Trading Account:

New [tag]stock picks[/tag] this week:

Stocks bought or added to portfolio this week:

none

Stocks dropped from portfolio this week:

none

Stocks watched this week:

Ansys, Inc. (ANSS) Long

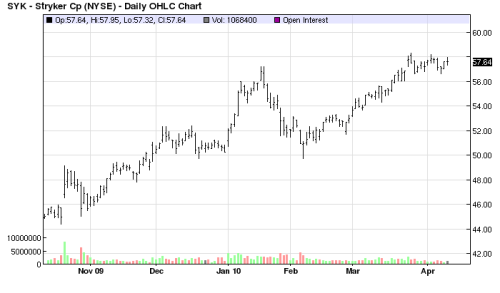

Stryker Corp. (SYK) Long

| Existing & new [tag]holdings[/tag]: |

| Symbol | Qty | Last | Gain($) | Gain(%) | Stop | ATR | Risk to stop (%) |

| [tag]DV[/tag] | 12 | 70.86 | 42.84 | 5.31 | 64.94 | 1.4800 | -3.49 |

| [tag]V[/tag] | 10 | 93.50 | 93.50 | 11.07 | 87.93 | 1.4800 | 4.06 |

Contribution this week: $0

Current [tag]capital exposure[/tag]: -5.78%

New positions available to open: 2

Starting [tag]account value[/tag] = $2,168.60

Account value = $2,253.91 (without margin)

Buying power = $5,732.33

[tag]Portfolio Gain/loss[/tag] this week = 3.93%

[tag]Portfolio[/tag] Gain/Loss for APRIL 2010 = 3.96%

Portfolio Gain/loss for 2010 = -14.36%

[tag]Annual Return[/tag] (CAGR): -22.00%

The stock market retreated at the end of the week and some commentators say we are ready for a correction. We have experienced a short decline in January this year and since then the market has rallied almost without any interruption, so maybe the following week we may see some pullback to 50 day MA. Who knows, we will see at the beginning of the next week.

Nevertheless I am still watching my two potential candidates Ansys, Inc (ANSS) and Stryker Corporation (SYK). Stryker is now in about a month long consolidation and may break up to new 52 week highs. The volume is slightly higher than average and the stock still offers a promising gain. I didn’t have time to evaluate Ansys yet but it shows great results to me so far. I’ll see this Sunday.

My existing holdings were doing well particularly DeVry (DV) increased in price driven by institutional buying, improving rating, increased income statements, increased students’ enrollment in 2Q 2010 and good looking outlook for upcoming quarters. The stock recently gapped up and now may retreat trying to close the gap or it may hold it’s current level as traders feel confident about this stock and believe it will hold. Nevertheless if the stock pulls back it will offer another opportunity to buy this stock. As log as the US unemployment rate will be as high as it is now this stock may perform well.

Visa (V) is a great stock and it may rise up to $180 price level over the time. It will greatly benefit on improving economy when people start buying more and more using their plastic and it won’t matter whether it will be a credit card or a debit one. Recently the company benefited with debit cards very well. However the stock is quite volatile partially because of misconceptions I could see among investors considering this company losing money because of high defaults. This company is not involved in lending and this risk keeps it intact. The greatest risk is in economy performance rather than credit crunch itself as we could see people shifting their card usage from credit to debit. With both types of cards Visa is making the same amount of cash. High fluctuation however presents investors with great opportunity to buy this stock or be adding to their positions.

However, since both stocks are considered as aggressive growth stocks with high uncertainty I am watching them closely and try moving my stop loss carefully not to get kicked out too early, but not to increase a potential loss (or reduce profits) by holding too long. So stop management is crucial here. I moved my stop loss orders higher today.

Lending Club:

| Debt notes |

| Available cash: | $0.00 |

| In Funding Notes: | $0.00 |

| Outstanding Principal: | $300.00 |

| Accrued Interest: | $2.16 | Account Total: | $302.16 |

| Contributions this week: | $0.00 |

| Weighted Average Rate: | 11.71% |

| Expected Monthly Payments: | $9.86 |

| Payments to Date: | $0.00 |

| Principal Payments: | $0.00 |

| Interest Payments: | $0.00 |

| Late Fees Received: | $0.00 |

ROTH IRA Account:

New [tag]stock picks[/tag] this week:

none

Existing & new [tag]holdings[/tag]:

| NTF Mutual Funds |

| Symbol | Qty | Last | Gain($) | Gain(%) | Div. Y(%) |

Port. (%) |

| AIGYX | 83.472 | 13.57 | 132.72 | 13.27 | 7.89 | 32 |

| ATIPX | 106.395 | 9.14 | 32.27 | 3.43 | 7.28 | 27 |

| HISIX | 26.918 | 7.31 | -3.23 | -1.62 | 4.56 | 5 |

| SICNX | 47.855 | 7.52 | 9.87 | 2.82 | 4.97 | 10 |

| SWDSX | 49.045 | 12.45 | 56.44 | 10.18 | 4.00 | 17 |

| SWLSX | 29.814 | 10.45 | 42.63 | 15.85 | 1.63 | 9 |

| Individual ETFs |

| Symbol | Qty | Last | Gain($) | Gain(%) | Div. Y(%) |

Portfolio (%) |

| AOD | 219.0 | 9.23 | 17.52 | 0.87 | 15.50 | 85 |

| IGD | 29.0 | 12.77 | 13.63 | 3.82 | 11.60 | 15 |

| Individual stocks |

| Symbol | Qty | Last | Gain($) | Gain(%) | Div. Y(%) |

Portfolio (%) |

| Account target and current allocation |

| Individual stocks | 0 | 42% | 0% |

| NTF Mutual funds | 3,583.97 | 38% | 57% |

| ETFs | 2,391.70 | 20% | 38% |

Contribution this week: $0

Starting [tag]account value[/tag] = $6,300.38

Account value = $6,276.84

Dividends received in April 2010 = $3.63

Dividends received in 2010 = $80.44

Portfolio dividends yield 2010 = 1.28%

Portfolio dividends yield lifetime = 2.62%

Dividends received lifetime = $164.56

[tag]Portfolio Gain/loss[/tag] this week = -0.37%

[tag]Portfolio[/tag] Gain/Loss for APRIL 2010 = 0.99%

Portfolio Gain/loss for 2010 = 4.78%

[tag]Annual Return[/tag] (CAGR): -2.29%

[tag]Portfolio Return[/tag] since inception: -7.35%

Are you interested in Reverse Scale Strategy and see how it works when implemented to even a small account?

Stay updated with Hello Suckers

|

We all want to hear your opinion on the article above: No Comments |

Recent Comments