There is a simple answer to this question, but I will make it a bit longer and complicated. It may be difficult for novice investors to engage in options trading, because from everywhere around us we keep hearing how dangerous options are.

Financial advisors of all sorts will tell you that options are very dangerous, you may lose money, it is a gamble, it is not for average investors, you shouldn’t trade options with your retirement money, and much more or similar nonsense.

Mostly, people who are discouraging you from trading options have never traded options. They are just playing their old scratched record they have been taught at their last seminar.

And brokers? Unfortunately they have to tell you that because the law forces them.

Trading options doesn’t mean jumping into complicated advanced strategies. A simple put selling strategy is enough to make you profits others will never believe you can make.

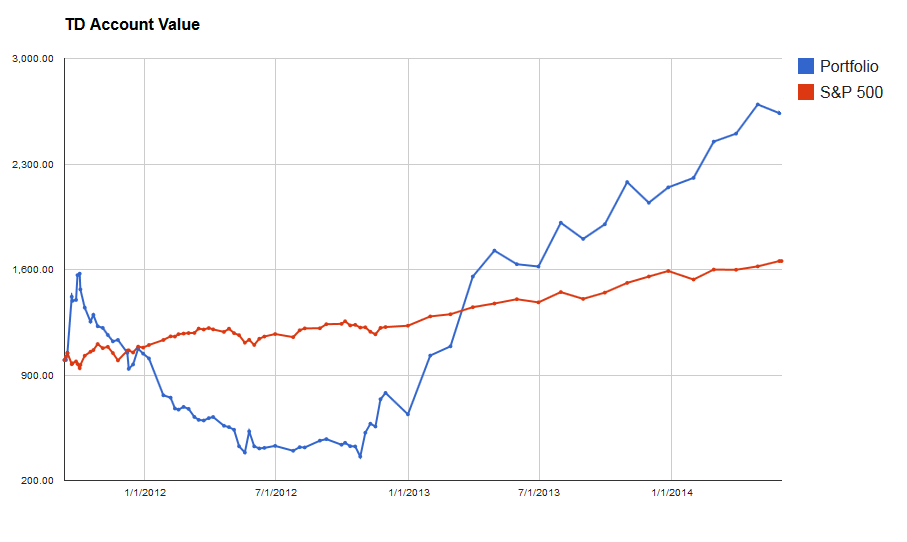

If I tell you that I have been making in average 45% profits annually in my last three years selling puts, you will not believe me and you will think about “too good to be true” thingy.

And yet it is possible to reach those numbers and without taking enormous risk with your money. One way to reduce the risk is trading options against stocks you want to own. And as a dividend investor, which stocks do you want to own?

(credit: Business Insider)

If you understand basics of options, how you can make money using them, you will find out, that trading options is very easy, simple and not risky at all. The best way to find out for yourself is to take a small trade and try it. If you do not want to commit your own cash trade in a paper money account first. I did it myself recently even after two years of trading I still use paper money account to practice trading. My small account doesn’t allow me trading as often as I wish, so for the rest of time I use paper money account.

Trading options, and in our case selling puts is all about an investor’s mindset. If you let your mind thinking how dangerous it is and never try even on your paper money account, you will miss a great opportunity of your life. I understand that it is not easy to get into a mindset of an option trader. I have been there myself. It is difficult at first when your understanding about options is limited. But do not worry, you do not have to make it complicated.

How to change your mindset to an option trader?

There are a few steps you can take and repeat yourself as long as you become comfortable with them. I did it myself a couple of years ago when looking at trades I would take.

A rule number one – sell puts against stocks you want to own – dividend stocks.

Rule number two – choose a strike price you are OK to pay for the stock in case you get assigned (when you will be forced to buy a stock)

Rule number three – if you have a small account and cannot afford more contracts than one, choose as long expiration as possible to collect at least 1.00 in premiums (before commissions). If you can afford more contracts you can choose shorter term (I like 56 days) and go with a smaller premium (for example 0.38 – see my latest trade of MSFT).

Rule number four – check the stocks supports and resistances, is the trend bullish? Will it last? Do you have a bullish or bearish expectations? If you are bullish, go ahead and sell the option. If you are bearish on that particular stock, go and choose another stock or wait for the bearish trend to finish and then sell the option.

Rule number five – sold your option? You collected a premium then. Never give it up! Defend it! Were you wrong on your assessment and stock went down? Do not worry, if the stock went ITM (in the money, meaning below strike) you have two options how to defend your premium:

- You do not want the stock yet – roll the option down.

