March 2021 is almost over, we have three trading days left and the month can be closed in the books. It is Saturday, and time to provide our weekly investing and trading report. This week was slow and I thought it would end the entire month weak and with very little income compared to January and February. Yet, this month is about to end as one of the best. Our income exceeded $5,000 and we reinvested the income for future growth. And I am optimistic about the future growth despite the weak market and a lot of pessimism and crash expectations. If the market keeps being weak or even crashes, I have enough cash in reserves to be buying cheap stocks.

Here is our investing and trading report:

| Account Value: | $39,713.98 | +$5,685.13 | +16.71% |

| Options trading results | |||

| Options Premiums Received: | $2,707.00 | ||

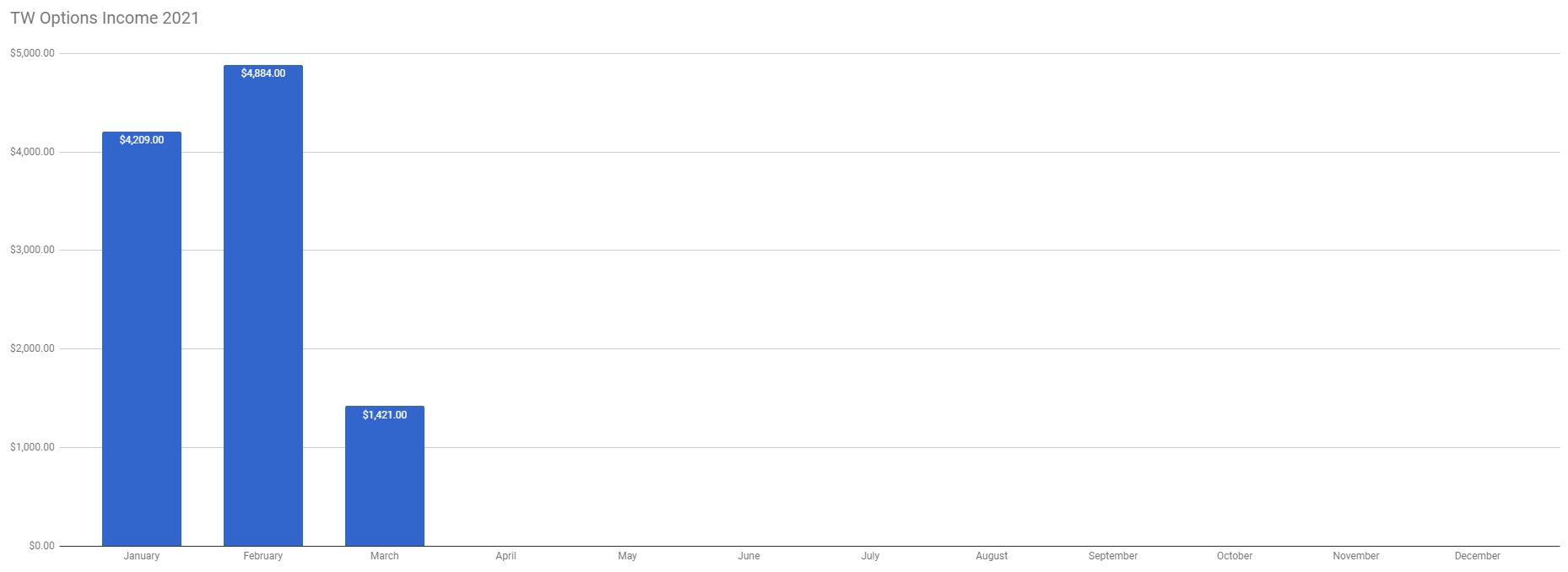

| 01 January 2021 Options: | $4,209.00 | +16.65% | |

| 02 February 2021 Options: | $4,884.00 | +15.41% | |

| 03 March 2021 Options: | $5,165.00 | +13.01% | |

| Options Premiums YTD: | $14,258.00 | +35.90% | |

| Dividend income results | |||

| Dividends Received: | $5.84 | ||

| 01 January 2021 Dividends: | $53.04 | ||

| 02 February 2021 Dividends: | $63.00 | ||

| 03 March 2021 Dividends: | $20.39 | ||

| Dividends YTD: | $136.43 | ||

| Portfolio metrics | |||

| Portfolio Yield: | 4.03% | ||

| Portfolio Dividend Growth: | 8.10% | ||

| Ann. Div Income & YOC in 10 yrs: | $5,771.29 | 14.88% | |

| Ann. Div Income & YOC in 20 yrs: | $41,732.60 | 107.59% | |

| Ann. Div Income & YOC in 25 yrs: | $169,690.73 | 437.47% | |

| Ann. Div Income & YOC in 30 yrs: | $1,048,060.01 | 2,701.97% | |

| Portfolio Alpha: | 28.43% | ||

| Portfolio Weighted Beta: | 0.72 | ||

| CAGR: | 759.68% | ||

| AROC: | 28.61% | ||

| TROC: | 27.60% | ||

| Our 2021 Goal | |||

| 2021 Dividend Goal: | $1,071.42 | 12.73% | |

| 2021 Portfolio Value Goal: | $42,344.06 | 93.79% |

The dividend growth and yield on cost growth are impressive over time. The numbers in the table above indicate how great passive income this portfolio will deliver in the next 20 years. And in the next 30 years, this portfolio will deliver over a million dollars annually in dividend income. That is a state of this portfolio as of today, given that we will do nothing from now on. But we will keep investing, accumulating, and monetizing our portfolio.

