In our group a trader asked me a question how many positions a trader can open when selling put or call options using margin.

Many investors and traders avoid trading on margin because they are afraid of it. Margin can be very helpful and boost your trading and results. It can also work against you. It can multiply your returns and it can ruin your account.

But with a proper money management, you can navigate your trading using margin and earn a lot more money.

In this post I will try to explain how margin works and what money management I use to make three times more money than if I traded cash secured.

Also this article applies to a Regulation T (or RegT) margin type and not portfolio margin.

I trade with TD Ameritrade and use TOS, so this post is tailored to TDA and TOS. If you use a different broker, you may want to verify terminology and requirements with your broker as these may differ.

· What Is Regulation T Margin?

I will not go into details describing this type of margin. You can google the term “Regulation T” and find tons of details.

In short, this type of margin is an extension of credit given to you by a broker. It is regulated by FED’s board and SEC. During crisis the board may increase margin requirements and thus decrease risk in the financial markets.

So if you get approved for margin trading, under RegT you will be allowed to trade 2:1 of your own money. It means that if you deposit $5,000 dollars of your own money then your broker will lend you the same amount and you will be able to trade $10,000 dollars in your account.

It is simple as that for stocks. But what about options?

Well, it differs.

· RegT Margin And Your Broker

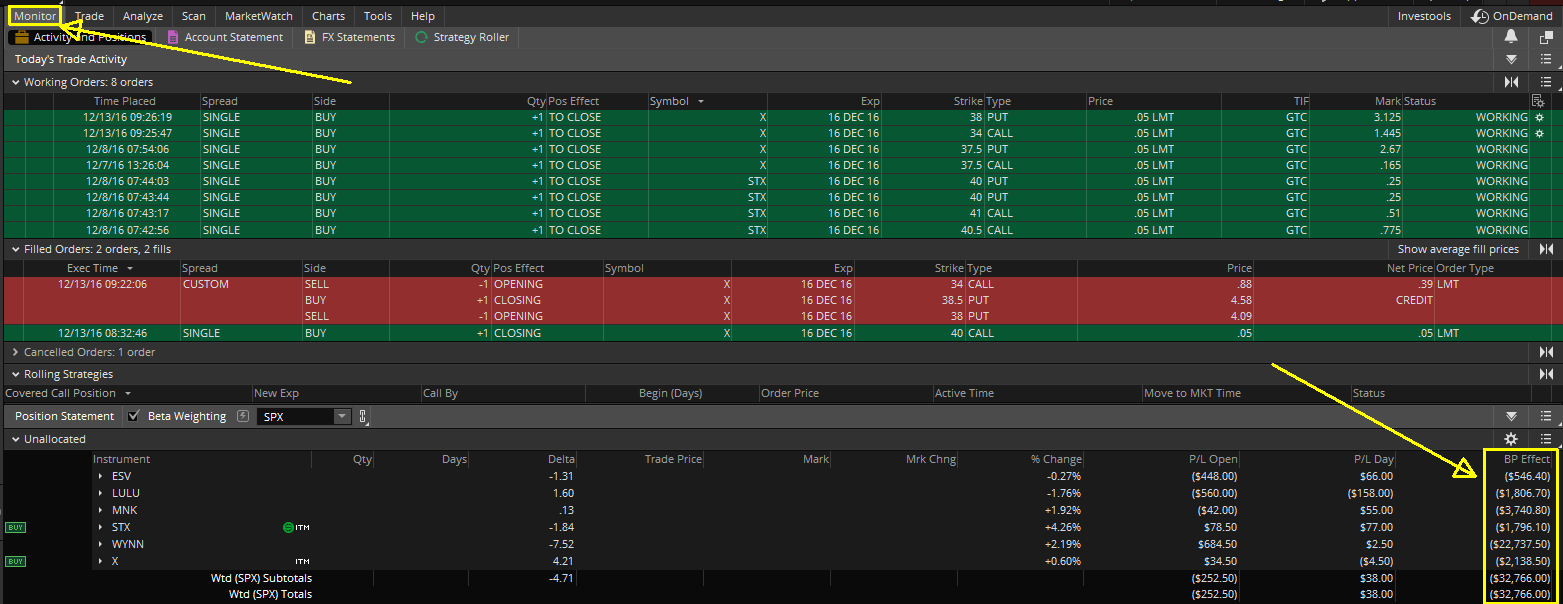

When you look at your broker’s platform, in our case TOS you may see the following:

On the picture above you can see that the Options buying power is $5,256.92 and the Stock buying power is $10,513.84.

