May 2021 is over and we can book it in our investing and trading report as history. It is amazing how fast this month passed. As expected, this month was our best month ever. We are closing our May 2021 options trading books with $6,346.00 income. I am happy with the results.

Announcement

The results and our trades are now relatively large and they require large capital to trade. Many of our trades are now demanding $3,000 to $4,000 of margin to trade them. That makes following our trades impractical for investors with small accounts. I had a few investors contacting me and asking me how can they trade those trades we post in our newsletter with their small accounts. I remember that I was in that same boat myself once.

Therefore, I decided to create a separate subscription showing how to grow a $100 account into $75,000 in 10 years (be conservative and realistic) starting with $100 and depositing $100 every month.

But this subscription will not be free. We plan to charge $15.00 a month to pay for the blog updates and plugins (that, unfortunately, are not free either; it can be more if we achieve the same or similar results as in this portfolio). Then we will guide you through the entire process of stock and options selection to trade small accounts and grow them into larger ones. Let us know in the comments below if you would be interested in this “course”.

Let’s go and review this week’s investing and trading.

Here is our investing and trading report:

| Account Value: |

$68,841.86 |

+$1,360.98 |

+2.02% |

| Options trading results |

| Options Premiums Received: |

$1,386.00 |

|

|

| 01 January 2021 Options: |

$4,209.00 |

+16.65% |

|

| 02 February 2021 Options: |

$4,884.00 |

+15.41% |

|

| 03 March 2021 Options: |

$5,258.00 |

+12.79% |

|

| 04 April 2021 Options: |

$2,336.00 |

