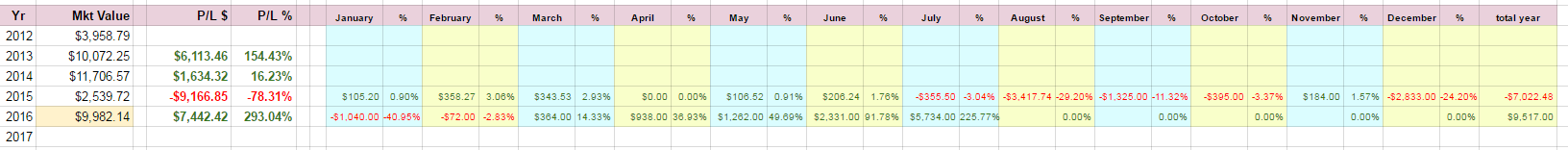

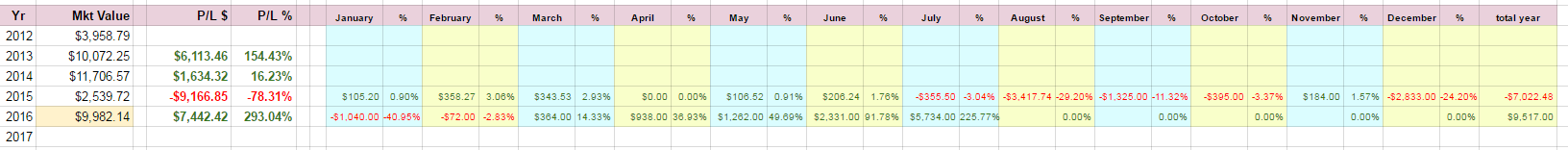

Below you can see all data and progress in our trading account:

Month-to-moth trading results

(The red dots on the chart indicate income estimate, blue bars actual earnings.)

| In May 2017 we made: |

27 trades |

| Total trades in 2017: |

207 trades |

| May 2017 options trading income: |

$1,475.59 (43.07%) |

| 2017 portfolio Net-Liq (net)*: |

$3,895.19 (-8.48%) |

| 2017 portfolio Net-Liq (gross)*: |

$24,104.72 (-2.63%) |

| 2017 portfolio Cash Value (net)*: |

$31,660.19 (7.34%) |

| 2017 portfolio Cash Value (gross)*: |

$51,869.72 (3.75%) |

| 2017 portfolio Equity (net)*: |

$35,913.19 (6.54%) |

| 2017 portfolio Equity (gross)*: |

$56,122.72 (3.53%) |

| 2017 Liability/Debt: |

$20,209.53 (-1.42%) |

| 2017 overall trading account result: |

18.46% |

* The numbers marked as “net” and “gross” are results with loan (liability) included (gross) or excluded (net).

We are presenting you our month-to-month business performance review:

In May we traded only a few trades, mostly roll overs of trades which didn’t go well.

That was the main reason behind our net liquidation value stagnation. Many bad trades being moved and rolled and running out of available cash to trade. However, we opened and maintaind the following trades:

Amazon (AMZN) was our earnings play we opened originally in February 2017. The play didn’t go as expected and the stock basically crashed. We opened only a bull put spread and when the stock smashed below both of our puts I decided to roll the trades rather that closing them for a full loss.

And I do not complain. It was a great trade and I still believe, this trade will end as a great winner. The best trade in 2017, in fact.

After I rolled the put spreads, I added calls converting the trade to an Iron Condor. This could have been a mistake as the stock recovered sharply and since then continued higher. I had to roll the entire Condor several times to keep the call side out of the money. In the end, I converted one call spread into a put spread so I do not have to do anything with it anymore.

I still have a second call spread which will give me a bigger headache in the near future and if the stock continues this impressive rally, I might do the same conversion as I did with the first trade.

Here is the trade review:

AMZN earnings play – TRADE OPEN

In May we opened two new strangles against Teck Reasources (TECK). It is quite cheap to trade this stock as the entire strangle requires only around $200 buying power. As long as it continues offering an interesting premium (and volatility) I plan on trading this stock.

In fact, I plan on creating a ladder using this stock and open strangles with expiration in every week.

Here are the trade reviews:

TECK strangle trade – TRADE OPEN

TECK strangle trade #2 – TRADE OPEN

We also have trades against STX, X, ESV, BMY, WYNN,LULU, and MNK which I haven’t reported regularly in this blog and I plan on doing so later as these trades end or I open new ones.

· Our Options Trading April 2017 rank

In April 2017 (last month) we ranked #1 in dividend/options income in Easy Dividend ranking chart run by Christopher (Chri) from Austria which was a great place to achieve and I am proud to reach such place.

It is because I do not expect ranking well for May.

I will be happy if we achieve a fifth or sixth place for May 2017. But the results for May are not yet available, so we have to wait.

You can review the Revenue Community chart in April 2017 – Community Edition results here.

· Options Trading June 2017 outlook

We expect the stock market to go higher in the next month as the US economy keeps improving. It may be a choppy move though as there are many expectations on Trump delivering his promises on tax cuts, for example, which may not happen. That may send the stocks down.

But as we could see in the recent past every selloff got immediately bought back as could be seen in the following chart:

I expect this trend to continue and I also expect the market showing some decent swings. And that’s what I like to see as it is what will make you money. And investors know that the economy is growing and they will be ready to buy in every move down.

As Robert Shiller himself mentioned that this market can go even higher. More than 50% higher. If so, we may see S&P 500 reaching 3,500 level in the future.

You can continue reading my outlook for the next market move in my previous post about our dividend investing results.

What do you think about options trading? Do you trade options to generate income as a main trading strategy or just a dividend income supplement? Tell us about your trading and results!

We all want to hear your opinion on the article above:

3 Comments |

Recent Comments