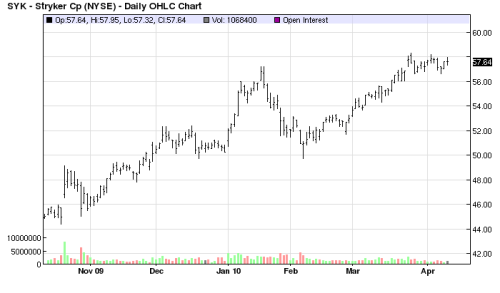

In my previous post I tried to describe how I evaluate stocks which I am going to buy. First I was looking at Stryker Corporation (SYK), but further evaluation disappointed me so I decided not to buy yet. The next stock I liked was Ansys (ANSS). My first criteria is that the stock must be in my screener list, then I look at the chart to see if the stock is trending. I look at 1 year chart, 3 year (or 2 year) chart and then to 5 year chart. If on both charts you can identify strong uptrends I then continue with evaluation or drop the stock and do not bother anymore. Ansys passed all these first screening criteria and now is time to take a look at fundamentals.

I want to buy an aggressive fundamentally strong companies which have great potential for doubling or tripling their value. However these stocks are naturally more volatile and sort of dangerous to trade. So a good money management with defined stop protection is crucial. To eliminate stocks which are just a pure pump & dump stocks I want to be sure that such a company is making money; that I am not looking at any sort of phantom stock with virtual value. The only way how I can be sure is to look at some fundamental numbers. I look at 14 financial ratios and key number and try to decide whether it is good or what I am looking for or not. It is not an easy job and I am not an expert in it, but at least I try and make sure I did all I could.

Also all those fundamentals I am reviewing do not guarantee that the stock will perform well or even exceeds all my expectations. But at least I know that the stock has a high probability to grow and I am more confident holding the stock during corrections.

First I take a look at 12 criteria to see whether to continue with others or not.

The very first ratio I look at is revenue. I think, there is no need to explain this. If the company is not making money, I do not bother buying it. I want to see the revenue growing every year, so I take a look at last three known years (if the last year is not known yet I compare last three known quarters):

| 2009 | 2008 | 2007 | ||

| Revenue | $516,885(t) | $478,339(t) | $385,340(t) | pass |

The stock passed. Every year the company increased its revenue.

Next I check its EPS. I want to see grow in every year:

| 2009 | 2008 | 2007 | ||

| EPS | 1.27 | 1.29 | 1.02 | fail |

EPS in 2009 was lower than in 2008, the stock didn’t pass.

Here are the next criteria I typically look at:

| 2009 | 2008 | 2007 | ||

| ROE | 9% | 9% | 13% | fail |

Analyst recommendation = should be buy or better. This stock fails. You may say that opinion of analysts may be irrelevant and they may be wrong. That’s true and they may be wrong, but 12 independent analyst ca create some consensus and today’s Wall Street is obsessed with analysts and every a bit piece of bad or good news may trigger a large move of the stock. I do not want to go against the crowd. I want the crowd to ride my profit.

Next number I look at is EPS surprise which has to be positive in every reported period. That means that the stock had to exceed analyst expectations. Those number are what provide fuel to the further growth of the stock. Ansys passes this criteria:

| Quarter End | Surprise % | |

| Dec 2009 | 8.38 | |

| Sep 2009 | 8.96 | |

| Jun 2009 | 18.78 | |

| Mar 2009 | 2.49 |

Next number I want to see is the EPS forecast and it should be positive and higher every following year. This company meets such criteria.

Then I check what is the EPS long term growth. It should be more than 10%. This company indicates 20%, so it exceeds my criteria twice.

Then I want to see how expensive the stock is, what premium I will pay by buying this stock. I check its PEG and it should be at 1 or less. This company doesn’t meet this criteria. It’s number at 1.87 exceeds my criteria. The expected 5 year trailing PEG is 1.27, so I assign “fail” to this criteria.

Next I check EPS growth of the stock with industry. The stock has a ratio 7.68% while the industry 16.04%, so the stock is not a leader in the industry.

Next criteria I look at is short interest. I want to know how long it would take to cover all short positions (assuming that I will trade the stock long). I want the coverage to be at 2 days or less. This number basically tells me how confident bulls are vs bears. The higher the number the more bears are selling the stock and it will most likely be falling in price. This stock has more than 5 days to cover, so it fails.

Next number I check is what insiders are doing. From the Form 4 I can see selling. Sometimes it doesn’t have to be as negative as it looks, but with this stock it may be a warning. This stock fails.

The last number I look at is Weighted Alpha. That tells me whether the stock price has growing or falling tendency over the time based on its current price and its movement. Ansys passes this criteria.

Overall this stock received 5 points out of 12 possible. That means I do not have to bother with further review because I am not satisfied with such results and I am not buying this stock.

If the stock ranked high (such as DeVry (DV) did recently) I would then calculate my risk, gain expectation, position size and look at the chart again to identify my entry point. But since I am not satisfied with the results of this stock I am not going to waste my time by reviewing it more.

The next stocks which were in my list and which I will review using the same approach are:

BIOS, PLCE, & CTSH (I will follow with this last one first, since it ranked really high). But I will write about it more later.

Happy trading.

|

We all want to hear your opinion on the article above: No Comments |

Recent Comments