+4.30% |

|

| 05 May 2021 Options: |

$6,346.00 |

+9.22% |

|

| Options Premiums YTD: |

$23,033.00 |

+33.46% |

|

| Dividend income results |

| Dividends Received: |

$0.00 |

|

|

| 01 January 2021 Dividends: |

$53.04 |

|

|

| 02 February 2021 Dividends: |

$63.00 |

|

|

| 03 March 2021 Dividends: |

$30.31 |

|

|

| 04 April 2021 Dividends: |

$139.70 |

|

|

| 05 May 2021 Dividends: |

$167.45 |

|

|

| Dividends YTD: |

$492.90 |

|

|

| Portfolio metrics |

| Portfolio Yield: |

4.73% |

|

|

| Portfolio Dividend Growth: |

8.47% |

|

|

| Ann. Div Income & YOC in 10 yrs: |

$14,023.53 |

19.95% |

|

| Ann. Div Income & YOC in 20 yrs: |

$136,328.21 |

193.96% |

|

| Ann. Div Income & YOC in 25 yrs: |

$715,025.21 |

1017.32% |

|

| Ann. Div Income & YOC in 30 yrs: |

$6,341,595.23 |

9,022.64% |

|

| Portfolio Alpha: |

24.93% |

|

|

| Portfolio Weighted Beta: |

0.83 |

|

|

| CAGR: |

836.76% |

|

|

| AROC: |

32.83% |

|

|

| TROC: |

21.93% |

|

|

| Our 2021 Goal |

| 2021 Dividend Goal: |

$1,071.42 |

46.00% |

|

| 2021 Portfolio Value Goal: |

$42,344.06 |

162.58% |

Accomplished |

Dividend Investing and Trading Report

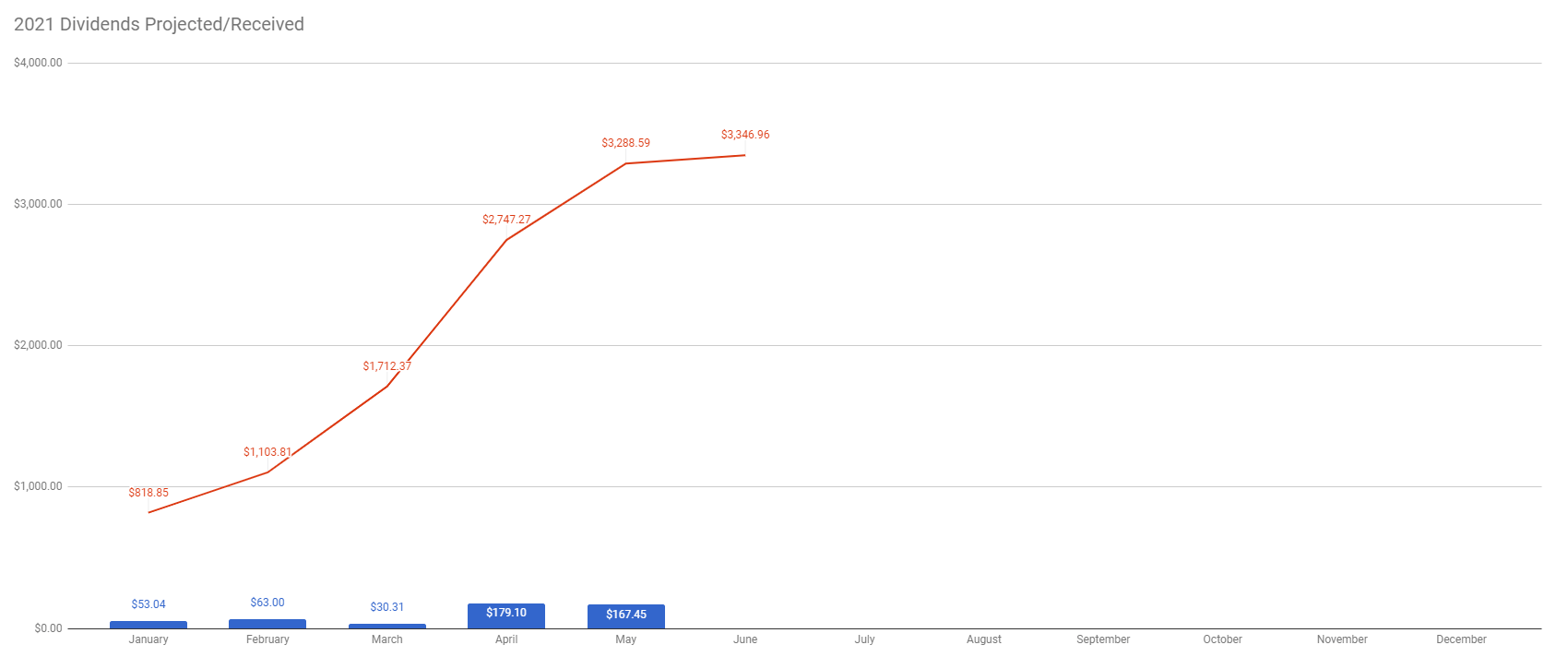

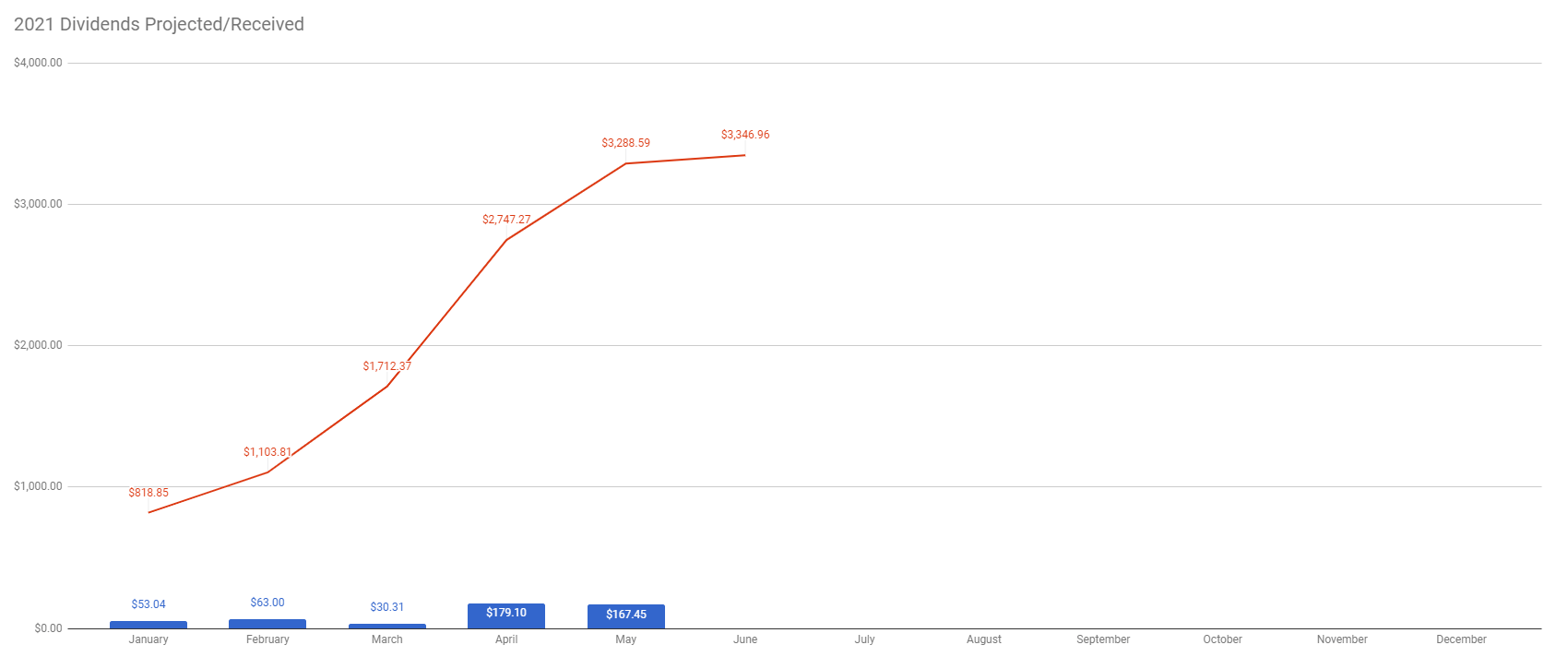

Last week, we have received no dividends capping May at $167.45 in dividend income. It was a bit disappointing to see no dividend income this week, but I still understand that our portfolio is in an accumulation phase and many stocks we purchased could not be eligible for dividends this month and we have to wait until the next payday period.