The future and the prospect of future dividend income are bright. Yet building such a portfolio is a slow and somewhat painful process. It takes time. If you look at the current dividend income, it looks pitiful and laughable. I just accumulated several positions such as AFL, QYLD, ASG, CHI and reached 100 shares in each of the companies; I also raised positions in Realty Income (O) and ABBV and all I have received is $20 bucks in dividends? What a joke!

Yes, it looks pitiful but the benefit of accumulating these great stocks didn’t yet come to fruition. All we need is to wait for the next dividend cycle to reap the juicy dividends. Dividend growth investing needs and takes time. It is not a quick-rich scheme. And many people these days are not willing to give their investments time. They want 1000% in a week returns. That’s why they invest in scams like bitcoin, or high-flying SPACs many of which will go belly up at some point in the future. Just look at NNDM. People were in frenzy buying the stock because ARKinvest was buying. The stock traded at almost $20 a share. Today, it is back down at $8.75 a share.

Last week, we received $2,707.00 in premiums trading options against our holdings. We opened new trades and accumulated new stock holdings to reach 100 shares of each. I am happy with our achievements this week. For the entire March 2021, we received $5,165.00 premiums. Our non-adjusted stock holdings market value increased from $33,327.00 to $41,602.80. All our income was reinvested.

Open trades

The table above shows all our open trades and expirations. It is just a simplified tracking and buying power reduction. Our goal is to trade a set amount of equity strangles in what I call perpetual strangle trading. It is nothing fancy. I just have a list of equities I like to trade options around them, I like to eventually own and I accumulate these stocks. Once a trade expires (or nears expiration) I re-open the trade or roll it into the next expiration (mostly trades that a stock is near the short strike and there is a risk of getting in the money).

We opened a few new trades that helped us to boost March 2021 premium income but it also significantly increased our buying power (BP) reduction. The BP reduction decreased from $27,393.00 to $36,124.40, a reduction of +$8,731.40 adding new trades. That represents an increase of 31.87%. This also helped to increase our net-liquidating value last week.

