As stocks are on the verge of fall there are now stocks which are providing yet another great entry point in my opinion. Since I started investing into dividend growth stocks last year I love to see stocks of my interest falling down. They still pay the same dividend payout or even increased their dividend rate, but some investors dump those stocks because they think that those stocks are doomed just because they missed one quarter or their outlook for next period is weak.

When looking at human life what is 80 or so years compared to eternity? Nothing. A spit into an ocean. I have the same look at Wall Street’s obsession about evaluating stocks based on one quarter. What is one quarter compared to 30 years of your investing time frame? Nothing.

Of course, you shouldn’t ignore those stocks. Our investing strategy isn’t buy and forget. But in our case we will see the troubles coming well before the Wall Street gurus tell us based on their thinking of a missed quarter. We will see a stagnant dividend or even a dividend cut and many times before it really happens. If the company is still doing great, increases the dividend and other metrics point to a fat cash flow, so the dividend remains sustainable, there is no need to panic. There actually is a need for opening our wallets and buying.

I believe, there are now stocks in this category offering nice entry point for your 30 year long dividend accumulation journey. Here they are:

Kinder Morgan Partnership (KMP)

I love KMP. It pays nice dividend. It’s current yield is at 6.40% and the company paid the dividend and increased it in 16 consecutive years. Do you think this long dividend increase history will suddenly stop today? I doubt.

It is one of the largest master limited partnerships with a very large economic moat. It’s recent acquisitions and portfolio cultivation poised this stock to a steady growth and there is no sign of troubles in the horizon (correct me if I am wrong).

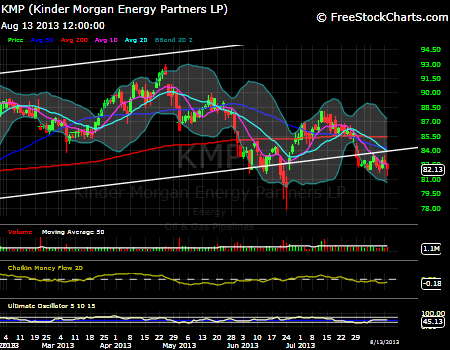

Let’s take a look at the chart:

The chart shows 6 months time frame. The white lower line indicates a 5 year long support trend. the stock broke below this support time several times in 2009, 2011, 2012 and twice this year (both shown on the chart). It always recovered and continued higher. The entire stock history since 1992 is even better and I wish I could buy this stock back then.

Anytime KMP falls below a certain level when the yield gets close to 6.5% or above it more buyers chasing nice YOC step in and start buying. With current yield we are close to this point.

Stock details

| Consecutive Dividend Increase: | 16 years |

| Dividend yield today: | 6.40% |

| Dividend 5yr Growth: | 6.68% |

| Dividend paid since: | 1992 |

Morningstar provides a fair value of this stock at $98 a share, so if that is something we can rely on, the stock is trading at a discount. An estimated growth rate is at 31.20%

Continue reading…

|

We all want to hear your opinion on the article above: 11 Comments |

Recent Comments