- You do not want to bother with rolling options, take the stock.

Rule number six – never buy options. Always sell them. Have time decay on your side, not against you. You can buy options only as a part of a spread, or when you are really 100% sure that a certain stock will go down or up. But who is 100% sure today, right? People buy puts as protection, but even then you need to be 100% correct or you will lose all you paid for the option.

What you need to know?

First, you do not have to know anything about Greeks behind option prices, valuation, or movement. All you need to know is what option is and how you can use it. All other stuff is just a noise.

Second, you want a watch list of stocks you want to trade.

Third, you need a broker’s approval for trading options.

Fourth, you need a good platform. I like ThinkorSwim platform, but you can use any other platform

Fifth, you need cash for cash secured puts or margin approval for naked puts. I prefer naked puts as I can use other people’s money to trade. But with naked puts when using margin, be sure you have enough cash anyway to potentially cover your assignment. It would be unpleasant being put a stock and not having money to buy it. That’s when losses can become large.

So what is an option?

Since I am talking about puts, let’s take a look at puts. A put option is a right to buy or sell a stock at a certain price (strike) at a certain time (expiration).

Every option is a time sensitive instrument. That means that as it is getting closer to expiration, its value is becoming smaller and smaller as long as it gets to zero, but only, if the option is out of the money. And this is the main reason why I do not buy options, but sell them. When you sell an option you get paid. You receive a premium.

By selling a put option to a guy on the other side you sell him a right to sell you his stock at a certain price at the time of expiration (and sometimes even earlier). That means that if you sell a put option with $20 strike price and 3 months left to expiration, you are selling a right to a person on the other side of the trade to sell you his 100 shares for $20 a share three months from now. If the stock falls to $13 a share, you will have to buy 100 shares for $20 a share. For this inconvenience you will get paid. You will get paid a premium.

And here you may say: “ouch”, I do not want to buy a $13 stock for $20! It is a loss!! What a risk! I can lose money! The advisors were right! And you freak out.

This is a reason why I trade options (sell puts) against dividend growth stocks. Dividend growth stocks are mature companies and it is very unlikely that they would fall dramatically in price during market panic.

If they happen to fall during a sell off (like a few years ago JNJ dropped for no reason* to $56 a share) they tend to recover pretty quickly or if not quickly over a course of a few years (again check the chart of JNJ as it went from $56 all the way up to $100 a share).

* There actually was a reason. A few products of JNJ were recalled by a company and investors freaked out about it. It was a ridiculous sell off, which offered great opportunity to buy.

So if any of the panicked investors out there decides to give up their stock (use their right to exercise their option) and assigns you to a stock like JNJ, will you be mad? Will you consider it as a loss?

If your option gets in the money at expiration and you decide not to roll to a lower strike but accept the stock, you will be forced to buy at strike price minus premium a share. And you start collecting dividends!

When selling puts against dividend stocks, there are only two possible outputs:

- An option expires and you keep the premium.

- An option doesn’t expire worthless and you get assigned to a dividend paying stock, so it is a win-win situation, isn’t it?

There are options traders out there who are very successful and they trade options for a living. One of them is a self-made multi-millionaire Teddi Knight from Ontario in Canada. You can find information on her website fullyinformed.com

Have you ever heard about “Karen the Supertrader”? Karen is another self-made millionaire who learned trading options and made millions. She started with $100,000 account and turned it into $41 million in three years! And she is using a simple naked put & call selling strategy (unprotected iron condor – 1 short OTM call + 2 short OTM puts)

You can watch a video with Karen being interviewed by Tom Sosnoff in Tasty Trade:

Trader – Made $41 Million Profit in 3 Years Option Trading

Karen the Supertrader could do it. Of course, it took her circa 5 years before she found her strategy and mastered it and then another 3 years to turn her account into a fortune. She is now my role model trader. I will do all in my power to find out my own strategy to multiply my account the same way. Since I started with less money, it will take me longer. Now I must increase my account from current $18k to $100k and then to millions. In three years!

Tell me, do you trade options or consider trading it? Are you afraid to start? I was afraid as a hell, but as time went by I realized how easy it was. If you need any help, write me an email and I can help you with a trade set up and you can learn and start your own money making machine – collecting dividends and options premiums.

We all want to hear your opinion on the article above:

43 Comments |

Recent Comments