The stock buying power is 2:1 but the options buying power is 1:1. Does it mean you cannot trade options on margin?

You can, but it is not that straight forward. Let’s review first the differences between cash secured and margin trading and get to the detail of how margin works with options.

· Margin Or Cash Secured?

Here is a difference between trading on margin and cash secured trading.

Cash secured

When you sell one contract of a cash secured put (CSP) with $38 strike price, you will be required to have the entire amount of money in your account in case you get assigned. If you get assigned, you will be forced to buy 100 shares of the stock at $38 a share no matter what it trades in open market. So you will need $3,800 in your account ($38 strike x 1 contract x 100 shares).

Margin

When you sell the same contract of naked put with $38 strike price and you will be assigned, you will be required to have only about 30% of the full requirement of $3,800 dollars. Therefore you will only need $1,140 dollars ($3,800 x 0.30 = $1,140).

With $10,000 dollars stock buying power you will be able to open 8 contracts! ($10,000 / $1,090 = 8.77 rounded down to 8).

If you collect 0.97 per contract or $97 dollars, with cash secured trading you make $97 dollars; with margin trading you make $776 dollars. Eight times more!

· Options Buying Power

From the trading platform picture above you could notice that the options buying power is the same as your original deposit. Are you then using margin? Yes, in some way you are.

To open the same contract as above you would need only about 16% to 20% of your options buying power. Here are the equations TDA uses to determine your margin requirement for options:

20% Rule

- 20% of the underlying, less the difference between the strike price and the stock price, plus the option value, multiplied by number of contracts.

Example:

We sell 1 put contract with 38 strike price and the stock is trading at 40 a share and collect 0.97 credit

20% x [$38.00 x (1×100)] = $760

($38-$40) x 100 = -$200

$0.97 x 100 = $97

Buying Power Requirement: $657 (760 – 200 + 97 = 657 x 1 contract)

10% Rule

- 10% of the exercise value plus premium value.

10% x [38 x (1×100)] = $380

$0.97 x 100 = $97

Buying Power Requirement: $477 (380 + 97) x 1 contract)

The broker then uses the equation which generates higher requirement. In this example, it will be the 20% rule and $657 margin requirement.

Most of the time the 20% rule will be used as in many cases it will generate a higher requirement. Also note that the calculations are estimates taken from the TDA options margin handbook and the actual results may differ. From my experience, the calculations above render higher numbers than what the broker will really use.

That is good for us though as it is safer for our trading.

· Let’s Put It All Together

Here is how our buying power will be changed if we use the above examples and we sell 1 put contract with 38 strike price and the stock is trading at 40 a share and collect 0.97 credit:

Original Options buying power: $5,256.92

Original Stock buying power: $10,513.84

Stock buying power requirements: $1,140 (approx. 30% of strike price x 30%)

Options buying power requirements: $657 (the higher requirement of the two equations)

New Options buying power: $4,599.92 ($5,256.92 – $657)

New Stock buying power: $9,373.84 ($10,513.84 – $1,140)

When trading in TOS the trading ticket will show you these numbers too, so you can verify what your buying power will be when you initiate a trade. Using the equations above in an Excel spreadsheet (or Google spreadsheet) you can watch your margin requirements during the entire life of your trade.

Note: our calculations returned a higher number than the broker’s one. Which is actually a good thing as in our money management strategy it will reduce our money available for trading more than if we use lower number and that is safer for us.

· Why Are People Afraid of Margin?

If it is so easy and you can make 8 times more money than if trading cash secured options why are some investors and traders afraid of using it? Why some do not touch margin even with a long stick?

Most of the time it is their ignorance and lack of management tailored for margin.

If, for example, you opened 8 contracts as we showed to you above to make $776 dollars instead of only $97 then I can 100% guarantee you that you will lose it and end up with a margin call.