The chart below indicates our current annual dividend payout from our dividend stock holdings. A dividend growth investor needs to be aware of this payout from each stock. The chart indicates that some stocks contribute (or will be contributing to our income with large sums while others contribute very little. That can be a problem. If a company that contributes with large dividends suddenly cuts the dividend, it will have a very significant impact on our income (for example, if OMF cuts the dividend, or suspends it, the impact on our portfolio dividend income will be significant.

I am OK with this imbalance during the accumulation phase but plan to address it in the next phase of cultivating our portfolio. In other words, in the next phase, I will be accumulating stocks with lesser payout to match the stocks that pay more in dividends. If a company cuts the dividend, the impact of a lost income will be mitigated.

Last week, our dividend income reached 46.00% of our dividend income goal.

Options Investing and Trading Report

Last week we continued trading options against the stocks we either already own or plan to buy soon. We rolled or opened new short strangles against IJS, AAPL, SPCE, BA, AES, DKNG, O, OMF, WEN, ABBV, and APAM.

The new trades and adjustments delivered $1,386.00 options premiums last week. This concludes the entire month of May options income at $6,346.00 which became our best month ever since I started trading options in 2010.

You can watch all our trades in this spreadsheet and you can also subscribe to our newsletter for our trade alerts.

Investing and Trading Newsletter

We started (or better say re-started) our free newsletter. We will send to our subscribers a notification of our new trades when we open them, when we adjust them, and when we close them or let them expire. The newsletter will also explain the trade and our expectations. As of now, it is free but it will not be free forever. But all existing subscribers will be grandfathered and receiving the emails for free.