Investing and trading ROI

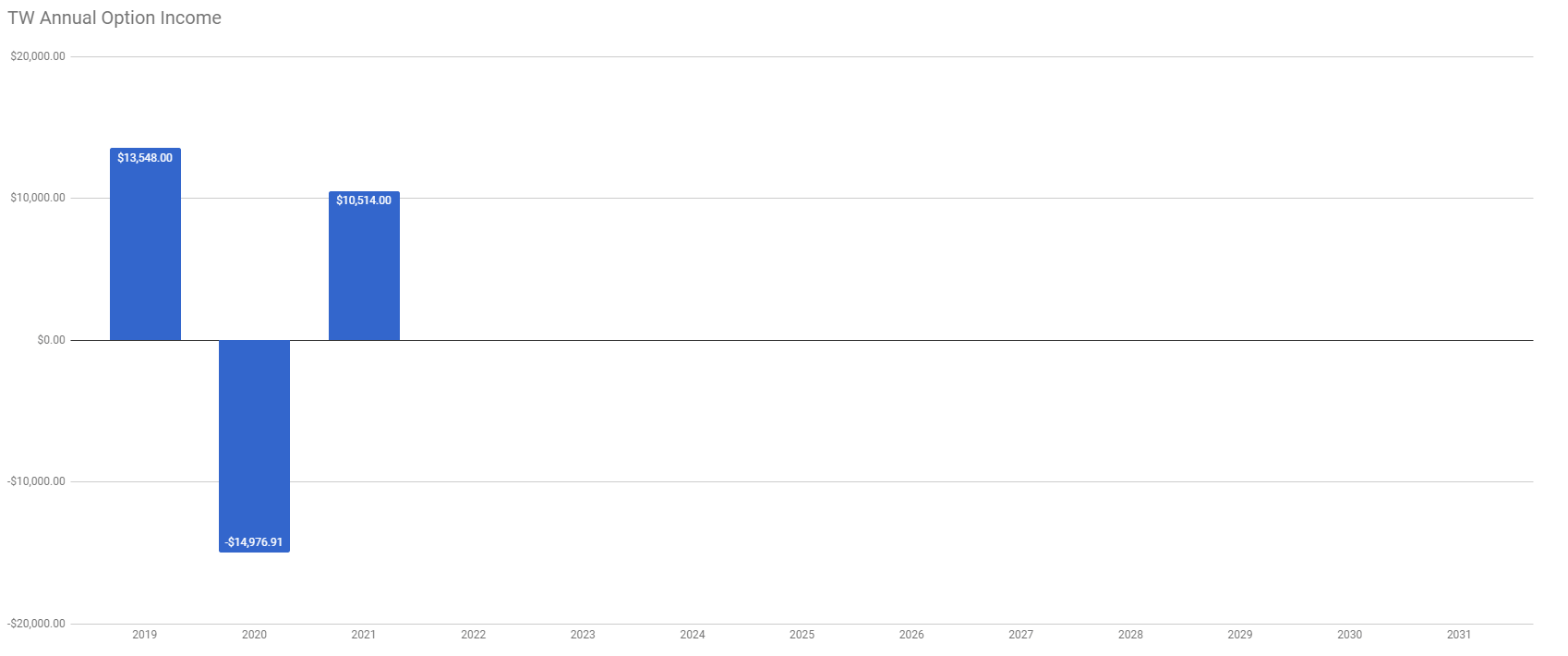

Our options trading delivered a 13.01% monthly ROI, totaling a 35.90% ROI.

Our account increased to 93.05% YTD growth. We are happy with this result because that means we are on the path of doubling our account in three months. Something nice to brag about on social media.

Our options trading averaged $4,752.67 per month this year. If this trend continues, we are on track to make $57,032.00 trading options in 2021.

We are still on track to complete goals in our portfolio. We made slight adjustments and we are providing our comments to our goals and tasks we set up in the week 6 report:

Old SPX trades repair

This week we have not done any adjustments to our old SPX trades. We are still sitting on those trades and waiting for the untouched side to close so we can roll the trades again. The goal will be to roll the trades until we will be able to close them for at least break even and release the buying power. We will keep doing this only if the resulting trade will be a credit trade or a very small debit. If adjusting these trades would require adding more new money, we would rather close these trades and move on.

Accumulating Growth Stocks

This week I took advantage of the weak stock market and selloff of the tech stocks. Many people panic and see the end of the world but I welcome this weakness. Last week, I twisted my arm and started buying Tesla (TSLA) and the more this stock shows weakness, the more I accumulate. I still feel a bit nervous about this stock but I also do a lot of reading about the company and I am more and more convinced that this stock is the sustainable long run. It resembles Amazon (AMZN) that was unprofitable for years because it was reinvesting all its revenue back to the company’s growth. TSLA seems to be doing the same and reinvesting their revenues to the new venues and new industries development. It will pay off one day.

I also kept accumulating Apple (AAPL) as the stock is displaying weakness. I despise this selling based on short-sighted predictions of the market participants who believe that the company will suffer next month. But I do not buy these companies for the next month’s time horizon. I buy because I want to hold that company for years to come. So when these predictors are in a heart attack-like panic and sell, I buy.