Why? Because the margin requirements fluctuate.

If the stock goes against you, the margin requirements will be increasing, your buying power decreasing and once BP reaches zero, you have a margin call.

And once you have a margin call, you will be forced to add more money to your account or close your (now losing) positions to satisfy the call.

And that is what scares people the most.

But many people look at this margin call issue without understanding how the margin requirements react to the stock price.

If your initial margin requirement from our example above was $1,140 dollars, it will reach the cash secured level ($3,800) when the stock literally drops to zero. And how many times does this happen?

Understanding how many contracts a trader can open is crucial to keep your trading running and be safe.

I will show you now (finally, right?) my money management dealing with the margin to determine how many contracts I can open at one time and avoid margin call.

· Options Margin Money Management

Note that these rules should be flexible and you can bend them only if they improve your position and increase your security in regards to margin. If you bend these rules and dig a bigger hole under yourself, you will be punished by Mr. Market. That I can guarantee you. I have been there and done that.

And I must admit, I still make that mistake and over trade. Even recently. And I got punished for that arrogance of bending the rules.

The rule is actually very simple.

50% of the Options BP rule

If you follow my blog, you know I always advocated for trading no more than 50% of your available buying power. I usually settle for a smaller number of 40% or 45% of the options BP.

I adjust this number based on:

- The overall market value and its trend.

- Traded stock value and trend.

- My overall trading situation such as number of symbols traded, duration of the trade, rolling of the trades, etc.

Here are the rules for adjusting the percentage according to the above rules:

- If the overall market keeps running up strong and making all time new highs, I keep reducing the above percentage and go lower. I do the same with the stock and take it into account.

- If the market runs up, but the stock dropped on fear and sudden but temporary sell off, then I do not reduce the percentage. I even increase it but not above 50% max number

- If the market goes up strongly, the stock goes up strongly, then I start reducing the percentage all the way down to 25% of the option BP.

- If the market goes down, the stock rallies strongly, I also start reducing the percentage all the way down to 25%

- If the market drops down, the stock also drops down heavily, then I start increasing the BP percentage back up to 50% of overall options BP

For simplicity, let’s call this variable as “trade allowance ratio” (TAR).

Typical margin requirement of traded equity

The second part of the equation is your highest margin requirement you are about to be trading. For example, you decide to trade puts for three underlying shares STX, X, and ADM. I wouldn’t recommend more underlying at the same time than three to max four as they may overwhelm you. Again, speaking from my own experience. One symbol going viciously against you may derail you and you start making mistakes even with the other two or three symbols.

Then you check what the margin requirements for the three symbols would be. You can either calculate it as described above or use your trading platform.

Also you need to check the requirement for the expiration period you plan on trading. The shorter term you trade the higher margin requirement will be (although the equations above do not include the time value in it, but if you check your broker and for example STX stock, you will see that 10 DTE needs $684.30 margin but 30 DTE only 534.30 margin).

Checking the three stocks and 10 DTE (which currently I trade) I see the following requirements:

STX = $684.30

X = $555.50

ADM = $839.50

Now I take the largest number to insert into my equation. In this case, it would be $839.50; you can round it up to $850. Review this number regularly to make sure you still use the correct one.

Let’s call this variable a “trade allowance margin” (TAM).

Used margin + available margin

It is easy to calculate your available number of contracts if you are just starting, but what to do if you already have opened trades? Well, add together used margin and available margin.

Where do you find used margin?