Expected Future Dividend Income

As the table at the beginning of this report indicates, our aggressive dividend growth stocks accumulation is starting to show significant progress in our future dividends income. Our portfolio dividend yield and dividend growth will be bringing us almost $136,328.21 in 20 years and $6,341,595.23 in 30 years. We will keep aggressively accumulating dividend growth stocks to generate liveable income sooner than in 20 years. And the portfolio is starting to show this to be happening.

Market value of our holdings

Our non-adjusted stock holdings market value increased from $70,601.91 to $74,857.07. We added to our positions to stocks such as SNOW, ABBV, and SPYG. We also kept buying an ISCH fund as “cash storage”.

Our goal is to accumulate 100 shares of each stock of our interest and we are getting to that goal. However, as mentioned above, this harms our dividend payout and portfolio growth. Although, it is temporary. Therefore, once we reach this goal (which we set because of the ability to trade covered calls), we will start accumulating these shares to equalize our dividend income rather than have an equal amount of shares.

Open trades

I decided to retire this spreadsheet as it became redundant and complicated to maintain. Now, you can follow more detailed trades in this spreadsheet.

Investing and trading ROI

Our options trading delivered a 9.22% monthly ROI in May 2021, totaling a 33.46% ROI YTD.

Our account grew by 234.63% this year.

Our options trading averaged $4,606.60 per month this year. If this trend continues, we are on track to make $55,279.20 trading options in 2021.

Old SPX trades repair

This week we have not done any adjustments to our old SPX trades. We are still sitting on those trades and waiting for the untouched side to close so we can roll the trades again. The goal will be to roll the trades until we will be able to close them for at least break even and release the buying power. We will keep doing this only if the resulting trade will be a credit trade or a very small debit. If adjusting these trades would require adding more new money, we would rather close these trades and move on.

Accumulating Growth Stocks

Last week, we took advantage of tech weakness and added 4 shares of SNOW. I am getting nervous about accumulating Tesla (TSLA) in our portfolio given all the buzz about this stock. On one hand, Michael Burry is shorting this stock (and he is a very good investor and stock picker no matter whether you hate him or love him, so he should be taken seriously), on the other hand, Tesla is seeing profits and the company is still a way progressed industry leader. So, I am mixed on this. I might be adding more shares, but I plan on adding shares on the way up rather than cost averaging.

We also added 10 shares of SPYG which is a cheaper growth alternative ETF to SPY. It provides us with exposure to growth stocks at a cheaper price than buying SPY. We also plan on accumulating SPGL for the same purpose.

Accumulating Dividend Growth Stocks

Last week, we added 10 shares of ABBV to our dividend growth portfolio as it is still our primary goal to accumulate these stocks.

Our goal is to reach 100 shares of high-quality dividend stocks and build a weekly dividend income as per this calendar:

You can see the entire spreadsheet here.

Market Outlook

I added the first standard deviation (1SD) to the market chart to see how the market could behave on a month-to-month basis (see dark blue dashed lines at $4288 and $4023 levels for June 2021 month. The standard deviation is calculated using ATM straddle prices, and this is typically done at the standard monthly expiration date (a third Friday of the month).

Calculate 1st Standard Deviation

The calculation as you can see on the chart below was done last week on Friday, May 21st, 2021. And here is how you can do it for yourself (note some brokers indicate 1 SD, but they may be using slightly different calculations to arrive at their numbers, I prefer using options as they are indicative of how the market is pricing the next move in).

Based on your time frame and outlook horizon, you choose when you want to calculate these levels. If you want to trade SPX day-to-day, you may choose to calculate these levels every week. My time frame is a bit longer so I use month-to-month calculation. Below, I will explain why.

Look at the closing price of the SPX on expiration day and go to the next expiration Friday options chain. For example, if today, May 28th, 2021 was the standard third Friday (monthly) expiration, I could see that the market closed at $4,204.11. That is close to $4,205 strikes. That is why I chose that strike price. If the market closed at $4,201.05 for example, I would choose $4,200 strikes.