Accumulating Dividend Growth Stocks

Buying high-quality dividend stocks is our core strategy. And we will continue to do so and at a faster pace. A week ago, we started accumulating Aflac (AFL) stock to reach 100 shares. As of today, we finished that goal and own 100 shares.

We also added 100 shares of Calamos Convertible Opportunities and Income Fund (CHI) to our portfolio. This stock is not necessarily a dividend growth stock. It is a high-yield dividend closed-end fund that pays dividends monthly. We may remove the stock from our portfolio if it no longer follows our criteria.

We finished accumulating 100 shares of Global X NASDAQ 100 Covered Call ETF (QYLD) last week. This also is not a dividend growth stock. It is a high-yield dividend closed-end fund that pays dividends monthly. We may also remove the stock from our portfolio if it no longer follows our criteria.

We proceeded to accumulate Realty Income (O), Abbvie (ABBV), and AES Corporation (AES). We started accumulating AES earlier but reached only about 10 shares. We will now proceed to reach 100 shares.

Our goal is to not only reach 100 shares of high-quality dividend stocks but also create a weekly dividend income from these stocks All it takes to create a weekly dividend income is to buy 12 stocks to spread the income for every week. I created this dividend calendar and track the stocks I want to buy to get this goal done fast.

As you can see in the table above, we are reaching our goal of weekly dividend income as almost all weeks are filled with dividend income. All that is missing is February and March first week “slot” (and subsequent months) but others are already filled. April should deliver an income every week. After we add all weeks, we will start increasing shares so the income is larger and larger every week. Also, note that I have included holdings of 100 shares in this table only. So, for example, we own 15 shares of AAPL and therefore it is not yet included in this table although we will receive income next month.