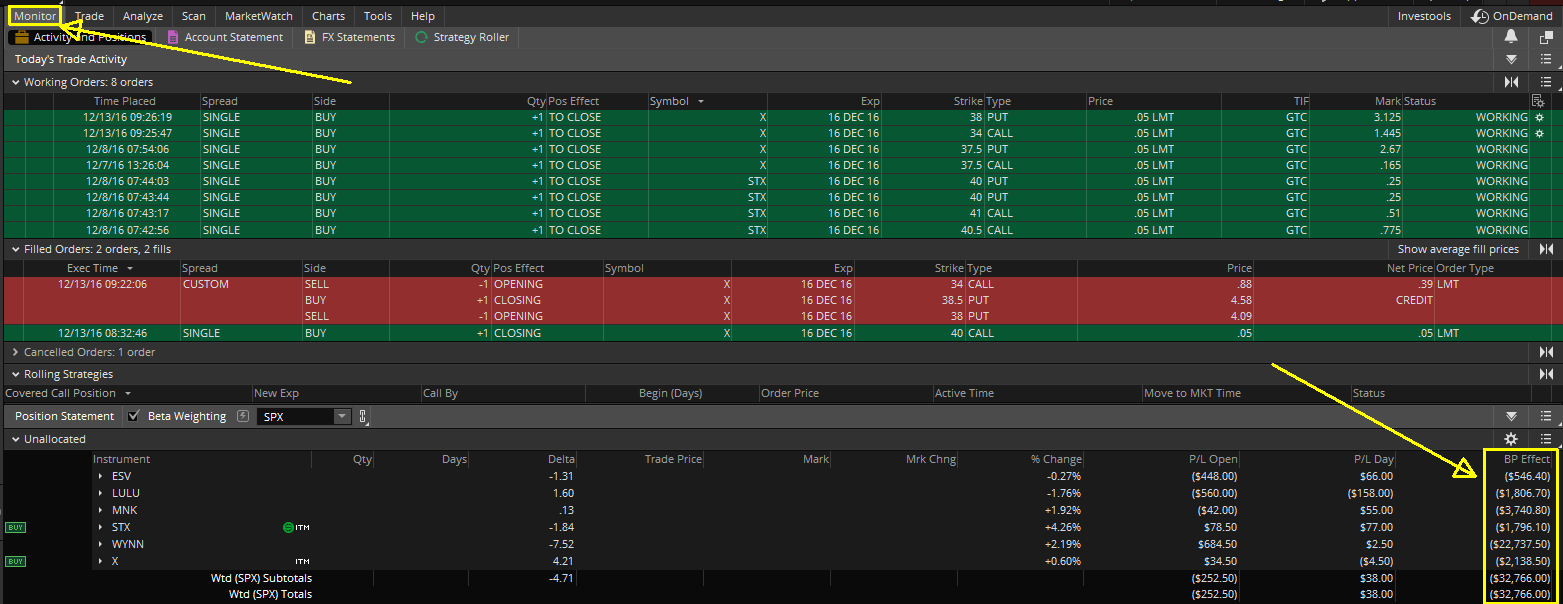

In TOS it is easy. Go to your TOS Monitor and on the bottom right corner you will find your used margin for each stock and total:

Now we have the total number from the platform and we also have all we need to calculate how many contracts to sell.

Equation

(Available BP + Used BP) * TAR / TAM = number of shares (rounded down)

If our available BP is $5,256, our used margin is $32,766, our TAR ratio set to 45% and TAM margin ratio $850 then we can trade 20 shares total at one time only:

(5256 + 32,766) * 0.45 / 850 = 20.12 or 20 contracts when rounded down.

· What’s Next?

The last step is to monitor how many contracts you have opened and compare it with your allowed number of contracts. If you are over, do not open any new contracts until you reduce your current exposure.

Always treat trade rolls as a new trade counted towards the entire number.

Check your used margin regularly. I do it every week and sometimes daily.

When you consume your number of allowed trades (contracts) never open a new trade (contract) until the old one closes.

Always check your total assignment value and compare it towards your stock margin (for example, if you have 5,000 account with 10,000 stock buying power and you calculate that you can open 2 contracts at 38 strike price, you will need $2,280 margin to get assigned (38 strike x 100 x 2 contracts x 0.30 = 2,280). With 10,000 stock margin you are more than safe.

This is how I do it. You may find other information out there and maybe it will be better than this. But this way worked for me well so far. The only problem I ever had in the past was when I broke these rules and traded more than allowed.

If you have any questions, you can post them below or join our Facebook group and ask question.

We all want to hear your opinion on the article above:

5 Comments |

I am also placing a new Iron Condor trade in my ROTH IRA account using

I am also placing a new Iron Condor trade in my ROTH IRA account using

Recent Comments