And now, take the midpoint of puts and calls and add them together. In our example on the picture above, our put midpoint would be $48.25 ($48.00 and $48.50) and on the call side $47.30 ($47.00 and $47.60). Adding these two values together gives us a $95.55 value. That is our 1st Standard deviation. Then add this value to the closing price of $4,205.11 to get the call side and subtract that value to get the put side. In our example, our call side would be $4,205.11 + $95.55 = $4,300.66 and $4,205.11 – $95.55 = $4,109.56.

Once you arrive at your numbers, do not change them for your time frame horizon. Keep the numbers to see how the market is behaving within that range.

Why these calculations may matter?

How can these levels and market behavior help you to feel the market and position your trades?

First, you need to understand, how big players trade options. Big traders sell options. They do not buy them unless they use them for hedging. Only suckers buy options as a trading vehicle and hope to be profitable long term. I can guarantee you that if you are buying options as your main strategy, long term, you will lose money. The big funds sell them and they will be happily selling them to you.

But, these funds do not trade naked or unprotected (unlike me, the sucker). They hedge their trades. They do not hedge their trades with cash but they use a synthetic position to their original trade to neutralize the negative effect of the market move.

And when the market starts moving towards the 1 SD, these big boys start hedging their positions. For example, if the market starts moving towards the upper level, that means that their calls are getting in danger and they start hedging those calls by buying underlying shares. And, that buying will further fuel the market move to the upside. And the more it moves to the upside, the more shares they buy to hedge their calls, and the more shares they buy, the more the market moves up… you get the point.

50% probability of going down

Given the behavior of the market, moving close to the upper level, as you can see on the chart below, the market may move higher. Yet, there is still a lot of indecision and it is hard to say what this market wants to do. There is still a lot of weakness and I still think we will go down to the level marked on the chart below, possibly even lower. But the probability of it happening is lower than last week.

Long term (one or two months outlook) the stock market will most likely push to the $4,300 – $4,400 level (second half of July 2021) and then we may see some serious correction (15% to 25%) before the market resumes its uptrend. We are still in a very strong secular bull market, so do not expect any catastrophe or doomsday as talking heads and Perma-bears start crawling out of their holes.

This probability still coincides with Ned Davis Research S&P 500 cycle composite market behavior as I posted last week, indicating that we may be seeing a correction.

Investing and trading report in charts

Account Net-Liq

Account Stocks holding

The table above shows our current holdings and gains. The “Options Adjusted” columns indicate how options help to boost (or ruin) our stock holdings appreciation, or in other words, lowering the cost basis. Without options, our holdings would be up 6.50%. With options, our holdings are up 15.36% (from inception on 4/1/2019). The SPX is up 45.33% since inception.

Our options adjusted stock holdings underperform the overall market (up only 15.36% vs SPX 45.33%). On a YTD basis, the market gained 15.49% while our options-adjusted stock holdings grew 8.38%.

Account Growth YTD

The stock holdings growth slowed down because we added many new stock positions and these positions didn’t have time to grow yet, so I expect the growth trend to improve over time and beat the market.

Our accounts are higher since 2017

This is something to celebrate. I started investing and trading stocks in 2006 (well, overall in 1996 but after I lost all my money (not knowing what I was doing), I stopped for a while and re-started in 2006) and I started trading options in 2010. I also started tracking all my financial accounts in 2013.

It was a long path towards success. A lot of mistakes (costly) and struggle. My accounts were zig-zagging in value providing no steady growth or income. In some of the accounts, I still pay for the consequences of my past reckless trading.

That being said, please, do not repeat my mistakes. Do not trade recklessly high-flying tips from Youtube, Reddit, or similar pump and dump social media. There will be people who will make money and they will be bragging about it very loudly (and selling their holy grail). But most people will lose money.

Yet, in 2017 I managed to grow our family accounts and this business account to the highest level I could ever dream of. Of course, just to lose it in the following years. In 2021, I finally recovered all my previous losses and managed to get higher. I am kinda proud.