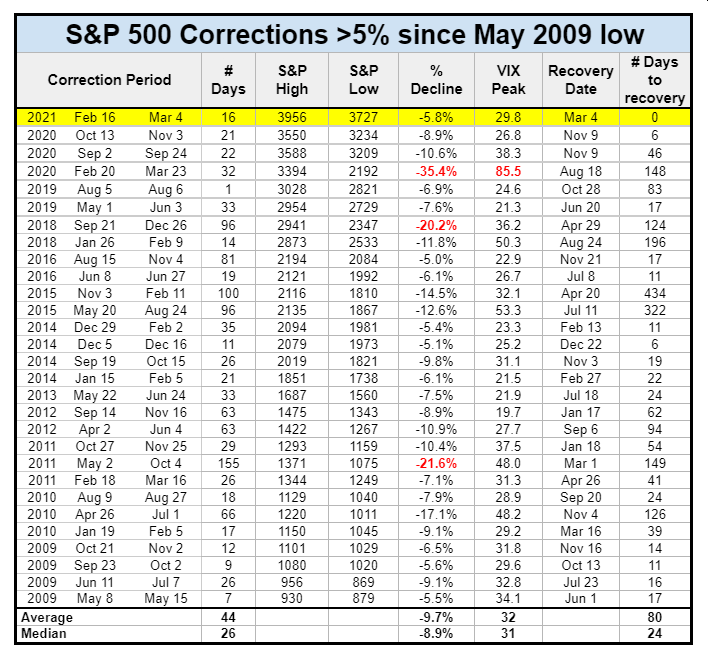

Market Outlook

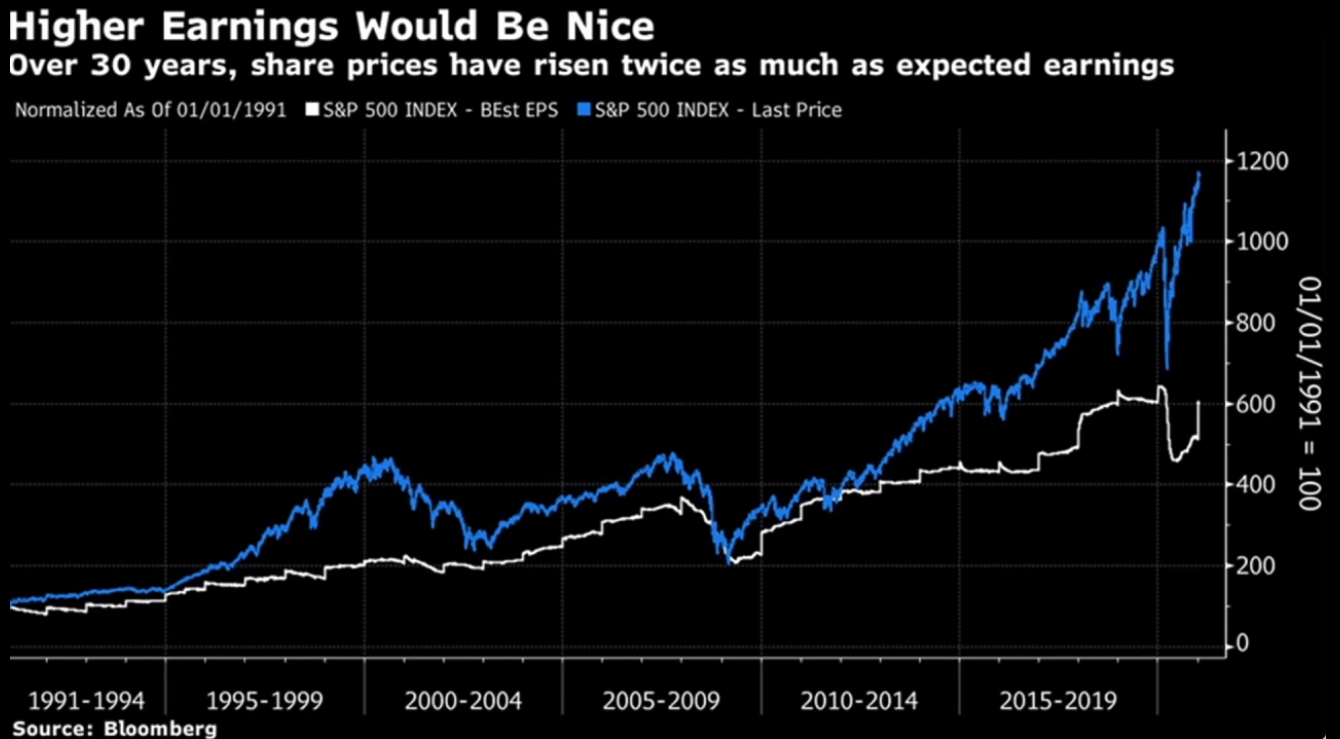

As I mentioned above, the stock market displays weakness. We reached ATH (all-time high) and then sold off more than 5%. We recovered that correction, reach the previous ATH, and sold off again although not that deep as before. Last Friday made the market a strong rally (which I believe will continue into the next week). But this behavior started to picturing nice, bullish patterns:

The market attempted to break the resistance three times. Normally, that is a good sign. The more often the market tries to break, the more likely it WILL break it. Despite people saying that we are on top and the market is about to crash, this is not the case. Reversals, do not work this way. There is a high chance now that the market breaks this resistance and moves higher. Will it happen next week? Possibly. If not, it still will be good for this market. Why?

The longer the market goes sideways, the better. In the last few years, we had a nice bullish run but no consolidation. We need to consolidate gains in order to call this bull market healthy. So in fact, I would prefer Friday’s rally to fail, turn down again, and drop back to $3720-ish level. The longer the market consolidates, the stronger the subsequent rally will be. We are in about a month-long consolidation now. That is good. If we break the resistance and confirm the breakout, expect a strong, month-long rally. Or similar. This is not an exact science.

We also formed a picture-perfect cup and handle pattern. Some say, this no longer works. Maybe. But there are still a lot of people who preach and trade CANSLIM strategy. This may spark their interest (unless they are all on Reddit chasing stocks like GME.

Trading options

We continue trading options around the stocks we own or plan to own. I call it monetizing our positions. It has a threefold benefit. It lowers our cost basis (at some point we will own all our shares for free), covers our call sides of each trade, and generates an additional income on top of the dividends. And that income is significant as you can see from our report at the top of this post.

We added a few new trades to our portfolio and we are close to having our trading “full”, or be fully invested. Once that happens, we will start adding multiple positions. As of now, we mostly trade one contract of strangles. We may start scaling up and start adding two contracts. I was also thinking of creating a put ladder. I tried to build the ladder a few times in the past, but mostly failed. One reason was that back then I didn’t have enough capital to do a ladder and also enough cash in reserves for adjustments or purchases of the underlying stock should the puts get assigned (if you do not have enough money, the losses can be catastrophic). We are in a very different situation today and we may start building a ladder.

One idea of a ladder can be using SPY LEAPS and selling in the money puts. This can be extremely profitable trading but also heavy in capital requirements:

As you can see, this trade would require $8,139.81 buying power. With approximately 30 expiration periods for SPY, this would require a free capital of $244,170 for buying power reduction (unless we reach the level when we can apply for portfolio margin and drop the capital requirements to approximately $40,695 and that is a lot more favorable. It is very intriguing.

Investing and trading report in charts

Our aggressive accumulation of dividend stocks, using proceeds from aggressive options trading (by “aggressive” I do not mean reckless, but using all available funds and be fully invested at all times), is delivering fruits. Our net liquidation value increased significantly this year. I expect this trend to continue.

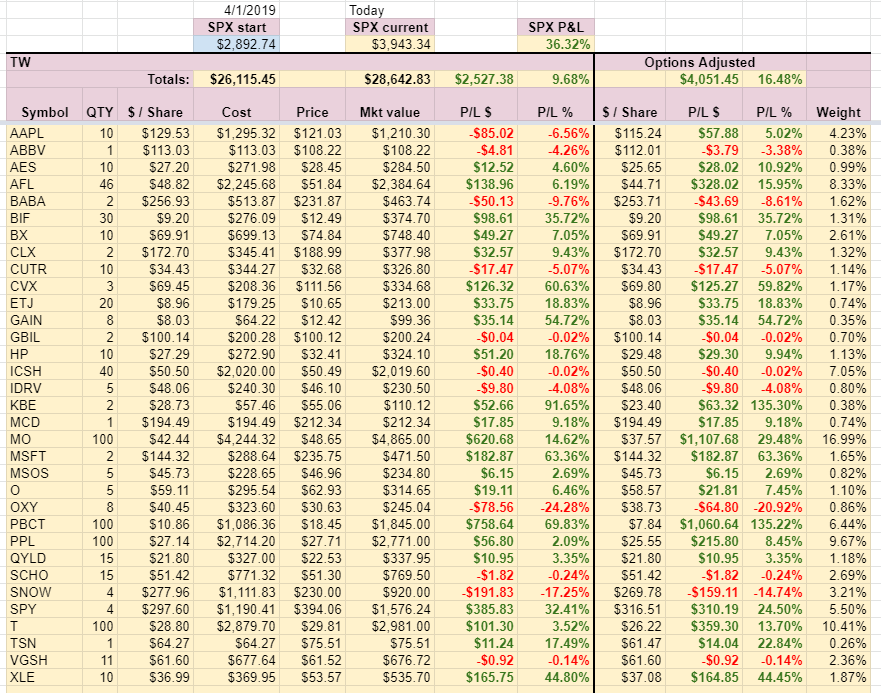

The table above shows our current holdings and gains on those holdings. Adjusted columns indicate how options help to boost (or ruin) our stock holdings appreciation, or in other words, lowering the cost basis. Without options, our holdings would be up 7.25%. With options, our holdings are up 13.23% (from inception on 4/1/2019). The SPX is up 37.40% since inception. Our stock holdings underperform the overall market since the inception of the fund (up only 13.23% on a cumulative basis). This week, our adjusted stock holdings underperformed the market. The market gained 7.55% YTD, our portfolio options-adjusted stock holdings grew by 6.25% YTD (note this includes stock holdings adjusted by options trading, not the entire portfolio).

The stock holdings growth dropped because we added many new positions and these positions didn’t have time to grow yet, so I expect the growth trend to improve over time and beat the market.

Conclusion of our investing and trading report

This week our options trading was great and we created a lot of income making March our best month so far. I expect some consolidation next week and light trading. I might be adjusting open trades only.

We will continue accumulating the dividend growth stocks in our portfolio to reach 100 shares. We will also replenish our cash reserves to bring them back to 25% of our current net-liq value.

We will report our next week’s results next Saturday. Until then, good luck and good trading!

|

We all want to hear your opinion on the article above: 1 Comment |

Recent Comments