Investing and Trading Report – Options Monthly Income

Investing and Trading Report – Options Annual Income

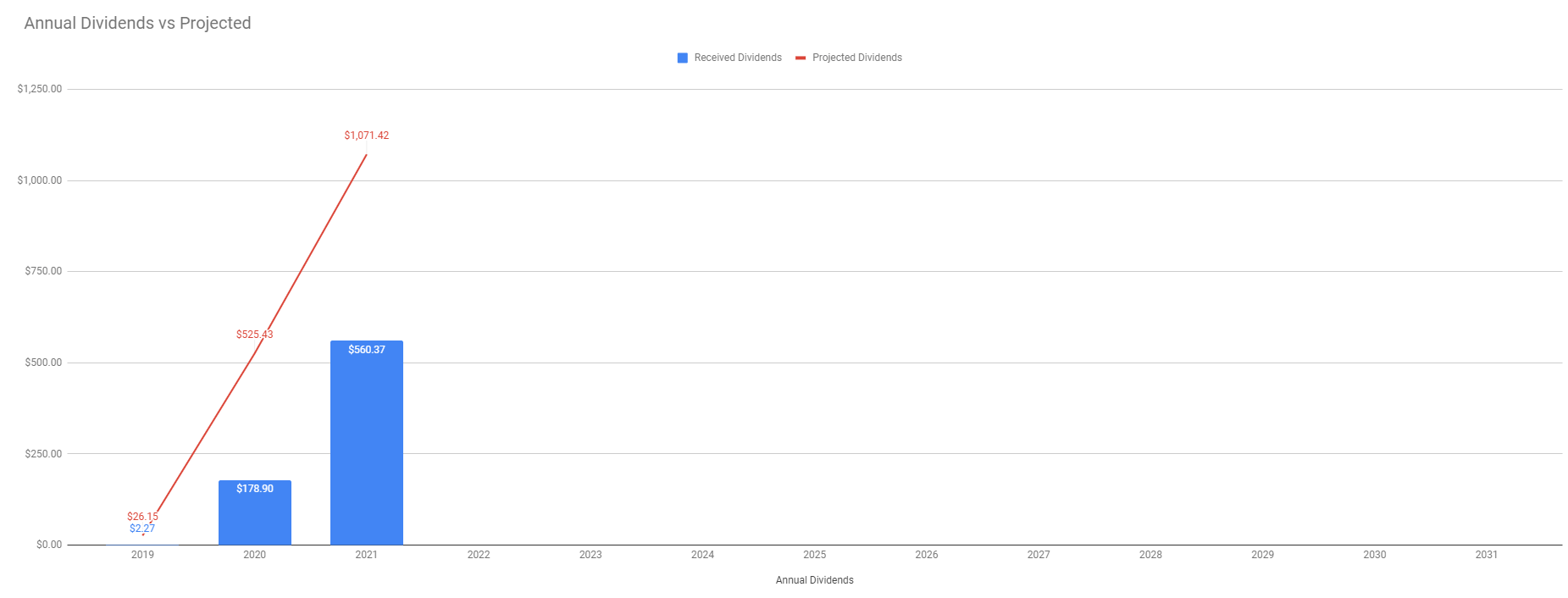

Our dividend goal and future dividends

Our portfolio still doesn’t represent the true dividend income potential, but we are already seeing the results of our accumulation effort. We are on track to accomplish our dividend income goal, currently, we are at 46.00% of the goal to reach $1,071 of dividend income this year.

However, the chart below indicates that our dividend income will possibly exceed this goal as we accumulated enough shares to receive $3,352.06 in dividends.

Our account cumulative return

The chart below indicates our cumulative adjusted return. It shows how the last week’s selloff shook down our returns but we are recovering along with the market.

As of today, our account cumulative return is 22.56% (since March 13, 2021).

Conclusion of our investing and trading report

This week our options trading exceeded our expectations. I hope, the rest of the month will be even better.

We will continue accumulating the dividend growth stocks in our portfolio to reach 100 shares. We will also replenish our cash reserves to bring them back to 25% of our current net-liq value.

We will report our next week’s results next Saturday. Until then, good luck and good trading!

We all want to hear your opinion on the article above:

5 Comments |

Recent Comments